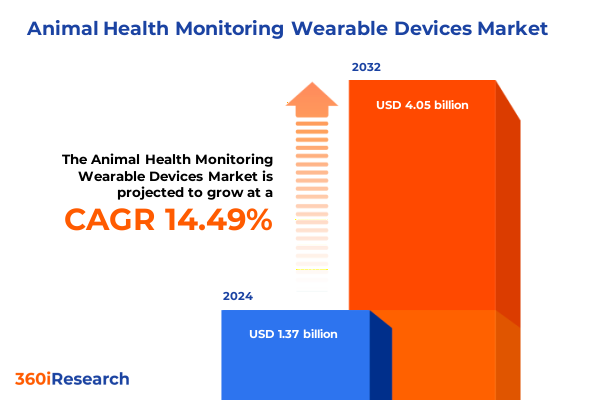

The Animal Health Monitoring Wearable Devices Market size was estimated at USD 1.87 billion in 2025 and expected to reach USD 2.11 billion in 2026, at a CAGR of 13.17% to reach USD 4.46 billion by 2032.

Revolutionary Wearable Innovations Redefine Animal Health Monitoring by Empowering Continuous Data Collection Predictive Insights and Proactive Care

Animal health monitoring is undergoing a profound transformation as wearable technologies converge with data analytics and cloud-based platforms, empowering stakeholders with unprecedented levels of visibility into the well-being of livestock and companion animals. Advances in miniaturized sensors, improvements in battery life, and the proliferation of wireless connectivity have created a fertile environment for continuous, real-time tracking of physiological parameters such as heart rate, body temperature, and activity levels. As a result, farmers, veterinarians, and pet owners can make data-driven decisions that enhance preventive care, detect early signs of illness, and optimize overall herd and pet management processes.

In the midst of rising concerns over animal welfare, labor shortages, and the need for sustainable farming practices, these wearable innovations have demonstrated their ability to reduce the burden on animal care professionals while improving health outcomes. Moreover, IoT-enabled devices coupled with machine learning algorithms allow for predictive insights that translate raw data into actionable recommendations. This introduction lays the foundation for understanding how the animal health wearable landscape is evolving, why it matters to key stakeholders, and how decision-makers can harness these trends to achieve both economic and ethical benefits.

Emerging Technological and Behavioral Shifts Are Transforming the Animal Health Wearable Landscape to Enable Precision Management and Enhanced Welfare

The animal health wearable sector is experiencing a wave of transformative shifts driven by breakthroughs in sensor technologies and the integration of artificial intelligence into monitoring systems. Next-generation devices leverage multi-parameter biosensors capable of detecting subtle physiological changes, enabling early detection of stress, disease, or reproductive events. At the same time, AI-driven analytics platforms are moving beyond simple threshold alerts to deliver contextualized health assessments, increasing the precision of interventions while reducing false alarms.

Alongside technological advancements, behavioral trends among end-users are reshaping the design and adoption of wearables. Pet owners are demanding more user-friendly interfaces and personalized insights, while livestock managers are seeking seamless integration with farm management software and automation tools. These behavioral shifts are inspiring device manufacturers to develop modular, scalable solutions, bridging the gap between individual animal care and enterprise-level herd management. Together, the confluence of cutting-edge sensor capabilities and evolving user expectations is redefining how health monitoring is conducted, laying the groundwork for a more proactive, welfare-centric approach.

Recent US Tariff Initiatives in 2025 Have Significantly Altered the Cost Dynamics of Animal Health Monitoring Devices Shifting Global Supply Strategies

In 2025, the United States implemented a series of tariffs on imported electronics components and sensor modules used in animal health monitoring devices, leading to a significant reassessment of global supply chain strategies. These tariffs applied to items ranging from MEMS-based biosensors to advanced microcontrollers, prompting device manufacturers to explore nearshoring and alternative sourcing from duty-free regions. Consequently, production costs have shifted, and companies are investing in regional manufacturing hubs to mitigate the impact of additional import expenses.

The cumulative effect of these tariff measures has been twofold. On one hand, increased input costs have pressured vendors to reevaluate design efficiencies, prioritize in-house component assembly, and negotiate long-term agreements with suppliers to secure preferential terms. On the other hand, the policy landscape has accelerated diversification of supply bases, as stakeholders aim to balance cost, quality, and delivery timelines. As a result, supply chain resilience has become a top priority, with manufacturers and distributors placing greater emphasis on strategic partnerships and localized inventory buffers to sustain consistent access to critical components.

Deep Dive Into Device Type Technology Connectivity Distribution Channels Animal Types Application and End User Segments Driving Value in Wearable Solutions

A comprehensive examination of the market’s segmentation reveals critical insights into how various device categories and application areas are shaping the evolution of wearable solutions. Collars, smart ear tags, smart neckbands, smart tags, and wearable wristbands each address unique monitoring requirements, from tracking grazing patterns in cattle to detecting stress indicators in companion animals. Underpinning these form factors are technologies such as Bluetooth, GPS, RFID, sensors, and Wi-Fi, which determine data transmission ranges, power consumption, and integration complexity. Connectivity choices further distinguish offerings, with wired interfaces providing reliable data throughput in barn environments, and wireless solutions offering flexibility for remote or free-ranging animals.

Distribution channels play a pivotal role in how devices reach end-users. Offline networks, including veterinary clinics and agricultural supply stores, remain vital for hands-on demonstrations and after-sales support. Meanwhile, online channels-particularly direct-to-consumer company websites and e-commerce platforms-offer scalability and streamlined procurement processes. Beyond hardware design and distribution, the choice of target animal type influences product specifications: companion animals versus livestock animals such as cattle, poultry, and swine each present distinct mobility patterns and health indicators. Applications span behavior monitoring, fertility tracking, and core health metrics, thereby attracting a diverse set of end-users including farmers and livestock managers, pet owners, research institutions, veterinarians, and zoos and wildlife conservationists. Taken together, this segmentation framework illuminates the multifaceted nature of wearable adoption and helps stakeholders pinpoint the most relevant device configurations and service offerings to address their unique operational needs.

This comprehensive research report categorizes the Animal Health Monitoring Wearable Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Technology

- Animal Type

- Distribution Channel

- Application

- End-user

Regional Dynamics in the Americas Europe Middle East and Africa and Asia Pacific Showcase Unique Drivers and Diverse Challenges Shaping Animal Health Monitoring

Regional dynamics play a pivotal role in determining adoption rates and innovation trajectories across distinct geographies. In the Americas, well-established livestock farming operations and a strong emphasis on animal welfare have resulted in early adoption of wearable devices, especially among commercial dairy and beef producers. North America’s regulatory environment supports data-driven health management, while Latin American markets show growing interest in improving productivity and disease prevention through remote monitoring solutions.

Moving to Europe, Middle East, and Africa, Europe’s stringent animal welfare regulations and precision agriculture initiatives have accelerated deployments in both livestock and equine segments. In contrast, Middle Eastern and African regions are characterized by emerging demand, where large-scale farming projects and increasing investments in agritech are beginning to unlock new use cases. Innovation is often driven by partnerships between local agribusinesses and international technology providers, underscoring a collaborative approach to technology transfer.

In Asia-Pacific, rapid modernization in countries such as China, India, and Australia has fueled a surge in wearable adoption for both industrial farming and urban pet care. The region’s emphasis on food security and government-sponsored smart agriculture programs has incentivized trials of sensor-based fertility tracking and behavior monitoring systems. Simultaneously, the expanding middle class and urbanization have sparked a boom in companion animal ownership, generating parallel demand for health monitoring solutions tailored to pets. Collectively, these regional patterns highlight the diversity of challenges and opportunities inherent in global expansion strategies.

This comprehensive research report examines key regions that drive the evolution of the Animal Health Monitoring Wearable Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Participants Drive Innovation Through Strategic Collaborations R&D Efforts and Partnerships to Elevate Wearable Animal Health Monitoring

Innovation in wearable animal health monitoring is increasingly driven by strategic collaborations and targeted partnerships among leading technology firms, sensor manufacturers, veterinary service providers, and research institutions. A subset of prominent players has focused on building end-to-end ecosystems by integrating hardware design, cloud-based analytics, and mobile applications into cohesive platforms. These companies are also participating in consortiums to establish interoperability standards, ensuring seamless data exchange across devices and software solutions.

At the same time, mid-market specialists are carving out niches by concentrating on specific segments such as smart ear tags for cattle or fertility tracking modules optimized for swine. These providers often engage in co-development agreements with academic research centers and veterinary hospitals to validate sensor accuracy and refine predictive algorithms. Partnerships with telemedicine networks further enhance post-deployment support, enabling remote diagnosis and timely interventions. Collectively, these initiatives underscore the importance of cross-sector alliances in advancing product performance, driving user engagement, and ultimately fostering trust among end-users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Health Monitoring Wearable Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Merck & Co., Inc.

- Nedap N.V.

- Datamars SA

- Tractive GmbH

- CowManager B.V.

- Afimilk Ltd.

- FitBark, Inc.

- AGRIWEBB PTY LTD

- Connecterra B.V.

- Digitanimal S.L.

- Dindog Tech SL

- Felcana Ltd.

- HerdDogg, Inc.

- Inupathy

- INVOXIA SAS

- Moocall Limited

- Pawfit by Latsen Technology Limited

- PetPace Ltd.

- Smart Tracking Technologies, LLC

- TekVet Technologies Co.

- Valley Agricultural Software, Inc

Strategic Roadmap for Industry Leaders to Accelerate Adoption of Next Generation Animal Health Wearables Through Collaboration Regulation and Ethical Standards

To navigate the complexities of the current landscape and remain at the forefront of innovation, industry leaders should adopt a multi-pronged strategic approach. First, prioritizing the development of open data standards and APIs will facilitate interoperability across diverse device types and connectivity protocols, reducing integration friction for end-users. Moreover, forging alliances with analytics specialists and cloud service providers can accelerate the deployment of advanced machine learning capabilities, enabling stakeholders to extract actionable insights in real time.

In light of the evolving tariff environment, organizations should explore nearshore assembly and component sourcing partnerships to mitigate cost pressures and enhance supply chain resilience. Engaging proactively with regulatory bodies will help shape standards and ensure product compliance, while participation in industry working groups can inform advocacy efforts. Furthermore, investing in pilot programs with key end-user segments will reveal critical feedback loops, guiding iterative product enhancements and service design. Finally, embedding ethical standards-such as data privacy safeguards and sustainable manufacturing practices-into corporate strategies will strengthen brand reputation and foster long-term customer loyalty.

Multi Phased Research Methodology Combines Qualitative Expert Interviews Quantitative Surveys and Secondary Data Analysis to Ensure Insights

This research is grounded in a robust, multi-phased methodology designed to deliver both depth and reliability of insights. Initially, primary research was conducted through structured interviews with a cross-section of stakeholders, including livestock managers, veterinarians, pet owners, veterinarians, and representatives from zoos and wildlife conservation organizations. Complementing these interviews, quantitative surveys captured adoption patterns, technology preferences, and perceived barriers across each end-user group.

Secondary research involved a thorough review of scientific publications, industry white papers, patent filings, regulatory guidelines, and company technical documentation to contextualize primary findings within broader technological trends. Data triangulation techniques were applied to reconcile information from multiple sources, ensuring validity and reducing bias. Throughout the process, quality control measures such as peer reviews and iterative hypothesis testing reinforced the research’s credibility, providing decision-makers with dependable, actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Health Monitoring Wearable Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Health Monitoring Wearable Devices Market, by Device Type

- Animal Health Monitoring Wearable Devices Market, by Technology

- Animal Health Monitoring Wearable Devices Market, by Animal Type

- Animal Health Monitoring Wearable Devices Market, by Distribution Channel

- Animal Health Monitoring Wearable Devices Market, by Application

- Animal Health Monitoring Wearable Devices Market, by End-user

- Animal Health Monitoring Wearable Devices Market, by Region

- Animal Health Monitoring Wearable Devices Market, by Group

- Animal Health Monitoring Wearable Devices Market, by Country

- United States Animal Health Monitoring Wearable Devices Market

- China Animal Health Monitoring Wearable Devices Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Perspectives on the Future Trajectory of Animal Health Monitoring Wearables and the Critical Factors That Will Define Success in an Evolving Market

As the animal health monitoring landscape continues to evolve, trends in sensor innovation, data analytics, and connectivity will drive the next wave of device adoption. Stakeholders must recognize that successful integration extends beyond hardware capabilities to include system interoperability, user training, and stakeholder collaboration. Moreover, the shifting regulatory and trade environments underscore the need for agile supply chain strategies and risk management frameworks.

Ultimately, the convergence of advanced wearable devices with intelligent software creates an ecosystem that can proactively safeguard animal welfare, optimize operational efficiencies, and support sustainable agriculture and pet care practices. By leveraging the segmentation and regional insights detailed herein, industry participants are better equipped to tailor their offerings, forge strategic alliances, and implement best practices. The time to act is now, as early movers will secure a commanding position in a rapidly maturing market.

Engage with Ketan Rohom Today to Unlock Bespoke Insights Tailored to Your Organization’s Needs in Animal Health Monitoring with Expert Guidance and Support

If you are ready to transform your strategic approach to animal health monitoring and gain a competitive edge in wearable technologies, now is the time to act. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore how our specialized report can be customized to align with your organizational objectives. During this consultation, you will receive an overview of the in-depth analyses, case studies, and strategic frameworks that can inform your next steps in product development, partnership formation, and go-to-market planning.

By engaging with Ketan Rohom today, you will benefit from tailored guidance on navigating regulatory landscapes, optimizing supply chains in the wake of tariff changes, and leveraging key segmentation and regional trends. We invite you to secure this essential resource and begin capitalizing on emerging opportunities in animal health wearable devices.

- How big is the Animal Health Monitoring Wearable Devices Market?

- What is the Animal Health Monitoring Wearable Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?