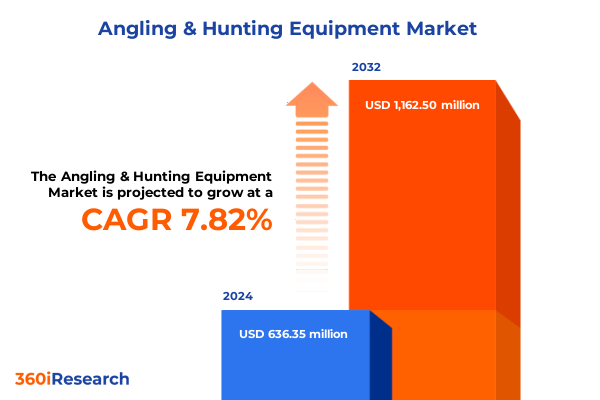

The Angling & Hunting Equipment Market size was estimated at USD 683.83 million in 2025 and expected to reach USD 735.39 million in 2026, at a CAGR of 7.87% to reach USD 1,162.50 million by 2032.

Navigating the Convergence of Tradition and Innovation Shaping the Contemporary Angling and Hunting Equipment Market Landscape

The angling and hunting equipment industry stands at a crossroads where enduring traditions meet accelerating innovation. Over decades, the market has evolved from handcrafted gear passed down through generations to high-precision tools leveraging advanced composites and digital interfaces. Consumers are no longer satisfied with basic performance; they demand equipment that enhances their overall experience, offering durability, reliability, and connectivity without compromising the authenticity of outdoor pursuits.

Amidst this transition, established players and emerging challengers alike are investing heavily in research and development to address shifting consumer preferences. From smart reels that track casting metrics to moisture-wicking apparel engineered for variable climates, the industry is witnessing a renaissance of product differentiation. Furthermore, environmental stewardship has become integral to brand identity, as manufacturers adopt sustainable sourcing and circular economy principles to meet the expectations of conscientious consumers.

Unveiling the Pivotal Technological and Consumer Behavior Disruptions Redefining Angling and Hunting Equipment Paradigms

In recent years, technological breakthroughs and evolving consumer mindsets have fundamentally disrupted the angling and hunting equipment arena. Wearable trackers and smartphone connectivity have shifted expectations, transforming passive gear into interactive platforms for performance optimization and social sharing. This digital infusion has not only amplified user engagement but also generated invaluable data streams that inform product development and personalized marketing campaigns.

Simultaneously, heightened environmental awareness has led to a surge in demand for eco-friendly materials and ethically sourced products. Biodegradable lures, recycled composites in rods, and low-impact production techniques are no longer niche offerings but growing segments of product portfolios. In addition, direct-to-consumer channels have expanded the reach of specialty brands, enabling them to build loyal communities through curated content, influencer partnerships, and virtual fitting experiences.

Assessing the Comprehensive Ripple Effects of United States 2025 Tariff Policies on the Angling and Hunting Equipment Supply Chain and Costs

The implementation of new tariff measures by the United States in early 2025 has introduced considerable complexity into the supply chains for key raw materials and finished goods. In particular, aluminum and steel levies have significantly impacted the cost structure for rods, reels, firearms, and ammunition, compelling manufacturers to reevaluate sourcing strategies and negotiate revised terms with overseas suppliers. These adjustments have translated to compressed margins, necessitating efficiency gains in production and logistics to preserve profitability.

Moreover, the tariff environment has accelerated strategic reshoring initiatives, as some companies explore domestic manufacturing partnerships to mitigate duties and reduce lead times. This shift requires substantial capital investment in automated processes and skilled labor training, yet it also presents an opportunity to highlight ‘‘Made in USA’’ credentials-a powerful differentiator in a market where provenance and quality assurance carry growing weight. Consequently, the virus of tariff volatility has unleashed a wave of operational realignment across the value chain.

Decoding Critical Segmentation Pillars to Illuminate Product Type Material Distribution Channel and End User Dynamics in Equipment Consumption

A nuanced understanding of market segmentation is critical to identifying growth pockets and tailoring strategic initiatives. When examined through the lens of product categories, fishermen and hunters encounter a spectrum of specialized tools. Fishing Equipment spans from precision-engineered Lines and Reels to high-modulus Rods and an expansive array of Tackle & Lures, while Hunting Gear encompasses Accessories, purpose-built Apparel, Archery Equipment, Firearms & Ammunition, and Optics & Scopes. Each subsegment follows distinct innovation cycles and caters to unique performance requirements, demanding targeted innovation and marketing approaches.

Material selection further differentiates offerings, with Composite Materials delivering superior strength-to-weight ratios, Metal affording durability and precision machining, Plastic enabling cost-effective mass production, and Wood preserving classic aesthetics and resonance. Distribution channels add another layer of complexity, as traditional Offline Channels such as Brand Outlets, Department Stores, and Specialty Stores coexist with Direct Online Channels including Brand Websites and E-Commerce Platforms. Finally, end users range from Commercial buyers like Fishing Companies and Hunting Reserves to Professional Competitive Anglers and Licensed Hunters, as well as Recreational Family Anglers and Hobbyist Hunters, each exhibiting varied purchasing drivers and loyalty vectors.

This comprehensive research report categorizes the Angling & Hunting Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Used

- Distribution Channel

- End User

Exploring Nuanced Regional Variations Shaping Angling and Hunting Equipment Demand Across Americas Europe Middle East Africa and Asia Pacific Markets

Regional nuances play a pivotal role in shaping consumer preferences and product demand across the globe. In the Americas, emphasis on large-bore firearms and high-performance reels reflects a culture that values power and endurance in both hunting and angling. Conversely, consumer interest in Europe, Middle East & Africa often centers on precision optics and lightweight fishing solutions tailored to diverse freshwater ecosystems, where heritage brands leverage centuries of craftsmanship to command premium positioning.

Meanwhile, the Asia-Pacific region has emerged as a hotbed for rapid adoption of entry-level gear and digital marketing sophistication, driven by growing middle-class participation in outdoor activities. Environmental regulations in several Asia-Pacific markets have also spurred manufacturers to introduce biodegradable lures and non-toxic ammunition, while partnerships with regional e-commerce leaders are expediting market access and consumer engagement. These regional dynamics underscore the necessity of tailored product portfolios and distribution models aligned with local regulatory frameworks and cultural affinities.

This comprehensive research report examines key regions that drive the evolution of the Angling & Hunting Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Initiatives and Competitive Differentiators Among Leading Brands Steering the Future of Angling and Hunting Equipment Innovation

Leading companies in the angling and hunting equipment space are deploying a mix of strategic initiatives to capture market share and fortify competitive moats. Industry giants are leveraging vertical integration to secure raw material pipelines and streamline assembly, while emerging challengers differentiate through niche expertise in advanced materials or digital accessories. Collaborations between optics specialists and software developers are giving rise to next-generation smart scopes capable of real-time ballistic calculations and environmental sensing.

Furthermore, brands are intensifying focus on sustainability, embedding recycled and plant-based materials across product lines and offsetting carbon footprints through supply chain partnerships. Mergers and acquisitions remain active as established firms acquire disruptive startups with patented technologies or strong direct-to-consumer followings. These moves not only expand product portfolios but also grant access to proprietary data on consumer usage patterns, offering a distinct advantage in forecasting emerging trends and adapting rapid innovation cycles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Angling & Hunting Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bass Pro Shops

- Beretta Holding S.A.

- Browning Arms Company

- Buck Knives Inc

- Cabela's

- Gamakatsu Co Ltd

- Garmin Ltd

- Johnson Outdoors Inc

- KUIU LLC

- Mathews Archery Inc

- Mustad & Son A.S.

- O.F. Mossberg & Sons

- OKUMA Fishing Tackle Co Ltd

- Pradco Outdoor Brands

- Pure Fishing Inc

- Rapala VMC Corporation

- Shimano Inc

- Sitka Gear

- Smith & Wesson Brands Inc

- Sturm Ruger & Co Inc

- The Orvis Company Inc

- Under Armour Inc

- Vista Outdoor Inc

Crafting Forward Looking Strategies to Optimize Growth Profitability and Sustainability for Industry Leaders in the Angling and Hunting Equipment Sector

To navigate the complexities of today’s market, industry leaders must adopt forward-looking strategies that balance growth objectives with operational resilience. Prioritizing investments in digital transformation-such as augmented reality try-before-you-buy platforms and data analytics capabilities-will unlock deeper customer insights and streamline the path from awareness to purchase. At the same time, enhancing supply chain agility through dual-sourcing agreements and modular manufacturing can buffer against geopolitical disruptions and fluctuating input costs.

Cultivating partnerships with outdoor lifestyle influencers and conservation organizations not only amplifies brand authenticity but also taps into purpose-driven consumer segments. In parallel, product development roadmaps should integrate eco-design principles from inception, ensuring regulatory compliance and resonating with environmentally conscious enthusiasts. By fostering a culture of continuous improvement and cross-functional collaboration, companies can turn market uncertainties into catalysts for sustainable profitability and long-term brand loyalty.

Unraveling Rigorous Research Frameworks and Data Validation Techniques Underpinning Comprehensive Analysis of Angling and Hunting Equipment Trends

This study employs a multifaceted research framework that blends primary and secondary methodologies to deliver robust insights. Primary research consists of structured interviews with senior executives across manufacturing, distribution, and retail channels, complemented by surveys of end users spanning commercial operators to recreational hobbyists. In addition, in-depth focus groups and field observations provide qualitative perspectives on product performance and user preferences across diverse environmental conditions.

Secondary research incorporates trade association publications, regulatory filings, and corporate disclosures, cross-referenced with import-export databases to validate supply chain dynamics and tariff impacts. Data triangulation and rigorous quality checks ensure consistency, while a panel of industry experts reviews preliminary findings to mitigate bias. Statistical analyses, including correlation and trend evaluation, underpin the segmentation insights, and all data points undergo an internal validation process before inclusion in the final report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Angling & Hunting Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Angling & Hunting Equipment Market, by Product Type

- Angling & Hunting Equipment Market, by Material Used

- Angling & Hunting Equipment Market, by Distribution Channel

- Angling & Hunting Equipment Market, by End User

- Angling & Hunting Equipment Market, by Region

- Angling & Hunting Equipment Market, by Group

- Angling & Hunting Equipment Market, by Country

- United States Angling & Hunting Equipment Market

- China Angling & Hunting Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Key Takeaways to Empower Industry Stakeholders with Insights Driving Innovation Resilience and Competitive Advantage in Equipment Markets

The convergence of digital innovation, sustainability imperatives, and evolving consumer behaviors has redefined the competitive landscape in angling and hunting equipment. Tariff-driven supply chain realignments and regional market distinctions demand tailored strategies, while segmentation analysis illuminates where value can be unlocked through targeted offerings. Companies that proactively embrace advanced materials, digital platforms, and circular economy principles will be best positioned to capitalize on emerging growth opportunities.

By synthesizing these insights, industry stakeholders gain a nuanced understanding of market dynamics-enabling them to make informed decisions that drive product differentiation, operational efficiency, and brand loyalty. The imperative now is to translate this knowledge into action, aligning investment priorities with consumer preferences and regulatory landscapes to secure a sustainable competitive advantage.

Engage with Ketan Rohom to Secure Your Comprehensive Angling and Hunting Equipment Market Intelligence Report Today

Engaging directly with Ketan Rohom offers a tailored opportunity to secure an in-depth market intelligence report that addresses the nuanced dynamics of angling and hunting equipment. As Associate Director of Sales & Marketing, Ketan Rohom brings a deep understanding of industry requirements and can help align the research insights to your strategic priorities, whether your focus lies in product innovation, distribution expansion, or operational resilience.

By reaching out today, you gain priority access to customized data sets, extended analyses on segment-level trends, and expert interpretations that drive informed decision-making. This comprehensive report synthesizes competitive benchmarks, regulatory impacts, and emerging consumer behaviors, empowering you to act decisively in a rapidly evolving marketplace. Contact Ketan Rohom to obtain this critical resource and elevate your strategic planning with actionable intelligence crafted for leaders in the angling and hunting equipment sector.

- How big is the Angling & Hunting Equipment Market?

- What is the Angling & Hunting Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?