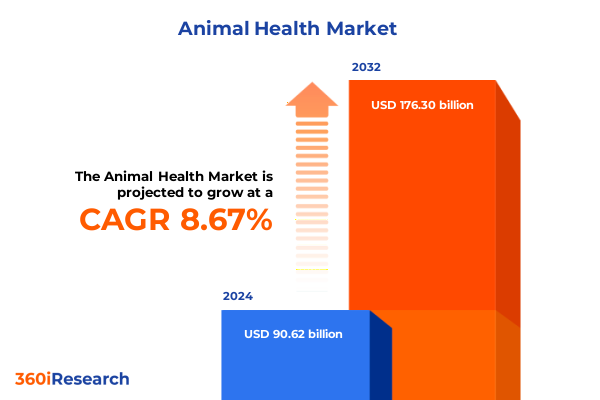

The Animal Health Market size was estimated at USD 98.50 billion in 2025 and expected to reach USD 106.22 billion in 2026, at a CAGR of 8.67% to reach USD 176.30 billion by 2032.

Unveiling the Critical Dynamics and Emerging Trends That Are Shaping the Future Trajectory of the Global Animal Health Industry for Strategic Decision Makers

The global animal health sector stands at a pivotal juncture as stakeholder expectations, technological breakthroughs, and regulatory landscapes converge to redefine industry horizons. Once primarily focused on fundamental disease control and livestock productivity, the market today is evolving into a complex ecosystem characterized by advanced biologics, precision diagnostics, and integrated service models. Fueled by rising pet ownership, intensifying concerns over antimicrobial resistance, and heightened demand for sustainable livestock practices, leading organizations are recalibrating strategies to capture emerging value pools. Consequently, this era of transformation demands robust frameworks that enable rapid adoption of innovative solutions, intelligent resource allocation, and proactive engagement with evolving policy mandates.

Emerging narratives around one-health integration and digitalization are reshaping how pharmaceutical companies, diagnostic innovators, and veterinary services align their portfolios. From harnessing data-driven insights in molecular diagnostics to leveraging telemedicine for remote care delivery, the intersections between technology and biology are driving unprecedented growth opportunities. Amidst these advancements, market players must also navigate a complex regulatory environment marked by enhanced scrutiny of feed additives, stricter vaccine approval pathways, and shifting import-export constraints. As we delve into this report, the introduction provides a comprehensive roadmap to decode these intricate dynamics, highlighting critical enablers of success and underscoring the strategic imperatives that will guide industry leadership into the next decade

Exploring the Disruptive Technological Innovations and Market Forces Redefining Animal Healthcare Practices and Driving Unprecedented Industry Transformation in 2025

Recent years have witnessed a fundamental shift in how animal health is approached, propelled by technological breakthroughs and evolving market demands. Advances in molecular diagnostics now enable real-time disease surveillance, empowering veterinarians to detect pathogens at the genomic level and tailor interventions with precision. Simultaneously, the proliferation of digital health platforms and mobile applications facilitates remote monitoring of animal well-being, reducing the need for in-person examinations and streamlining treatment protocols. These technological strides are converging with breakthroughs in vaccine development, where novel recombinant and subunit platforms promise broader immunogenicity and expedited response to emerging pathogens.

In parallel, consumer preferences are reshaping product formulations, with growing interest in natural feed additives such as prebiotics and probiotics, and a marked shift toward antibiotic stewardship. This movement dovetails with tightening regulatory measures aimed at curbing antimicrobial resistance, leading global agencies to impose stricter guidelines on antibiotic usage in both companion and production animals. Moreover, sustainability considerations are driving the adoption of alternative protein sources and environmentally friendly packaging, reflecting a holistic approach to animal welfare that integrates ethical, ecological, and economic dimensions. As these transformative forces coalesce, companies are forging collaborative partnerships with biotech start-ups, research institutions, and technology providers to pioneer integrated solutions that transcend traditional pharmaceutical portfolios and deliver enhanced value across the supply chain

Assessing the Far Reaching Consequences of the 2025 United States Tariff Adjustments on Supply Chains Production Costs and Market Accessibility in Animal Health

The 2025 revisions to United States tariff policy have introduced a complex web of cost pressures and strategic recalibrations across the animal health supply chain. Historically reliant on affordable active pharmaceutical ingredients and feed additive precursors sourced from global hubs, many manufacturers are now grappling with elevated import duties that have increased landed costs. These escalations, in turn, have accelerated domestic investments in contract manufacturing and API synthesis, as companies seek to mitigate margin erosion through localized production. However, transitioning to onshore facilities entails significant capital outlays and extended validation timelines, making strategic sourcing diversification a critical imperative.

Concurrently, the cumulative impact of tariff adjustments has reverberated through distribution networks, compelling intermediaries and veterinary clinics to reevaluate procurement strategies. Price adjustments have rippled downstream, influencing end-user adoption rates for higher-margin biologics and sophisticated diagnostics. At the same time, regulatory agencies are under pressure to streamline approval processes for domestically produced assets, recognizing the need to bolster supply resilience. In response, several leading animal health firms have entered joint ventures with regional manufacturers to share risk and leverage local expertise. Looking ahead, navigating this tariff-driven landscape will require a balanced approach that combines near-term contingency planning with long-term strategic alliances and an unwavering focus on operational efficiency

Illuminating the Multidimensional Segmentation Framework That Unlocks Profound Insights into Animal Health Demand Across Species Products Therapeutic Uses Distribution Pathways and End Users

A nuanced understanding of market segmentation reveals the granular dynamics that underpin demand drivers and competitive pressures across the animal health sector. Based on animal type, the industry dichotomizes into companion animals and livestock, with companion streams further differentiating into cats and dogs, while livestock encompasses aquaculture, cattle, poultry, and swine populations. This duality underscores the divergent treatment approaches and product adoption patterns observed in urban pet care compared to large-scale production systems. Moreover, the companion segment’s focus on disease prevention and wellness parallels the livestock segment’s emphasis on productivity and disease mitigation, demonstrating the importance of tailored value propositions.

Parallel segmentation by product category highlights a spectrum ranging from molecular and immunological diagnostics to specialized vaccine platforms and pharmacological interventions. Within diagnostics, genomics-led tools are complementing traditional immunoassays, enabling earlier detection and more accurate disease management. In the feed additive domain, enzyme formulations and prebiotic-probiotic blends are gaining traction to enhance gut health and feed conversion ratios. Likewise, parasiticides bifurcate into ectoparasiticides and endoparasiticides, each addressing distinct ectoparasite and internal parasite burdens. Pharmaceuticals further subdivide into branded assets versus generics, reflecting divergent commercialization strategies, while vaccine development tracks killed inactivated, live attenuated, and recombinant modalities to meet varying efficacy and safety profiles.

Therapeutic applications provide another lens, where anti-infectives segment into antibiotics, antifungals, and antivirals, and anti-inflammatories separate into corticosteroids versus NSAIDs, each category addressing specific physiological pathways. Hormonal therapeutics span growth hormones and reproductive hormones, optimizing productivity, and lifecycle management. Distribution channels further delineate market reach, with e-commerce ecosystems offering direct-to-consumer and third-party platform access, complementing traditional retail pharmacies-both chain and independent-and veterinary hospitals and clinics, which range from large animal hospitals to smaller companion care clinics. Finally, end users coalesce into animal owners-divided between livestock farmers and pet enthusiasts-feed manufacturers focused on nutritional solutions, and veterinarians in large animal, mixed practice, and small animal capacities. Together, these segmentation insights illuminate the heterogeneous needs and evolving priorities that shape product development, go-to-market strategies, and investment decisions across the animal health landscape

This comprehensive research report categorizes the Animal Health market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Product

- Therapeutic Application

- Distribution Channel

- End User

Decoding the Regional Nuances and Emerging Growth Patterns Across Americas Europe Middle East Africa and Asia Pacific in the Evolving Animal Health Ecosystem

Regional landscapes in animal health demonstrate distinct growth trajectories shaped by demographic trends, regulatory frameworks, and disease prevalence patterns. In the Americas, expansion in companion animal ownership is complemented by technologically advanced pharmaceutical research and a robust contract manufacturing infrastructure. The United States remains the center of innovation for novel vaccines and biologics, while Latin American markets are increasingly adopting cost-effective generics and over-the-counter parasiticides to address endemic health challenges in cattle and poultry systems. This regional contrast emphasizes the need for dual strategies catering to premium wellness segments alongside high-volume production markets.

Moving to Europe, the Middle East, and Africa, regulatory harmonization across the European Union has streamlined approvals for molecular diagnostics and next-generation vaccines, fostering cross-border trade in high-value therapeutics. Meanwhile, in the Middle East and parts of North Africa, investments in aquaculture have surged, driving demand for specialized health products tailored to marine species. Sub-Saharan Africa’s livestock sector continues to grapple with transboundary diseases, prompting partnerships between public sector veterinary services and private feed additives manufacturers to bolster biosecurity and productivity. These regional dynamics underscore the importance of flexible market entry models and strategic collaborations with local stakeholders.

Across Asia-Pacific, rapid population growth and rising protein consumption are intensifying livestock production, particularly within poultry, aquaculture, and swine segments. Government incentives for antibiotic reduction and vaccine adoption are catalyzing shifts toward recombinant vaccines and natural feed supplements. At the same time, urban pet ownership is fueling demand for premium parasiticides and diagnostics in urban centers. With a diverse mosaic of mature and emerging markets, the Asia-Pacific region demands differentiated value propositions that address both sophisticated demand pockets and regions in nascent development stages

This comprehensive research report examines key regions that drive the evolution of the Animal Health market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Positioning Innovation Portfolios and Collaborative Strategies of Leading Global Animal Health Corporations Steering Market Competition and Growth

Leading corporations in animal health have adopted varied strategic blueprints to secure competitive advantage, with a clear bifurcation between diversified pharmaceutical giants and specialized diagnostic innovators. Multibillion-dollar enterprises maintain expansive portfolios encompassing vaccines, parasiticides, and feed additives, leveraging global distribution networks and strategic acquisitions to consolidate market share. These firms invest heavily in research collaborations and licensing agreements to access cutting-edge technologies such as mRNA vaccine platforms and AI-driven diagnostic algorithms. Conversely, niche players concentrate on high-margin segments like molecular diagnostics and recombinant biologics, differentiating through rapid lifecycle innovation and customized service offerings.

Collaborative ventures are increasingly prevalent, as established animal health companies partner with biotechnology start-ups to co-develop solutions that integrate precision diagnostics with targeted therapies. Equity alliances and joint research programs are facilitating accelerated approvals and commercial scale-up, particularly for novel vaccine platforms and gene-edited therapeutics. At the same time, regional manufacturers are forging licensing partnerships to localize production, enabling faster market access and cost efficiencies. Within this landscape, diagnostic specialists are expanding their footprints through service-based models that bundle lab testing, data analytics, and telehealth consultations for companion animal practices. The interplay between consolidation among traditional portfolio leaders and the ascendancy of agile innovators continues to reshape competitive dynamics, underscoring the need for continuous portfolio optimization and strategic foresight

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Health market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alltech, Inc.

- Boehringer Ingelheim International GmbH

- Cargill, Incorporated

- Ceva Santé Animale SA

- Chr. Hansen Holding A/S

- Covetrus, Inc.

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Incorporated

- Heska Corporation

- HIPRA, S.A.

- Huvepharma AD

- IDEXX Laboratories, Inc.

- Kemin Industries, Inc.

- Koninklijke DSM N.V.

- Merck & Co., Inc.

- Neogen Corporation

- Phibro Animal Health Corporation

- Vetoquinol S.A.

- Virbac S.A.

- Zoetis Inc.

Formulating Practical Strategic Roadmaps and Operational Imperatives for Industry Leaders to Capitalize on Market Disruptions Innovation Trends and Regulatory Shifts in Animal Health

To thrive amidst the converging forces of technological disruption, regulatory recalibration, and shifting end-user preferences, industry leaders must adopt a multifaceted strategic blueprint. First, embedding digital diagnostics into core service offerings will enable more accurate disease monitoring and foster proactive care models. This requires not only investment in advanced laboratory infrastructure but also strategic partnerships with software developers to deliver integrated data platforms. Next, prioritizing biologics and recombinant vaccine research can create differentiated market entry points, particularly as governments promote sustainable veterinary solutions and reduced antibiotic reliance.

Supply chain resilience is another priority, necessitating diversified sourcing strategies and selective onshoring of critical manufacturing processes. Companies should conduct scenario planning exercises to stress-test procurement channels and establish contingency agreements with regional producers. Meanwhile, sustainability initiatives-such as environmentally friendly feed additive formulations and recyclable packaging for pharmaceutical products-can enhance brand value and meet evolving regulatory expectations. Finally, engaging end users through educational initiatives and value-based service models will build loyalty and expand uptake across companion animal wellness programs and livestock productivity solutions. By orchestrating these imperatives in a cohesive roadmap driven by cross-functional leadership, organizations can capitalize on emerging opportunities while mitigating risks inherent to the dynamic animal health ecosystem

Detailing the Rigorous Mixed Method Research Approaches and Data Triangulation Processes Employed to Ensure Robust Validity and Reliability in Animal Health Market Analysis

This analysis is underpinned by a rigorous mixed-methods research design that integrates comprehensive secondary and primary data sources. Secondary research involved detailed reviews of regulatory filings, patent databases, scientific publications, and corporate disclosures to map the competitive landscape and technological pipeline. Simultaneously, proprietary databases were leveraged to track historical precedent for policy shifts, tariff impacts, and clinical development progress across key therapeutic areas.

To validate preliminary findings, extensive primary research was conducted through structured interviews with senior executives from leading pharmaceutical and diagnostic firms, academic thought leaders, and senior veterinary practitioners. In addition, surveys were administered to a stratified sample of end users-including livestock farmers, pet owners, and clinical veterinarians-to gauge adoption barriers and unmet needs. Data triangulation was achieved by cross-referencing interview insights with survey outcomes and secondary intelligence, ensuring robust accuracy and consistency. The resulting framework was subjected to iterative peer review and expert panel validations, culminating in a comprehensive, evidence-based set of insights and recommendations tailored to the evolving priorities of the animal health sector

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Health market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Health Market, by Animal Type

- Animal Health Market, by Product

- Animal Health Market, by Therapeutic Application

- Animal Health Market, by Distribution Channel

- Animal Health Market, by End User

- Animal Health Market, by Region

- Animal Health Market, by Group

- Animal Health Market, by Country

- United States Animal Health Market

- China Animal Health Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3339 ]

Synthesizing Core Insights and Strategic Implications to Provide a Cohesive Perspective on the Future Trajectory and Priority Imperatives in Animal Health Management

The convergence of technological innovation, regulatory evolution, and changing consumer paradigms has positioned the animal health industry for sustained transformation. By closely examining segmentation nuances-from companion animal care through to large-scale livestock systems-stakeholders can identify precise value drivers and align product development with emerging needs. Regional insights highlight the importance of localized strategies, where market maturity, disease profiles, and regulatory harmonies shape distinct demand landscapes.

The strategic analysis of corporate initiatives reveals that success hinges on collaborative innovation, agile supply chain design, and a balanced portfolio that spans pharmaceuticals, biologics, diagnostics, and nutritional supplements. As cumulative tariff shifts redefine cost structures and domestic manufacturing landscapes, companies must adopt resilient sourcing strategies and leverage strategic alliances to maintain competitive agility. Ultimately, the actionable recommendations outlined here provide a blueprint for leaders to harness these macro-and micro-level insights, ensuring that their organizations not only adapt to change but also shape the future of animal health care. In doing so, they will drive enhanced animal welfare, sustainable productivity, and long-term value creation across the global ecosystem

Engage Directly with Associate Director of Sales & Marketing Ketan Rohom to Acquire Comprehensive Market Intelligence That Drives Informed Leadership Decisions in Animal Health

For executives seeking a deeper, panoramic understanding of these market dynamics and tailored insights to accelerate growth, I encourage you to connect with Associate Director of Sales & Marketing Ketan Rohom. His expertise in translating comprehensive animal health research into actionable strategies will empower your team to navigate regulatory complexities, optimize product portfolios, and unlock new partnership opportunities. Reaching out to Ketan ensures you receive the full, detailed market research report, complete with exclusive data analyses, competitive benchmarking, and strategic roadmaps designed for resilient decision-making. Engage with Ketan Rohom today to equip your organization with the intelligence necessary to stay ahead in this rapidly evolving industry environment, and secure your competitive advantage through informed leadership decisions in animal health

- How big is the Animal Health Market?

- What is the Animal Health Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?