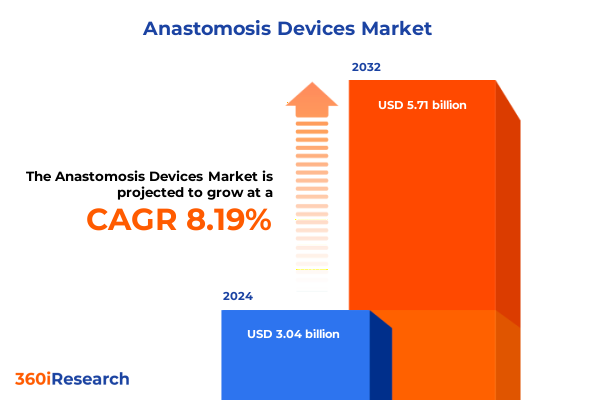

The Anastomosis Devices Market size was estimated at USD 3.25 billion in 2025 and expected to reach USD 3.48 billion in 2026, at a CAGR of 8.38% to reach USD 5.71 billion by 2032.

Discovering How Anastomosis Devices Are Revolutionizing Surgical Outcomes and Driving Innovation Across Cardiovascular and Gastrointestinal Care

Anastomosis devices lie at the heart of modern surgical practice by providing precision and reliability in the reconnection of anatomical structures. From cardiovascular bypass grafting to gastrointestinal reconstruction, these specialized tools facilitate critical junctions that dictate patient outcomes and long-term recovery trajectories. As minimally invasive techniques gain prominence, the design and functionality of anastomosis devices have adapted to support reduced incision sizes, improved hemostatic control, and enhanced ergonomics for surgeons.

The integration of advanced materials and digital technologies has further elevated performance standards, enabling controlled deployment and real-time feedback during procedures. Surgeons today demand instruments that not only ensure patency and sealing strength but also accommodate varying tissue profiles and procedural workflows. Consequently, device manufacturers are channeling resources into iterative innovation cycles and surgeon training programs to optimize usability.

Looking ahead, the convergence of data analytics, smart instrumentation, and patient-centric design principles will continue to define the next wave of breakthroughs. Collaboration across surgical specialties and strategic engagement with clinical thought leaders are essential to align product development with evolving care pathways. This section lays the foundation for understanding how anastomosis devices have become indispensable in achieving reproducible, high-quality surgical results.

Mapping the Transformative Technological and Procedural Shifts Reshaping the Anastomosis Device Industry Landscape in Recent Years

The last few years have witnessed a profound transformation in the anastomosis device landscape as manufacturers embrace both technological and procedural shifts. Traditional manual stapling systems remain a staple of the operating room, but the rapid adoption of powered stapling platforms has markedly enhanced consistency in staple formation, reduced tissue trauma, and shortened operative times. Concurrently, robotic-assisted surgical platforms have integrated specialized anastomotic instruments that offer unparalleled dexterity in confined surgical fields.

Emerging materials science has also played a pivotal role. Biodegradable polymers now allow for temporary support structures that are gradually resorbed, eliminating the need for removal and minimizing foreign body reactions. Composite materials that marry flexibility with tensile strength have enabled novel device geometries tailored to specific anatomical contexts. These material innovations are tightly coupled with advancements in imaging and navigation systems, providing surgeons with real-time guidance to position devices optimally.

Procedural paradigms have evolved in tandem, driven by the principles of enhanced recovery after surgery (ERAS) and value-based care. Shorter hospital stays and reduced complication rates have become benchmarks of success, prompting device makers to focus on streamlined workflows and standardized protocols. Partnerships between clinical innovators and engineering teams are fostering iterative refinements that align device functionality with the nuanced demands of both elective and emergency surgery.

Analyzing How New United States Tariff Strategies in 2025 Are Creating Ripples Across Anastomosis Device Manufacturing and Supply Chains

In 2025, the implementation of new United States tariff measures brought significant downstream effects across the anastomosis device supply chain. Duties applied to imported surgical staples, cartridges, and critical raw materials prompted suppliers to reevaluate sourcing strategies and manufacturing footprints. As a result, some global manufacturers accelerated the localization of production operations within North America to mitigate cost pressures and ensure uninterrupted supply to healthcare providers.

The elevated import costs also influenced procurement dynamics, with hospitals and surgical centers negotiating more aggressively on pricing, contract terms, and value-added services. Device companies responded by refining their logistics networks, consolidating inventory at regional distribution centers, and enhancing collaboration with third-party distributors to preserve margin structures. Additionally, the tariff environment underscored the importance of supply chain transparency, leading to increased investment in digital tracking systems to monitor component flows and anticipate potential disruptions.

Over time, these strategic adaptations have not only buffered the immediate financial impact of tariffs but also contributed to a more resilient ecosystem. By diversifying supplier bases and strengthening domestic partnerships, the industry has secured a more stable foundation for future growth. Insights from this tariff-driven realignment offer valuable lessons on balancing cost management with quality assurance, particularly as global trade policies continue to evolve.

Leveraging Multifaceted Segmentation to Unlock Deep Insights into Application, End Use, Technology, Procedure Types, Distribution Channels, and Material Types

Understanding the anastomosis device market requires an appreciation of how diverse clinical applications shape demand and product design. In the cardiovascular sphere, devices tailored for coronary interventions address the intricacies of bypass graft anastomosis, while vascular solutions focus on peripheral vessel reconnections in critical limb ischemia or aneurysm repair. On the gastrointestinal front, colorectal anastomosis has driven innovations in seal integrity to prevent leakage, esophageal reconstructions necessitate slender-profile stapling systems for narrow lumens, and gastric procedures leverage reinforced staple lines to withstand luminal pressures.

Equally important are the settings in which these devices are deployed. Ambulatory surgical centers demand compact and cost-effective platforms that support same-day procedures, whereas hospitals often prioritize robust portfolios capable of handling high acuity cases and complex revisions. Specialty clinics specializing in bariatric or oncologic interventions look for customization features that align with specific procedural pathways and patient populations.

Technological choices influence both clinical outcomes and operational efficiency. Manual instruments remain indispensable in resource-limited environments and for irregular anatomies, while powered systems deliver consistent results in high-volume settings. The shift toward minimally invasive approaches has bolstered demand for articulating instruments, yet open surgery continues to rely on proven staple configurations with ergonomic handles. Distribution strategies vary accordingly: direct sales teams forge deep clinical partnerships, online channels offer rapid replenishment for standardized items, and third-party distributors provide coverage in markets where direct presence is limited.

Material selection further refines device performance across applications. Biodegradable polymers are favored when temporary structural support is paramount, composite blends offer a balance between rigidity and flexibility, and titanium constructs provide permanent reinforcement in demanding environments. By integrating these segmentation dimensions, stakeholders can tailor their approach to meet the nuanced requirements of surgeons, care pathways, and institutional priorities.

This comprehensive research report categorizes the Anastomosis Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Procedure Type

- Material Type

- Distribution Channel

- Application

- End Use

Deciphering Regional Dynamics and Growth Patterns Across the Americas, Europe Middle East & Africa, and Asia-Pacific in the Anastomosis Devices Market

Regional dynamics in the anastomosis device industry reveal distinct growth drivers and challenges across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, a combination of advanced healthcare infrastructure, reimbursement frameworks that reward clinical excellence, and a concentration of research institutions has fueled robust adoption of cutting-edge devices. North American hospitals often lead pilot studies for powered staplers and robotic integration, setting benchmarks that inform global best practices.

Within Europe Middle East & Africa, regulatory harmonization across the European Union and collaborative research networks have lowered barriers to market entry for innovative device designs. Centers of excellence in cardiothoracic and colorectal surgery located in key European cities serve as hubs for technology validation and clinician training. Meanwhile, Middle Eastern healthcare systems are investing heavily in surgical modernization programs, and African markets are gradually adopting mid-tier solutions that bridge the gap between basic manual devices and premium powered platforms.

Asia-Pacific stands out for its rapid expansion of hospital networks in emerging economies, coupled with strong government initiatives to enhance local manufacturing capabilities. Leading hospitals in China, India, and Southeast Asia are increasingly participating in global clinical trials, often co-developing region-specific device variants to address local patient anatomies and procedural preferences. Distribution partnerships and joint ventures are instrumental in scaling production and ensuring timely delivery across vast geographic areas. Collectively, these regional insights underscore the need for tailored strategies that align product offerings with regulatory landscapes, healthcare funding models, and clinical priorities in each market.

This comprehensive research report examines key regions that drive the evolution of the Anastomosis Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Anastomosis Device Industry with Breakthrough Technologies and Partnerships

Leading players in the anastomosis device sector continue to reshape the industry through a combination of organic innovation and strategic partnerships. Some global medical device manufacturers have augmented their portfolios with acquisitions of small specialists, thereby integrating proprietary material technologies and surgeon-centric design philosophies into established product lines. Others have invested in internal innovation centers that leverage cross-functional teams of engineers, clinical researchers, and human factors specialists to accelerate time to market.

Emerging firms, including those spun out of academic institutions, are capturing attention with novel approaches such as sensor-enabled stapling devices that track staple formation quality or disposable robotic clips designed for single-use applications. Collaborations between these challengers and established distributors are bridging access gaps in underserved regions and expanding the overall market footprint.

Across the industry, companies are also exploring digital services that enhance the surgical ecosystem. Cloud-based platforms for case analytics, virtual training modules, and remote proctoring tools are enabling continuous performance improvement and driving brand loyalty among surgical teams. Joint ventures between device manufacturers and software developers are thus forming the next frontier of integrated solutions, where hardware and data converge to redefine standards of care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anastomosis Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AtriCure, Inc.

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health, Inc.

- ConMed Corporation

- Cook Medical LLC

- Getinge AB

- Intuitive Surgical, Inc.

- Johnson & Johnson

- LivaNova PLC

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- Peters Surgical Company, Inc.

- Smiths Group plc

- Stryker Corporation

- Teleflex Incorporated

- Terumo Corporation

- W. L. Gore & Associates, Inc.

Delivering Strategic and Operational Recommendations to Propel Stakeholders Toward Sustainable Growth and Competitive Advantage in Anastomosis Devices

Industry leaders seeking to capitalize on the evolving anastomosis device landscape should prioritize multi-pronged strategies that align technological innovation with clinical and commercial imperatives. First, investing in powered and robotic-assisted platforms will position organizations at the forefront of demand for precision and efficiency, while also facilitating the capture of high-value procedural segments. Concurrently, companies should build modular device portfolios that can be optimized for either minimally invasive or open surgery workflows, thereby ensuring broad applicability across care settings.

Strengthening direct relationships with hospitals and ambulatory centers is paramount. By embedding clinical specialists within institutional teams and offering tailored training programs, manufacturers can foster deeper levels of engagement and co-creation. In parallel, exploring partnerships or joint ventures in high-growth regions of Asia-Pacific will unlock access to emerging patient populations and local production capabilities.

Equally critical is the development of resilient supply chains. Near-shoring component manufacturing and leveraging advanced digital tracking will minimize the impact of future trade disruptions. Finally, advancing material science initiatives that focus on biodegradable and composite innovations will meet surgeon and patient demands for both temporary and permanent solutions, while digital service offerings will enhance procedural outcomes and support value-based care reimbursement models. These recommendations collectively lay out a blueprint for sustained competitive advantage.

Outlining Rigorous Research Frameworks and Analytical Approaches Employed to Ensure Robust Insights into the Anastomosis Device Ecosystem

The research underpinning this report was conducted through a rigorous blend of primary and secondary methodologies designed to ensure comprehensive coverage of the anastomosis device ecosystem. Primary inputs were gathered via in-depth interviews with key stakeholders, including cardiovascular and gastrointestinal surgeons, procurement officers, and device engineers across multiple geographies. These conversations provided firsthand insights into clinical priorities, procedural challenges, and adoption barriers.

Secondary research sources comprised peer-reviewed surgical journals, regulatory databases, patent filings, and surgical case registries. Detailed analysis of these materials enabled cross-verification of technology trends, material innovations, and regulatory developments. To enhance the robustness of qualitative findings, triangulation techniques were applied, comparing data points across multiple sources and reconciling discrepancies through follow-up expert consultations.

A dedicated advisory panel of leading clinicians and industry veterans reviewed the draft findings, offering critical feedback that refined the final narratives and ensured practical relevance. Throughout the process, strict adherence to data privacy regulations and ethical research standards was maintained, guaranteeing that all insights are grounded in credible evidence and reflect the dynamic realities of the anastomosis device market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anastomosis Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anastomosis Devices Market, by Technology

- Anastomosis Devices Market, by Procedure Type

- Anastomosis Devices Market, by Material Type

- Anastomosis Devices Market, by Distribution Channel

- Anastomosis Devices Market, by Application

- Anastomosis Devices Market, by End Use

- Anastomosis Devices Market, by Region

- Anastomosis Devices Market, by Group

- Anastomosis Devices Market, by Country

- United States Anastomosis Devices Market

- China Anastomosis Devices Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Core Discoveries and Perspectives to Illuminate the Strategic Imperatives Driving Future Progress in Anastomosis Device Innovation

In synthesizing the core discoveries of this executive summary, several strategic imperatives emerge that will guide future progress in anastomosis device innovation. The confluence of powered stapling, robotic assistance, and advanced materials underscores a shift toward solutions that deliver reproducible precision and streamline surgical workflows. Meanwhile, the tariff-induced reorientation of manufacturing and distribution strategies highlights the critical need for supply chain agility and localized partnerships.

Segmentation analysis demonstrates that success hinges on tailoring device attributes to specific clinical applications, procedural settings, and material preferences. Regional dynamics reinforce the importance of customizing strategies to diverse regulatory, economic, and healthcare delivery landscapes. Furthermore, the competitive landscape points to the growing role of digital services and collaborative ventures in expanding the value proposition beyond hardware alone.

As device developers and healthcare providers navigate these multidimensional shifts, a coordinated approach that integrates product innovation, strategic alliances, and operational resilience will be essential. Embracing data-driven decision making, prioritizing surgeon engagement, and investing in next-generation materials and service models will collectively define the leaders of tomorrow’s anastomosis device ecosystem.

Engage Directly with Ketan Rohom to Secure Exclusive Access to Comprehensive Anastomosis Device Insights and Tailored Strategic Guidance

Embark on a journey to deepen your strategic understanding of anastomosis devices by connecting with Ketan Rohom, an experienced Associate Director of Sales & Marketing who stands ready to guide you through tailored insights. Ketan’s expertise encompasses the intersections of surgical innovation, market dynamics, and customer needs, ensuring that every consultation illuminates opportunities for differentiation and growth.

By engaging directly with Ketan, you gain privileged access to a comprehensive research dossier that distills the complexities of anastomosis device technologies, regulatory landscapes, and competitive strategies into actionable guidance. Whether you seek to refine your product roadmap, identify high-priority clinical applications, or align your commercial approach with evolving procurement models, Ketan’s personalized advisory will equip your team with the clarity and confidence needed to make informed decisions.

Reach out today to secure your tailored consultation and unlock the full value of our in-depth analysis. This strategic collaboration will empower your organization to stay ahead of emerging trends, mitigate risk in an ever-changing global environment, and capture new avenues for market differentiation. Don’t miss this opportunity to leverage Ketan’s deep industry knowledge and drive sustainable success for your anastomosis device initiatives.

- How big is the Anastomosis Devices Market?

- What is the Anastomosis Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?