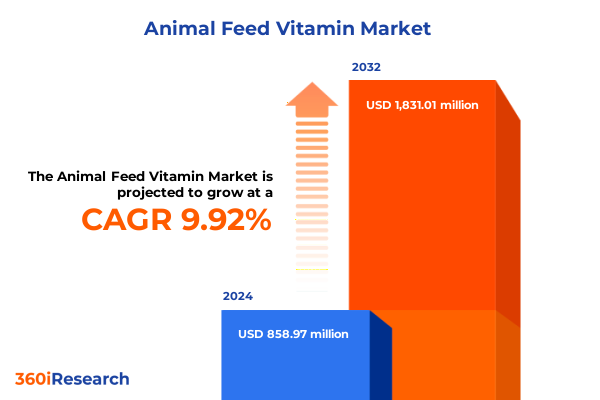

The Animal Feed Vitamin Market size was estimated at USD 945.25 million in 2025 and expected to reach USD 1,025.67 million in 2026, at a CAGR of 9.90% to reach USD 1,831.01 million by 2032.

Exploring the Critical Role of Vitamin Fortification in Animal Nutrition and Its Strategic Importance for Sustainable Feed Solutions Worldwide

Vitamin fortification has emerged as a cornerstone in modern animal nutrition, playing an indispensable role in optimizing health, productivity, and welfare across multiple species. As animal agriculture confronts ever-intensifying demands for efficiency and sustainability, vitamins serve as vital catalysts for immune system support, growth regulation, and feed conversion enhancement. This dynamic landscape underscores the strategic importance of precision nutrition, in which micronutrient balance is not merely an additive consideration but a fundamental framework guiding feed formulation and farm management practices.

Over the past decade, escalating market pressures from regulatory bodies, consumer advocacy groups, and environmental stakeholders have propelled vitamins to the forefront of innovation in feed science. Producers are increasingly under scrutiny to demonstrate responsible resource utilization, reduce waste, and meet stringent performance benchmarks. Consequently, vitamin suppliers and integrators are collaborating with researchers and technology developers to deliver targeted solutions that address species-specific requirements, regional challenges, and evolving industry standards. In this context, understanding the complex interplay of biological, economic, and regulatory factors is essential for formulating robust strategies that drive both animal well-being and operational resilience.

How Emerging Technologies, Sustainability Mandates, and Regulatory Evolutions Are Redefining Vitamin Enrichment Practices in Animal Feed Globally

The landscape of animal feed vitamin enrichment is undergoing transformative shifts driven by breakthroughs in biotechnology, digitalization, and consumer-driven sustainability demands. Precision nutrition platforms now leverage real-time analytics and sensor-derived data to customize vitamin inclusion rates at the individual animal or flock level, ensuring maximal efficacy while minimizing waste. Simultaneously, advances in encapsulation and controlled-release technologies enable targeted delivery systems that enhance bioavailability, reduce degradation during feed processing, and lower environmental nutrient runoff.

Moreover, regulatory frameworks across major markets are evolving to emphasize traceability and stringent quality controls. Emerging mandates on clean-label feed formulations have prompted manufacturers to replace synthetic carriers with natural or plant-derived excipients, accelerating research into alternative vitamin sources such as microalgae and fermentation-derived compounds. In parallel, collaborative partnerships among feed producers, biotech firms, and academic institutions are ushering in a new era of formulation innovation centered on sustainability metrics, lifecycle assessments, and circular economy principles.

Consequently, industry stakeholders must navigate an increasingly complex value chain where science, policy, and market preferences converge. From granular shifts in production processes to macro-level realignments in trade flows, the integration of cutting-edge technologies and evolving governance structures is redefining how vitamins are developed, delivered, and regulated within the animal nutrition spectrum.

Assessing the Comprehensive Consequences of the 2025 United States Tariff Adjustments on the Vitamin Supplement Supply Chain for Animal Feed

In 2025, the United States implemented a series of tariffs targeting vitamin precursors, carriers, and related feed additives, reshaping the operational calculus for domestic integrators. These measures, aimed at bolstering local production capacities and addressing trade imbalances, have introduced new cost layers that ripple through multinational supply chains. With certain bulk vitamins sourced primarily from overseas production hubs, feed formulators now confront elevated input expenses that challenge conventional procurement strategies and margin structures.

The cumulative impact extends beyond pricing. To mitigate import cost pressures, several integrators have reconfigured their logistics networks, forging alliances with regional distributors and investing in domestic fermentation and synthesis facilities. This realignment has fostered vertical integration among select players, enhancing supply security but also intensifying competition for raw material access. Smaller-scale operations face heightened vulnerability, as they grapple with shorter lead times and reduced negotiating leverage in a market where tariff-driven scarcity can precipitate abrupt availability dips.

As an adaptive response, ingredient innovators are accelerating efforts to localize precursor production, diversify sourcing geographies, and optimize process efficiencies. Concurrently, collaborative initiatives between industry associations and regulatory agencies are emerging to streamline approval pathways for novel vitamin analogs and biofortification techniques. These developments underscore the necessity for a holistic understanding of trade policy ramifications and strategic supply chain redesign to maintain consistent nutritional profiles and cost competitiveness in fortified feed formulations.

Unveiling the Intricacies of Animal Type, Vitamin Category, Formulation, and End User Segments to Illuminate Market Dynamics

When examining the market through the lens of animal type, researchers uncover a complex fabric of requirement patterns that span aqua species-crustaceans and finfish-to the broad categories of poultry encompassing breeders, broilers, and layers. In parallel, ruminant segments such as beef and dairy cattle alongside sheep and goats exhibit distinct micronutrient absorption dynamics, while the swine domain stretches from vulnerable piglets and weaners to grower and finisher stages, each with tailored vitamin profiles critical for development and health.

Exploring vitamin categories reveals that multivitamin complexes command significant relevance across species by providing comprehensive nutrient coverage, whereas targeted inclusions of vitamins A, D3, and E address specific physiological functions from vision support to calcium metabolism and antioxidant protection. This diversity in vitamin type allows feed formulators to align interventions precisely with species-specific growth phases and production goals.

The chosen formulation form further refines delivery efficacy; liquid preparations enable rapid assimilation and compatibility with on-farm dosing systems, while pellet and powder matrices offer enhanced stability during extrusion and pelleting processes. Finally, end-user distinctions between independent and integrated feed mills versus commercial and smallholder farms shape purchasing behaviors, volume requirements, and technical support needs. Together, these segmentation dimensions form an intertwined framework guiding nuanced product development, marketing strategies, and operational execution across the animal feed vitamin ecosystem.

This comprehensive research report categorizes the Animal Feed Vitamin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Vitamin Type

- Form

- Source

- End User

Deciphering Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific to Uncover Emerging Opportunities in Vitamin Fortified Feed

Across the Americas, the animal feed vitamin landscape is defined by robust investment in precision agriculture, integrated supply chains, and advanced manufacturing infrastructure. North American producers leverage cutting-edge research collaborations to enhance vitamin bioavailability and traceability, while Latin American markets emphasize cost optimization and local sourcing to accommodate diverse farm scales and cost sensitivities. This regional mosaic reflects both mature commercial frameworks and rapidly scaling operations in emerging economies.

In Europe, the Middle East, and Africa, regulatory diversity presents both challenges and opportunities. Stringent European Union quality standards drive innovation in clean-label formulations and promote fortified feed as a means to reduce reliance on medicinal treatments. Conversely, markets in the Middle East and Africa often prioritize basic nutritional security, with vitamins playing a crucial role in combating deficiencies under variable feeding regimes. Cross-regional trade corridors facilitate knowledge transfer and technology adoption, yet fraught logistical complexities can affect supply continuity and cost structures.

Meanwhile, the Asia-Pacific region is experiencing exponential growth fueled by rising protein consumption, governmental initiatives to modernize livestock operations, and expanding feed mill networks. Southeast Asian nations are rapidly integrating vitamin fortification into aquaculture feed to meet export standards, while major producers in East Asia focus on high-precision blends targeting poultry and swine sectors. Across APAC, public-private partnerships and digital platforms are accelerating the uptake of data-driven nutrition models, positioning the region as a hotbed for next-generation vitamin delivery solutions.

This comprehensive research report examines key regions that drive the evolution of the Animal Feed Vitamin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Competitive Landscape Highlighting Industry Leaders Driving Innovation, Collaboration, and Growth Trajectories in Animal Feed Vitamin Solutions

The competitive arena for animal feed vitamins is populated by a mix of global multinationals, specialized ingredient innovators, and agile regional players. Leading companies distinguish themselves by integrating robust research and development pipelines with extensive technical support networks that facilitate on-farm trials and bespoke formulation services. These organizations often leverage scale advantages in fermentation, microencapsulation, and process optimization to deliver cost-effective, high-purity vitamin offerings tailored to diverse species demands.

Simultaneously, niche specialists are carving out positions by focusing on novel vitamin precursors, plant-based carriers, and biofortified ingredients derived from algae or microbial fermentation. Their lean structures enable rapid prototyping and quicker market entry for breakthrough solutions. Partnerships between these innovators and large feed mill operators frequently culminate in co-development agreements, shaping a dynamic ecosystem where collaboration and competition coexist to drive continuous product improvement.

In addition, technology firms specializing in data analytics and digital traceability are reshaping value propositions by offering end-to-end systems that monitor vitamin stability, feed intake patterns, and animal performance metrics in real time. This convergence of ingredients expertise and digital capabilities underscores an evolving competitive landscape where strategic alliances and cross-sector integration become essential levers for differentiation and growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Feed Vitamin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adisseo France S.A.S.

- Alltech, Inc.

- Archer Daniels Midland Company

- Balchem Corporation

- BASF SE

- Bluestar Adisseo Co., Ltd.

- Cargill, Incorporated

- DSM Nutritional Products AG

- Jefo Nutrition Inc.

- Kemin Industries, Inc.

- Lonza Group AG

- Novus International, Inc.

- Nutreco N.V.

- Orffa International B.V.

- Pancosma SA

- Phibro Animal Health Corporation

- Vetagro S.p.A.

- Zinpro Corporation

Strategic Imperatives and Practical Measures for Industry Stakeholders to Capitalize on Evolving Trends and Strengthen Vitamin Integration in Animal Nutrition

Industry leaders should prioritize the deployment of precision nutrition platforms that combine sensor-derived data with predictive analytics to calibrate vitamin inclusion on a granular scale. By embracing modular dosing systems and in-line fortification equipment, operations can achieve leaner supply chains, minimize batch variability, and improve feed conversion ratios. Concurrently, fostering collaborative research initiatives with academic institutions and technology partners will expedite the development of advanced delivery mechanisms such as microencapsulation and nanocarrier systems, enhancing bioefficacy and environmental stewardship.

Diversification of raw material sourcing is imperative to mitigate lingering tariff pressures and geopolitical disruptions. Establishing multi-tiered procurement frameworks that include regional suppliers, contract farming ventures, and in-house synthesis facilities will safeguard continuity and cost stability. Furthermore, investing in sustainability certifications and life-cycle assessments can strengthen market positioning and preempt regulatory shifts toward carbon accountability and regenerative agriculture practices.

Finally, unlocking value from digital integration requires scaling up traceability solutions and decision-support tools that link vitamin analytics with herd management software. Offering bundled service models that encompass formulation design, performance monitoring, and ongoing advisory support will differentiate providers and forge deeper customer relationships. By executing these strategic imperatives, stakeholders can reinforce competitive advantage and capitalize on the rapidly advancing frontiers of animal feed vitamin science.

Illuminating the Rigorous Mixed Methodology Integrating Primary Interviews, Secondary Analysis, and Data Triangulation in Animal Feed Vitamin Research

This report synthesizes insights derived from a rigorous mixed‐methods research methodology encompassing both qualitative and quantitative analyses. Secondary research involved an extensive review of industry publications, regulatory filings, company annual reports, and peer‐reviewed scientific literature to establish a foundational understanding of vitamin chemistry, market drivers, and value chain dynamics. Quantitative datasets were acquired from reputable government resources, trade databases, and industry consortiums to map supply flows, pricing trends, and regional production capacities.

Primary research comprised in-depth interviews with over fifty experts, including feed mill managers, nutritionists, regulatory authorities, and ingredient suppliers. These discussions provided nuanced perspectives on emerging challenges such as tariff impacts, formulation innovations, and end-user adoption barriers. The qualitative inputs were systematically triangulated against secondary data, ensuring consistency and validating key findings. Statistical analyses, including variance assessments and correlation studies, were employed to reveal relationships between vitamin dosage strategies and animal performance metrics.

To enhance the reliability and relevance of conclusions, the research applied scenario planning and sensitivity modeling to examine potential market disruptions, regulatory shifts, and technological breakthroughs. This layered approach ensured that reported insights reflect both current realities and plausible future developments, equipping stakeholders with a comprehensive, data‐driven foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Feed Vitamin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Feed Vitamin Market, by Animal Type

- Animal Feed Vitamin Market, by Vitamin Type

- Animal Feed Vitamin Market, by Form

- Animal Feed Vitamin Market, by Source

- Animal Feed Vitamin Market, by End User

- Animal Feed Vitamin Market, by Region

- Animal Feed Vitamin Market, by Group

- Animal Feed Vitamin Market, by Country

- United States Animal Feed Vitamin Market

- China Animal Feed Vitamin Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Insights and Forward-Looking Perspectives That Define the Future Trajectory of Vitamin Supplementation Practices in Animal Feed

The preceding analysis underscores that vitamin fortification in animal feed is no longer a supplementary consideration but a central pillar of modern livestock nutrition strategies. Core insights reveal that technological advancements, regulatory evolutions, and shifting trade policies are collectively reshaping sourcing paradigms, formulation approaches, and competitive dynamics. The interplay among regional regulations, end‐user requirements, and supply chain resilience necessitates a multi‐faceted perspective to effectively navigate risks and identify growth levers.

Looking ahead, the convergence of sustainability mandates and digital innovation is poised to drive further evolution in vitamin delivery methods, data integration, and product traceability. Stakeholders who proactively invest in precision nutrition platforms and collaborative research networks will be best positioned to deliver high‐value solutions that address performance, health, and environmental objectives. The synergistic alignment of technical expertise, strategic sourcing, and service differentiation will define the next frontier of value creation in the animal feed vitamin arena.

In conclusion, the dynamic nature of this market demands continuous vigilance and adaptive strategies. By synthesizing the data‐driven insights and actionable recommendations presented, decision-makers can fortify their strategic roadmaps and capitalize on emerging opportunities, ensuring robust, sustainable growth in the years to come.

Take Prompt Action and Connect Directly with Ketan Rohom to Unlock Exclusive Access and Secure Your Comprehensive Animal Feed Vitamin Market Research Report Today

We invite you to reach out today to Ketan Rohom, Associate Director, Sales & Marketing, to gain privileged insights and secure your comprehensive market intelligence on vitamin supplementation strategies in animal feed. Engaging with Ketan will equip your organization with the critical analysis needed to optimize nutritional programs, navigate evolving regulatory landscapes, and harness emerging growth opportunities in fortified feed solutions. Act now to ensure your team is armed with the latest expert research and actionable data to drive competitive advantage and sustainable profitability across your operations.

- How big is the Animal Feed Vitamin Market?

- What is the Animal Feed Vitamin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?