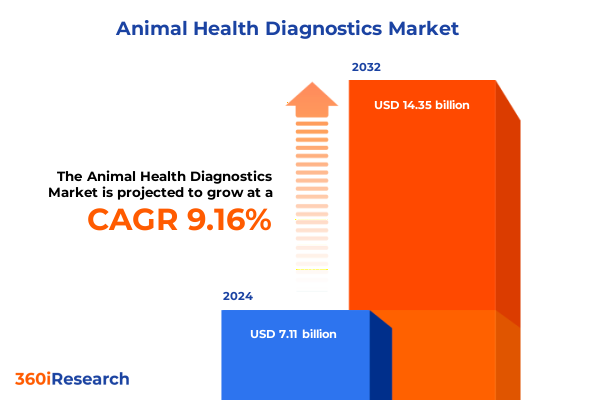

The Animal Health Diagnostics Market size was estimated at USD 7.11 billion in 2024 and expected to reach USD 7.73 billion in 2025, at a CAGR of 9.16% to reach USD 14.35 billion by 2032.

Revolutionizing Animal Health Diagnostics Through Technological Innovation and Emerging Veterinary Practices to Enhance Disease Management Across Species

The animal health diagnostics landscape is witnessing a renaissance driven by the convergence of heightened disease awareness, advances in biotechnology, and evolving veterinary practices. As zoonotic risks capture global attention, stakeholders across agriculture and companion care are prioritizing robust diagnostic protocols to safeguard both animal welfare and public health. This shift reflects the recognition that early detection and accurate disease characterization not only improve treatment outcomes but also fortify biosecurity in an era marked by complex supply chains and intensifying livestock operations.

Preventive healthcare is emerging as a cornerstone of modern veterinary strategy, with a growing emphasis on proactive screening and continuous monitoring. Regulatory bodies worldwide are reinforcing standards for laboratory accreditation and disease surveillance, while digital tools streamline data integration across decentralized networks. Consequently, veterinarians and diagnostic providers are collaborating more closely to deliver comprehensive solutions that meet the demands of a diverse animal population, from high-value livestock to cherished companion pets.

Navigating the Transformative Shifts in Animal Health Diagnostics Fueled by AI Advancements, Digitalization, and Next-Generation Preventive Veterinary Strategies

Technological breakthroughs are reshaping every facet of animal health diagnostics, from molecular assays to artificial intelligence–driven image analysis. Machine learning algorithms now interpret complex biological data, flagging subtle anomalies in pathological specimens and facilitating earlier identification of conditions such as mastitis in dairy herds or lymphoma in companion animals. These advanced systems not only accelerate diagnostic workflows but also support data-driven decision making by integrating historical and environmental parameters into predictive models.

Parallel to AI, the rise of portable molecular platforms is democratizing access to high-sensitivity tests outside traditional laboratory settings. Field-deployable PCR instruments and isothermal amplification kits empower veterinarians to conduct on-site pathogen detection, drastically reducing turnaround times and enabling immediate containment measures. Such decentralization of diagnostics is especially critical in regions where laboratory infrastructure is limited, ensuring that emerging outbreaks are promptly identified and managed.

Digital pathology and data analytics are further fueling the transformation by enabling remote slide interpretation and real-time herd health monitoring. Cloud-based platforms aggregate test results from multiple sources, delivering actionable insights on disease prevalence and antimicrobial resistance trends. This seamless integration of digital data facilitates continuous surveillance and underscores the shift from episodic testing to continuous health management, catalyzing improved outcomes and operational efficiencies across the veterinary ecosystem.

Assessing the Multifaceted Cumulative Impact of United States Tariff Policies on Animal Health Diagnostics Supply Chains and Pricing in 2025

Recent trade policy developments have introduced new complexities to the sourcing and cost structure of diagnostics reagents and instruments. U.S. authorities have maintained Section 301 tariffs on imports from China, with select exclusions extended only through August 31, 2025. The continuation of duties-reaching up to 145% on certain medical device components-has pressured manufacturers to reassess supply chain strategies, often leading to higher input costs and constrained availability of critical parts. These dynamics pose a particular challenge to veterinary diagnostic providers who rely on specialized components such as molecular assay reagents and immunodiagnostic kits.

Simultaneously, new tariff rates implemented in late 2024 have substantially increased duties on consumables, including PCR reagents, syringes, needles, and disposable gloves. These levies-ranging from 25% to 100% on various items-threaten to elevate per-test expenses and compress margins for both laboratory services and point-of-care providers. In response, some industry leaders are exploring regional manufacturing partnerships and alternative sourcing strategies to mitigate tariff risks and maintain competitive pricing, underscoring the need for agility in a shifting regulatory environment.

Uncovering Critical Insights Across Product, Animal, Disease, and End User Segments That Define the Nuances of the Animal Health Diagnostics Market

Insights drawn from product segmentation reveal that consumables such as probes and reagents & kits represent the bulk of routine veterinary testing, driving volume growth while instruments like hematology and immunodiagnostic analyzers underpin diagnostic accuracy. In parallel, market momentum varies by animal type, with livestock diagnostic demand shaped by herd health management and biosecurity mandates, and companion animal testing propelled by rising pet humanization and wellness screening protocols. Disease type further refines this landscape: bacterial, viral, and parasitic infection diagnostics command immediate attention during outbreak scenarios, whereas genetic disorder panels and nutritional deficiency tests are increasingly incorporated into preventive checkups. Across end users, research institutes leverage cutting-edge molecular platforms for assay development, veterinary diagnostic labs focus on high-throughput workflows, and hospitals prioritize rapid turnaround on point-of-care solutions. This multifaceted segmentation underscores the importance of tailored strategies that address the distinct requirements and growth drivers unique to each submarket segment.

This comprehensive research report categorizes the Animal Health Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Animal Type

- Disease Type

- End User

Exploring Diverse Regional Dynamics and Growth Drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific Animal Health Diagnostics Markets

In the Americas, widespread adoption of advanced diagnostics is fueled by robust veterinary infrastructure and substantial investment in livestock biosecurity. North America serves as a hub for innovation, with major technology providers collaborating with academic and government institutions to pilot next-generation screening platforms. Latin America’s growing feedlot operations are increasingly integrating molecular and immunodiagnostic assays to prevent the spread of endemic diseases.

Europe, the Middle East & Africa exhibit diverse regional dynamics driven by stringent regulatory frameworks and a strong focus on antimicrobial resistance monitoring. The European Union’s harmonized standards facilitate cross-border data sharing and collaborative surveillance initiatives. Meanwhile, Middle Eastern countries are enhancing laboratory capacity under national animal health programs, and African nations are progressively embracing field-based diagnostics to manage zoonotic outbreaks and support food security.

In the Asia-Pacific region, rapid economic growth, expanding livestock populations, and a rising middle-class pet segment are creating high demand for veterinary diagnostics. China and India are investing heavily in local manufacturing of instruments and consumables to reduce import dependency, while Southeast Asian markets prioritize cost-effective point-of-care solutions for smallholder farmers. Across all subregions, digital telemedicine platforms are gaining traction, linking remote practitioners with specialized diagnostic services.

This comprehensive research report examines key regions that drive the evolution of the Animal Health Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Strategic Developments and Competitive Positioning of Major Players Shaping the Animal Health Diagnostics Landscape

Leading companies are pursuing distinct strategies to capture growth in animal health diagnostics. IDEXX Laboratories continues to expand its global presence by enhancing molecular diagnostic offerings and integrating digital data analytics into its laboratory services. Its partnerships with academic research centers facilitate the development of next-generation assays that address emerging disease threats. Zoetis is investing heavily in point-of-care platforms, targeting rapid test development for companion animal applications and reinforcing its position through strategic acquisitions of niche biotech developers. Thermo Fisher Scientific has broadened its portfolio to include veterinary-specific next-generation sequencing solutions and supports field diagnostics through portable instrument lines. Meanwhile, specialized players like Heska and Neogen are differentiating through focus on immunodiagnostics and food-safety-related assays respectively, leveraging streamlined workflows and targeted product development to meet specific end user needs. Collectively, these competitive moves highlight an industry in which collaboration, portfolio diversification, and technological integration are key to maintaining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Health Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- IDEXX Laboratories, Inc.

- Zoetis Inc.

- Thermo Fisher Scientific Inc.

- Heska Corporation

- Bio-Rad Laboratories, Inc.

- Eurofins Scientific SE

- Neogen Corporation

- Merck & Co., Inc.

- Sysmex Corporation

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- ALS Limited

- Becton, Dickinson and Company

- bioMérieux SA

- BioNote Inc.

- Boehringer Ingelheim Vetmedica, Inc

- Boule Diagnostics AB

- BYOVET

- Ceva S.A.

- Elanco Animal Health Incorporated

- Farmlab Diagnostics

- Fujifilm Holdings Corporation

- Hester Biosciences Limited

- Promega Corporation

- Randox Laboratories Ltd

- Red Belly

- Siemens Healthineers AG

- Vetoquinol Group

Driving Strategic Excellence Through Actionable Recommendations to Enhance Resilience, Innovation, and Market Penetration in Animal Health Diagnostics

Industry leaders should prioritize investment in modular diagnostic platforms that can be rapidly adapted to detect emerging pathogens, ensuring readiness for future outbreak scenarios. Strengthening regional manufacturing partnerships and supply chain diversification will mitigate tariff-related risks and bolster resilience in consumables sourcing. Collaborative data-sharing initiatives among veterinary networks, coupled with advanced analytics, can drive predictive health management and unlock new value propositions for clients. Additionally, targeted training programs for end users on digital diagnostic tools and telemedicine services will support adoption and enhance the perceived utility of new technologies. By executing these strategic actions, companies can achieve sustained growth, foster innovation, and reinforce their competitive advantage in an evolving market.

Adopting a Rigorous Research Methodology Leveraging Comprehensive Primary and Secondary Data to Ensure Robust Insights in Animal Health Diagnostics

This analysis is grounded in a rigorous multi-step research methodology that blends comprehensive secondary research with targeted primary engagement. Press releases, government publications, and industry news form the basis of the secondary landscape review, while proprietary databases provide detailed information on product launches and regulatory developments. Primary insights are gathered through in-depth interviews with key opinion leaders, including veterinarians, diagnostic lab directors, and biotechnology executives. Data triangulation ensures consistency and reliability, cross-verifying findings against multiple sources.

Quantitative data on diagnostic volumes, adoption rates, and technology utilization are synthesized alongside qualitative perspectives on innovation trends and operational challenges. The research framework incorporates both top-down and bottom-up analytical techniques to identify growth drivers and assess market dynamics. Regular validation checkpoints with subject matter experts reinforce the accuracy of conclusions, culminating in a robust set of insights designed to inform strategic decision making for stakeholders across the animal health diagnostics value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Health Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Health Diagnostics Market, by Product Type

- Animal Health Diagnostics Market, by Animal Type

- Animal Health Diagnostics Market, by Disease Type

- Animal Health Diagnostics Market, by End User

- Animal Health Diagnostics Market, by Region

- Animal Health Diagnostics Market, by Group

- Animal Health Diagnostics Market, by Country

- Competitive Landscape

- List of Figures [Total: 28]

- List of Tables [Total: 669 ]

Consolidating Key Findings to Illuminate the Path Forward for Stakeholders in the Evolving Animal Health Diagnostics Ecosystem

In summary, the animal health diagnostics market stands at a pivotal juncture, shaped by technological innovation, evolving regulatory landscapes, and shifting trade dynamics. The growing emphasis on preventive care underscores a transition from reactive treatment models to proactive health management, enabled by AI, molecular assays, and digital platforms. Although tariff pressures introduce short-term supply chain challenges, they also compel stakeholders to pursue localized manufacturing and strategic partnerships, ultimately strengthening market resilience.

Segmentation analysis reveals opportunities across consumables, instruments, and service-driven solutions tailored to companion and livestock applications. Regional insights underscore the importance of localized strategies that address unique regulatory requirements and infrastructure capabilities. Meanwhile, competitive dynamics highlight that agility, collaboration, and continuous innovation will dictate market leadership in the years ahead. As the industry advances, organizations that integrate advanced diagnostics with data-driven decision support will be best positioned to deliver superior animal health outcomes and capture long-term value.

Seize the Opportunity to Deepen Your Market Understanding with Expert Insights—Contact Ketan Rohom to Access the Animal Health Diagnostics Research Report

To explore the full depth of findings and gain unparalleled clarity on the dynamics shaping animal health diagnostics, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored insights that align with your strategic priorities and help unlock new growth opportunities. Reach out today to secure immediate access to the comprehensive Animal Health Diagnostics Research Report and position your organization at the forefront of innovation and market leadership.

- How big is the Animal Health Diagnostics Market?

- What is the Animal Health Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?