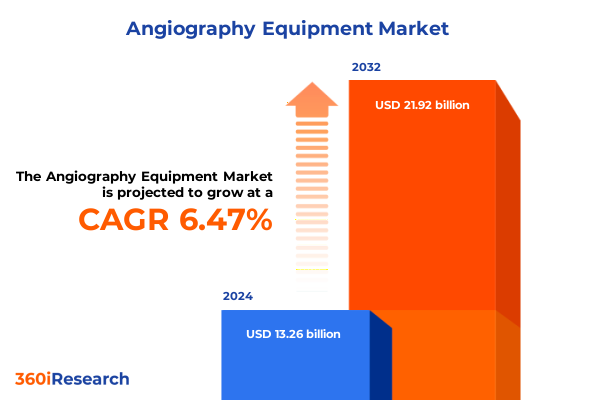

The Angiography Equipment Market size was estimated at USD 14.08 billion in 2025 and expected to reach USD 14.96 billion in 2026, at a CAGR of 6.52% to reach USD 21.92 billion by 2032.

Unveiling a New Paradigm in Cardiovascular Imaging Where Breakthrough Technologies Redefine Accuracy, Speed, and Patient Outcomes in Angiography Equipment

The landscape of diagnostic imaging is witnessing a profound evolution driven by technological breakthroughs and growing demand for precision-driven interventional procedures. Recent advances in angiography equipment have fundamentally altered the way clinicians visualize vascular structures, enabling more accurate diagnoses and minimally invasive interventions across a spectrum of cardiovascular, neurological, and radiological applications. As healthcare systems grapple with rising patient volumes and heightened expectations for efficiency, the integration of state-of-the-art imaging modalities has become indispensable for maintaining clinical excellence and enhancing patient outcomes.

In parallel, regulatory bodies and reimbursement frameworks are increasingly emphasizing evidence of clinical efficacy and safety, prompting manufacturers to innovate and validate next-generation angiography platforms. Simultaneously, healthcare providers are seeking solutions that balance exceptional image quality with considerations of operational throughput, radiation dose reduction, and cost containment. This introductory overview sets the stage for a detailed exploration of the forces reshaping the angiography equipment domain, highlighting why stakeholders across the value chain must adapt to stay ahead in an era defined by rapid transformation and heightened scrutiny.

Tracking the Rapid Digital Transformation That Is Reshaping Clinical Imaging and Empowering Precision Diagnostics in Interventional Angiography Procedures

Over the past decade, the angiography equipment sector has undergone a series of transformative shifts that transcend incremental improvements, ushering in a new era of digital integration and procedural versatility. Artificial intelligence and machine learning algorithms are now embedded within imaging consoles to deliver automated vessel segmentation, real-time motion correction, and predictive analytics, empowering clinicians to make faster, more informed decisions. Cloud-based data management platforms facilitate seamless access to high-resolution angiographic images and patient records across multiple sites, enabling multidisciplinary teams to collaborate more effectively and accelerate workflow.

Moreover, system architectures have evolved to accommodate both monoplane and biplane configurations with unparalleled flexibility. The adoption of flat panel detectors, superseding traditional image intensifiers, delivers enhanced contrast resolution and reduced geometric distortion, thereby improving lesion delineation and procedural confidence. This digital convergence extends to hybrid operating suites, where angiography equipment integrates harmoniously with CT, MRI, and robotic systems, fostering a comprehensive environment for image-guided therapy.

A pivotal shift has also materialized in the realm of patient safety and ergonomics. Automated dose-optimization protocols leverage real-time feedback to minimize radiation exposure without compromising image fidelity, while innovations in table and gantry design enhance patient comfort and streamline operator set-up. Taken together, these transformative developments underscore a migration toward smart, adaptable platforms that redefine the standard of care in interventional imaging.

Evaluating the Far-Reaching Implications of 2025 United States Tariffs on Supply Chains, Costs, and Technological Adoption in Angiography

The introduction of new United States tariffs in early 2025 has created a ripple effect through the global supply chain for angiography equipment, prompting manufacturers and distributors to reevaluate sourcing strategies and cost structures. Components such as X-ray tubes, flat panel detectors, and high-precision motors-often produced overseas-have become subject to increased duties, elevating landed costs and leading to renegotiations of long-term supply agreements. In response, some vendors have accelerated efforts to diversify production footprints, establishing assembly lines in tariff-exempt regions or seeking local partnerships to mitigate exposure to incremental import levies.

This shift has not only impacted procurement budgets but has also driven a reassessment of research and development roadmaps. With component costs under scrutiny, companies are prioritizing modular designs that allow for field-upgradable detector arrays and software key-activation of advanced imaging features, reducing the need for full system replacements. Hospitals and specialty clinics are likewise adapting their capital expenditure plans, exploring lease-to-own models and extended service contracts to spread costs and preserve liquidity. Regulatory compliance processes have been streamlined to accommodate these asset optimization strategies, ensuring that device modifications adhere to safety standards while delivering a predictable total cost of ownership.

Amid these adjustments, collaborative ecosystems between OEMs, tier-one suppliers, and healthcare providers are gaining prominence. Joint ventures focused on component localization and co-funded R&D initiatives are emerging as critical enablers for overcoming tariff-induced headwinds. Collectively, these developments illustrate how the 2025 tariff framework is catalyzing more resilient and innovative approaches to equipment design, manufacturing, and procurement across the angiography landscape.

Uncovering Critical Insights Through a Multi-Dimensional Analysis of Angiography Equipment Segmentation by System, Detector, Application, and End Users

A nuanced understanding of angiography equipment segmentation reveals distinct dynamics that inform product development and market positioning strategies. When differentiating offerings based on system type, monoplane configurations continue to dominate in high-volume diagnostic centers due to their streamlined design and lower upfront cost, whereas biplane systems are preferred in tertiary hospitals and specialty clinics for complex interventional procedures requiring simultaneous multi-angle visualization. This dichotomy underscores the importance of tailoring solution portfolios to the procedural mix and budgetary constraints of end users.

Detector technology further stratifies the competitive landscape, with flat panel detectors establishing a performance benchmark for image clarity, low-dose operation, and seamless integration with advanced software toolkits. Legacy image intensifier models retain relevance in resource-constrained environments and niche applications, but the migration toward digital panels is accelerating as clinical demands for precision continue to escalate. Vendors that offer retrofit pathways from image intensifier systems to flat panel ecosystems position themselves favorably among existing installed-base customers seeking incremental upgrades without full capital reinvestment.

The application layer introduces another dimension of complexity, spanning cardiology procedures subdivided into coronary and peripheral interventions, neurology workflows focused on cerebral and spinal diagnostics, and radiology protocols encompassing abdominal and peripheral vascular assessments. Each segment exhibits unique procedural requirements, such as real-time stent visualization in peripheral cardiology or microcatheter navigation in cerebral neurology, driving the creation of specialized imaging presets and catheter-tracking algorithms.

End users themselves-ranging from diagnostic centers to hospitals and specialty clinics-demonstrate divergent procurement behaviors. While diagnostic centers emphasize throughput and cost efficiency, hospitals prioritize multi-functional systems capable of supporting a broad procedural mix, and specialty clinics seek compact, procedure-optimized platforms to deliver targeted services. Recognizing these segmentation insights enables stakeholders to align development pipelines and go-to-market strategies with evolving clinical and financial imperatives.

This comprehensive research report categorizes the Angiography Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Detector Type

- Application

- End User

Exploring Regional Dynamics and Growth Drivers Across Americas, Europe Middle East & Africa, and Asia-Pacific in the Angiography Equipment Domain

Regional dynamics play a crucial role in shaping technology adoption, reimbursement policies, and competitive intensity across the angiography equipment landscape. In the Americas, the United States leads with robust capital spending on advanced imaging infrastructure, underpinned by favorable reimbursement for interventional cardiology and neurology procedures. Canada exhibits a growing appetite for digital adoption driven by nationwide health initiatives focused on diagnostic efficiency, while Latin American markets often prioritize cost-effective, retrofit solutions that can be integrated into existing imaging suites with minimal disruption.

Across Europe, Middle East, and Africa, variation in healthcare budgets and regulatory requirements yields a heterogeneous market environment. Western European nations are characterized by early uptake of premium angiography platforms and stringent radiation safety mandates, compelling suppliers to demonstrate clinical value through comprehensive real-world evidence. Meanwhile, in the Middle East, government-backed healthcare modernization projects have spurred investment in hybrid operating theaters equipped with cutting-edge imaging technology. In Africa, the market remains nascent, with growth concentrated in urban centers and facilitated by partnerships between multinational vendors and local distributors.

Asia-Pacific represents a dynamic and rapidly evolving frontier. Japan and Australia maintain high levels of sophistication in both product innovation and clinical protocols, whereas emerging economies such as China and India prioritize scalable, cost-effective solutions that address high patient volumes and infrastructure variability. Local manufacturing incentives and government-driven healthcare expansion programs are propelling domestic players to elevate their capabilities, intensifying competition and accelerating the trajectory toward digital-first angiography platforms.

This comprehensive research report examines key regions that drive the evolution of the Angiography Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Collaborators Driving Competitive Advantages in the Global Angiography Equipment Market

In today’s competitive landscape, leading equipment manufacturers are distinguished by their ability to integrate hardware innovations with comprehensive software ecosystems. Established industry leaders have invested heavily in proprietary image-processing algorithms and cloud-enabled data analytics platforms, creating end-to-end solutions that address both procedural precision and operational efficiency. Strategic collaborations with AI startups and academic research institutions further bolster their innovation pipelines, ensuring a steady stream of feature enhancements that cater to evolving clinical needs.

Emerging players are carving out niches by focusing on cost-optimized detector modules and modular gantry designs that facilitate customizable system configurations. By offering flexible upgrade paths and tailored service agreements, these agile companies can rapidly address the requirements of diagnostic centers and specialty clinics that demand targeted functionality without the burden of comprehensive enterprise investment. Partnerships between global original equipment manufacturers and regional suppliers also underscore a trend toward co-development models, enabling faster market entry and localized support infrastructure.

This comprehensive research report delivers an in-depth overview of the principal market players in the Angiography Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Boston Scientific Corporation

- Boston Scientific Corporation

- Canon Medical Systems Corporation

- Canon Medical Systems Corporation

- Cardinal Health, Inc.

- Carestream Health Inc.

- Electron Co.

- GE Healthcare

- General Electric Company

- Hitachi Medical Systems Corporation

- Koninklijke Philips N.V.

- Koninklijke Philips N.V.

- Medical Warehouse

- Medtronic plc

- MicroPort Scientific Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shimadzu Corporation

- Shimadzu Corporation

- Siemens Healthineers AG

- Stryker Corporation

- Terumo Corporation

- Toshiba Corporation

Implementing Practical Strategies for Stakeholders to Navigate Technological Disruptions and Regulatory Shifts in Angiography Equipment

To navigate the complex interplay of technological advancements and regulatory dynamics, industry leaders should prioritize investment in scalable digital architectures that can be seamlessly updated as new AI-based imaging tools emerge. Building modular platforms with field-enablement capabilities allows for incremental feature deployment, reducing the need for disruptive system replacements and preserving customer loyalty. Additionally, diversifying component sourcing through strategic alliances and near-shore manufacturing partnerships can mitigate the risk posed by tariff fluctuations and geopolitical uncertainties.

Stakeholders must also enhance clinician engagement by offering immersive training programs and remote support services that accelerate proficiency with novel imaging workflows. By cultivating an ecosystem of certified application specialists and leveraging tele-mentoring technologies, manufacturers can drive adoption and ensure safe, effective use of advanced angio modalities. Finally, embracing data-driven commercial models-such as outcome-based service contracts or pay-per-procedure arrangements-enables a more collaborative alignment of financial incentives between providers and suppliers, fostering long-term partnerships and shared success.

Detailing Rigorous Research Methodologies Leveraging Primary Interviews and Secondary Data to Ensure Unmatched Accuracy in Angiography Insights

This analysis is grounded in a rigorous research framework that combines primary interviews with key opinion leaders, clinical experts, and senior executives across healthcare provider organizations. In-depth discussions with interventional cardiologists, neurointervention specialists, and radiology department heads provided qualitative insights into evolving procedural requirements, buying criteria, and pain points associated with current imaging platforms.

Secondary data sources were meticulously curated from peer-reviewed journals, regulatory filings, company white papers, and conference proceedings. Proprietary databases tracking equipment installations and service contract volumes were leveraged to validate market dynamics, while public material from governmental healthcare agencies offered context on reimbursement trends and regulatory changes. Data triangulation techniques and cross-validation with anonymized end-user surveys ensured that findings uphold the highest standards of accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Angiography Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Angiography Equipment Market, by System Type

- Angiography Equipment Market, by Detector Type

- Angiography Equipment Market, by Application

- Angiography Equipment Market, by End User

- Angiography Equipment Market, by Region

- Angiography Equipment Market, by Group

- Angiography Equipment Market, by Country

- United States Angiography Equipment Market

- China Angiography Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings to Illuminate Future Opportunities and Reinforce Strategic Priorities in Angiography Equipment Development

The confluence of advanced detector technologies, digital workflow integration, and emerging AI capabilities underscores a paradigm shift in angiography equipment that promises to deliver unmatched diagnostic clarity and procedural efficiency. Tariff-induced supply chain realignments have accelerated modular design strategies, while diverse segmentation dynamics highlight the critical importance of aligning product offerings with the specific needs of monoplane versus biplane configurations, flat panel versus image intensifier technologies, and varied clinical applications spanning cardiology, neurology, and radiology.

Regional analysis reveals a mosaic of adoption patterns driven by local reimbursement frameworks, infrastructure maturity, and economic priorities. Whether in the Americas, Europe Middle East & Africa, or Asia-Pacific, the path to sustained growth hinges on the ability to innovate responsibly, engage stakeholders effectively, and deploy flexible commercial models that resonate with end-user requirements. By synthesizing these core insights, industry stakeholders are well positioned to capitalize on emerging opportunities and reinforce strategic priorities in the angiography equipment domain.

Take Action Today to Secure Comprehensive Angiography Equipment Research Insights Tailored to Your Strategic Goals with Ketan Rohom

Unlock unparalleled strategic value with a tailored angiography equipment research package designed to align perfectly with your organizational objectives and clinical priorities. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, for an in-depth consultation on how this comprehensive study can drive innovation, optimize procurement, and secure competitive advantages. Take the next step toward data-driven decision-making and schedule your personalized briefing to explore exclusive insights and bespoke advisory support today

- How big is the Angiography Equipment Market?

- What is the Angiography Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?