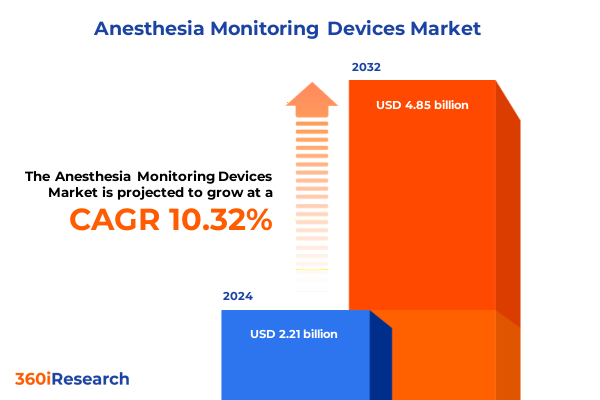

The Anesthesia Monitoring Devices Market size was estimated at USD 2.42 billion in 2025 and expected to reach USD 2.66 billion in 2026, at a CAGR of 10.41% to reach USD 4.85 billion by 2032.

Igniting a Comprehensive Understanding of the Evolving Anesthesia Monitoring Devices Market and Its Crucial Role in Enhancing Patient Safety and Outcomes

The anesthesia monitoring device sector stands at the forefront of patient safety and clinical efficiency, integrating advanced technologies to support anesthesiologists and perioperative teams in delivering precise, real-time insights. As surgical procedures become more complex and patient profiles diversify, the reliance on sophisticated monitoring solutions has never been greater. From high acuity operating rooms to ambulatory centers, these devices form the backbone of anesthesia management protocols, detecting physiological changes which may be imperceptible to the human eye.

In recent years, healthcare institutions have prioritized minimizing perioperative risk and optimizing workflow throughput. This shift has propelled significant investments in cutting-edge monitors that capture critical parameters such as blood pressure, capnography, gas analysis, pulse oximetry, and temperature. Moreover, the convergence of these modalities into multi-parameter platforms has enabled continuous, non-stop surveillance of patient status, driving improvements in both outcomes and resource allocation.

This executive summary outlines the pivotal trends, regulatory influences, and competitive forces defining the global anesthesia monitoring device market. It establishes a foundational perspective that will guide stakeholders in understanding transformative innovations, market segmentation nuances, and strategic pathways to navigate emerging challenges and capitalize on new growth opportunities.

Navigating Transformational Innovations and Technological Paradigm Shifts That Are Reshaping Clinical Practices and Device Integration in Anesthesia Monitoring

Breakthroughs in sensor miniaturization, wireless connectivity, and embedded software intelligence have triggered a fundamental transformation in anesthesia monitoring workflows. Devices are no longer isolated measurement tools; they form an ecosystem of interoperable solutions capable of seamless data exchange with electronic health records and perioperative information systems. As a result, anesthesiologists gain a holistic, longitudinal view of patient physiology that extends beyond individual procedures, enabling predictive analytics and personalized care pathways.

The rise of artificial intelligence and machine learning has further accelerated this paradigm shift, as advanced algorithms mine vast repositories of monitoring data to identify subtle trends, predict adverse events, and optimize drug dosing strategies. Enhanced visualization platforms now present composite indices that amalgamate multiple physiological signals into singular risk scores, streamlining decision making under time-sensitive conditions. At the same time, the integration of telemonitoring capabilities has empowered remote specialists to collaborate in real time, expanding access to anesthesiology expertise in underserved regions.

Furthermore, regulatory bodies are increasingly focusing on harmonizing device interoperability standards and data security requirements. This has prompted manufacturers to adopt modular designs and open architecture frameworks, ensuring that new product launches seamlessly integrate with existing hospital infrastructures. Collectively, these technological and regulatory influences are redefining the competitive landscape, compelling stakeholders to pivot toward adaptive, platform-oriented strategies that can scale with the evolving demands of modern healthcare delivery.

Assessing the Comprehensive Effects of Newly Implemented United States Tariffs in 2025 on Supply Chain Dynamics Cost Structures and Market Accessibility

The introduction of new United States tariffs in 2025 has injected a layer of complexity into the global supply chain for anesthesia monitoring devices. Components such as precision sensors, electronic modules, and proprietary software licenses, once sourced predominantly from cost-effective overseas manufacturers, now face elevated import duties. This has placed upward pressure on input costs, compelling original equipment manufacturers to reevaluate sourcing strategies or absorb additional expenses that could erode profit margins.

In response, some device developers have accelerated plans to localize production, investing in domestic manufacturing facilities and strategic partnerships with regional suppliers. This not only mitigates tariff impact but also strengthens resilience against logistical disruptions. However, such transitions require significant capital outlay and carry implementation risks, including capacity constraints and the challenge of re-establishing quality control benchmarks across new production lines.

End users are navigating these cost shifts by renegotiating service contracts and exploring bundled procurement arrangements that offer greater price stability. Health systems are increasingly open to flexible leasing and device as a service models to sidestep large upfront capital expenses. Although these adaptations partially offset tariff-related increases, they also introduce new complexities in asset management and lifecycle planning, underscoring the need for robust total cost of ownership analyses.

Unveiling Critical Segmentation Insights That Illuminate Diverse Product Types Technologies Applications End Users and Distribution Channels

Product type diversification remains a cornerstone of market evolution, with offerings spanning blood pressure monitors, capnography monitors, gas analyzers, multi-parameter monitors, pulse oximeters, and temperature monitors. Each category serves distinct clinical imperatives, yet overlaps in functionality are driving greater integration of measurement modalities into unified systems. Blood pressure monitoring devices benefit from improved oscillometric algorithms, while capnography solutions are distinguished by enhanced CO₂ detection accuracy. Gas analyzers now incorporate broader gas mixture evaluations, and multi-parameter platforms offer configurable interfaces that cater to both adult and pediatric cohorts.

The technology segmentation underscores a dichotomy between invasive and noninvasive monitoring approaches. Invasive modalities, including arterial blood pressure monitoring, central venous pressure monitoring, and intracranial pressure monitoring, continue to dominate high-risk surgical and critical care settings where precision is non-negotiable. Conversely, noninvasive monitoring, which encompasses capnography, gas analysis, oscillometric blood pressure monitoring, pulse oximetry, and temperature surveillance, gains widespread adoption for its ease of use, reduced infection risk, and compatibility with ambulatory surgical centers and outpatient clinics.

Applications within general anesthesia, regional anesthesia, and sedation procedures reveal that general anesthesia accounts for the broadest utilization, driven by complex surgical workflows requiring continuous physiological surveillance. Regional anesthesia’s growth is fueled by its minimized systemic impact and rising preference for nerve block techniques in orthopedic and obstetric procedures. Meanwhile, sedation procedures have carved out a niche within diagnostic imaging and dental surgery environments, demanding compact, rapid-response devices that maintain patient comfort and safety.

End users shape procurement trends through distinct operational requirements. Hospitals, particularly emergency departments, intensive care units, and operating rooms, demand high-performance, ruggedized equipment with integrated alarm systems. Ambulatory surgical centers prioritize cost-effective, easy-to-maintain monitors that support high patient turnover. Clinics and other outpatient settings focus on compact footprint solutions that offer fundamental monitoring capabilities without the overhead of complex interfacing. Distribution channels reinforce these preferences, as direct sales relationships empower large hospital systems with customization options, while indirect sales networks extend reach to smaller facilities through value-added distributors and contract service providers.

This comprehensive research report categorizes the Anesthesia Monitoring Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Distribution Channel

Decoding Pivotal Regional Market Dynamics Across the Americas Europe Middle East Africa and Asia Pacific Powering Anesthesia Monitoring Adoption

The Americas continue to lead in technology adoption, driven by substantial healthcare investments and stringent safety regulations. North American markets exhibit high receptiveness to next-generation monitors featuring advanced analytics and connectivity options. Latin America presents a growing yet price-sensitive segment where demand for cost-effective, portable devices is on the rise as surgical volumes increase in emerging urban centers.

In Europe, Middle East and Africa, regional disparities underscore the need for adaptable solutions. Western Europe prioritizes interoperability and compliance with robust regulatory frameworks such as the EU Medical Device Regulation, incentivizing manufacturers to demonstrate device traceability and software validation. In the Middle East, rapid hospital expansions in the Gulf Cooperation Council countries have generated demand for integrated operating room suites, including multi-parameter monitors with telemonitoring capabilities. African markets, while nascent, are gradually investing in upgraded anesthesia infrastructure, often in partnership with international aid organizations that emphasize technology transfer and training.

Asia-Pacific exhibits the fastest growth trajectory, propelled by large patient populations and escalating surgical procedure volumes in China and India. Governments across the region are promoting domestic manufacturing under strategic initiatives, incentivizing local production of devices to support self-sufficiency. Southeast Asian healthcare systems seek modular monitoring platforms that can be scaled according to facility size and resource availability. Moreover, expanding medical tourism hubs in countries like Thailand and Malaysia are elevating quality expectations for monitoring standards, further stimulating demand for premium device offerings.

This comprehensive research report examines key regions that drive the evolution of the Anesthesia Monitoring Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Innovative Portfolios from Leading Industry Players Driving Growth and Competitive Differentiation in Anesthesia Monitoring

Leading industry participants are leveraging focused R&D investments to expand their product portfolios and maintain competitive differentiation. Established names such as GE Healthcare and Dräger are refining multi-parameter monitor platforms with integrated artificial intelligence frameworks that optimize alarm management and predictive analytics. Meanwhile, Philips is enhancing sensor technology to improve SpO₂ accuracy under challenging clinical conditions, and Nihon Kohden is emphasizing ergonomic designs that support prolonged surgical procedures with minimal clinician fatigue.

Mid-tier players are strengthening their presence by targeting niche segments and value-driven propositions. Mindray has increased collaborations with regional distributors to accelerate market entry in Asia-Pacific and the Middle East, bundling service agreements to enhance long-term customer retention. Similarly, Smiths Medical is focusing on modular capnography and gas analysis units that can be easily configured to meet specific hospital and ambulatory surgery center requirements, simplifying procurement and maintenance processes.

Innovative partnerships between device manufacturers and software developers are further diversifying the competitive landscape. Companies are co-developing cloud-native platforms that aggregate monitoring data across multiple care settings, delivering unified dashboards for anesthesiologists and perioperative teams. Such alliances facilitate seamless firmware updates and remote diagnostics, reducing device downtime and enabling continuous performance optimization. As market entrants and incumbents navigate tightening regulatory scrutiny around cybersecurity, these joint ventures are becoming instrumental in ensuring that monitoring ecosystems remain both secure and scalable.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anesthesia Monitoring Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambu A/S

- Baxter International, Inc.

- Becton, Dickinson and Company

- Beijing Aeonmed Co., Ltd.

- Criticare Technologies Inc.

- Drägerwerk AG & Co. KGaA

- Fukuda Denshi Co., Ltd.

- GE Healthcare

- Getinge AB

- Heyer Medical AG

- Infinium Medical, Inc.

- Intersurgical Limited

- Koninklijke Philips N.V.

- Medtronic PLC

- Medtronic plc

- Mindray Medical International Limited

- Nihon Kohden Corporation

- OSI Systems, Inc.

- Senzime AB

- Smiths Medical, Inc.

- Smiths Medical Inc.

- Spacelabs Healthcare, Inc.

- Teleflex Inc.

- Vyaire Medical Inc.

Implementing Actionable Strategies and Forward Looking Recommendations to Strengthen Market Position and Foster Sustainable Innovation in Anesthesia Monitoring

Stakeholders should prioritize investment in interoperable architectures that facilitate seamless integration of monitoring solutions with hospital information systems and telehealth platforms. Establishing open standards for data exchange will enable faster deployment of advanced analytics and support predictive maintenance models that minimize service disruptions. Moreover, organizations must diversify their supply chains to mitigate exposure to fluctuating tariffs and geopolitical uncertainties, pursuing dual-sourcing arrangements and regional assembly partnerships.

Innovation efforts should concentrate on refining user interfaces and alarm management frameworks to reduce clinician cognitive load. By incorporating context-aware alerts and consolidated risk indices, device providers can enhance situational awareness and streamline perioperative workflows. Concurrently, expanding training programs and certification courses will empower practitioners to harness the full potential of sophisticated monitoring technology, promoting consistent adoption across diverse clinical settings.

Finally, entering emerging markets with tiered product models that balance cost and feature sets will unlock new growth opportunities. Tailoring devices for low-resource environments-through durable designs, energy-efficient operation, and simplified maintenance protocols-will address critical care gaps while cultivating brand loyalty. Collaborations with government agencies and non-governmental organizations can facilitate deployment and training initiatives, reinforcing long-term partnerships that drive sustainable innovation and patient safety improvements.

Detailing Rigorous Research Approaches Embracing Primary and Secondary Data Triangulation Expert Consultations and Comprehensive Analytical Techniques

This report employs a dual-phased research approach combining exhaustive secondary research with in-depth primary investigations. Secondary sources include regulatory filings, clinical trial registries, peer-reviewed journals, and publicly available financial statements from key industry participants. These resources were synthesized to map historical trends, technology roadmaps, and competitive landscapes across global markets.

Primary research encompassed structured interviews with anesthesiologists, biomedical engineers, procurement executives, and regulatory specialists. These discussions provided granular insights into device performance benchmarks, purchasing drivers, and implementation challenges. Additionally, manufacturer surveys were conducted to obtain detailed specifications on product pipelines, pricing strategies, and distribution models.

Data triangulation was applied to reconcile information obtained from secondary and primary sources, ensuring consistency and reliability. Advanced analytical techniques-including SWOT analysis, Porter’s Five Forces, and scenario modeling-were utilized to evaluate market dynamics and forecast strategic outcomes. This robust methodology underpins the credibility of the findings and supports evidence-based decision making for stakeholders across the anesthesia monitoring device ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anesthesia Monitoring Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anesthesia Monitoring Devices Market, by Product Type

- Anesthesia Monitoring Devices Market, by Technology

- Anesthesia Monitoring Devices Market, by Application

- Anesthesia Monitoring Devices Market, by End User

- Anesthesia Monitoring Devices Market, by Distribution Channel

- Anesthesia Monitoring Devices Market, by Region

- Anesthesia Monitoring Devices Market, by Group

- Anesthesia Monitoring Devices Market, by Country

- United States Anesthesia Monitoring Devices Market

- China Anesthesia Monitoring Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Core Takeaways and Forward Looking Insights to Equip Stakeholders with a Clear Vision of Anesthesia Monitoring Device Market Trajectory

The anesthesia monitoring device market is undergoing a profound transformation driven by technological convergence, escalating regulatory demands, and evolving clinical workflows. Stakeholders must navigate shifting tariff regimes and supply chain reconfigurations while capitalizing on advances in AI-powered analytics and connected care platforms. Diverse product segments-from invasive pressure monitors to noninvasive gas analyzers and multiparameter suites-offer tailored solutions to meet specific procedural requirements and end-user preferences.

Regional dynamics underscore the importance of localization and flexibility. North America leads in innovation adoption, Europe prioritizes regulatory compliance, and Asia-Pacific delivers robust growth fueled by expanding surgical volumes and domestic manufacturing initiatives. Emerging markets in Latin America, the Middle East, and Africa present high-potential corridors for cost-sensitive device models and service-driven partnerships.

Collectively, these insights form a strategic blueprint for optimizing market entry, investment prioritization, and product development roadmaps. By aligning with the detailed segmentation, regional nuances, and competitive positioning outlined in this summary, decision makers can craft robust strategies that anticipate disruptions, accelerate time to value, and secure a sustainable foothold in the anesthesia monitoring device industry.

Empowering Data Driven Decision Making with an Exclusive Industry Report Curated by Ketan Rohom to Propel Strategic Success in Anesthesia Monitoring Devices

Investing in a comprehensive industry report curated by Ketan Rohom, Associate Director of Sales & Marketing, unlocks an unparalleled opportunity to inform and shape strategic initiatives across the anesthesia monitoring device landscape. This meticulously developed resource distills extensive primary and secondary research into actionable insights that address evolving regulatory requirements, competitive dynamics, and emerging technological breakthroughs. Engaging with this report empowers decision makers to anticipate market shifts, optimize procurement strategies, and prioritize innovation pathways that align with clinical imperatives and budgetary constraints.

By collaborating with Ketan Rohom, stakeholders gain direct access to tailored guidance on leveraging data-driven recommendations, ensuring their investments in blood pressure monitors, gas analyzers, pulse oximeters, and other critical devices yield maximum clinical and economic returns. Reaching out through the official inquiry channels will facilitate an in-depth discussion of customization options, licensing terms, and value-added consulting services.

Secure your organization’s competitive advantage in an increasingly complex and rapidly evolving arena. Contact Ketan Rohom today to acquire the full market research report and drive informed decisions that will shape the future of anesthesia monitoring.

- How big is the Anesthesia Monitoring Devices Market?

- What is the Anesthesia Monitoring Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?