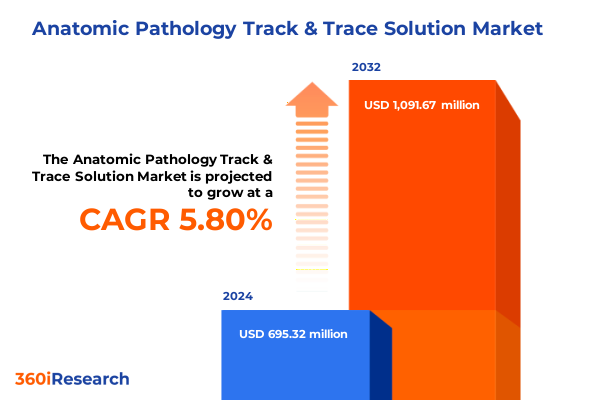

The Anatomic Pathology Track & Trace Solution Market size was estimated at USD 724.56 million in 2025 and expected to reach USD 756.65 million in 2026, at a CAGR of 6.03% to reach USD 1,091.67 million by 2032.

Comprehensive Approach to Revolutionizing Specimen Integrity and Workflow Efficiency Through Advanced Anatomic Pathology Track and Trace Innovations

The landscape of pathology laboratories is witnessing a paradigm shift as digital transformation accelerates the need for precise specimen tracking and sample integrity assurance. Recent innovations in specimen management systems have emerged to address growing concerns around misidentification, regulatory compliance, and workflow bottlenecks. Laboratories are increasingly pressured by higher testing volumes and tighter turnaround time expectations, with real-time monitoring and data integration becoming fundamental components of modern diagnostic workflows. As healthcare networks expand, the demand for seamless interoperability between tracking solutions and core informatics platforms has intensified, prompting solution providers to integrate cutting-edge labeling, scanning, and analytics tools to ensure specimen traceability and quality oversight across the diagnostic continuum.

Unveiling the Transformative Technological and Regulatory Shifts Redefining the Anatomic Pathology Track and Trace Ecosystem

In recent years, pathology labs have embraced a wave of disruptive technologies that are reshaping how specimens are managed, monitored, and analyzed. The integration of artificial intelligence and machine learning into track and trace systems has enabled predictive analytics that can proactively flag deviations in specimen handling, reducing errors and enhancing diagnostic accuracy. Concurrently, Internet of Things–enabled sensors embedded in storage units now deliver granular environmental data, safeguarding sample integrity through automated alerts that mitigate risks associated with temperature and humidity fluctuations. These technological advancements are complemented by the widespread adoption of mobile applications, allowing laboratory personnel to track and verify specimens from collection to analysis using handheld devices and real-time data streams.

Assessing the Complex Impact of 2025 United States Tariff Measures on Anatomic Pathology Track and Trace Supply Chains and Cost Structures

The implementation of United States tariff policies in 2025 has introduced significant cost pressures across the healthcare supply chain, directly affecting the procurement of key components used in track and trace solutions. Under expanded Section 301 measures, tariffs of up to 25% on medical consumables-including diagnostic instruments, labeling systems, and RFID tags-have elevated equipment and maintenance expenses for laboratories. Additionally, the broader 10% tariff on all Chinese-origin imports is projected to contribute to a 15% uptick in operational costs for medical device and solution providers, as highlighted by industry experts, potentially straining budgets and prompting labs to reassess sourcing strategies and supply chain resilience.

Decoding Critical Segmentation Dimensions to Illuminate Tailored Opportunities Across Product Types, Deployment Models, Channels, Applications, and End Users

A deep understanding of market segmentation reveals critical avenues for targeted solution development and deployment. Within product types, laboratories balance the adoption of barcode solutions alongside more advanced active and passive RFID systems, while integrated software platforms unify tracking data and sample management capabilities-including labeling, storage oversight, and temperature monitoring functionalities. Decision-makers contrast cloud-based deployments against legacy on-premise installations, weighing scalability and accessibility against data sovereignty and control. Distribution networks span direct engagements with end users and partnerships with distributors, each channel influencing time-to-market and service frameworks. Across applications, from chain of custody management to predictive analytics and reagent optimization, labs tailor workflows to ensure specimen identification, inventory efficiency, and data-driven insights. Finally, end users in diagnostic laboratories, hospitals and clinics, pharmaceutical companies, and research institutes demand customizable offerings that align with regulatory requirements and operational priorities, driving evolution in solution design and service models.

This comprehensive research report categorizes the Anatomic Pathology Track & Trace Solution market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Deployment Mode

- Distribution Channel

- Application

- End User

Uncovering Key Regional Dynamics and Emerging Trends Shaping Anatomic Pathology Track and Trace Adoption in the Americas, EMEA, and Asia-Pacific

Regional dynamics continue to shape the adoption trajectories of track and trace solutions around the globe. In the Americas, North America leads with a share of nearly 38% of the total market, underpinned by advanced healthcare infrastructure, rigorous CLIA and CAP standards, and significant investments in precision medicine and digital pathology initiatives. Within Europe, stringent in vitro diagnostic regulations and GDPR mandates drive demand for interoperable, secure, and compliant systems that support both hospital and reference laboratory networks, while emerging markets in the Middle East and Africa invest in scalable barcoding and hybrid platforms to bolster diagnostic capabilities. Across Asia-Pacific, surging healthcare expenditures and government-backed digital transformation programs are fueling the fastest regional growth-projected above 9% annually-with laboratories in China, Japan, and India prioritizing hybrid deployments that blend on-premise control with cloud-based analytics to address urban–rural disparities and expand telepathology services.

This comprehensive research report examines key regions that drive the evolution of the Anatomic Pathology Track & Trace Solution market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Growth and Competitive Differentiation in Anatomic Pathology Track and Trace Solutions

Leading solution providers are differentiating through targeted investments in innovation, strategic partnerships, and service expansion. Thermo Fisher Scientific has introduced the SlideMate and PrintMate labeling platforms, coupled with CheckMate verification and LabWriter software, to deliver high-resolution slide and cassette labeling with end-to-end event histories that ensure specimen authenticity and traceability within pathology workflows. Impinj, in collaboration with partners such as Idox Health, has championed RAIN RFID–enabled asset tracking solutions that empower hospitals to locate instruments, manage consumables, and uphold clinical documentation with 99.5% accuracy, reducing waste and streamlining clinical operations. Roche Diagnostics has bolstered its digital ecosystem through the Navify portfolio, unveiling Navify Sample Tracking and Digital Pathology offerings that integrate preanalytical quality oversight with remote collaboration, reinforcing lab-to-point-of-care connectivity. Zebra Technologies continues to enhance laboratory data capture with the DS9900 Series hybrid imagers and RF-enabled scanners, combining barcode excellence with optional RFID to support high-throughput slide and specimen identification in regulated environments. Beckman Coulter’s DxONE portfolio unifies inventory, workflow, and data analytics across mid to high-volume labs, delivering cloud-based command central and insights modules to optimize operational performance and reagent management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anatomic Pathology Track & Trace Solution market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Danaher Corporation

- GE HealthCare Technologies Inc.

- LabVantage Solutions, Inc.

- LabWare, Inc.

- PerkinElmer, Inc.

- Psychē Systems Corporation

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Strategic Recommendations to Accelerate Innovation, Enhance Resilience, and Capitalize on Opportunities in the Anatomic Pathology Track and Trace Landscape

To thrive in a competitive and evolving landscape, industry leaders should adopt a multi-pronged strategy that balances technology, partnerships, and operational agility. Investment in modular, interoperable platforms that seamlessly integrate with laboratory information systems and electronic health records will ensure rapid deployment and user adoption. Building strategic alliances with edge device manufacturers, software developers, and channel partners can expand solution reach while mitigating supply chain vulnerabilities. Organizations should prioritize cloud-native architectures and hybrid models that offer scalability, data security, and compliance with regional regulations. Leveraging advanced analytics, machine learning, and IoT-driven environmental monitoring will unlock deeper insights into specimen lifecycle management, driving continuous process improvements. Finally, fostering a customer success–focused service framework, including training, validation, and support, will be essential to achieve high utilization rates and reinforce long-term partnerships.

Comprehensive Research Methodology Incorporating Secondary Sources, Primary Interviews, and Data Triangulation for Anatomic Pathology Track and Trace Analysis

This analysis is grounded in a rigorous research methodology that combines extensive secondary research with targeted primary interviews and data triangulation. Publicly available sources, including company reports, regulatory filings, industry publications, and government databases, were reviewed to establish market context and identify key industry developments. Primary insights were gathered through interviews with senior executives, product managers, and end users across hospitals, reference laboratories, and diagnostics companies to validate assumptions and uncover nuanced requirements. Quantitative validation techniques were applied to ensure alignment between qualitative insights and market observations, while a segmentation framework was employed to categorize market dynamics across product types, deployment modes, distribution channels, applications, and end users. Throughout the study, best practices in data integrity, confidentiality, and ethical guidelines were maintained to deliver robust, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anatomic Pathology Track & Trace Solution market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anatomic Pathology Track & Trace Solution Market, by Product Type

- Anatomic Pathology Track & Trace Solution Market, by Deployment Mode

- Anatomic Pathology Track & Trace Solution Market, by Distribution Channel

- Anatomic Pathology Track & Trace Solution Market, by Application

- Anatomic Pathology Track & Trace Solution Market, by End User

- Anatomic Pathology Track & Trace Solution Market, by Region

- Anatomic Pathology Track & Trace Solution Market, by Group

- Anatomic Pathology Track & Trace Solution Market, by Country

- United States Anatomic Pathology Track & Trace Solution Market

- China Anatomic Pathology Track & Trace Solution Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Perspectives on the Critical Role of Anatomic Pathology Track and Trace Solutions in Driving Diagnostic Accuracy and Operational Excellence

Advanced specimen tracking and management solutions are transforming the operational backbone of anatomic pathology laboratories, elevating sample integrity, and driving faster, more accurate diagnoses. The convergence of AI, IoT, and cloud technologies is enabling a new generation of interoperable platforms that align with regulatory mandates and evolving clinical workflows. As tariff pressures and supply chain considerations reshape procurement strategies, laboratories and solution providers alike must adapt through resilient sourcing and strategic partnerships. By harnessing segmentation insights, regional dynamics, and competitive landscapes, stakeholders can identify targeted growth pathways and optimize investment decisions. Ultimately, a coordinated focus on innovation, compliance, and user experience will define the next era of pathology track and trace solutions, ensuring laboratories can meet the demands of precision diagnostics and deliver superior patient care.

Get Your Customized Anatomic Pathology Track and Trace Market Research Report Today by Connecting with Ketan Rohom to Empower Informed Strategic Decisions

For a tailored consultation on how in-depth insights into the Anatomic Pathology Track and Trace Solution market can drive your strategic roadmap, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He will guide you through our comprehensive research report offerings, address your unique requirements, and facilitate the acquisition of the data and analysis you need to gain a competitive edge. Reach out today to explore customized solutions, unlock critical market intelligence, and empower confident investment and operational decisions that will shape the future of specimen management and diagnostic excellence.

- How big is the Anatomic Pathology Track & Trace Solution Market?

- What is the Anatomic Pathology Track & Trace Solution Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?