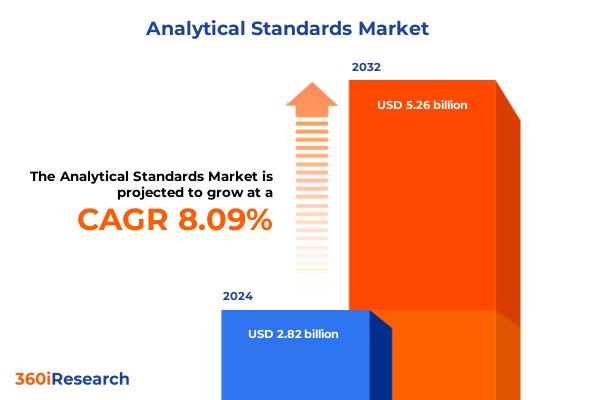

The Analytical Standards Market size was estimated at USD 3.03 billion in 2025 and expected to reach USD 3.27 billion in 2026, at a CAGR of 8.17% to reach USD 5.26 billion by 2032.

Setting the Stage for Technology Infrastructure Insights Driving Strategic Decisions Amid Rapid Digital Transformation and Geopolitical Shifts

The following executive summary illuminates the critical contours of a rapidly evolving technology infrastructure and services market, characterized by converging digital transformation imperatives and shifting geopolitical dynamics. In an environment where innovation cycles accelerate and operational resilience becomes paramount, leaders require a synthesized view of the forces reshaping procurement, deployment, and consumption of hardware, software, and service portfolios. This introduction establishes not only the scope of the analysis but also the strategic lens through which the subsequent sections offer actionable intelligence.

By framing the discussion around transformative shifts, regulatory impacts, and segmentation insights, this summary sets the stage for informed decision-making across diverse organizational contexts. Emphasis has been placed on rigorously examining the cumulative impact of tariff adjustments announced in 2025, the evolving priorities across public cloud and private cloud deployments, and the nuanced behaviors of end users spanning financial services to manufacturing. The methodology underpinning these findings integrates primary and secondary research, ensuring credibility while facilitating a holistic understanding. Ultimately, this introduction underscores the necessity for business leaders to adopt a forward-looking posture, leveraging data-driven insights to navigate uncertainty and capitalize on emerging opportunities.

Exploring Revolutionary Technological and Operational Shifts Reshaping Market Dynamics in Cloud Services Infrastructure and Managed Offerings

The market landscape for technology infrastructure and services has undergone seismic realignment as digital transformation initiatives transition from experimental pilots to enterprise-wide mandates. Organizations are integrating cloud-native architectures with on-premises systems to create hybrid environments that optimize performance, security, and cost. This evolution has propelled managed services from a supplement to core operational models, with outsourcing and professional services playing an increasingly pivotal role in maintaining agility and resilience.

Simultaneously, software delivery has experienced a paradigm shift towards subscription-based licensing, enabling continuous feature rollouts and scalable consumption. Perpetual models continue to coexist but are now complemented by flexible offerings that align vendor incentives with customer success outcomes. In parallel, hardware portfolios are evolving to include specialized networking solutions, high-density server platforms, and software-defined storage architectures, reflecting the requirement for enhanced data throughput and analytics at the edge.

These structural shifts are underpinned by emerging technologies such as artificial intelligence, edge computing, and 5G connectivity, which collectively redefine performance benchmarks and service level expectations. Vendor ecosystems are responding through strategic partnerships and modular product designs, facilitating rapid integration and minimizing deployment risks. Therefore, this section highlights the transformative dynamics that every stakeholder must consider when crafting technology roadmaps that balance innovation with operational stability.

Analyzing the Layered Consequences of United States 2025 Tariff Policies on Technology Supply Chains Procurement Practices and Cost Structures

The introduction of new tariff measures by the United States in 2025 has introduced additional complexity into supply chain and procurement strategies for technology hardware and component assemblies. As duties were applied across networking equipment, storage arrays, and server imports, procurement teams faced heightened cost pressures that necessitated a reevaluation of sourcing geographies and vendor relationships. In many cases, organizations accelerated diversification efforts by engaging with alternative suppliers beyond traditional hubs.

This tariff environment prompted procurement leaders to implement more robust total cost of ownership analyses, incorporating adjusted duty rates and potential soft costs associated with compliance and logistics. Rather than defaulting to lowest upfront price points, buying decisions increasingly accounted for lead times, supply resiliency, and vendor risk scores. The shift toward subscription-based software offerings and managed services has also served as a hedge against capital-intensive hardware purchases subject to tariff escalations.

Moreover, the broader ecosystem responded through the development of local assembly and configuration centers, mitigating some of the tariff impact while fostering closer collaboration between vendors and end-user organizations. This regionalization of service delivery models underscores an emerging emphasis on proximity, responsiveness, and customized solutions. Consequently, understanding how these tariff policies have reshaped cost structures and supply chain architectures is essential for any enterprise aiming to sustain competitiveness in 2025 and beyond.

Unveiling Critical Segment-Level Insights Spanning Hardware Services Software Deployment Models End User Verticals and Organizational Tiers

A nuanced exploration of market segments reveals differentiated drivers and barriers across hardware, services, and software. Within hardware, networking equipment is challenged by the need for higher bandwidth and low-latency connectivity, reinforcing investments in next-generation switches and routers. Server demand is being shaped by application performance requirements for cloud-native workloads, while storage architectures must balance capacity growth with data protection imperatives. In the services domain, managed offerings are prioritized by enterprises seeking predictable operational outcomes, whereas outsourcing relationships are recalibrated to deliver on specific performance metrics. Professional services engagements are expanding to address integration and migration complexities associated with hybrid estate transformations.

Software licensing models are evolving alongside technological capacities. Perpetual licenses remain relevant for established on-premises deployments, though subscription models are increasingly preferred for their alignment with agile development cycles and continuous updates. Deployment preferences differ markedly as well, with private cloud installations favored by organizations seeking stringent data governance and public cloud platforms adopted to leverage elasticity and global availability. End-user verticals present distinct use cases: the financial sector demands high transaction throughput and stringent security controls; healthcare prioritizes compliance and interoperability; manufacturing seeks real-time analytics across automotive and electronics lines; and retail focuses on seamless omnichannel experiences. Organizational size further influences adoption behaviors, with large enterprises leveraging scale to negotiate enterprise-wide agreements, medium businesses balancing structured vendor relationships with customization needs, and small enterprises favoring turnkey, low-overhead solutions that accelerate time to value.

This comprehensive research report categorizes the Analytical Standards market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- End User

Decoding Regional Market Dynamics Revealing How Americas EMEA and Asia-Pacific Are Shaping Technology Infrastructure Investment Priorities

Regional landscapes exhibit unique patterns driven by regulatory frameworks, investment priorities, and infrastructure maturity. In the Americas, market dynamics are shaped by a mix of large-scale digital transformation initiatives and the ongoing recalibration of cross-border trade agreements. Organizations across North and South America leverage well-established data center footprints while exploring edge deployments to support remote and distributed operations. Latency-sensitive applications gain traction, particularly in financial hubs and manufacturing clusters.

The Europe, Middle East & Africa region balances stringent privacy regulations and data residency requirements against ambitious digitalization roadmaps. Cloud adoption accelerates within public sector and large enterprise segments subject to robust compliance standards, prompting investments in sovereign cloud solutions and local data centers. Meanwhile, emerging markets in the Middle East and Africa focus on foundational network expansion and cybersecurity enhancements to support nascent digital economies.

Asia-Pacific stands out for its rapid uptake of both public and private cloud models, fueled by aggressive government-led initiatives and vibrant technology ecosystems. Leading economies invest heavily in high-performance infrastructure to power artificial intelligence, IoT, and advanced manufacturing. Concurrently, regional trade partnerships and supply chain realignments influence hardware sourcing strategies, reinforcing a hybrid approach that optimizes cost, performance, and geopolitical latitude.

This comprehensive research report examines key regions that drive the evolution of the Analytical Standards market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Maneuvers of Leading Vendors Demonstrating Innovation Partnerships and Service Portfolio Enhancements in the Tech Ecosystem

Leading technology providers are executing multifaceted strategies that blend innovation, partnership, and portfolio optimization. Cloud hyperscalers continue to expand their footprints through strategic data center investments and deeper support for hybrid integration frameworks. They are also extending managed service capabilities to smaller enterprises by offering preconfigured solutions and flexible consumption models. Established hardware vendors are strengthening competitiveness by integrating software-defined features into their core products, enabling seamless orchestration across on-premises and cloud environments.

Service integrators and consultancies are differentiating based on domain expertise, often targeting vertical-specific use cases such as automotive digital twins or healthcare interoperability platforms. These players are forging alliances with niche software vendors to deliver end-to-end solutions that reduce integration risk and accelerate time to deployment. Meanwhile, software companies are embracing platform-based approaches that consolidate disparate workloads under unified management consoles, simplifying licensing and support models.

Strategic acquisitions have emerged as a common playbook, with major vendors acquiring specialized firms to augment security, AI, and automation capabilities. This consolidation trend not only broadens feature sets but also deepens technical support ecosystems. The result is a highly interconnected vendor landscape where collaboration and co-innovation define competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Analytical Standards market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Absolute Standards Inc.

- AccuStandard Inc.

- Agilent Technologies, Inc.

- Avantor, Inc.

- Bruker Corporation

- Cayman Chemical

- Dr. Ehrenstorfer GmbH

- GFS Chemicals, Inc.

- Honeywell International Inc.

- Merck KGaA

- PerkinElmer Inc.

- Restek Corporation.

- RICCA Chemical Company

- Shimadzu Corporation

- Shimadzu Corporation

- SPEX CertiPrep

- Starna Scientific Ltd.

- Thermo Fisher Scientific Inc.

- United States Pharmacopeial Convention

- VICI AG International

- Waters Corporation

Implementing Forward-Looking Recommendations to Strengthen Resilience Drive Operational Excellence and Seize New Prospects in Tech Infrastructure

Industry leaders should prioritize the deployment of agile, modular infrastructure architectures that can scale dynamically in response to demand fluctuations. By embedding software-defined networking and storage functionalities, organizations will reduce dependency on rigid hardware lifecycles and accelerate new service introductions. In parallel, cultivating a diverse supplier ecosystem mitigates risk associated with tariff-driven cost volatility and geopolitical realignments, ensuring continuity of critical components and assemblies.

Adopting subscription-based software and managed service models can align technology expenses more closely with operational outcomes, transforming capital-intensive expenditures into predictable operational investments. Vendors that offer integrated support for both private and public cloud environments enable seamless workload mobility, facilitating a hybrid strategy that leverages the strengths of each deployment model. Concurrently, focusing on digital upskilling and change management initiatives ensures that IT and business teams are equipped to maximize the value of these investments.

Finally, forging co-innovation partnerships with specialized technology providers will accelerate the development of differentiated solutions, from AI-driven analytics to cybersecurity orchestration platforms. By engaging in early access programs and joint development efforts, organizations can stay ahead of competitive curves and address industry-specific pain points with greater agility.

Detailing a Rigorous and Transparent Research Framework Combining Qualitative and Quantitative Approaches to Validate Market Insights and Data Integrity

This analysis is underpinned by a comprehensive research framework that integrates both qualitative and quantitative methodologies. Primary research consisted of in-depth interviews with senior IT executives, procurement leaders, and solution architects across diverse industries. These conversations provided firsthand perspectives on strategic priorities, technology pain points, and adoption roadblocks. Secondary research involved rigorous examination of peer-reviewed publications, government regulations, industry white papers, and corporate filings to ensure that publicly stated intentions and compliance mandates were accurately reflected.

A structured survey instrument captured quantitative data on adoption rates, deployment preferences, and investment drivers across organizational sizes and verticals. The findings were triangulated with publicly available vendor performance reports and independent analyst commentary to validate insights and minimize bias. Data points were cross-verified through multiple sources, and any anomalies were subjected to follow-up inquiries with original respondents.

Expert panels comprising domain specialists in cloud computing, networking, and software licensing reviewed preliminary findings to assess relevance and applicability. Their feedback informed refinements to the segmentation framework and the interpretation of regional variances. The result is a transparent and replicable methodology that balances depth of analysis with broad-based validation, ensuring that decision-makers can trust the integrity of the conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Analytical Standards market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Analytical Standards Market, by Component

- Analytical Standards Market, by Deployment

- Analytical Standards Market, by End User

- Analytical Standards Market, by Region

- Analytical Standards Market, by Group

- Analytical Standards Market, by Country

- United States Analytical Standards Market

- China Analytical Standards Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Drawing Conclusions on Market Trends Strategic Imperatives and the Path Forward for Organizations Navigating Complex Technology Ecosystems

The convergence of tariff policy adjustments, accelerated digital transformation, and evolving consumption models has fundamentally altered the technology infrastructure landscape. Organizations that adopt hybrid deployment strategies, embrace subscription-based software models, and diversify their supplier networks will be better positioned to manage cost volatility and operational complexity. Segmentation insights highlight that tailoring offerings to specific hardware, service, and software preferences across verticals and organizational sizes is critical for unlocking value.

Regional dynamics underscore the importance of aligning strategies with local regulatory environments, infrastructure maturity, and geopolitical considerations, while vendor maneuvers reveal that co-innovation and strategic partnerships remain key differentiators. The recommended actionable steps emphasize agility, risk mitigation, and a customer-centric approach to technology adoption. Collectively, these insights chart a path forward for organizations seeking to navigate uncertainty, harness innovation, and achieve sustainable competitive advantage in an increasingly interconnected market backdrop.

In essence, the strategic imperatives outlined herein serve as a roadmap for decision-makers to synthesize diverse data streams into cohesive plans that support both immediate objectives and long-term digital aspirations. By internalizing these conclusions, leaders can move beyond reactive tactics to proactive, strategic execution.

Engaging with Ketan Rohom to Acquire the Comprehensive Market Analysis Report and Unlock Strategic Advantages for Your Organization’s Technology Investments

To explore the full depth of these insights and equip your organization with a competitive edge in technology infrastructure investments, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Through a tailored consultation, you can uncover how our detailed analyses align with your strategic objectives and address the specific challenges you face in an increasingly complex market. Engage with Ketan Rohom to discuss bespoke packages, licensing options, and implementation support designed to empower data-driven decision-making. By partnering with an expert who understands both the macro trends and the granular dynamics of this sector, you will accelerate your journey toward operational excellence, cost efficiency, and sustainable growth. Do not miss the opportunity to transform uncertainty into strategic advantage-connect with Ketan Rohom today and secure your organization’s pathway to success in the evolving technology ecosystem

- How big is the Analytical Standards Market?

- What is the Analytical Standards Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?