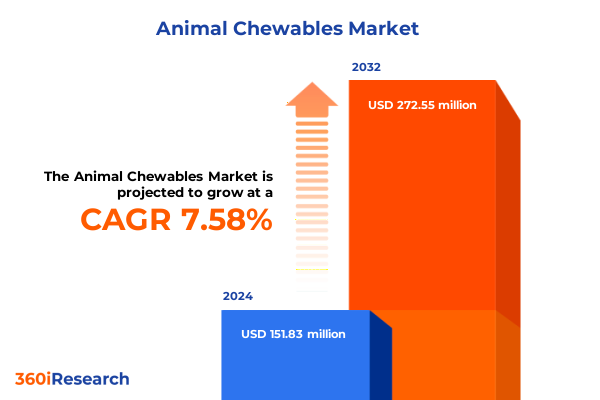

The Animal Chewables Market size was estimated at USD 162.71 million in 2025 and expected to reach USD 180.69 million in 2026, at a CAGR of 7.64% to reach USD 272.55 million by 2032.

Unlocking the Essentials: Exploring the Evolutionary Trends and Market Drivers Shaping the Global Animal Chewables Landscape

The Animal Chewables market stands at an inflection point, propelled by an unprecedented convergence of pet humanization trends, evolving animal health demands, and heightened consumer awareness. Over the past decade, pet owners have increasingly embraced supplementary nutrition as an integral component of holistic animal care, elevating chewable formulations from niche offerings to mainstream essentials. This shift underscores a broader transformation in which veterinary practitioners, nutritionists, and end users collaborate to identify, validate, and adopt products that blend convenience with scientific efficacy.

In response, manufacturers have intensified investments in research and development to enhance ingredient bioavailability, palatability, and stability, while simultaneously optimizing production processes to meet rigorous quality standards. Consequently, chewable tablets, functional chewables, and soft chewables now feature a wide spectrum of active ingredients-ranging from multivitamins and omega-3 fatty acids to targeted probiotic strains-tailored to address specific health conditions and life stages. As we begin this exploration of market dynamics, it is essential to recognize the intricate interplay between formulation innovation, regulatory frameworks, and consumer preferences, which together define the current landscape and illuminate the pathways for future growth.

Identifying Key Transformative Forces Redefining Formulation Innovation and Supply Chain Strategies in Animal Chewables Industry

Major shifts are reshaping the Animal Chewables landscape, driven by breakthroughs in nutraceutical chemistry, digital supply chain technologies, and data-driven consumer insights. Advances in encapsulation techniques now enable time-release delivery of omega-3 or probiotic blends, extending the therapeutic impact while reducing dosing frequency. Simultaneously, the proliferation of blockchain and IoT-enabled tracking systems enhances transparency, traceability, and quality assurance across every link of the value chain, from raw material sourcing to end-user distribution.

Furthermore, the integration of artificial intelligence and machine learning tools has unlocked predictive analytics capabilities, enabling formulators to anticipate emerging health concerns in specific species and adjust ingredient portfolios accordingly. This technological convergence is reinforced by partnerships between feed ingredient suppliers, veterinary institutions, and digital health platforms, fostering an ecosystem where continuous feedback loops accelerate product refinement. As a result, stakeholders can respond in near real-time to shifts in pathogen prevalence, nutritional deficiencies, and consumer sentiment, ensuring that chewable offerings not only meet but exceed evolving standards for safety and efficacy.

Assessing the Comprehensive Effects of 2025 United States Tariff Adjustments on Raw Material Costs and Market Accessibility

In 2025, the United States implemented new tariff structures targeting select feed-grade raw materials and finished nutraceutical imports, precipitating a cascade of cost and compliance challenges. Raw sources of omega-3 fatty acids and specialized probiotic strains, often imported from established suppliers abroad, have experienced duty increases of up to 15 percent. Consequently, formulators have had to reassess supply agreements, negotiate escalated freight and customs expenses, and, in many cases, pivot toward domestic ingredient partnerships to mitigate financial strain.

Moreover, the tariff adjustments have influenced the distribution channel economics, particularly within veterinary clinics and pet specialty stores where smaller batch sizes and niche product lines are predominant. These outlets often operate with tighter margins, compelling manufacturers to absorb a portion of the incremental costs or adjust recommended retail prices. In tandem, online retailers and larger retail chains have leveraged scale to partially offset tariff impacts, fostering a two-tiered pricing environment. Looking ahead, the cumulative effect of these tariffs will continue to shape sourcing strategies and channel-specific positioning, underscoring the need for agile procurement models and diversified ingredient portfolios.

Unearthing Actionable Intelligence from Diverse Segmentation Criteria to Illuminate Animal Chewables Market Nuances

An in-depth view of segmentation criteria reveals nuanced growth levers spanning animal species, product formulation, distribution pathways, end-user communities, and ingredient categories. When examining animal type, the division between companion animals-namely cats, dogs, and horses-and livestock segments brings distinct regulatory and nutritional frameworks into focus, with cattle, pigs, and poultry demanding large-scale bulk formulations tailored to herd health management. From a product perspective, chewable tablets offer precision dosing and shelf stability, whereas functional chewables introduce specialty blends for joint support or digestive health, and soft chewables emphasize palatability for finicky feeders.

Turning to distribution channels, online retailers excel in broad reach and subscription models, pet specialty stores provide expert sales support, supermarkets and hypermarkets drive volume penetration, and veterinary clinics deliver professional endorsement and customized recommendations. Through the lens of end use, animal shelters seek cost-effective nutritional aids to support rescued animals’ well-being, commercial farming operations prioritize feed efficiency and disease prevention, and individual pet owners demand premium formulations backed by transparent ingredient sourcing. Finally, ingredient type segmentation showcases multivitamin mixes for general wellness, omega-3 enriched chewables for cardiovascular and skin health, and probiotic-infused products to maintain digestive balance. Together, these intersecting segmentation dimensions form a strategic matrix for tailoring market approaches and product positioning.

This comprehensive research report categorizes the Animal Chewables market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Animal Type

- Ingredient Type

- End User

- Distribution Channel

Highlighting Regional Dynamics and Growth Catalysts Across Americas, Europe Middle East & Africa, and Asia-Pacific Territories

Regional analysis highlights divergent market drivers and adoption patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific territories. In the Americas, robust pet adoption rates, high veterinary expenditure per animal, and advanced e-commerce infrastructure serve as primary growth catalysts. Meanwhile, Latin American countries are witnessing gradual uptake of premium chewables, supported by expanding urban middle-class incomes and digital retail expansions. Transitioning to Europe Middle East & Africa, established veterinary networks and stringent regulatory oversight in Western Europe contrast with emerging markets in Eastern regions, where improving cold-chain logistics and growing awareness of animal welfare are fostering incremental demand.

Shifting focus to Asia-Pacific, accelerating pet ownership in urban centers alongside expanding commercial farming communities drives a bifurcated market dynamic. China and India are prioritizing livestock health programs to enhance productivity, whereas Japan and South Korea lead in companion animal nutritional innovation, embracing localized flavors and traditional herbal adjuncts. Across all regions, cross-border collaborations, knowledge transfer initiatives, and localized clinical trials reinforce global standards while accommodating regional preferences, thereby creating a mosaic of opportunity for manufacturers, distributors, and research institutions.

This comprehensive research report examines key regions that drive the evolution of the Animal Chewables market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Major Stakeholders and Competitive Strategies Driving Innovation in the Animal Chewables Arena

Leading players are deploying strategic partnerships, targeted acquisitions, and proprietary formulation platforms to solidify their positions in the Animal Chewables segment. Many firms have established in-house R&D centers dedicated to advanced encapsulation and metered-dose technologies, enabling rapid iteration of ingredient matrices. Additionally, collaborations with academic veterinary schools and contract research organizations yield access to in vivo efficacy studies, strengthening product dossiers and regulatory submissions.

Competitive differentiation also emerges through forward integration into direct-to-consumer channels, enhanced by personalized subscription services and loyalty programs. Established feed ingredient suppliers are vertically integrating by launching co-branded chewable ranges, while contract manufacturers are differentiating through flexible, small-batch capabilities. Collectively, these strategic maneuvers underscore a shift toward end-to-end value chain control, where data analytics and consumer feedback loops inform continuous product enhancement and expedite time-to-market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Chewables market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AllAccem, Inc.

- Bayer AG

- Boehringer Ingelheim International GmbH

- Buck Bone Organics

- Ceva Animal Health, LLC

- Dechra Veterinary Products Limited

- Elanco Animal Health Incorporated

- GREENIES by Mars, Incorporated

- Himalayan Pet Supply

- Loving Pets

- Merck & Co., Inc.

- NATURAL ORGANICS INC.

- Nature Gnaws

- Nestle S.A.

- Nutri-Vet

- Nylabone

- Pala-Tech Laboratories

- Stella & Chewy’s LLC

- The Hartz Mountain Corporation

- The J.M. Smucker Co

- The Kroger Co.

- Zoetis, Inc.

Delivering Strategic Recommendations to Empower Industry Leaders in Maximizing Value and Competitive Advantage

Industry leaders should prioritize diversified sourcing frameworks that balance domestic and international suppliers to mitigate tariff volatility and ensure uninterrupted raw material flows. Investing in modular manufacturing lines capable of switching between chewable tablets, functional chews, and soft formats will facilitate rapid response to shifting consumer preferences and regulatory guidelines. Furthermore, establishing strategic alliances with digital health platforms and veterinary networks can amplify product visibility and credibility, creating seamless pathways for education, sampling, and repeat purchase.

In parallel, companies must adopt data-driven marketing approaches, leveraging advanced CRM systems to segment customers by species, usage intent, and purchasing behavior. Tailored communication strategies, including targeted social media campaigns and veterinarian-endorsed content, can enhance attachment rates and drive higher lifetime value. Finally, embedding sustainability criteria-such as responsible ingredient sourcing and recyclable packaging-into core operations will resonate with increasingly environmentally conscious stakeholders and fortify brand equity over the long term.

Detailing Robust Research Methodology Framework Ensuring Rigor, Reliability, and Reproducibility of Market Insights

This research employs a mixed-methodology approach, integrating qualitative interviews with key opinion leaders, veterinarians, and industry executives alongside quantitative data collection from proprietary surveys and secondary sources. Primary data collection was structured through in-depth telephonic and virtual discussions, capturing nuanced perspectives on formulation efficacy, channel economics, and regulatory compliance. Secondary data sources include peer-reviewed journals, government regulatory filings, and open-source trade publications, ensuring triangulation and validation of market insights.

Analytical techniques encompass SWOT analyses at product and regional levels, Porter’s Five Forces assessments to gauge competitive intensity, and correlation studies to identify relationships between ingredient adoption rates and species-specific health outcomes. Rigorous data cleansing protocols and consistency checks were applied throughout the research cycle to minimize bias and enhance reproducibility. The resulting framework ensures that all findings are grounded in empirical evidence and reflect the complex realities of the Animal Chewables market ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Chewables market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Chewables Market, by Product Type

- Animal Chewables Market, by Animal Type

- Animal Chewables Market, by Ingredient Type

- Animal Chewables Market, by End User

- Animal Chewables Market, by Distribution Channel

- Animal Chewables Market, by Region

- Animal Chewables Market, by Group

- Animal Chewables Market, by Country

- United States Animal Chewables Market

- China Animal Chewables Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Discoveries to Guide Stakeholders Toward Informed Decisions in the Animal Chewables Sector

The collective findings underscore a market in flux, driven by converging factors such as pet humanization, regulatory evolution, and supply chain digitization. A clear consensus emerges around the increasing importance of specialized functional chewables that address chronic conditions and enhance preventative health. Simultaneously, the impact of external variables like tariff revisions and regional infrastructure disparities highlights the necessity for agile, region-specific strategies.

Ultimately, stakeholders are encouraged to leverage segmentation intelligence, regional nuances, and competitive benchmarks to craft differentiated value propositions. Whether through formulation innovation, channel optimization, or collaborative research initiatives, the roadmap to success lies in proactive adaptation to market signals. By synthesizing the strategic imperatives detailed herein, decision-makers can position their organizations to capitalize on the enduring demand for animal health supplements and to chart a course toward long-term resilience.

Engaging with Ketan Rohom to Access the Full-Scale Animal Chewables Market Research Report and Drive Performance

To access the comprehensive analysis and unlock tailored strategic guidance for navigating the evolving Animal Chewables market, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep industry expertise and can guide you through the full-scale report, ensuring you leverage every insight from formulation trends to tariff implications. Engaging with Ketan will expedite your decision-making process and empower your business to capitalize on emerging opportunities. Reach out today to secure your copy of the definitive Animal Chewables market research report and position your organization for sustainable growth.

- How big is the Animal Chewables Market?

- What is the Animal Chewables Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?