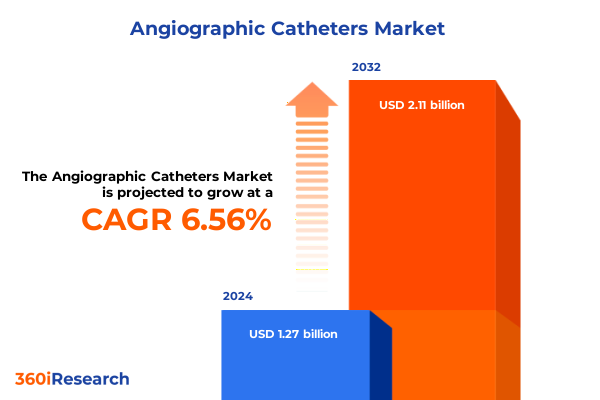

The Angiographic Catheters Market size was estimated at USD 1.35 billion in 2025 and expected to reach USD 1.44 billion in 2026, at a CAGR of 6.57% to reach USD 2.11 billion by 2032.

Uncovering the Strategic Foundations and Clinical Imperatives Shaping the Evolution of Angiographic Catheters in Modern Healthcare’s State-of-the-Art Innovation Landscape

The angiographic catheter market sits at the intersection of cardiovascular innovation and precision medicine, underpinning transformative procedures that save and improve lives. As interventional cardiology and radiology continue to expand their clinical applications, these specialized catheters facilitate minimally invasive imaging, targeted drug delivery, and complex vessel navigation. With an aging population and rising incidence of vascular diseases globally, the demand for reliable, high-performance catheters is intensifying. Moreover, the market’s competitive dynamics are driven by continuous technological enhancements, supplier consolidation, and stringent regulatory requirements that shape strategic priorities for both established participants and emerging challengers. Understanding these forces is essential for stakeholders aiming to navigate an increasingly complex ecosystem and capitalize on future growth opportunities.

Revolutionary Technological and Clinical Trends Redefining Precision and Safety in Interventional Cardiology Through Advanced Catheter Innovations

Innovation within the angiographic catheter sector is rapidly redefining clinical workflows and procedural outcomes. The integration of artificial intelligence and machine learning into robotic-assisted navigation systems has enhanced the precision of catheter placement by facilitating real-time vessel segmentation, device tracking, and path optimization, thereby reducing radiation exposure and procedural times for both patients and physicians. Concurrently, miniaturization efforts are enabling access to more distal and complex vascular territories, with companies developing catheters that combine intravascular ultrasound, optical coherence tomography, and near-infrared spectroscopy into a single hybrid device to deliver comprehensive vessel assessment during interventions.

Moreover, the emergence of hybrid operating rooms that unite advanced imaging platforms with surgical capabilities is accelerating the adoption of AI-driven intravascular solutions. These digital health platforms offer cloud connectivity for real-time data sharing, remote consultation, and integration with hospital information systems, supporting multidisciplinary collaboration and longitudinal patient tracking across care settings. At the same time, industry stakeholders are advancing biocompatible and antimicrobial surface technologies, including chlorhexidine-impregnated materials and UV disinfection modules, which aim to mitigate catheter-related bloodstream infections and align with heightened clinical safety protocols. Together, these trends are propelling the angiographic catheter landscape toward a future of greater autonomy, enhanced safety, and unparalleled diagnostic capability.

Assessing the Cumulative Economic, Supply Chain, and Clinical Effects of 2025 U.S. Trade Tariffs on the Angiographic Catheter Ecosystem

The 2025 U.S. tariff regime has introduced layers of complexity to the angiographic catheter supply chain and broader cardiovascular device market. In April, a baseline 10 percent levy on medical imports from key trading partners, coupled with additional duties on steel and aluminum-containing components, has elevated input costs for catheter manufacturers dependent on global sourcing. This shift has led leading device makers to assess potential one-time earnings adjustments and operational realignments. Early market responses included a decline in medical device equities, reflecting investor concerns over cost pressures and supply disruptions.

Amidst these challenges, industry groups such as the American Hospital Association have lobbied for carve-outs and exceptions, underscoring the critical nature of diagnostic and interventional equipment in delivering essential care. Notwithstanding these efforts, many manufacturers are exploring strategic adjustments, including nearshoring production and reinforcing domestic partnerships to mitigate tariff exposure. GlobalData analysts warn that without stable and transparent trade policies, cardiovascular device companies may be forced to continuously revise production plans and redirect focus toward markets with more predictable regulatory environments. As the tariff landscape evolves, these cumulative impacts will continue to shape cost structures, innovation pipelines, and the global competitiveness of angiographic catheter portfolios.

Illuminating Critical Market Segmentation Dimensions and Their Influence on Product, Application, and End-User Dynamics Within the Angiographic Catheter Sector

The angiographic catheter market is defined by distinct segmentation layers that guide product development, clinical adoption, and strategic focus. Product type differentiation spans a broad spectrum of balloons, diagnostic instruments, guiding platforms, and specialty microcatheters. Balloon variants, designed for vessel dilation, include both monorail and over-the-wire configurations, each optimized for specific procedural preferences. Diagnostic catheters feature curved and straight designs tailored to anatomical navigation requirements, while guiding catheters are available with hydrophilic coatings for enhanced lubricity and non-coated options for cost-sensitive applications. Specialty catheters encompass flow diverters for aneurysm management and microcatheters engineered for intricate neurovascular interventions.

Application-based segmentation further delineates market dynamics by focusing on coronary interventions, neurovascular procedures, and peripheral therapies. End users vary across ambulatory surgical centers that demand efficient workflows, high-volume catheterization laboratories that prioritize throughput and precision, outpatient clinics emphasizing cost containment, and hospitals requiring comprehensive device portfolios to support diverse procedural suites. Material selection-ranging from polymeric composites to silicone and Teflon coatings-influences catheter performance characteristics such as flexibility, tensile strength, and biocompatibility. Finally, usage models differentiate between reusable systems, valued for long-term cost efficiencies, and single-use disposables, driven by infection control mandates and simplified logistics. These interlocking segmentation dimensions shape manufacturer strategies, clinical preferences, and end-user procurement choices in the angiographic catheter domain.

This comprehensive research report categorizes the Angiographic Catheters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Material

- Usage

Exploring Key Regional Dynamics Across Americas, Europe, Middle East, Africa, and Asia-Pacific to Shape Strategic Decisions in Angiographic Catheter Deployment

Regional dynamics exert a profound influence on the development, adoption, and strategic direction of angiographic catheters. In the Americas, mature healthcare systems in the United States and Canada drive demand for cutting-edge catheter technologies that support high procedural volumes and stringent safety standards. Providers are investing in next-generation solutions to enhance patient outcomes, while supply chain resilience and tariff mitigation remain focal points for procurement teams. Simultaneously, Latin American markets are experiencing incremental growth, underpinned by public health initiatives and expanding interventional capabilities.

Across Europe, the Middle East, and Africa, established markets in Western Europe maintain robust clinical adoption, supported by well-defined reimbursement frameworks and strong regulatory alignment. Meanwhile, emerging economies in the Middle East and select African nations are prioritizing infrastructure upgrades and clinician training to broaden access to advanced vascular interventions. Tighter regulatory pathways and regional collaboration are facilitating harmonized device approvals that accelerate market entry.

Asia-Pacific is witnessing accelerated uptake of angiographic catheter technologies, as governments in China, India, and Southeast Asia increase healthcare spending and expand national network capabilities. Targeted investments in hybrid operating suites and telehealth integration underscore the region’s commitment to advanced interventional services. Expansion into these markets demands nuanced local partnerships, tailored value propositions, and robust distribution networks to meet diverse clinical and economic requirements.

This comprehensive research report examines key regions that drive the evolution of the Angiographic Catheters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Positioning, Innovation Portfolios, and Collaborative Initiatives of Leading Companies in the Angiographic Catheter Arena

Leading entities in the angiographic catheter space leverage differentiated strategies to sustain market leadership and foster innovation. Boston Scientific, headquartered in Massachusetts, maintains a broad portfolio that spans interventional cardiology, peripheral interventions, and neurovascular therapies. The company’s commitment to R&D and strategic acquisitions has expanded its catheter offerings and enhanced its ability to deliver integrated procedural solutions.

Medtronic’s extensive product suite includes balloon angioplasty catheters, guiding systems, and advanced diagnostic platforms, supported by its global manufacturing footprint and strong brand recognition. It prioritizes modular design and simplicity to meet the evolving needs of care teams across multiple geographies.

Terumo Corporation, with its roots in Tokyo, continues to deepen its presence in cardiovascular access devices through targeted R&D investments and strategic partnerships. The company’s focus on material science and coherent device ecosystems underpins the development of catheters that balance performance and safety.

Cook Medical’s angiographic catheter line is characterized by its radiopaque tip technology, nylon braiding, and torque-responsive shafts that provide physicians with reliable navigation in complex anatomies. The company’s emphasis on user feedback and iterative design has been validated by regulatory interactions, including recent product recalls that underscore its commitment to safety and continuous improvement.

Merit Medical, through its Performa series, has gained traction by offering prepackaged catheter bundles and hybrid hub designs that streamline procedure setup and facilitate radial access workflows. Its emphasis on hydrophilic coatings and ergonomics supports both clinician adoption and patient-centric outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Angiographic Catheters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AngioDynamics Inc

- Argon Medical Devices Inc

- Asahi Intecc Co Ltd

- B Braun Melsungen AG

- Becton Dickinson and Company

- Biotronik SE & Co KG

- Boston Scientific Corporation

- Cardinal Health Inc

- Cook Medical LLC

- Cordis Corporation

- Lepu Medical Technology Co Ltd

- Medtronic plc

- Merit Medical Systems Inc

- MicroPort Scientific Corporation

- Nipro Corporation

- Penumbra Inc

- Teleflex Incorporated

- Terumo Corporation

- Vascular Solutions Inc

Developing Actionable Industry Strategies for Enhanced Innovation, Supply Chain Agility, and Regulatory Compliance in Angiographic Catheter Markets

In order to navigate a landscape marked by technological disruption and regulatory complexity, industry participants should prioritize cross-functional collaboration and supply chain agility. First, establishing strategic alliances with contract manufacturers and regional distributors can mitigate the impact of trade uncertainties and enable near-shore capacity expansion. This approach safeguards timely delivery and reinforces resilience against external shocks.

Second, innovation roadmaps must align closely with evolving clinical protocols and clinician workflows. Engaging key opinion leaders in iterative prototyping phases accelerates user adoption and ensures that product enhancements translate into measurable procedural efficiencies.

Third, proactive engagement with regulatory bodies and standards organizations plays a critical role in expediting approvals and aligning on emerging safety guidelines. Organizations should invest in comprehensive post-market surveillance frameworks to demonstrate real-world performance and shape favorable reimbursement pathways.

Finally, embracing digital platforms for training, remote support, and data analytics fosters continuous learning and quality improvement. Deploying interactive simulation modules and cloud-based dashboards strengthens stakeholder trust and supports evidence-based decision-making across the continuum of care.

Detailing a Rigorous Multi-Source Research Framework Integrating Primary Interviews, Secondary Data Analysis, and Proprietary Validation for Catheter Market Insights

This research incorporates a multi-source methodology designed to deliver robust and unbiased insights. Primary data was collected through in-depth interviews with interventional cardiologists, radiologists, procurement experts, and industry executives to capture qualitative perspectives on market dynamics and unmet clinical needs. Simultaneously, secondary data analysis synthesized information from peer-reviewed literature, regulatory filings, healthcare databases, and trade publications to contextualize technological trends and policy impacts.

To validate findings, a proprietary database was leveraged to triangulate reported developments against real-world market activity, including device launches, patent filings, and clinical trial registries. Throughout the study, data integrity was ensured via cross-verification and frequent consultations with an advisory panel of subject-matter experts. This rigorous framework enables confident strategic decision-making and supports actionable intelligence for stakeholders across the angiographic catheter ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Angiographic Catheters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Angiographic Catheters Market, by Product Type

- Angiographic Catheters Market, by Application

- Angiographic Catheters Market, by End User

- Angiographic Catheters Market, by Material

- Angiographic Catheters Market, by Usage

- Angiographic Catheters Market, by Region

- Angiographic Catheters Market, by Group

- Angiographic Catheters Market, by Country

- United States Angiographic Catheters Market

- China Angiographic Catheters Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Implications to Propel Future Growth and Superior Clinical Outcomes in the Angiographic Catheter Landscape

The angiographic catheter market is undergoing a transformative phase driven by converging factors: rapid technological advancements, evolving regulatory landscapes, and complex global trade dynamics. Key findings highlight the centrality of artificial intelligence, robotics, and hybrid imaging modalities in elevating procedural precision and safety. Meanwhile, tariff fluctuations underscore the imperative for supply chain diversification and strategic regional engagement. Segmentation analysis reveals the nuanced interplay between product type, application area, end-user preferences, material innovations, and usage models in shaping market behaviors.

For industry leaders, adapting to these imperatives necessitates a balanced focus on innovation, collaboration, and regulatory foresight. By synthesizing these insights and aligning them with organizational priorities, stakeholders can craft strategies that harness emerging opportunities, mitigate risks, and ultimately advance patient care through superior angiographic catheter solutions. This executive summary lays the groundwork for informed decision-making that will drive the next wave of growth and clinical differentiation.

Connect with Ketan Rohom to Secure Your Comprehensive Market Intelligence Report and Empower Strategic Decisions in Angiographic Catheter Innovations Today

Unlock unparalleled insights and competitive advantage by securing the comprehensive angiographic catheter market research report today from Ketan Rohom. Engage directly with an expert who understands the nuances of product development, regulatory complexities, and evolving clinical trends. By collaborating with Ketan Rohom (Associate Director, Sales & Marketing), you will gain access to in-depth analyses, tailored data, and strategic recommendations designed to drive innovation and optimize decision making within your organization. Don’t miss this opportunity to leverage exclusive intelligence and propel your strategic initiatives forward with confidence. Reach out now to request your full report and transform your approach to angiographic catheter market dynamics

- How big is the Angiographic Catheters Market?

- What is the Angiographic Catheters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?