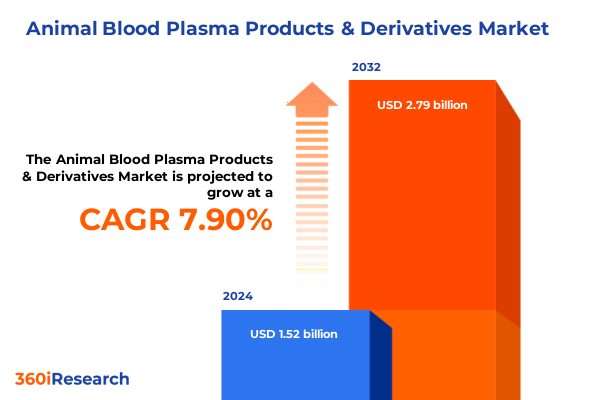

The Animal Blood Plasma Products & Derivatives Market size was estimated at USD 1.63 billion in 2025 and expected to reach USD 1.75 billion in 2026, at a CAGR of 7.99% to reach USD 2.79 billion by 2032.

Unveiling the Strategic Importance and Dynamic Growth Drivers Shaping the Animal Blood Plasma Products and Derivatives Market Landscape

In recent years, the utilization of animal blood plasma products and derivatives has emerged as a pivotal component across diverse industries ranging from food processing to biomedical research. This segment harnesses biological compounds such as immunoglobulins, serum albumin, and thrombin, offering critical functionalities that drive product quality, safety, and efficacy. The dynamic interplay of technological progress and evolving regulatory landscapes has further elevated the strategic significance of these materials. As industry decision-makers seek robust solutions to advance cell culture methodologies and enhance nutritional supplements, the demand for high-purity plasma derivatives has intensified, creating avenues for innovation and competitive differentiation.

Amidst this momentum, stakeholders confronting supply chain complexities, tariff disruptions, and shifting consumer preferences require a consolidated perspective that integrates scientific, commercial, and policy dimensions. This executive summary aims to present a comprehensive overview of the most pressing developments shaping the sector. Through an examination of transformative technological breakthroughs, tariff impacts in the United States in 2025, granular segmentation insights, and regional performance trajectories, this document equips leaders with the insights necessary to formulate resilient strategies. Subsequent sections will delve into the nuances of product applications, delineate major competitive strengths, and propose actionable pathways to navigate the evolving marketplace with confidence.

In developing this overview, we have prioritized clarity and relevance, synthesizing industry feedback, regulatory bulletins, and technological trend analyses to craft a narrative that resonates with operational objectives and strategic planning imperatives. The structured insights within this summary lay the foundation for informed decision-making and proactive market positioning in the period ahead.

Analyzing the Technological Innovations Operational Shifts and Regulatory Transformations Redefining the Animal Blood Plasma Industry Dynamics

The animal blood plasma industry has been reshaped by an accelerated wave of technological innovations, regulatory reforms, and operational shifts that are redefining traditional value chains. Advances in chromatographic purification techniques and nanofiltration platforms have enhanced yield efficiencies and minimized contamination risks, enabling producers to deliver higher-purity immunoglobulins and albumins for sensitive applications such as cell culture and tissue engineering. Meanwhile, the emergence of recombinant protein synthesis is beginning to complement conventional plasma-derived molecules, offering a sustainable alternative that addresses ethical and scalability concerns while maintaining functional integrity.

Concurrently, regulatory authorities across key markets have undertaken comprehensive revisions of guidelines governing plasma collection, processing, and distribution. In the United States, streamlined processes for Good Manufacturing Practices inspections have reduced approval timelines, whereas Europe’s updated Animal By-Products Regulation has introduced more stringent traceability requirements that bolster consumer confidence and public safety. These policy adjustments, when combined with digital transformation initiatives-from blockchain-enabled supply chain tracking to AI-driven quality control-are fostering a more transparent and agile ecosystem.

Together, these transformative shifts are driving convergence between life sciences, food technology, and veterinary sectors. As collaboration intensifies across research institutions and commercial producers, stakeholders are leveraging cross-disciplinary expertise to innovate product formulations and expand end-use possibilities. This convergence not only accelerates time-to-market for novel derivatives but also empowers companies to anticipate evolving regulatory demands and consumer expectations in a dynamic global landscape.

Assessing the Comprehensive Impact of 2025 United States Tariff Adjustments on Supply Chains Pricing Structures and Competitive Positioning

In 2025, the United States implemented a series of adjusted tariff measures targeting imported animal blood plasma products and derivatives, catalyzing a reevaluation of sourcing strategies among domestic manufacturers and end users. These increases in duties on key intermediates prompted immediate cost pressures, compelling organizations to scrutinize vendor contracts and explore alternative supply origins. As import-related expenses rose, several producers accelerated investments in local processing facilities to secure continuity of supply and attenuate the volatility introduced by cross-border levies.

These cumulative tariff effects extended beyond procurement budgets. Price adjustments reverberated through downstream applications, particularly in cell culture media and specialized nutritional supplements, where cost-sensitivity dictates adoption rates. At the same time, pharmaceutical developers faced heightened scrutiny over raw material traceability, leading to closer collaboration with domestic plasma collection centers that already conformed to stringent federal safety standards. Notably, the tariff environment incentivized diversification of raw material portfolios; companies expanded sourcing across animal types to distribute risk and capture favorable yield-to-cost ratios.

Despite near-term operational challenges, the imposition of these tariff changes also fostered strategic resilience. Industry players have pursued forward-looking initiatives such as long-term supplier alliances, capacity expansions in low-tariff jurisdictions, and targeted process optimizations to offset higher input costs. As a result, the sector is entering a phase of recalibrated supply chains characterized by greater regional self-reliance, enhanced logistical coordination, and a renewed emphasis on value-added services to preserve margin integrity.

Unpacking Critical Segmentation Insights to Illuminate Animal Types Derivative Classes End Users and Application-Driven Market Nuances

Segmentation analysis reveals nuanced dynamics that inform product development and market outreach strategies across four critical dimensions. Based on Animal Type, bovine-derived plasma continues to anchor the market due to its abundant availability and rich immunoglobulin profile, while porcine derivatives are gaining traction for their complementary peptide structures suited to specialized nutrition and therapeutic formulations. Ovine plasma has carved out a niche in select veterinary and cosmetic applications, and avian plasma is emerging as a versatile ingredient in nutraceutical solutions, particularly where poultry breeding cycles align with projected supply needs.

Considering Derivative Type, fetal bovine serum remains the gold standard for many cell culture applications thanks to its growth factor composition, yet cost and ethical considerations have propelled the exploration of immunoglobulins for passive immunity, fibrinogen-thrombin complexes for scaffold engineering, and serum albumin as a stabilizer in pharmaceutical formulations. Thrombin, with its critical role in coagulation-based tissue regeneration, has unlocked new avenues in wound management and regenerative medicine, driving R&D initiatives toward tailored purification processes and application-specific product enhancements.

When viewed across End-User categories, food manufacturers leverage plasma proteins for functional ingredients that enhance texture and nutritional profiles, whereas pharmaceutical companies demand ultra-purified derivatives that meet rigorous safety and traceability standards. Veterinary practitioners capitalize on immunoglobulin formulations to bolster animal health in livestock and companion settings. Lastly, Application analysis underscores that while traditional domains like animal feed and food processing sustain steady demand, emerging segments such as cell culture media, tissue engineering, and high-value cosmetic products exhibit the most pronounced growth trajectories, influencing where producers allocate R&D resources and capacity expansions.

This comprehensive research report categorizes the Animal Blood Plasma Products & Derivatives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Derivative Type

- End-User

- Application

Comparative Analysis of Regional Market Dynamics Across Americas EMEA and Asia-Pacific in Shaping Blood Plasma Product Demand Patterns

Geographic performance in the animal blood plasma domain exhibits distinct regional characteristics shaped by regulatory frameworks, industrial capabilities, and evolving end-user requirements. In the Americas, robust livestock production infrastructures in North and South America partner with advanced biomanufacturing hubs to supply high-purity derivatives. Regulatory bodies have fostered synergy between agricultural and pharmaceutical stakeholders, streamlining approvals and incentivizing onshore processing investments. As a result, this region stands at the forefront of exploring next-generation plasma technologies and reinforcing domestic supply chains to mitigate international trade uncertainties.

Within Europe Middle East & Africa, stringent safety and traceability mandates under regional animal by-products regulations have driven up-front compliance investments, elevating quality assurance standards across the value chain. Pharmaceutical and biomedical research centers leverage these regulatory controls to fast-track clinical applications of plasma derivatives, while select markets in the Middle East serve as growing hubs for contract manufacturing and formulation development. This mosaic of regulatory rigor and application-driven demand underpins EMEA’s reputation for producing premium-grade plasma products that align with global quality benchmarks.

The Asia-Pacific region is notable for its rapid expansion, fueled by rising pharmaceutical R&D activity in China and India alongside a surging pet care market in Japan and Southeast Asia. Government-led biotechnology initiatives support local plasma collection and processing capabilities, and consumer trends favoring nutritional supplements bolster demand for functional ingredients. With a combination of cost-competitive manufacturing and fast-evolving regulatory alignment, this region is rapidly ascending as both a major production center and high-growth consumption market for animal blood plasma derivatives.

This comprehensive research report examines key regions that drive the evolution of the Animal Blood Plasma Products & Derivatives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives Production Capabilities and Portfolio Diversification Among Leading Organizations in the Animal Blood Plasma Ecosystem

Leading organizations in this sector have pursued diversified strategies to fortify their market positions and respond to evolving stakeholder expectations. Several multinational producers have invested in vertically integrated operations, securing raw material supply through proprietary blood collection networks and augmenting purification capacity via state-of-the-art chromatography lines. These strategic investments not only streamline quality control but also enable rapid scaling in response to demand spikes, particularly for high-margin derivatives custom-tailored to pharmaceutical and tissue engineering clients.

Simultaneously, specialized biotech firms have focused on portfolio differentiation by developing niche products such as recombinant immunoglobulins or ultra-pure thrombin formulations optimized for regenerative medicine applications. These companies often collaborate with academic institutions and contract research organizations to accelerate product validation and expand their distribution channels. In parallel, established players are exploring joint ventures in emerging markets to tap into localized production incentives and benefit from regulatory fast-track programs aimed at boosting biopharmaceutical manufacturing capabilities.

Across the board, strategic emphasis on sustainability and ethical sourcing has become a defining criterion. Top-tier companies publicize initiatives to enhance animal welfare protocols, minimize waste through process intensification, and explore circular economy models. As a result, competitive advantage increasingly hinges on demonstrating transparent supply chains, verifiable quality credentials, and an unwavering commitment to environmental and social governance principles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Blood Plasma Products & Derivatives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACROBiosystems Inc.

- Alfa Laval Corporate AB

- ANZCO Foods Limited

- Auckland BioSciences Ltd.

- BioChemed Services

- Biowest Company

- Bovogen Biologicals Pty Ltd.

- Canvax Reagents S.L.

- Ebrator Biochemicals Inc.

- Kraeber & Co. GmbH

- Lake Immunogenics, Inc.

- LAMPIRE Biological Laboratories, Inc.

- Meiji Holdings Co., Ltd.

- Merck KGaA

- Pel-Freez, LLC

- Rockland Immunochemicals, Inc.

- Rocky Mountain Biologicals

- Scripps Laboratories, Inc.

- Sigma-Aldrich

- TCS Biosciences Ltd.

- Thermo Fisher Scientific Inc.

Delivering Targeted Strategic Recommendations to Empower Industry Leaders in Navigating Challenges and Capitalizing on Emerging Opportunities

Industry leaders aiming to sustain and accelerate growth must prioritize the diversification of their supply networks by forging deep collaborations with both long-standing and emerging plasma collection partners. By investing in decentralized processing facilities located in strategically advantageous regions, companies can attenuate currency fluctuations and tariff-related disruptions while ensuring continuity of raw material access. Moreover, integrating advanced purification technologies, such as multi-modal chromatography and continuous processing pipelines, will heighten product consistency and lower unit costs, positioning organizations to compete effectively across both premium and cost-sensitive segments.

Leaders should also commit to fostering innovation through targeted partnerships with academic research centers and biotech startups. This approach accelerates the development of next-generation derivatives-ranging from recombinant alternatives to bioengineered scaffolds-that meet the evolving demands of regenerative medicine and advanced cell therapies. Concurrently, adopting comprehensive digital traceability frameworks bolstered by blockchain and machine learning will strengthen regulatory compliance, mitigate fraud risks, and reinforce end-user confidence in product provenance.

Finally, proactive engagement with policy-makers is essential to shape forthcoming regulatory guidelines and to secure incentive programs that support sustainable sourcing and ethical practices. By positioning themselves as trusted advisors in policy forums, companies can influence safety standards and access funding for green manufacturing initiatives. Collectively, these recommendations will empower industry leaders to navigate complexity, capture emerging opportunities, and solidify their competitive standing in the evolving animal blood plasma landscape.

Delineating the Rigorous Research Framework Data Collection Techniques and Analytical Approaches Underpinning the Executive Market Assessment

This analysis rests upon a meticulously structured research framework that blends qualitative and quantitative techniques to ensure robust and actionable insights. Primary research encompassed in-depth interviews with key stakeholders, including supply chain managers, quality assurance directors, and product development executives across leading plasma processing organizations. These conversations provided direct visibility into operational bottlenecks, emerging R&D priorities, and strategic investment plans.

Secondary research involved a comprehensive review of regulatory publications from major jurisdictions, peer-reviewed articles detailing technological advancements, and whitepapers issued by relevant trade associations. Data triangulation across multiple sources enabled cross-validation of trend signals and the identification of consensus viewpoints. In parallel, thematic coding and scenario analysis were applied to distill critical themes and envisage potential market trajectories under varying policy and economic conditions.

To ensure the integrity of findings, an expert advisory panel comprising academic scientists, industry veterans, and regulatory consultants reviewed interim deliverables and provided validation feedback. This iterative process guaranteed that conclusions reflect both empirical evidence and practitioner experience. The resulting synthesis offers a cohesive narrative that aligns strategic imperatives with operational realities, equipping decision-makers with a clear roadmap for the evolving animal blood plasma domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Blood Plasma Products & Derivatives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Blood Plasma Products & Derivatives Market, by Animal Type

- Animal Blood Plasma Products & Derivatives Market, by Derivative Type

- Animal Blood Plasma Products & Derivatives Market, by End-User

- Animal Blood Plasma Products & Derivatives Market, by Application

- Animal Blood Plasma Products & Derivatives Market, by Region

- Animal Blood Plasma Products & Derivatives Market, by Group

- Animal Blood Plasma Products & Derivatives Market, by Country

- United States Animal Blood Plasma Products & Derivatives Market

- China Animal Blood Plasma Products & Derivatives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Insights and Strategic Imperatives into a Coherent Perspective to Guide Future Direction in Animal Blood Plasma Domain

The animal blood plasma products and derivatives ecosystem stands at a pivotal inflection point, where technological innovation, regulatory evolution, and global trade dynamics converge to shape future trajectories. Through this analysis, we have highlighted how advanced purification methods and digital traceability are redefining quality benchmarks, how tariff shifts are recalibrating supply chain configurations, and how nuanced segmentation and regional performance patterns inform targeted growth strategies.

Key takeaways underscore the necessity for strategic agility, underscoring that organizations which invest in diversified sourcing, foster collaborative R&D ecosystems, and embrace sustainability will emerge as frontrunners. The strategic imperatives illuminated here-spanning supply chain resilience, portfolio diversification, and proactive regulatory engagement-provide a cohesive blueprint for navigating market complexities and unlocking new value streams.

As stakeholders chart their next moves, embracing a data-driven, forward-looking approach will be paramount. The insights distilled within this document serve as both a reference point and a catalyst for strategic dialogue, enabling teams to anticipate shifts, mitigate risks, and capitalize on emerging applications. Ultimately, the cohesive alignment of scientific innovation, operational excellence, and strategic foresight will determine the winners in this dynamic arena.

Seize the Opportunity to Engage with Ketan Rohom for Exclusive Access to the In-Depth Animal Blood Plasma Market Research Report

To secure competitive advantage and access the definitive analysis of current and future opportunities in animal blood plasma products and derivatives, we invite you to engage with Ketan Rohom, Associate Director of Sales & Marketing. In a personalized consultation, Ketan will walk you through the report’s comprehensive sections, illuminating critical findings and strategic takeaways suited to your organization’s needs. Whether you seek deeper insights into tariff impacts, segmentation nuances, or regional growth trajectories, this tailored session will equip you with the clarity and confidence to make informed investment and operational decisions.

Take the next step toward optimizing your strategic roadmap by arranging a direct conversation with Ketan Rohom. With his guidance, you will gain exclusive access to actionable data and expert recommendations that empower your teams to capitalize on emerging trends, mitigate supply chain risks, and accelerate innovation. Contact Ketan today to unlock the full potential of this in-depth market research report and transform critical insights into sustainable business outcomes.

- How big is the Animal Blood Plasma Products & Derivatives Market?

- What is the Animal Blood Plasma Products & Derivatives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?