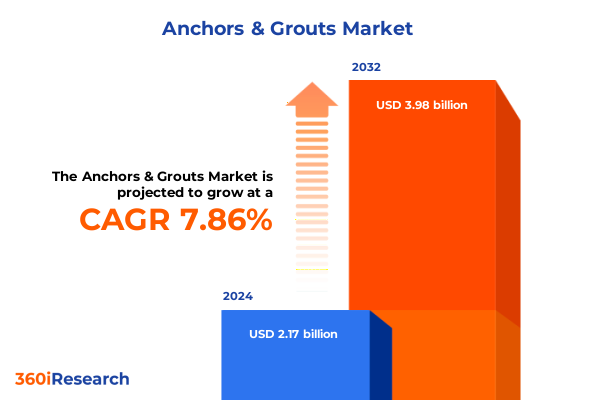

The Anchors & Grouts Market size was estimated at USD 2.34 billion in 2025 and expected to reach USD 2.49 billion in 2026, at a CAGR of 7.84% to reach USD 3.98 billion by 2032.

Anchors and Grouts Market Overview Illuminating the Critical Role of Bonding Technologies in Modern Construction and Industrial Applications

In a global landscape where infrastructure resilience and building safety command increasing attention, anchor and grout solutions underpin every critical construction and industrial operation. Anchoring mechanisms provide essential stability for structural assemblies, machinery foundations, and heavy equipment installations, while advanced grout formulations ensure integrity through load distribution and resistance to environmental stressors. Together, these products form the backbone of projects that range from urban high-rise developments to utility-scale energy platforms, delivering the performance reliability that end users demand.

As sustainability criteria and regulatory frameworks evolve, stakeholders are challenged to balance material performance with environmental stewardship and cost efficiency. Manufacturers are integrating novel chemistries and mechanical innovations to enhance adhesion strength, temperature tolerance, and installation speed. At the same time, digital tools for specification selection and project planning streamline procurement and execution workflows. Against this backdrop of technological advancement and shifting priorities, this introduction lays the foundation for a deeper exploration of transformative shifts, policy impacts, segmentation dynamics, regional nuances, and strategic imperatives within the anchors and grouts arena.

Evolving Dynamics Shaping Anchors and Grouts Sector Driven by Sustainability Performance Demands Digital Innovations and Global Supply Chain Adaptations

The anchors and grouts domain is undergoing transformative shifts driven by an emphasis on sustainability, performance optimization, and supply chain resilience. Eco-friendly binders and low-VOC formulations are gaining traction as regulatory bodies tighten emissions limits and end users prioritize green credentials. Concurrently, performance demands have spurred breakthroughs in high-strength epoxy resins and rapid-set cementitious grouts, offering significant time savings on-site without compromising structural integrity.

Moreover, the digitalization of specification and installation processes is revolutionizing how projects are executed. Real-time monitoring of curing conditions, augmented-reality guidance for anchor placement, and predictive analytics for material selection are becoming mainstream. Supply chain adaptations, including diversified sourcing of raw materials and near-shoring of production facilities, are mitigating risks associated with geopolitical fluctuations and logistics constraints. Together, these forces are redefining competitive landscapes and setting new benchmarks for quality, speed, and environmental performance within the anchors and grouts industry.

Assessment of 2025 United States Tariff Adjustments Revealing the Cumulative Effects on Raw Material Access Pricing Structures and Competitive Positioning in Anchors and Grouts

In 2025, the United States introduced revised tariffs affecting key resin and cementitious precursors essential to anchors and grouts production. These cumulative adjustments have influenced raw material sourcing strategies, compelling manufacturers to reassess supplier portfolios and explore alternative chemistries. The higher import duties on epoxy resins in particular have led to more rigorous cost-containment measures and spurred investment in domestic capacity expansions, while cementitious inputs have seen recalibrated logistics approaches to offset added financial burdens.

As a result, pricing structures for end products have adjusted to reflect increased procurement costs, with many producers adopting tiered pricing models and longer-term supply agreements to stabilize margins. Competitive positioning has also shifted: companies with integrated manufacturing capabilities or strategic partnerships in regions outside the US-tariff scope have gained an advantage in delivering consistent delivery times and price predictability. Looking ahead, firms are expected to leverage advanced material substitution and process optimization to further mitigate the effects of tariff-induced cost pressures.

In-Depth Segmentation Insights Unveiling How Product Categories End Use Industries Distribution Channels and Applications Intersect to Drive Industry Dynamics

Anchors and grouts market dynamics can be illuminated by examining how product categories, end use industries, distribution channels, and application types intersect to create nuanced demand patterns. Based on Product Category, market offerings span Anchors and Grouts, with Anchors divided into Chemical and Mechanical variants, the former encompassing Epoxy, Polyester, and Vinyl Ester formulations and the latter incorporating Expansion, Undercut, and Wedge types; Grouts extend into Acrylic, Cementitious, Epoxy, and Vinyl Ester segments, the Cementitious category further distinguishing Nonshrink, Nonstructural, and Structural grades, while Epoxy grouts are available in Onepack and Twopack formats.

Shifting to End Use Industry, the spectrum ranges from Construction and Energy & Power to Infrastructure, Mining, and Oil & Gas, each segment demanding unique performance attributes. The Distribution Channel landscape includes Dealers & Retailers, Ecommerce, and Specialized Distributors, with ecommerce channels subdivided into Company Website and Third-party Platform transactions. Application considerations span Anchoring, Bonding, Repair, and Structural Reinforcement, where selection criteria hinge on load requirements, substrate compatibility, and environmental exposure. Understanding these layered segmentation insights allows industry participants to tailor offerings, optimize go-to-market strategies, and address the distinct needs of end users across verticals.

This comprehensive research report categorizes the Anchors & Grouts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Distribution Channel

- Application

- End Use Industry

Key Regional Analysis Highlighting Distinct Market Characteristics and Growth Drivers across Americas Europe Middle East Africa and Asia Pacific Territories

Regional characteristics exert a profound influence on market trajectories within the anchors and grouts sphere. In the Americas, robust infrastructure initiatives and a resurgence in commercial construction activity have driven steady demand for both chemical and cementitious solutions, with North America prioritizing regulatory compliance and Latin America emphasizing cost efficiency in resource development projects.

Across Europe, the Middle East & Africa, stringent building codes and sustainability mandates have accelerated adoption of low-emissions grouts and advanced mechanical anchor systems, while significant oil and gas expansions in the Gulf and mining investments in sub-Saharan Africa underscore the region’s reliance on heavy-duty anchoring and repair materials. Meanwhile, the Asia-Pacific landscape is characterized by rapid urbanization, high-growth infrastructure funding in Southeast Asia, and targeted renewable energy programs in Northeast Asian markets. These regional dynamics collectively shape portfolio priorities, R&D focus, and market entry strategies for stakeholders aiming to capitalize on localized growth drivers while navigating regulatory and environmental considerations.

This comprehensive research report examines key regions that drive the evolution of the Anchors & Grouts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Company Profiles Showcasing Competitive Strategies Innovation Focus Partnerships and Growth Initiatives of Leading Anchors and Grouts Manufacturers

Leading players in the anchors and grouts arena are differentiating themselves through targeted innovation, strategic collaborations, and expanded service offerings. Hilti, for instance, has concentrated on developing digital asset management platforms that complement its high-performance mechanical anchors, fostering stronger customer relationships through value-added technical support. Sika’s emphasis on sustainable polymer technologies and cross-linked grout compositions has positioned it as a go-to partner for infrastructure projects that demand both durability and environmental compliance.

Simpson Strong-Tie’s modular anchor portfolio and comprehensive engineering consultancy services illustrate how combining product breadth with advisory capabilities can yield competitive advantage. Mapei’s investments in specialty resins and regional manufacturing footprint have improved responsiveness to local market requirements, while Fosroc’s joint ventures and licensing agreements have expanded its access to niche chemical formulations. Across the board, alliances with construction firms, joint R&D initiatives, and distribution partnerships are enabling key companies to fortify their value propositions and accelerate time to market for novel anchoring and grouting solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anchors & Grouts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Chembond Chemicals Limited

- Cico Group

- Denso Company Ltd.

- Dow Chemical Company

- Euclid Chemical Company

- fischer Group of Companies

- Five Star Products Inc.

- Fosroc International Ltd.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hilti Corporation

- ITW Construction Products

- Krete Industries Inc.

- Larsen Products Corporation

- Mapei S.p.A.

- Powers Fasteners Inc.

- RPM International Inc.

- Saint-Gobain Weber

- Sika AG

- Simpson Strong-Tie Company Inc.

- Würth Group

Actionable Strategic Recommendations Guiding Industry Leaders to Optimize Supply Chains Amplify Sustainable Practices and Enhance Product Innovation in Anchors and Grouts

To navigate industry complexities and capitalize on emerging opportunities, leaders should prioritize supply chain diversification by cultivating relationships with multiple resin and cement suppliers, thereby enhancing resilience against tariff volatility and logistical disruptions. Concurrently, integrating sustainability into product development roadmaps will not only satisfy tightening regulatory demands but also resonate with end users who are increasingly focused on carbon footprint reduction.

Investing in digital toolsets that offer real-time project analytics and performance monitoring can improve installation accuracy and drive customer loyalty. Collaboration with academic institutions and testing laboratories to validate novel formulations will expedite regulatory approval processes and reinforce product credibility. Finally, customizing value-added services such as technical training for installers and specification support for design firms will transform routine transactions into strategic partnerships, ensuring that companies remain agile, differentiated, and aligned with evolving market expectations.

Comprehensive Research Methodology Clarifying Data Sources Analytical Frameworks and Validation Procedures Underpinning the Anchors and Grouts Market Analysis

This research employed a multi-method approach combining both primary and secondary sources to ensure a robust analytical foundation. Primary data was collected via in-depth interviews with technical experts, procurement managers, and field engineers across key end use industries, supplemented by structured surveys targeting regional distributors and specification consultants. Secondary research encompassed the review of peer-reviewed journals, industry standards documentation, regulatory filings, and company technical bulletins, enabling comprehensive coverage of product performance criteria and compliance frameworks.

Data triangulation techniques were applied to validate insights, cross-referencing quantitative findings with qualitative inputs to identify any discrepancies and refine interpretation. An analytical framework mapping thematic trends against segmentation variables facilitated the extraction of actionable insights, while rigorous peer review within a panel of market specialists ensured methodological consistency and impartiality. This structured process underpins the credibility of the findings and the strategic recommendations derived throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anchors & Grouts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anchors & Grouts Market, by Product Category

- Anchors & Grouts Market, by Distribution Channel

- Anchors & Grouts Market, by Application

- Anchors & Grouts Market, by End Use Industry

- Anchors & Grouts Market, by Region

- Anchors & Grouts Market, by Group

- Anchors & Grouts Market, by Country

- United States Anchors & Grouts Market

- China Anchors & Grouts Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Conclusive Reflections Summarizing Market Insights Strategic Imperatives and Value Propositions Shaping the Future of Anchors and Grouts Solutions Across Industries

The anchors and grouts market is at an inflection point where innovation, sustainability, and strategic agility converge to shape competitive advantage. Transformative material technologies and digital enhancements are redefining performance benchmarks, while evolving tariff landscapes and regional investment patterns continue to influence supply chain and pricing dynamics. By synthesizing segmentation insights with company profiles and actionable recommendations, stakeholders can better anticipate shifts in end use requirements and optimize their offerings accordingly.

Fundamentally, success in this sector will hinge on the ability to deliver tailored solutions that address the precise demands of construction, energy, infrastructure, mining, and oil & gas applications. Companies that invest in differentiated product portfolios, foster collaborative synergies, and align with stringent environmental standards will be best positioned to capture emerging growth opportunities. These conclusive reflections underscore the imperative for ongoing vigilance, adaptive strategy formulation, and continuous innovation to secure leadership in the competitive anchors and grouts landscape.

Engage with Ketan Rohom to Access Detailed Anchors and Grouts Market Research Report and Unlock Tailored Insights for Strategic Decision Making

For tailored insights and a granular understanding of the anchors and grouts sector’s evolving dynamics, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. His expertise in translating market intelligence into actionable strategies will ensure you obtain a customized research report that aligns with your organization’s objectives. Engage with Ketan to schedule a consultation and explore flexible licensing options, enabling your team to leverage in-depth analyses, company profiles, and region-specific findings. By partnering with Ketan Rohom, you can secure access to comprehensive qualitative and quantitative insights, empowering data-driven decision making and competitive differentiation within the anchors and grouts landscape

- How big is the Anchors & Grouts Market?

- What is the Anchors & Grouts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?