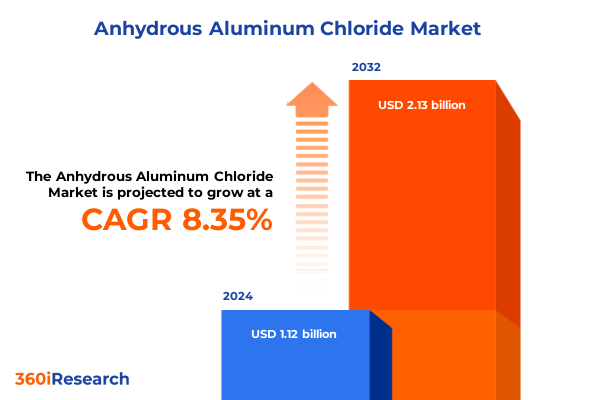

The Anhydrous Aluminum Chloride Market size was estimated at USD 1.20 billion in 2025 and expected to reach USD 1.30 billion in 2026, at a CAGR of 8.44% to reach USD 2.13 billion by 2032.

Anhydrous Aluminum Chloride's Critical Role in Modern Chemical Manufacturing and Catalysis with Emerging Market Application Insights

Anhydrous aluminum chloride is a vital inorganic compound characterized by its distinctive Lewis acidity and reversible polymer–monomer behavior at mild temperatures. As a colorless crystalline solid, it exhibits a pronounced affinity for moisture, fuming in humid air and reacting vigorously with water to produce hydrochloric acid. In its anhydrous form, aluminum chloride’s low melting and boiling points contribute to its versatility, enabling it to function effectively as a catalyst under a wide range of industrial process conditions. Its polymorphic transition between a covalent polymer and a monomeric ionic species underlines its utility in facilitating diverse reaction mechanisms across chemical manufacturing sectors.

Over the past decade, the growing emphasis on lean manufacturing and sustainable process intensification has elevated anhydrous aluminum chloride’s role in modern production environments. Its catalytic prowess in generating electrophilic species has been harnessed to streamline Friedel–Crafts alkylation and acylation pathways, critical for synthesizing aromatic intermediates in dye, resin, and polymer industries. Moreover, its application in dehydrating organic substrates underlines its importance in refining operations and specialty chemical synthesis, where efficient water removal can dramatically enhance reaction yields. As market dynamics shift toward greener reaction media and energy-efficient protocols, anhydrous aluminum chloride’s established performance benchmarks place it at the forefront of catalyst selection, ensuring optimized output and reduced environmental footprint.

Transformative Industry Shifts Reshaping Anhydrous Aluminum Chloride Supply Chains and Technological Innovations in Catalytic Processes

The anhydrous aluminum chloride landscape is undergoing transformative shifts driven by both geopolitical developments and technological breakthroughs. Supply chain disruptions stemming from raw material constraints have compelled producers to explore alternative sourcing strategies, integrating backward-integration initiatives to secure chloride feedstocks. Simultaneously, innovations in nanostructured catalyst design-such as AlCl₃-loaded zinc oxide composites-have yielded substantial gains in activity and selectivity, redefining performance standards for solvent-free processes and enabling high-yield transformations under ambient conditions. These advancements underscore how process intensification can coexist with sustainability objectives, minimizing waste and energy consumption without compromising reaction efficiency.

In parallel, regulatory landscapes in key manufacturing regions have evolved to incentivize lower-emission chemical processes, fostering collaboration between industry consortia and academic institutions. Such partnerships have accelerated the development of heterogeneous and recyclable aluminum chloride catalysts that offer simplified separation protocols and reduced downstream treatment burdens. This confluence of supply optimization and catalytic innovation is reshaping market dynamics, as emerging entrants leverage modular reactor technologies to introduce tailored AlCl₃-based solutions. Consequently, established suppliers are recalibrating their value propositions, integrating digital process monitoring and customized logistics platforms to maintain competitiveness in a rapidly shifting environment.

Assessing the Cumulative Impact of 2025 United States Steel and Aluminum Tariffs on Anhydrous Aluminum Chloride Pricing and Availability

Early in 2025, the United States government enacted a series of Section 232 proclamations that significantly raised tariffs on aluminum and its derivative articles, culminating in a 25 percent ad valorem duty effective March 12 and a subsequent increase to 50 percent on June 4. These measures aimed to address national security concerns by curbing excess global capacity, but they have also intensified cost pressures across downstream industries reliant on anhydrous aluminum chloride as a catalyst and process reagent. Following the February 10 proclamation increasing duties from 10 percent to 25 percent for all countries, exemptions for major trading partners were terminated on March 12, 2025, exposing raw material importers to the highest levies in decades.

The escalation to a 50 percent tariff under Proclamation 14267 on June 4 further exacerbated supply constraints, particularly for companies without domestic production capabilities. Affected stakeholders have reported sharp increases in transaction premiums and spot market volatility, as importers scramble to secure allocation from U.S. smelters operating below optimal capacity utilization rates. These cost inflations have rippled through chemical manufacturing, petrochemical refining alkylation units, and pharmaceutical intermediates synthesis, prompting many organizations to reassess sourcing strategies and accelerate joint investments in local production expansions. The aggregate effect of these tariff interventions has been a reconfiguration of global trade flows, marked by a shift toward non-U.S. suppliers for derivative AlCl₃ feedstock and heightened interest in backward-integration projects to mitigate future exposure to policy changes.

Deriving Actionable Insights from Segmentation: Product Type Purity Grade Application End Use and Distribution Channels in AlCl₃ Market

Market segmentation provides a critical lens through which industry participants can tailor their strategies and resource allocations. When considering variations in product morphology, flakes deliver rapid dissolution kinetics in batch processes, granules offer a balanced trade-off between handling convenience and reactivity, and powder grades can maximize surface area for high-throughput continuous flow systems. Purity classifications delineate between reagent-grade materials, meeting stringent analytical reagent specifications for pharmaceuticals and research laboratories, and robust industrial-grade streams optimized for large-scale dehydration and Friedel–Crafts acylation operations. Application domains further refine the value proposition: chemical synthesis leverages the dehydration capabilities and strong Lewis acidity for acylation chemistry, petrochemical refiners rely on the catalyst’s proficiency in hydrocarbon alkylation and isomerization pathways, and pharmaceutical manufacturers depend on precise catalysis for bulk drug production and intermediates. Understanding the interplay between these variables is essential, as end users in chemical manufacturing facilities weigh cost, performance, and regulatory compliance, while research laboratories demand high-purity formulations. Additionally, distribution channel dynamics influence market penetration, with direct sales offering strategic partnerships and tailored logistics, distributors providing regional stocking and technical support, and online retail platforms facilitating niche volumes and rapid replenishments. By synthesizing these segmentation perspectives into cohesive strategies, stakeholders can advancedly position their offerings to meet the nuanced demands of each sector.

This comprehensive research report categorizes the Anhydrous Aluminum Chloride market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Application

- End Use

- Distribution Channel

Unveiling Regional Dynamics: Analyzing the Americas Europe Middle East Africa and Asia-Pacific Markets for Anhydrous Aluminum Chloride

Regional patterns of consumption and production continue to shape strategic decision-making in the anhydrous aluminum chloride market. In the Americas, demand is driven by integrated petrochemical complexes and agrochemical service providers concentrated along the Gulf Coast, where proximity to feedstock sources and downstream manufacturing clusters underpins cost-effective supply chains. Meanwhile, Europe, the Middle East, and Africa exhibit a diversified demand profile, with mature chemical hubs in Western Europe coexisting alongside rapidly industrializing regions in the Middle East, where petrochemical expansion projects generate significant catalyst requirements. These dynamics are further influenced by trade corridors linking North African refining centers with European polymer producers, creating logistical arteries for bulk shipments of AlCl₃. In Asia-Pacific, the market is characterized by robust growth in China and India, fueled by escalating capacity additions in pharmaceuticals and specialty chemicals. Local manufacturing in these countries is complemented by import programs in Southeast Asia and Oceania, where research laboratories and mid-scale chemical manufacturers seek both industrial and reagent grades to support R&D initiatives and production scale-ups. As regional regulatory frameworks evolve, especially concerning chemical safety and emissions, patterns of regional self-sufficiency and import substitution will continue to dictate the competitive landscape.

This comprehensive research report examines key regions that drive the evolution of the Anhydrous Aluminum Chloride market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Anhydrous Aluminum Chloride Manufacturers and Suppliers Driving Innovation and Expansion Across Global Markets

The anhydrous aluminum chloride industry is anchored by a blend of global conglomerates and specialized chemical manufacturers. Gulbrandsen Chemicals stands out for its dedicated production capacity in North America, South America, and Asia, supplying high-purity grades tailored for Friedel–Crafts catalysis in pharmaceutical intermediates and polymer resin manufacturing. BASF SE leverages its extensive R&D infrastructure to introduce energy-optimized production processes that enhance product consistency and reduce carbon intensity, positioning its offerings for water treatment applications and high-value acylation reactions. Aditya Birla Chemicals and Gujarat Alkalies and Chemicals have both expanded capacity in India’s Gujarat region, focusing on reagent and industrial grades to serve domestic demand and export markets. These players have collectively navigated feedstock volatility by securing long-term supply agreements for chlorine derivatives and implementing flexible production scheduling. In addition, emerging producers in Eastern Europe and Southeast Asia are investing in modular micro-reactor facilities, enabling rapid deployment of capacity in response to shifting demand peaks. As global trade flows adjust to new tariff regimes and regional regulations, the ability of these companies to adapt through strategic alliances, capacity reconfigurations, and process innovations will determine their market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anhydrous Aluminum Chloride market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- BASF SE

- Gujarat Alkalies and Chemicals Limited

- KMG Chemicals, Inc.

- Koura Group, Inc.

- LC Industrial Chemicals India Private Limited

- Nippon Light Metal Co., Ltd.

- Saudi Basic Industries Corporation

- Showa Denko K.K.

- Solvay S.A.

- Tanfac Industries Limited

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the Anhydrous Aluminum Chloride Sector

Industry leaders seeking to maintain competitive advantage in the anhydrous aluminum chloride domain should prioritize investments in flexible manufacturing platforms that can toggle between reagent and industrial-grade production. By implementing advanced process control systems and modular reactor designs, companies can optimize output in response to real-time demand signals and raw material fluctuations. Moreover, strengthening supply chain resilience through geographically diversified sourcing agreements will help mitigate the impacts of future tariff adjustments and feedstock disruptions. Collaborations with academic institutions and catalysis consortia can expedite the development of recyclable heterogeneous AlCl₃ catalysts, reducing waste streams and decreasing total cost of operation. Organizations should also consider digital twin simulations of their process units to forecast the performance implications of variable purities and particle sizes, enhancing decision-making around product formulations. Finally, forging strategic partnerships with logistics specialists will enable more agile distribution across direct sales networks, distributor ecosystems, and e-commerce channels, ensuring rapid access to critical materials for chemical manufacturing plants and research laboratories. Collectively, these actions will position industry leaders to capitalize on growth opportunities and sustain margins in an evolving market environment.

Comprehensive Research Methodology Leveraging Primary and Secondary Data Sources to Analyze the Anhydrous Aluminum Chloride Market Dynamics

Our research methodology combined primary interviews with industry executives, plant managers, and procurement specialists alongside extensive analysis of secondary data from regulatory filings, trade association reports, and patent databases. We conducted qualitative assessments of technological trends through collaboration with leading university labs, examining peer-reviewed studies on advanced catalyst designs and process intensification strategies. Quantitative data was validated through triangulation, reconciling production capacity figures and customs import–export statistics to ensure consistency across multiple sources. To evaluate the impact of recent tariff changes, we integrated governmental proclamations and Federal Register notices with price premium data from major commodity exchanges, enabling a robust assessment of cost pass-through effects. Geographic segmentation insights were derived by mapping regional manufacturing clusters and evaluating demand patterns for flakes, granules, and powder forms based on end-use categorizations. Finally, distribution channel analysis incorporated supply chain mapping exercises and sentiment analysis of customer feedback to characterize direct sales, distributor reach, and online procurement trends. This multi-layered approach ensures that our findings reflect both macroeconomic influences and operational realities, providing a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anhydrous Aluminum Chloride market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anhydrous Aluminum Chloride Market, by Product Type

- Anhydrous Aluminum Chloride Market, by Purity Grade

- Anhydrous Aluminum Chloride Market, by Application

- Anhydrous Aluminum Chloride Market, by End Use

- Anhydrous Aluminum Chloride Market, by Distribution Channel

- Anhydrous Aluminum Chloride Market, by Region

- Anhydrous Aluminum Chloride Market, by Group

- Anhydrous Aluminum Chloride Market, by Country

- United States Anhydrous Aluminum Chloride Market

- China Anhydrous Aluminum Chloride Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Conclusive Reflections on Market Drivers Challenges and Growth Trajectories Shaping the Future of Anhydrous Aluminum Chloride Applications

Throughout this executive summary, we have highlighted the multifaceted drivers influencing anhydrous aluminum chloride, from its foundational Lewis acid properties facilitating Friedel–Crafts and dehydration reactions to the seismic policy shifts caused by escalating tariff regimes in the United States. The market’s segmentation across product types, purity grades, applications, end uses, and distribution channels reveals clear pathways for targeted growth and enhanced value delivery. Regional dynamics in the Americas, Europe, Middle East & Africa, and Asia-Pacific underscore the importance of localized strategies that align supply chain structures with shifting regulatory and demand environments. Leading companies, supported by advancements in sustainable catalyst design and flexible production architectures, are well-positioned to address both cost pressures and emerging environmental imperatives. Moving forward, stakeholders must navigate the dual challenges of raw material volatility and evolving policy landscapes by investing in digital process control, modular reactors, and collaborative innovation partnerships. By doing so, they can secure resilient supply chains, optimize operational efficiencies, and unlock new application frontiers for this indispensable catalyst.

Engage with Ketan Rohom to Secure Your Customized Market Research Report and Gain Actionable Insights on Anhydrous Aluminum Chloride

To explore how anhydrous aluminum chloride can drive growth strategies and address emerging market demands, reach out to Ketan Rohom, the Associate Director of Sales & Marketing. Engage with Ketan to discuss customized research packages designed to deliver precise, actionable insights that align with your organization’s strategic objectives. Scheduling a consultation will allow you to dive deep into exclusive data on product segment dynamics, tariff impacts, and regional supply chain shifts. By partnering with Ketan Rohom, you will gain access to a comprehensive suite of analytical tools, priority updates on policy changes affecting the industry, and tailored recommendations that can help you optimize procurement, mitigate regulatory risks, and stay ahead of technological innovations. Connect today to secure your personalized market research report and unlock the detailed intelligence necessary to make informed investment decisions and capitalize on growth opportunities in the anhydrous aluminum chloride sector.

- How big is the Anhydrous Aluminum Chloride Market?

- What is the Anhydrous Aluminum Chloride Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?