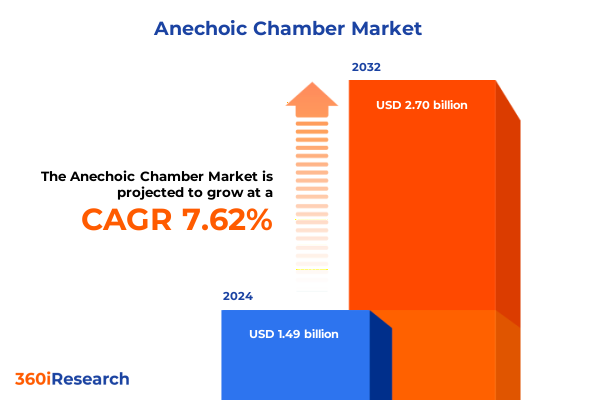

The Anechoic Chamber Market size was estimated at USD 1.61 billion in 2025 and expected to reach USD 1.74 billion in 2026, at a CAGR of 8.10% to reach USD 2.79 billion by 2032.

Unveiling the foundational importance of anechoic chambers for advancing precision testing in complex acoustic and electromagnetic environments

Anechoic chambers serve as the bedrock for high-precision acoustic and electromagnetic testing, enabling engineers and researchers to replicate idealized environments free from disruptive reflections and interference. These specialized enclosures are meticulously designed to absorb sound waves and block external electromagnetic fields, creating a controlled setting for performance validation, calibration, and compliance testing. Such chambers are critical for advancing a broad spectrum of technologies, from wireless communication systems to next-generation automotive sensors, by ensuring that products meet stringent regulatory standards and perform reliably under real-world conditions.

The concept of the anechoic chamber has evolved substantially since its inception, shifting from simple sound-dampening rooms to highly sophisticated facilities that integrate advanced absorber materials, optimized geometries, and state-of-the-art shielding techniques. Modern installations often incorporate active noise control elements and digital twins to enhance testing fidelity and reduce the time required for setup and calibration. As a result, anechoic chambers have become essential assets for research laboratories, aerospace firms, semiconductor manufacturers, and telecom operators striving to refine product performance and drive innovation.

In essence, anechoic chambers represent the convergence of acoustics, materials science, and electromagnetic engineering, forming a platform where theoretical models are rigorously validated and iterative design improvements occur rapidly. Their role extends beyond mere certification; they act as incubators for innovation, enabling organizations to push the boundaries of what is possible in audio and RF performance. With demand surging for faster, more reliable, and more efficient devices, the importance of these chambers in the product development lifecycle has never been more pronounced.

Identifying transformative shifts reshaping the anechoic chamber landscape through technological innovation and evolving industry demands

In recent years, the anechoic chamber landscape has undergone transformative shifts driven by converging technological, regulatory, and market dynamics. One of the most notable developments is the integration of digital twin technology, which enables virtual prototyping and simulation of acoustic and electromagnetic phenomena. By combining high-fidelity models with real-world data, manufacturers can streamline testing cycles and identify performance bottlenecks earlier in the development process. This shift towards digital coupling has not only reduced time-to-market but has also elevated the granularity of insights, empowering stakeholders to make more informed design choices.

Concurrently, the proliferation of 5G networks and the race towards 6G research have intensified demand for chambers capable of handling millimeter-wave frequencies and complex MIMO antenna configurations. As telecom operators and equipment vendors push the envelope of wireless performance, anechoic facilities must adapt to accommodate broader frequency ranges, tighter tolerance criteria, and multi-antenna measurements. To meet these challenges, chamber providers are exploring modular absorber layouts and reconfigurable test ranges that balance flexibility with measurement accuracy.

Moreover, the accelerating adoption of electric vehicles and advanced driver-assistance systems has fueled the need for EMC validation under diverse operational conditions. Anechoic chambers are being reimagined as multi-domain environments where acoustic, vibration, and electromagnetic assessments occur concurrently. This holistic testing approach ensures that sensors, control modules, and infotainment systems perform reliably amidst the electromagnetic noise generated by electric powertrains and wireless connectivity. Collectively, these shifts underscore a broader trend: anechoic chambers are evolving from single-purpose enclosures into adaptable test ecosystems tailored to the complexity of modern technologies.

Assessing the cumulative impact of United States tariffs in 2025 on the anechoic chamber market dynamics and global supply chain resilience

The imposition of new United States tariffs in 2025 has exerted a cumulative impact on the anechoic chamber market, reverberating through production costs, supply chain strategies, and pricing models. Tariffs on key imports such as specialized absorber materials, structural steel components, and high-frequency instrumentation have elevated manufacturing expenses and compelled original equipment manufacturers to reevaluate sourcing pathways. As input costs climbed, some leading providers accelerated efforts to localize component production, forging partnerships with domestic suppliers to attenuate exposure to cross-border levies.

Furthermore, the tariff landscape has prompted companies to adopt dynamic pricing strategies, incorporating flexible surcharge mechanisms to preserve margins without undermining demand elasticity. In parallel, extended lead times for imported electronics and shielding grids have underscored the importance of robust inventory management practices. Providers that invested in buffer stocks and diversified their supplier base have demonstrated greater resilience, mitigating the risk of testing delays for critical programs in aerospace, defense, and consumer electronics.

Beyond immediate fiscal pressures, the tariffs have catalyzed a broader strategic realignment. Several stakeholders have initiated feasibility studies for localized production hubs in tariff-exempt regions, complemented by technology transfer agreements to maintain quality control. Others have pursued cost-saving design optimizations, such as integrating composite materials with absorbing properties that reduce overall weight and assembly complexity. Taken together, these responses reflect an industry in transition, where agility and supply chain innovation have become as vital as technical prowess in navigating the post-tariff environment.

Unlocking critical segmentation insights across end users applications chamber types and distribution channels to drive tailored anechoic chamber market strategies

A granular examination of market segmentation reveals distinct performance drivers across end user, application, chamber type, and distribution channel categories. End users such as aerospace and defense benefit from anechoic chambers tailored to both commercial aviation and defense aviation, where stringent certification processes demand specialized absorber configurations and reinforced shielding. Similarly, automotive testing environments cater to both aftermarket suppliers and OEM manufacturers, enabling validation of infotainment systems, radar sensors, and noise suppression solutions against dynamic real-world conditions.

Application-based segmentation yields further nuances, with acoustic testing encompassing noise level measurement and sound absorption testing for products ranging from consumer appliances to automotive cabins. Electromagnetic compatibility assessments, by contrast, cover conducted emission and immunity testing along with radiated emission and immunity testing, each critical for certifying the electromagnetic resilience of interconnected devices. This duality underscores the dual functionality of modern anechoic facilities as versatile test centers across a spectrum of performance criteria.

Chamber type also plays a pivotal role in defining capability and cost structure. Fully anechoic chambers excel in simulating free-field conditions for comprehensive acoustic and RF analysis, whereas hemianechoic chambers provide a balance between footprint efficiency and measurement range. Semi-anechoic chambers, with their partial absorber arrays, offer a cost-effective alternative for basic noise assessment and low-frequency testing. From a distribution perspective, direct sales channels facilitate bespoke engineering collaborations, distributor networks amplify market reach through localized support, and online platforms streamline procurement for standardized test solutions.

This comprehensive research report categorizes the Anechoic Chamber market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Chamber Type

- End User

- Application

- Distribution Channel

Analyzing key regional dynamics across the Americas Europe Middle East & Africa and Asia Pacific to pinpoint strategic growth pathways in anechoic chambers

Regional landscapes vary significantly in terms of regulatory environments, infrastructure investment, and industry focus, producing a mosaic of opportunities for anechoic chamber suppliers. In the Americas, advanced aerospace programs and stringent emission standards in North America stimulate demand for high-end test facilities, while growing defense modernization in Latin America opens avenues for mid-tier chamber solutions. Market leaders have capitalized on regional government incentives and defense contracts to deploy mobile test ranges and modular enclosures that serve remote operational theaters.

In Europe, Middle East & Africa, Europe’s established aerospace clusters and rigorous EMC directives maintain steady requirements for both acoustic and electromagnetic chambers. Meanwhile, investment in satellite communication infrastructure across the Middle East and defense testing in Africa drives specialized use cases for hemi- and semi-anechoic configurations. Suppliers with regional service networks and localized absorber production have outpaced competitors by ensuring rapid deployment and compliance with evolving certification norms.

Across Asia-Pacific, rapid 5G rollouts in China, Japan’s consumer electronics innovation, and South Korea’s semiconductor export focus have collectively elevated the need for chambers capable of handling high-frequency testing and complex antenna arrays. India’s burgeoning automotive and research laboratory sectors further augment demand for versatile test environments. Companies that align their regional strategies with local manufacturing ecosystems and strategic partnerships have maximized market penetration, leveraging proximity to major OEMs and research institutions to facilitate co-development initiatives.

This comprehensive research report examines key regions that drive the evolution of the Anechoic Chamber market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining leading industry players and strategic partnerships setting the pace for innovation and competitiveness within the global anechoic chamber market

Leading companies in the anechoic chamber domain have distinguished themselves through technological innovation, strategic collaborations, and adaptive service models. Global engineering firms have invested heavily in modular absorber systems that can be reconfigured swiftly for changing test requirements, reducing downtime and capital expenditure for end users. Meanwhile, specialized manufacturers of absorber materials have forged partnerships with academic institutions to advance novel composites that combine electromagnetic shielding with enhanced acoustic dampening properties.

Strategic alliances have also emerged between chamber builders and instrumentation providers, offering turnkey solutions that integrate hardware calibration, automated data acquisition, and cloud-based analytics platforms. This convergence of capabilities has enabled customers to transition seamlessly from test execution to actionable insight, streamlining time-to-certification and reducing the risk of non-compliance penalties. Additionally, several companies have expanded their global footprint through acquisitions of regional distributors, bolstering local support networks and enhancing logistical efficiencies.

Service differentiation has become a critical competitive lever, with leading players offering comprehensive maintenance contracts, remote monitoring dashboards, and on-site training programs. By embedding themselves in client operations, these firms not only ensure optimal chamber performance but also cultivate long-term partnerships that drive recurring revenue streams. As the market matures, the ability to deliver value-added services alongside capital equipment has become a hallmark of industry leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anechoic Chamber market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albatross Projects Limited

- Brüel & Kjær Sound & Vibration A/S

- EM Test GmbH

- ETS-Lindgren, Inc.

- Frankonia Germany EMC Solutions GmbH

- G.R.A.S. Sound & Vibration A/S

- Keysight Technologies, Inc.

- Panashow Electronics Co., Ltd.

- Rohde & Schwarz GmbH & Co. KG

- SATIMO SA

- Sunol Sciences Corporation

- TDK RF Solutions, Inc.

Delivering actionable recommendations for industry leaders to optimize production testing environments and capitalize on emerging anechoic chamber trends

Industry leaders seeking to capitalize on emerging trends should prioritize investments in modular and reconfigurable test environments that adapt rapidly to evolving protocols. By embracing digital twin simulations and integrated analytics, organizations can optimize chamber utilization and accelerate validation cycles, yielding faster time-to-market and reduced operational costs. Furthermore, engaging in collaborative R&D initiatives with semiconductor and automotive OEMs will ensure that design requirements are anticipated and incorporated early in the development process.

To mitigate exposure to geopolitical and tariff-related uncertainties, executives should diversify their supplier portfolios and evaluate the feasibility of localized production hubs. Establishing strategic inventory buffers and leveraging nearshore manufacturing options can shield operations from abrupt cost increases while maintaining continuity in test schedules. Concurrently, adopting sustainable materials and energy-efficient absorber systems can reduce both carbon footprint and long-term maintenance expenses, aligning with corporate ESG objectives.

Finally, enhancing customer experience through value-added services such as remote diagnostics, predictive maintenance platforms, and specialized operator training will strengthen client retention and foster new revenue opportunities. By coupling technical excellence with consultative support, companies can position themselves as trusted partners in the innovation ecosystem, driving competitive differentiation and sustainable growth.

Detailing rigorous research methodology clarifying the multifaceted approach used to gather and validate insights on the anechoic chamber market

Our research methodology combines rigorous primary engagements with comprehensive secondary analysis to ensure depth and accuracy of insights. Primary data collection involved structured interviews with senior engineers, testing facility managers, and procurement directors across key sectors including aerospace, automotive, telecom, and consumer electronics. These dialogues provided firsthand perspectives on evolving performance requirements, procurement decision drivers, and service expectations.

Secondary research encompassed a systematic review of industry standards, patent filings, technical publications, and conference proceedings to trace the trajectory of absorber material advancements and chamber design innovations. This desk investigation was supplemented by analysis of trade association reports, regulatory guidelines, and open-source supply chain data, enabling robust triangulation of qualitative and quantitative findings. Data validation workshops with select industry experts further polished the insights and resolved discrepancies.

To frame market segmentation and regional assessments, we deployed a matrix-based analytical model that integrates end user applications, chamber typologies, and distribution pathways. This multidimensional approach facilitated the identification of high-potential niches and risk factors, informing both strategic and tactical recommendations. Throughout this process, stringent quality assurance protocols governed data integrity, ensuring that the final deliverable meets the highest standards of reliability and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anechoic Chamber market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anechoic Chamber Market, by Chamber Type

- Anechoic Chamber Market, by End User

- Anechoic Chamber Market, by Application

- Anechoic Chamber Market, by Distribution Channel

- Anechoic Chamber Market, by Region

- Anechoic Chamber Market, by Group

- Anechoic Chamber Market, by Country

- United States Anechoic Chamber Market

- China Anechoic Chamber Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Concluding insights synthesizing critical findings and outlining the pivotal role of anechoic chambers in future testing and development landscapes

The anechoic chamber market is at a pivotal juncture, driven by accelerated innovation cycles and complex performance demands across industries. As digital twins and modular configurations become integral to testing strategies, suppliers must evolve beyond static installations and embrace adaptive ecosystems. At the same time, tariff-induced supply chain realignments underscore the necessity of sourcing flexibility and local partnership networks, ensuring resilience in an increasingly unpredictable geopolitical environment.

Segmentation insights reveal that tailored solutions for aerospace, automotive, and telecommunications sectors are essential for capturing value, while diverse chamber types and targeted distribution channels can address specific end user and application needs. Regional dynamics further accentuate the importance of aligning go-to-market approaches with local regulatory landscapes and investment priorities, whether in North America’s defense hubs, EMEA’s telecom corridors, or Asia-Pacific’s manufacturing powerhouses.

Ultimately, companies that excel in innovation, service excellence, and strategic agility will lead the next wave of market growth. By integrating advanced materials, automated analytics, and comprehensive support offerings, industry stakeholders can fortify their competitive position and deliver superior value to customers. This report’s findings and recommendations offer a roadmap for navigating the complexities of the modern testing environment and capitalizing on the transformative potential of anechoic chambers.

Engaging with Ketan Rohom for comprehensive market intelligence and securing the definitive anechoic chamber research report to inform strategic decisions

Are you prepared to elevate your strategic decision-making with unparalleled insights into the anechoic chamber landscape? Ketan Rohom, Associate Director of Sales & Marketing, invites you to explore the in-depth analysis and actionable intelligence presented in our comprehensive report. This meticulously crafted study offers a multidimensional perspective on market trends, competitive dynamics, and technological innovations, providing you with the confidence to navigate emerging challenges and seize new opportunities.

By partnering with Ketan Rohom, you gain direct access to specialized expertise and tailored guidance that aligns with your organization’s objectives. The report’s rich qualitative narratives and rigorous methodological framework equip decision-makers with the clarity needed to optimize product development, fine-tune market entry strategies, and strengthen supply chain resilience. In addition, exclusive executive summaries and bespoke data visualizations further streamline the process of extracting relevant insights and driving stakeholder alignment.

Don’t miss the opportunity to secure this vital resource and stay ahead of market shifts. Engage with Ketan Rohom today to request a personalized walkthrough of the report’s key findings, discuss subscription options, and learn how our research can support your growth trajectory. Take the next step toward informed, data-driven strategies that will define the future of acoustic and electromagnetic testing environments.

- How big is the Anechoic Chamber Market?

- What is the Anechoic Chamber Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?