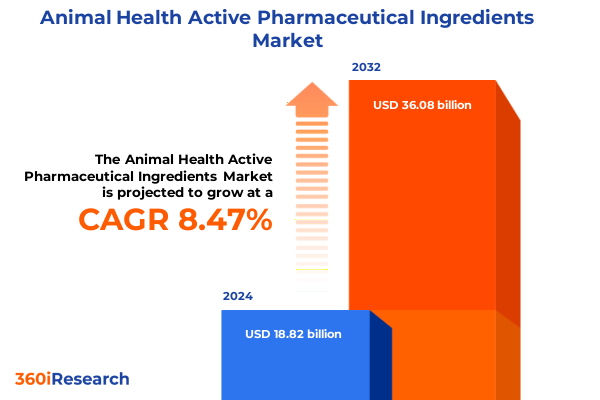

The Animal Health Active Pharmaceutical Ingredients Market size was estimated at USD 20.39 billion in 2025 and expected to reach USD 22.03 billion in 2026, at a CAGR of 8.49% to reach USD 36.08 billion by 2032.

Understanding the Strategic Importance of Active Pharmaceutical Ingredients in Animal Health to Address Evolving Demands and Rapidly Shifting Industry Dynamics

In today’s rapidly evolving animal health landscape, active pharmaceutical ingredients have emerged as the cornerstone of therapeutic innovation. With rising global demand for animal protein driven by changing dietary preferences and population growth, manufacturers are under mounting pressure to develop high-efficacy API formulations. At the same time, a parallel surge in companion animal ownership has fueled demand for products that ensure pet health and longevity. These dual dynamics underscore the strategic importance of APIs as the enabling building blocks that translate scientific breakthroughs into tangible health outcomes for both livestock and pets.

Regulatory frameworks continue to evolve in response to safety and environmental concerns, compelling companies to invest in robust quality assurance measures throughout the API lifecycle. Moreover, the increasing adoption of advanced manufacturing techniques, including continuous flow reactors and single-use bioreactors, is reshaping cost structures and accelerating time-to-market. In this context, stakeholders must navigate an intricate tapestry of scientific innovation, compliance mandates, and shifting market preferences. By understanding these converging forces, industry participants can chart a clear path forward, leveraging the transformative potential of active pharmaceutical ingredients to meet rising global needs and drive sustainable growth across the animal health ecosystem.

How Emerging Biologic Innovations, Regulatory Evolutions, and Sustainability Imperatives Are Transforming the Animal Health API Landscape

The animal health API arena is undergoing a period of profound transformation, driven by multiple convergent trends that redefine traditional industry paradigms. Breakthroughs in biologic technologies have democratized access to complex molecule production, enabling peptides and recombinant proteins to become commercial realities rather than academic curiosities. Concurrently, antimicrobial stewardship initiatives have catalyzed the development of novel antiparasitic and anti-inflammatory agents that balance therapeutic efficacy with resistance management.

Technological integration is another powerful catalyst, as digital twin simulations and artificial intelligence–guided process optimization enhance manufacturing predictability and yield. Meanwhile, heightened consumer scrutiny regarding sustainability and traceability has prompted companies to adopt greener production pathways, from solvent recycling to biosourced feedstocks. These shifts are complemented by evolving regulatory landscapes that prioritize risk-based review processes and global harmonization of standards. Taken together, these dynamics constitute a new paradigm in which agility, innovation, and environmental stewardship are not merely complementary but essential for competitive differentiation.

Assessing the Far-Reaching Effects of 2025 U.S. Trade Tariffs on Animal Health API Supply Chains Cost Structures and Global Sourcing Strategies

In 2025, the United States implemented a series of targeted tariffs that have cumulatively reshaped the global supply chain for animal health ingredients. Tariffs applied to certain chemical intermediates and finished APIs have led to a notable increase in import costs, particularly affecting compounds sourced from key manufacturing hubs in Asia. As a result, companies reliant on incremental cost structures are reassessing vendor relationships and accelerating diversification efforts.

Moreover, the levies have precipitated a strategic pivot toward nearshoring and regional manufacturing hubs. Firms are now evaluating investments in domestic and Mexico-based production facilities to mitigate tariff exposure and reduce logistical complexity. Supply chain agility has also become a competitive imperative, with increased emphasis on multi-sourcing strategies and buffer inventory approaches to guard against future trade policy volatility. In addition, downstream partners are confronting margin compression, driving a wave of collaborative procurement agreements and long-term offtake contracts to stabilize pricing. Collectively, these developments underscore the far-reaching impact of tariff policy on supply chain design, cost governance, and strategic decision-making in the animal health API sector.

Gaining Deep Insights Through a Multi-Dimensional Segmentation Framework Integrating Animal Type Product Innovations and Administration Pathways

A comprehensive view of the animal health API market necessitates a multi-dimensional segmentation framework that illuminates opportunities in distinct product categories and delivery pathways. When evaluating by animal type, manufacturers can tailor formulations specifically for aquaculture species susceptible to waterborne pathogens, design companion animal therapies optimized for canine and feline physiology, and address the metabolic profiles of livestock and poultry to enhance growth performance and disease resistance. Such targeted approaches drive higher efficacy and safety margins.

Product type segmentation reveals differentiated innovation cycles across anti-inflammatory small molecules that address joint health, broad-spectrum antibiotics engineered to combat bacterial infections, advanced antiparasitic agents for both endo- and ectoparasite control, hormone-based compounds that regulate reproductive cycles, and next-generation vaccines utilizing subunit and adjuvant technologies. Compound type analysis further distinguishes between biologics-such as monoclonal antibodies with high specificity-peptides that bridge the gap between small molecules and proteins, and small molecules prized for stability and oral bioavailability. Route of administration is equally critical, spanning inhalation via aerosol, dry powder, or nebulization for respiratory ailments, oral modalities including bolus, granules, powder, or tablet for ease of dosing, parenteral injections delivered intramuscularly, intravenously, or subcutaneously for systemic therapies, and topical applications across dermatological, ophthalmic, or otic domains. Finally, raw material source classification highlights the continuum from fermentation-derived precursors and plant- or animal-extracted actives to fully synthetic APIs engineered for consistency and scale. By leveraging this layered segmentation, stakeholders can pinpoint high-growth niches and align R&D investments with precise market demands.

This comprehensive research report categorizes the Animal Health Active Pharmaceutical Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Product Type

- Compound Type

- Source

- Application

- End-User

Evaluating Regional Dynamics Across the Americas Europe Middle East Africa and Asia-Pacific to Identify Strategic Growth Opportunities in Animal Health APIs

Regional dynamics exert a profound influence on product development, regulatory compliance, and commercialization strategies in the animal health API market. In the Americas, robust feedlot operations and a well-established veterinary infrastructure drive demand for advanced antibiotics and vaccines, while ongoing investments in digital health tools enable telemedicine and remote dosing solutions. North American regulatory authorities emphasize stringent residue limits and environmental impact assessments, prompting companies to prioritize sustainable manufacturing techniques. South American producers, meanwhile, seek cost-effective antiparasitic and anti-inflammatory APIs to support emerging aquaculture and livestock sectors, often leveraging localized fermentation and extraction capabilities.

Meanwhile, the Europe, Middle East, and Africa region presents a mosaic of regulatory frameworks and production strengths. Western Europe is characterized by rigorous quality standards, strong R&D collaborations between academic institutions and industry, and increasing adoption of biologics. The Middle East market is expanding rapidly, driven by rising income levels and a growing appetite for premium companion animal products, while Africa’s aquaculture initiatives create nascent demand for targeted vaccine and antiparasitic solutions. Across these markets, harmonization efforts, such as the European Medicines Agency guidelines, facilitate cross-border product registrations and streamline compound licensure. In the Asia-Pacific, dynamic growth in livestock consumption and pet ownership coexists with a maturing regulatory environment. China’s ongoing deregulation of APIs and South Asia’s cost-competitive manufacturing platforms position the region as both a major production hub and an increasingly influential end market. Regional complexities thus underscore the necessity of nuanced go-to-market strategies tailored to local requirements and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Animal Health Active Pharmaceutical Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Leveraging Innovation Expertise and Collaborative Ecosystems to Drive Competitive Advantage in Animal Health APIs

The competitive landscape in animal health APIs is defined by a balance of multinational conglomerates and specialized biotech innovators. Leading pharmaceutical giants are investing heavily in pipeline diversification, securing biologic tenants through partnerships with contract development and manufacturing organizations, and pursuing targeted acquisitions to bolster capabilities in high-value peptide and protein APIs. At the same time, niche players with focused expertise in fermentation processes or synthetic route optimization are capturing share in specialized segments, such as autogenous vaccine production for poultry or macrocyclic antiparasitic compounds.

Collaboration has become a differentiator, as co-development agreements and strategic alliances enable companies to share risk, accelerate time-to-market, and access complementary technologies. In parallel, an emphasis on digital manufacturing analytics and real-time quality monitoring systems is strengthening competitive moats, reducing batch failures, and ensuring regulatory compliance. Forward-looking organizations are also exploring modular facility designs that enable rapid scale-up of novel compound types, while expanding geographic footprints to address regional tariff constraints. These concerted efforts by incumbent and emerging players alike continue to shape the market’s innovation trajectory and competitive intensity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Health Active Pharmaceutical Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alivira Animal Health Limited

- Ashish Life Science Pvt. Ltd.

- Aurobindo Pharma Ltd.

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale

- Cipla Ltd.

- Elanco Animal Health Incorporated

- Hikal Ltd.

- Huvepharma Inc.

- Karishma Pharma Pvt. Ltd.

- Menon Animal Health

- Merck & Co., Inc.

- NGL Fine-Chem Ltd.

- Phibro Animal Health Corporation

- Ridgeway Biologicals Ltd.

- Sequent Scientific Ltd.

- Vetoquinol S.A.

- Virbac SA

- Zoetis Inc.

- Zydus Animal Health and Investments Ltd.

Strategic Recommendations for Industry Leaders to Enhance Resilience Drive Innovation and Capitalize on Shifting Animal Health API Market Dynamics

To thrive amid evolving market conditions and policy headwinds, industry leaders must adopt a multi-pronged strategy that prioritizes resilience, innovation, and strategic alignment. First, organizations should diversify their supply base by cultivating alternative sourcing channels, including domestic and nearshore production sites, to insulate against tariff volatility and logistical disruptions. Simultaneously, investing in biologic and peptide development pipelines can unlock differentiated product profiles and command premium pricing.

Furthermore, embedding advanced analytics into manufacturing operations will reduce cycle times, enhance yield optimization, and improve batch-to-batch consistency, thereby driving cost efficiencies. In tandem, forging partnerships with academic institutions and technology providers can accelerate access to emerging modalities such as mRNA-based vaccines and precision adjuvant systems. From a commercial perspective, deepening engagement with key opinion leaders and leveraging digital outreach platforms will elevate market visibility and foster stronger end-user relationships. Finally, a proactive approach to sustainability-embracing green chemistry principles and pursuing carbon-neutral manufacturing certifications-not only addresses regulatory demands but also meets growing consumer and investor expectations for environmental stewardship. By executing these targeted initiatives, leaders can position their organizations to capitalize on both current opportunities and future industry shifts.

Detailing a Rigorous Mixed-Methodology Approach Combining Primary Expert Interviews Secondary Research and Robust Data Triangulation for Unparalleled Insights

This research is founded upon a rigorous methodology that integrates both primary and secondary data sources to ensure comprehensive coverage and analytical robustness. Primary research entailed in-depth interviews with senior executives, process engineers, veterinarians, and procurement specialists across leading pharmaceutical and biotech companies. These qualitative insights were complemented by a series of executive roundtables and expert panels focused on emerging compound technologies and regulatory developments.

Secondary research comprised a detailed review of peer-reviewed journals, patent filings, regulatory filings, trade publications, and technical white papers. Data triangulation techniques were employed to cross-validate findings and minimize bias, leveraging statistical reconciliation between top-down assessments of industry spend and bottom-up analyses of manufacturing capacity. In addition, proprietary databases tracking global trade flows and tariff schedules were utilized to quantify the cumulative effects of policy changes. The final deliverable synthesizes these diverse inputs, offering a robust, evidence-based perspective that equips stakeholders with actionable insights and a clear understanding of dynamic market forces.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Health Active Pharmaceutical Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Health Active Pharmaceutical Ingredients Market, by Animal Type

- Animal Health Active Pharmaceutical Ingredients Market, by Product Type

- Animal Health Active Pharmaceutical Ingredients Market, by Compound Type

- Animal Health Active Pharmaceutical Ingredients Market, by Source

- Animal Health Active Pharmaceutical Ingredients Market, by Application

- Animal Health Active Pharmaceutical Ingredients Market, by End-User

- Animal Health Active Pharmaceutical Ingredients Market, by Region

- Animal Health Active Pharmaceutical Ingredients Market, by Group

- Animal Health Active Pharmaceutical Ingredients Market, by Country

- United States Animal Health Active Pharmaceutical Ingredients Market

- China Animal Health Active Pharmaceutical Ingredients Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Insights on the Decisive Role of Active Pharmaceutical Ingredients in Shaping the Future of Animal Health and Strategic Industry Positioning

The animal health API sector stands at a pivotal juncture, where scientific innovation, regulatory evolution, and global trade policies converge to redefine competitive boundaries. From the advent of cutting-edge biologics to the strategic reconfiguration of supply chains in response to tariffs, stakeholders must remain vigilant and adaptive. Segmentation insights clarify where differentiated value can be captured, while regional analyses highlight markets ripe for expansion or realignment.

Moreover, the strategic playbook outlined herein underscores the urgency of embedding agility into R&D pipelines, operational processes, and commercial engagement models. By harnessing advanced manufacturing technologies, forging collaborative partnerships, and upholding stringent sustainability standards, organizations can navigate complexity and secure a sustainable growth trajectory. As the industry continues to evolve, the integration of these multifaceted strategies will be essential for capturing new opportunities and delivering enduring value to the global animal health community.

Secure Your Specialized Animal Health API Market Research Report by Connecting with Ketan Rohom Associate Director Sales & Marketing to Unlock Critical Industry Insights Today

To explore comprehensive findings that can drive your strategic initiatives and support evidence-based decision-making, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan will allow you to discuss tailored licensing options, secure priority access to proprietary data sets, and arrange a personalized briefing that aligns with your organization’s objectives. Don’t miss the opportunity to leverage these critical insights and position your enterprise at the forefront of the animal health API sector; connect today to obtain your specialized market research report and gain an unmatched competitive advantage.

- How big is the Animal Health Active Pharmaceutical Ingredients Market?

- What is the Animal Health Active Pharmaceutical Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?