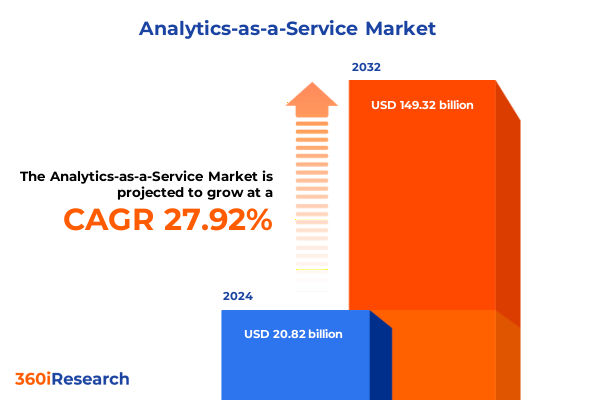

The Analytics-as-a-Service Market size was estimated at USD 26.76 billion in 2025 and expected to reach USD 33.32 billion in 2026, at a CAGR of 27.83% to reach USD 149.32 billion by 2032.

Driving Strategic Insights with Scalable Cloud-Powered Analytics-as-a-Service Solutions to Accelerate Data-Driven Decision Making Across Industries

The rapid proliferation of data across enterprises, coupled with escalating demands for immediate insights, has elevated analytics-as-a-service into a cornerstone of modern digital strategy. Organizations no longer view analytics as a standalone function but as an integral, cloud-delivered capability that accelerates decision cycles, supports agile operations, and fosters a culture of data-driven innovation. As artificial intelligence and machine learning models become embedded into operational workflows, analytics-as-a-service platforms are uniquely positioned to democratize advanced analytics, making predictive and prescriptive insights accessible to a broader spectrum of users, from line-of-business stakeholders to executive leadership

Embracing Edge Intelligence and Explainable AI Innovations That Are Redefining the Analytics-as-a-Service Landscape for Real-Time Action and Accessible Insights

Enterprise priorities are being redefined by a convergence of emerging technologies that reshape the analytics-as-a-service landscape. Edge analytics has shifted the paradigm by moving compute closer to data sources, enabling real-time decision-making and reducing latency for critical applications. Whether monitoring industrial IoT sensors or processing transactional data streams, organizations are leveraging edge architectures to gain instantaneous insights where traditional cloud-only models fall short

Simultaneously, explainable AI is gaining ground as enterprises demand transparency and trust in algorithmic recommendations. By augmenting complex machine learning models with interpretable layers, analytics platforms can elucidate the rationale behind predictions, mitigating risk in regulated industries such as finance and healthcare while fostering user confidence in data-driven strategies

Beyond these shifts, agent-based AI and generative analytics are driving a new wave of transformative capabilities. Advanced AI agents embedded within analytics platforms automate complex workflows, generate actionable insights through natural language interactions, and enable scenario planning at scale. These innovations not only enhance operational efficiency but also redefine how decision-makers interact with data, positioning analytics-as-a-service as an indispensable asset in the digital enterprise era

Navigating Rising Tariff Pressures on Cloud Infrastructure and Data Center Hardware Reshaping Cost Structures and Service Delivery in Analytics-as-a-Service

Since the implementation of Section 301 tariffs on technology components in early 2025, enterprises have faced immediate cost pressures across the analytics-as-a-service value chain. Heightened duties on imported servers, GPUs, and networking equipment have increased hardware expenses by as much as 20 percent for some providers, forcing cloud operators to either absorb costs or recalibrate pricing structures to maintain service levels and margins

Supply chain disruptions have compounded these challenges, with lead times for tariff-impacted components extending by up to six months. As a result, several analytics-as-a-service vendors have encountered delays in data center expansions and hardware refresh cycles, impeding rollout plans for new geographies and customer segments. In response, some organizations are diversifying their manufacturing footprint toward South-East Asia and Mexico, although vendor requalification and logistical realignments introduce additional complexity and time to market

Ultimately, higher infrastructure costs are cascading through to end users, prompting mid-sized and enterprise customers to seek alternative deployment strategies such as workload optimization, hybrid-cloud trade-offs, and cost-sharing models. While hyperscale providers leverage scale economies to mitigate some tariff impacts, smaller operators and specialized analytics-as-a-service firms must adopt innovative procurement and pricing approaches to sustain growth and preserve competitive differentiation in a tariff-influenced environment

Uncovering Deep Demographic and Operational Segmentation Insights That Illuminate Diverse Industry Verticals Deployment Models and Analytics Preferences

The analytics-as-a-service market exhibits multifaceted segmentation that reflects the diverse needs of its users. Industry vertical segmentation underscores the pivotal role of banking divisions within BFSI, capital markets, and insurance in driving demand for fraud detection and risk analytics, while oil and gas operations, power utilities, federal and state government agencies, healthcare providers, hospitals, and pharmaceutical companies pursue domain-specific insights to enhance operational resilience. The IT services and telecom operators segment relies on cloud-native analytics to optimize network performance, whereas discrete and process manufacturing entities apply predictive maintenance and quality management use cases. Media and entertainment companies leverage user engagement and content performance analytics across broadcast, gaming, and publishing sectors, and transportation logistics firms analyze passenger and freight data to streamline routes and capacity planning.

Deployment-mode segmentation further reveals that hybrid-cloud environments are preferred by organizations seeking to balance on-premises control with public-cloud scalability, even as private-cloud ecosystems address stringent security and compliance requirements in regulated sectors. Organization-size segmentation highlights divergent buying behaviors, with large enterprises focusing on enterprise-grade SLAs and integration complexity, while SMEs prioritize ease of use and subscription-based flexibility. Analytics-type segmentation showcases the transition from descriptive and diagnostic analytics toward predictive and prescriptive models, enabling proactive decision-making. Pricing-model segmentation identifies pay-per-use options for variable workloads alongside subscription plans for predictable cost structures. End-user departmental segmentation covers finance, HR, IT, marketing, and operations teams, each demanding tailored insights aligned with functional KPIs. Finally, data-type segmentation distinguishes between structured relational data and unstructured content sources, underscoring the importance of flexible ingestion pipelines and unified data-processing platforms in supporting comprehensive analytic workflows.

This comprehensive research report categorizes the Analytics-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Analytics Type

- Pricing Model

- Data Type

- Industry Vertical

- End User

- Organization Size

Assessing Regional Dynamics in the Americas Europe Middle East Africa and Asia Pacific That Shape Adoption and Innovation in Analytics-as-a-Service Markets

Regional dynamics play a critical role in shaping the adoption and evolution of analytics-as-a-service offerings. In North and Latin America, hyperscale cloud providers have catalyzed the mainstreaming of advanced analytics through aggressive investment in AI-powered infrastructure and seamless integration with enterprise systems. Financial institutions and healthcare organizations in the Americas are leading early-adopter use cases for AI-driven forecasting and patient analytics, leveraging scalable platforms to capitalize on mature digital ecosystems and robust connectivity

Conversely, the Europe, Middle East, and Africa region contends with a mosaic of regulatory frameworks and data-governance requirements that influence cloud deployment choices and data residency. Governments and enterprises are increasingly prioritizing sovereign-cloud initiatives and cross-border interoperability protocols to balance innovation with compliance. At the same time, multinationals in EMEA are harnessing analytics-as-a-service to streamline supply chains and support sustainability goals amid complex geopolitical landscapes

In Asia-Pacific, a wave of infrastructure investments has accelerated cloud-region expansion, with major announcements such as Oracle’s $6.5 billion commitment in Malaysia and Google’s $1 billion development in Thailand reinforcing the region’s transformation into a strategic analytics hub. These developments empower organizations across Southeast Asia and beyond to leverage localized analytics capabilities with lower latency, enabling real-time insights for industries ranging from manufacturing to financial services

This comprehensive research report examines key regions that drive the evolution of the Analytics-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves by Hyperscale Cloud Providers and Emerging Pure-Play Analytics Firms That Drive Competitive Advantages and Innovation in the Market

Hyperscale cloud providers continue to assert dominance in analytics-as-a-service through differentiated investments in AI-optimized infrastructure and global network footprints. Amazon Web Services, Microsoft Azure, and Google Cloud each integrate advanced machine-learning services and specialized accelerators into their analytics portfolios, enabling enterprises to leverage agent-based AI workflows and generative-model integrations at scale. These platforms benefit from deep R&D funding and extensive partner ecosystems, reinforcing their competitive moats amid evolving customer demands

At the same time, pure-play analytics firms and niche solution providers are carving out market share by delivering specialized offerings. Snowflake’s expanded AI service integrations and resilient data-sharing architecture have resulted in elevated market expectations and stronger financial forecasts. The company’s recent full-year product-revenue guidance outpaced consensus estimates, a testament to the growing enterprise reliance on consumption-based analytics models. Additionally, strategic collaborations-such as partnerships between network monitoring vendors and AI analytics startups-demonstrate how targeted alliances drive innovation, enabling more tailored, real-time analytics solutions across industries

This comprehensive research report delivers an in-depth overview of the principal market players in the Analytics-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Alteryx Inc.

- Amazon Web Services Inc.

- Atos SE

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Deloitte Touche Tohmatsu Limited

- DXC Technology Company

- Ernst & Young Global Limited

- GoodData Corporation

- Google LLC

- Hewlett Packard Enterprise Company

- Infosys Limited

- International Business Machines Corporation

- KPMG International Limited

- Microsoft Corporation

- Mu Sigma Inc.

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Tata Consultancy Services Limited

- Teradata Corporation

- Wipro Limited

Implementing Strategic Roadmaps for Leaders to Enhance Resilience Scalability and Data Democratization in Analytics-as-a-Service Operations

To navigate the complex analytics-as-a-service landscape, industry leaders should prioritize the diversification of hardware sourcing and invest in resilient supply-chain frameworks to mitigate tariff-driven cost fluctuations. Establishing strategic partnerships with alternate manufacturing hubs and secondary suppliers can reduce lead times and safeguard infrastructure scalability. Concurrently, embracing hybrid-cloud strategies will enable organizations to optimize workload placements based on cost, performance, and compliance metrics, ensuring balanced technology portfolios that withstand external disruptions

Furthermore, adopting edge analytics and real-time streaming frameworks is crucial for unlocking instantaneous insights at the data source. By incorporating edge compute capabilities into the analytics architecture and refining data ingestion pipelines, enterprises can minimize latency and enhance operational agility. Similarly, expanding investments in explainable AI and model governance frameworks will ensure transparent decision-making processes and fortify trust among stakeholders in regulated environments. Finally, empowering citizen data scientists through intuitive analytics interfaces and augmented AI assistants will broaden organizational analytics literacy and drive cross-functional innovation, transforming raw data into strategic outcomes at every level of the enterprise

Detailing Robust Primary Secondary and Analytical Methodologies Utilized to Ensure Rigorous and Objective Insights in Market Research

The research methodology employed a structured approach to deliver comprehensive and objective insights. Initially, extensive secondary research was conducted across industry publications, regulatory filings, technology whitepapers, and corporate disclosures to establish baseline market intelligence. This phase included a thorough review of trade journals, academic studies, and general economic data to contextualize macroeconomic and policy impacts.

Subsequently, primary interviews were carried out with key stakeholders, including senior executives at service providers, enterprise technology leadership, and domain experts. These discussions validated trends, identified emerging use cases, and elucidated strategy nuances across market participants. Data triangulation techniques were then applied to reconcile disparate data points, ensuring consistency and accuracy across market segments.

Finally, a rigorous analytical framework integrated qualitative insights with quantitative assessments. Statistical modeling and scenario analysis were utilized to examine tariff impacts, pricing dynamics, and segmentation performance. Each finding underwent multiple rounds of internal validation and peer review to uphold methodological rigor and deliver actionable conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Analytics-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Analytics-as-a-Service Market, by Analytics Type

- Analytics-as-a-Service Market, by Pricing Model

- Analytics-as-a-Service Market, by Data Type

- Analytics-as-a-Service Market, by Industry Vertical

- Analytics-as-a-Service Market, by End User

- Analytics-as-a-Service Market, by Organization Size

- Analytics-as-a-Service Market, by Region

- Analytics-as-a-Service Market, by Group

- Analytics-as-a-Service Market, by Country

- United States Analytics-as-a-Service Market

- China Analytics-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Summarizing Critical Findings and Strategic Implications to Guide Decision-Makers Toward Maximizing Value Through Analytics-as-a-Service Initiatives

The evolving analytics-as-a-service domain underscores the critical importance of scalable cloud architectures, innovative AI integrations, and resilient supply chains in driving strategic advantage. Through transformative shifts such as edge intelligence, explainable AI, and agent-based workflows, organizations can harness real-time analytics to anticipate market shifts, optimize operational performance, and unlock new revenue streams. Regional investments and regulatory considerations further shape adoption patterns, while hyperscale providers and specialized firms continue to refine their competitive positioning.

As enterprises confront tariff-driven cost challenges and diversify deployment strategies, a nuanced understanding of segmentation insights-from industry verticals to pricing models-becomes indispensable for tailoring offerings to distinct customer needs. By synthesizing rigorous research methodologies with real-world practitioner perspectives, this report provides a definitive guide to navigating the analytics-as-a-service landscape. The strategic implications outlined herein will inform decision-makers as they architect resilient platforms, cultivate data-driven cultures, and secure sustained value creation in a rapidly evolving digital economy

Connect with Ketan Rohom to Discover How an Executive-Level Market Research Report Can Empower Your Organization with Actionable Analytics-as-a-Service Insights

To explore the full breadth of market dynamics and gain a competitive edge, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan will guide you through the report’s comprehensive analyses and customized insights tailored to your organization’s strategic goals. By partnering with Ketan, you can secure an executive-level market research report designed to empower your team with actionable analytics-as-a-service strategies. Reach out now to transform data complexities into clear strategic roadmaps that drive innovation and growth through advanced analytics solutions

- How big is the Analytics-as-a-Service Market?

- What is the Analytics-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?