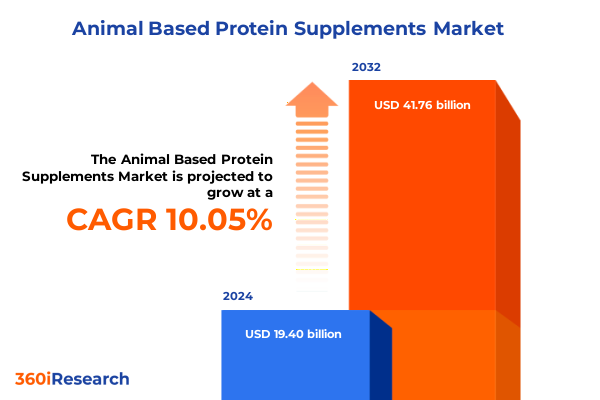

The Animal Based Protein Supplements Market size was estimated at USD 21.32 billion in 2025 and expected to reach USD 23.44 billion in 2026, at a CAGR of 10.07% to reach USD 41.76 billion by 2032.

Exploring the Rising Momentum of Animal Protein Supplements in Response to Evolving Health Consciousness and Nutritional Innovation

The surge in demand for animal based protein supplements has been propelled by a transformative wave of consumer awareness around holistic health, sports performance, and functional nutrition. As individuals prioritize dietary strategies that support muscle recovery, immune resilience, and overall wellbeing, the appeal of proteins derived directly from animal sources-known for their complete amino acid profiles-has never been stronger. This introduction sets the stage for understanding how the confluence of scientific validation, lifestyle trends, and supply chain advancements has placed animal based protein supplements at the forefront of nutritional innovation.

In recent years, the marketplace has witnessed a proliferation of product offerings targeting diverse niches, from elite athletes seeking rapid muscle synthesis to aging populations aiming to preserve lean mass. Against this backdrop, manufacturers have intensified their focus on formulating high-purity powders, ready-to-drink formulations, and novel delivery systems that prioritize bioavailability and clean-label credentials. These developments underscore a broader movement away from one-size-fits-all solutions toward tailored nutritional support, which in turn has fueled investment in research and development across the value chain.

Transitioning from traditional protein sources, industry stakeholders are leveraging advances in extraction technologies and ingredient refinement to deliver higher performance outcomes with fewer additives. This foundational shift has catalyzed strategic partnerships among ingredient suppliers, contract manufacturers, and scientific institutions, all aiming to validate the efficacy and safety of new animal based protein variants. As this report unfolds, readers will garner a comprehensive view of the market’s driving forces, key inflection points, and strategic imperatives necessary to thrive in an evolving landscape.

Unpacking the Key Transformative Shifts Shaping the Animal Protein Supplement Landscape Through Technological, Regulatory, and Consumer Dynamics

The animal based protein supplement sector is undergoing fundamental transformation driven by technological breakthroughs, regulatory developments, and shifting consumer preferences. At the technological frontier, extraction processes such as enzymatic hydrolysis and microfiltration are enabling producers to achieve unprecedented levels of purity and functionality, thereby elevating product performance. These methods not only optimize bioactive peptides for faster absorption but also reduce residual lactose or allergens, ultimately broadening the appeal of whey and casein proteins among sensitive consumer segments.

Regulatory dynamics have also reshaped market parameters, as authorities in key geographies implement stricter labeling guidelines and quality control mandates. These regulations demand transparent sourcing disclosures, allergen management, and validation of protein integrity, compelling brands to adopt rigorous testing protocols. Concurrently, evolving definitions of “natural” and “clean-label” have prompted manufacturers to replace synthetic additives with plant-derived stabilizers and to optimize formulations for minimal processing footprints.

Consumer behavior has further accelerated these transformations, with rising demand for traceability and ethical sourcing prompting companies to publicize animal welfare standards and supply chain audits. In addition, digital platforms have empowered end users to access in-depth product reviews and scientific insights, fostering a marketplace where authenticity and evidence-based claims carry significant weight. Taken together, these transformative shifts provide a dynamic backdrop for stakeholders aiming to align their innovation pipelines with emerging opportunities and competitive pressures.

Assessing the Cumulative Impact of 2025 United States Tariffs on Cost Structures Supply Chains and Strategic Sourcing for Animal Protein Supplements

In 2025, the imposition of new tariffs by the United States on selected imported ingredients has yielded a tangible ripple effect across cost structures, supply networks, and strategic sourcing within the animal based protein supplement industry. The levies targeted premium collagen types sourced from European and Asian markets, as well as select dairy derivatives, effectively raising import costs by a significant margin and compelling brands to revisit their ingredient portfolios. As prices for marine and porcine collagen edged upward, manufacturers explored alternative inputs, including increased reliance on domestically produced bovine collagen and acid casein, to mitigate the financial impact.

Supply chain resilience has ascended to the top of boardroom agendas, driven by the need to buffer against tariff-induced volatility. Companies have forged closer collaborations with regional producers, investing in capacity expansions and long-term offtake agreements to secure consistent access at predictable prices. Integration of nearshore manufacturing facilities has emerged as a preferred strategy for several leading players, facilitating faster turnaround times and reducing exposure to external policy shifts.

From a strategic standpoint, the tariff environment has also catalyzed innovation in cost-efficient extraction and purification technologies. With higher landed costs prompting scrutiny of every input, research teams have prioritized yield optimization and waste reduction initiatives. This renewed focus has accelerated the development of advanced membrane separation methods and enzyme recycling systems designed to lower production overhead while maintaining stringent quality benchmarks. Collectively, these adaptations underscore the industry’s agility in navigating geopolitical headwinds and underscore the importance of proactive supply chain management in a tariff-sensitive era.

Deriving Strategic Insights from Detailed Segmentation across Source Types Product Forms Distribution Channels and End Users in Animal Protein Supplements

An in-depth segmentation framework reveals nuanced patterns that define consumer appeal, product formulation, and distribution efficacy within the animal based protein supplement landscape. When categorized by source type, the market encompasses proteins derived from beef and casein, with the latter further bifurcated into acid and micellar forms prized for their sustained-release and rapid-absorption properties respectively. The collagen segment extends across bovine, marine, and porcine origins, each variant selected based on functional attributes such as joint support, skin health, or gut integrity. Egg proteins are sourced from both white and yolk fractions, catering to applications that demand high solubility or richness in phospholipids, while whey derivatives include concentrate, hydrolysate, and isolate, reflecting a spectrum of protein concentrations and digestion rates.

Product form segmentation highlights evolving consumption behaviors. Powder formats remain dominant due to their flexibility in mixing and flavor customization, yet flavored and unflavored variants address different taste preferences and clean-label expectations. Ready-to-drink solutions, available in multi-serve and single-serve configurations, offer convenience for on-the-go lifestyles, while bars delivered as high-protein or meal replacement options satisfy snack occasions and sustained energy needs. Capsules, subdivided into gelatin and vegetable delivery matrices, appeal to consumers prioritizing dose precision and portability.

Distribution channel segmentation underscores the growing significance of omnichannel strategies. Online retail, which includes brand-owned websites and third-party e-commerce platforms, continues to expand through personalized subscription models and digital marketing initiatives. Pharmacies and supermarkets/hypermarkets serve as outlets for mainstream visibility, whereas specialty stores-comprising gym outlets and nutrition-focused retailers-provide curated assortments and expert guidance. Finally, end-user segmentation spans athletes, bodybuilders, general fitness enthusiasts, medical nutrition applications, and seniors, each group exhibiting unique consumption drivers and ingredient preferences. Together, these segmentation layers furnish a comprehensive lens through which industry participants can tailor product development, positioning, and go-to-market tactics.

This comprehensive research report categorizes the Animal Based Protein Supplements market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source Type

- Product Form

- End User

- Distribution Channel

Unveiling Regional Divergences in Adoption Innovation and Market Drivers across the Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics within the animal based protein supplement sphere vary considerably across the Americas, Europe Middle East and Africa, and Asia-Pacific regions. In the Americas, robust dairy infrastructure and a mature sports nutrition culture underpin widespread adoption, particularly in North America where established cold chain logistics and regulatory harmonization facilitate the rapid rollout of novel formulations. This environment supports experimentation with enriched blends, fortified bars, and functional beverages aimed at diverse consumer profiles from professional athletes to aging baby boomers.

Conversely, Europe, the Middle East and Africa present a mosaic of regulatory frameworks and consumer behaviors that demand tailored strategies. Western European markets, characterized by stringent quality standards and high consumer awareness of clean-label formulations, incentivize premium pricing for organic and grass-fed protein variants. Middle Eastern demand has surged for collagen supplements targeting beauty and wellness, while African markets are beginning to recognize the role of protein fortification in addressing nutritional deficiencies and supporting physical labor segments.

In Asia-Pacific, rapid urbanization and rising disposable incomes are creating fertile ground for protein supplements. Markets in East Asia demonstrate particular interest in marine collagen for its anti-aging and skin health benefits, whereas Southeast Asian markets show growing receptivity to whey and egg-based options integrated into traditional dietary patterns. Supply chain innovations, such as cold chain expansion in inland regions and e-commerce penetration across rural submarkets, are enabling brands to bridge logistical gaps and deliver products to emerging consumer clusters. Across all regions, digital engagement and influencer-led marketing continue to accelerate cross-border awareness and trial, ultimately shaping global demand trajectories.

This comprehensive research report examines key regions that drive the evolution of the Animal Based Protein Supplements market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Approaches and Market Differentiators of Leading Companies Shaping the Animal Protein Supplement Ecosystem Today

Leading companies in the animal based protein supplement ecosystem are differentiating themselves through a combination of ingredient innovation, strategic partnerships, and brand storytelling. Several multinational ingredient suppliers have advanced their portfolios by investing in proprietary extraction technologies that enhance peptide purity and yield. These investments often coincide with co-development agreements, enabling formulators to access exclusive ingredient grades and application expertise. Meanwhile, vertically integrated manufacturers are leveraging in-house research centers to expedite product development cycles, reducing the time from concept validation to retail launch.

Collaboration between brands and scientific institutions has emerged as a key differentiator for market leaders, providing independent clinical data that substantiates health claims for joint support, muscle recovery, or metabolic balance. Such evidence-based positioning not only elevates consumer trust but also helps navigate evolving regulatory landscapes that prioritize substantiation. Additionally, companies are capitalizing on digital health trends by integrating protein supplements into comprehensive wellness platforms, offering personalized nutrition plans and direct consumer feedback loops through mobile applications.

Marketing innovation has also become central to competitive positioning. Storytelling that highlights ethical sourcing, traceability, and animal welfare initiatives resonates deeply with conscious consumers. Brands are adopting immersive digital experiences, from virtual farm tours to augmented reality product demos, to reinforce transparency and authenticity. As the category evolves, successful companies will be those that can harmonize technical excellence with meaningful narratives, thereby cultivating differentiated value propositions in a crowded market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Based Protein Supplements market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrana Group

- Amco Proteins

- Archer Daniels Midland Company

- Arla Foods Ingredients Group P/S

- Cargill, Incorporated

- Cooklist, Inc.

- Drink Wholesome LLC

- Glanbia PLC

- Gnarly Nutrition

- Kellogg Company

- Kerry Group PLC

- MusclePharm Corporation

- MyProtein

- Nestlé S.A.

- NOW Health Group, Inc.

- Old School Labs

- Orgain, Inc.

- Thermo Fisher Scientific Inc.

- Universal Nutrition

Formulating Actionable Recommendations to Drive Innovation Consumer Engagement and Sustainable Growth in the Animal Protein Supplement Sector

To capitalize on current market momentum and anticipate future shifts, industry leaders should prioritize a series of actionable strategies that drive innovation, strengthen consumer engagement, and ensure sustainable growth. First, fostering cross-functional collaboration between R&D, supply chain, and marketing teams will accelerate the translation of novel extraction methods into compelling product propositions. By aligning technical feasibility with consumer insights, organizations can rapidly iterate formulations that meet emerging demands for clean-label credentials and high-performance outcomes.

Next, building resilient supply networks through diversified sourcing and strategic alliances will mitigate the impact of geopolitical volatility and tariff fluctuations. Securing long-term contracts with regional suppliers, investing in nearshore manufacturing capabilities, and leveraging advanced demand forecasting tools can collectively safeguard ingredient availability and cost predictability. Additionally, embedding sustainability measures-such as waste valorization and circular byproduct utilization-within operations will address growing stakeholder expectations around environmental stewardship.

Finally, deepening consumer engagement through digital innovation will unlock new revenue streams and loyalty pathways. Personalized subscription models, interactive educational content, and community-driven platforms can transform transactional relationships into meaningful brand ecosystems. By harnessing data analytics to tailor recommendations and monitor consumption patterns, companies can deliver differentiated experiences that foster retention and advocacy. These integrated recommendations, when executed cohesively, position industry participants to thrive amid intensifying competition and evolving market dynamics.

Detailing the Robust Research Methodology Integrating Primary and Secondary Sources Expert Interviews and Comprehensive Data Validation Techniques

The research methodology underpinning this executive summary integrates a rigorous blend of primary and secondary sources, designed to ensure analytical depth and objectivity. Primary research components included in-depth interviews with senior executives from leading ingredient suppliers, contract manufacturers, and branded supplement companies. These conversations provided firsthand perspectives on supply chain challenges, regulatory impacts, and innovation priorities. Complementing these insights, consumer focus groups across key demographics-from professional athletes to seniors-offered granular understanding of usage occasions, formulation preferences, and purchasing triggers.

Secondary research involved exhaustive review of industry publications, peer-reviewed journals in food science and nutrition, and regulatory filings from pertinent authorities. This enabled validation of primary findings and triangulation of market trends without relying on proprietary market estimates. In addition, patent landscape analysis illuminated emerging technologies in protein extraction and formulation. Data validation steps included cross-referencing ingredient import-export databases, trade association reports, and public company disclosures. This systematic approach ensured that conclusions and recommendations are grounded in verifiable evidence and reflect the current state of the animal based protein supplement market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Based Protein Supplements market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Based Protein Supplements Market, by Source Type

- Animal Based Protein Supplements Market, by Product Form

- Animal Based Protein Supplements Market, by End User

- Animal Based Protein Supplements Market, by Distribution Channel

- Animal Based Protein Supplements Market, by Region

- Animal Based Protein Supplements Market, by Group

- Animal Based Protein Supplements Market, by Country

- United States Animal Based Protein Supplements Market

- China Animal Based Protein Supplements Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Key Insights and Strategic Imperatives from the Animal Protein Supplement Analysis to Guide Decision Making and Future Initiatives

The insights presented in this report converge to depict a market characterized by dynamic innovation, evolving consumer expectations, and complex geopolitical influences. Technological advancements in protein extraction and purification have elevated product efficacy, while stringent regulatory frameworks and sustainability imperatives have reshaped formulation and sourcing strategies. Segmentation analysis reveals targeted opportunities across source types, product forms, channels, and end-user profiles, underscoring the importance of bespoke approaches rather than monolithic strategies.

Regional analysis further highlights divergent adoption patterns and market drivers across the Americas, Europe Middle East Africa, and Asia-Pacific, reaffirming the need for localized go-to-market plans. Leading companies distinguish themselves through integrated research collaborations, digital engagement models, and authentic brand storytelling. Collectively, these factors form the strategic imperatives that will govern competitive positioning in the years ahead.

As stakeholders navigate rising tariff pressures, shifting consumer values, and technological breakthroughs, the ability to translate deep market understanding into agile execution will determine success. This synthesis of key insights provides a strategic compass for decision-makers seeking to harness the full potential of the animal based protein supplement category and lay the groundwork for sustained growth and differentiation.

Take Immediate Action to Gain In-Depth Market Insights and Strategic Advantages by Partnering with Ketan Rohom to Secure Your Definitive Supplement Report

For organizations seeking to unlock the deepest layers of consumer behavior and strategic opportunity within the animal based protein supplement industry, partnering directly with Ketan Rohom offers an unrivaled path forward. His expertise in sales and marketing integration ensures that your team will not only gain access to the most definitive research report available but also receive customized, actionable insights tailored to your specific business objectives. Engaging now grants you dedicated support in interpreting complex data, aligning findings to your growth strategy, and implementing the recommendations that will differentiate your offerings in an increasingly competitive market. Take this critical step toward consolidating your market position and driving enduring value creation by collaborating with Ketan Rohom to secure your comprehensive animal based protein supplement research report

- How big is the Animal Based Protein Supplements Market?

- What is the Animal Based Protein Supplements Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?