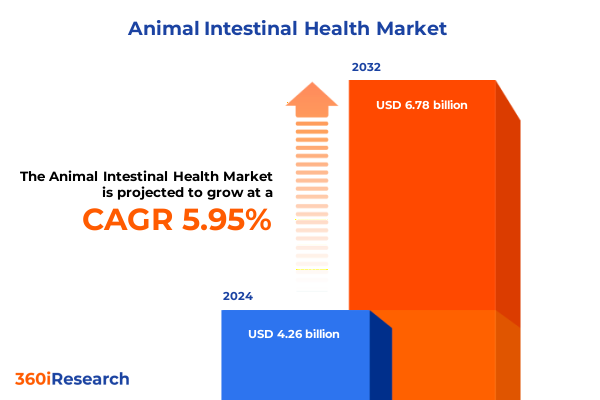

The Animal Intestinal Health Market size was estimated at USD 4.52 billion in 2025 and expected to reach USD 4.79 billion in 2026, at a CAGR of 6.17% to reach USD 6.88 billion by 2032.

A Holistic Introduction to the Critical Role of Animal Intestinal Health in Driving Efficiency, Resilience, and Innovation across Global Livestock and Aquaculture Industries

The intestinal tract serves as the cornerstone of health, nutrient absorption, and growth performance in all animal species, from broiler chickens to dairy cattle and beyond. Emerging research has linked gut integrity to immunity, energy utilization, and even behavioral outcomes in companion animals, highlighting the multifaceted value of intestinal health management. As consumer demand for antibiotic-free and sustainable production intensifies, stakeholders across feed, pharmaceutical, and livestock segments are seeking science-backed nutritional solutions that bolster gut resilience under diverse husbandry conditions.

Against this backdrop, this report offers a comprehensive examination of animal intestinal health drivers, market dynamics, and strategic imperatives without focusing on historical market estimates or projections. Instead, it synthesizes the latest regulatory shifts, tariff developments, and technological advancements shaping the sector. Throughout the chapters that follow, you will gain clarity on product type innovations spanning enzymes, organic acids, phytogenics, prebiotics, and probiotics, as well as their specific modes of action and performance benchmarks.

Employing a structured approach that integrates product, animal, application, formulation, and distribution channel dimensions, this analysis provides robust segmentation insights. It is designed to inform R&D prioritization, supply chain optimization, and go-to-market strategies for decision-makers seeking to capitalize on the next wave of animal intestinal health innovation.

Exploring the Transformative Shifts Reshaping Animal Gut Health: From Sustainability Mandates to Precision Nutrition Breakthroughs and Digital Innovation Driving New Solutions

The animal intestinal health landscape is undergoing transformative shifts powered by evolving consumer expectations, technological breakthroughs, and regulatory momentum aimed at reducing antibiotic use. Sustainability imperatives have accelerated adoption of feed additives formulated with natural acids and plant-derived compounds, enabling producers to demonstrate environmental stewardship while maintaining robust yields. Concurrently, precision nutrition platforms that leverage microbiome profiling and real-time monitoring technologies are enabling tailored interventions, optimizing nutrient uptake and reducing feed conversion ratios across poultry, swine, and ruminant production systems.

Simultaneously, the intersection of digital agriculture and gut health is generating novel business models. Sensor-enabled feeding systems, coupled with data analytics, now allow for early detection of suboptimal gut function, thereby informing timely supplementation strategies. Biotechnology firms are advancing next-generation probiotics engineered for targeted pathogen inhibition, while enzyme manufacturers are expanding portfolios to address complex fiber matrices in feed ingredients. These innovations underscore a shift from one-size-fits-all supplementation to agile, data-driven solutions calibrated to specific herd, flock, or farm challenges.

Taken together, these developments illustrate a sector in flux, where collaboration across feed additive producers, integrators, and technology providers is essential to develop holistic intestinal health programs. As the industry evolves, stakeholders that align product innovation with digital and sustainability frameworks will shape the future of animal nutrition and welfare.

Analyzing the Cumulative Impact of 2025 United States Tariff Policies on Supply Chains, Ingredient Costs, and Innovation Trajectories in Animal Intestinal Health

In 2025, new tariff measures enacted by the United States government have had a far-reaching impact on the importation of key raw materials used in animal intestinal health formulations. Ingredients such as specialty enzymes and microbial strains previously sourced from major exporting regions have faced ad valorem duties, which has led to higher landed costs and, in many cases, supply chain realignment. Manufacturers have had to adapt by securing alternate sourcing agreements, investing in domestic production capacity, and renegotiating contracts to mitigate cost volatility.

These trade measures have also influenced the pace of innovation. With imported microbial strains subject to elevated duties, biotech firms are increasingly focused on local strain development and fermentation processes to preserve margin structures. At the same time, ingredient distributors and feed companies have accelerated vertical integration, bringing critical manufacturing steps in-house to control quality and minimize exposure to external tariff risks. This trend is particularly pronounced in enzyme production, where the complexity of fermentation infrastructure has spurred collaborative partnerships between feed mills and specialty biotechnology providers.

Despite the cost pressures imposed by tariffs, opportunities have emerged for agile players to capitalize on reshoring incentives and government subsidies for domestic ingredient production. Companies that can demonstrate resilient supply chains and compliance with evolving trade regulations are better positioned to secure long-term procurement agreements. As these dynamics continue to unfold, strategic planning around tariff exposure, supplier diversification, and regulatory liaison will remain central to sustaining innovation and competitive advantage in animal intestinal health.

Uncovering Key Segmentation Insights: How Product Types, Animal Categories, Applications, Formulations, and Distribution Channels Shape Intestinal Health Markets

A nuanced understanding of market segmentation reveals how distinct categories fuel tailored innovation. Within the product type dimension, enzymes such as phytase, protease, and xylanase are prioritized for their ability to unlock bound nutrients and improve feed efficiency, while organic acids and phytogenics address microbial balance and gut morphology. Similarly, prebiotics and probiotics-spanning bacterial and yeast strains-play complementary roles in modulating the intestinal microbiota and enhancing barrier function.

When dissecting animal type segmentation, the poultry sector, encompassing broilers, layers, and turkeys, continues to lead demand for feed-based intestinal health solutions due to high-density production systems. Concurrently, the swine segment, including breeder, grower–finisher cohorts and sow–piglet pairs, demands targeted formulations to manage post-weaning challenges and reproductive performance. Ruminant livestock-beef cattle, dairy cattle, sheep, and goats-require specialized enzyme blends to address fiber digestion, whereas aquaculture producers of fish and shrimp, along with companion animal brands serving cats and dogs, increasingly seek customized supplements to optimize gut health under diverse husbandry practices.

Across application formats, feed additives remain the cornerstone for prophylactic gut support, while nutritional supplements provide nuanced nutrient delivery, and therapeutic interventions address disease-related gut dysfunctions. Formulation segmentation into liquid, pellet, and powder types influences dosing flexibility and feed stability across production environments. Finally, distribution channels bifurcate into offline pathways-direct sales and distributor networks-and online platforms, where digital marketplaces are gaining traction for rapid reordering and technical support. Understanding these segmentation layers equips stakeholders to align product portfolios with end-user needs and channel preferences.

This comprehensive research report categorizes the Animal Intestinal Health market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Animal Type

- Formulation

- Application

- Distribution Channel

Deep Dive into Regional Dynamics: Contrasting the Americas, Europe Middle East & Africa, and Asia-Pacific Intestinal Health Ecosystems

Regional variations in regulatory frameworks, production systems, and consumer preferences underpin the global intestinal health ecosystem. In the Americas, stringent antibiotic reduction policies in major livestock markets have driven robust uptake of organic acids, antibiotic-alternative phytogenics, and targeted enzyme blends. Feed integrators are leveraging near-farm manufacturing hubs to streamline logistics and reduce lead times, particularly in North America, while South American producers focus on feed enzyme adoption to optimize nutrient utilization in extensive grazing systems.

The Europe, Middle East, and Africa region presents a complex tapestry of compliance standards, with European Union regulations mandating comprehensive gut health monitoring and transparency. R&D investments in next-generation probiotics and precision feeding solutions are concentrated in Western Europe, whereas Middle Eastern and North African markets prioritize cost-effective organic acid blends to support intensive poultry and ruminant operations. South Africa and select Gulf Cooperation Council countries are emerging adopters of novel phytogenic additives, reflecting a growing emphasis on sustainability and localized feed resource utilization.

In Asia-Pacific, dynamic growth in aquaculture and swine production has catalyzed demand for enzyme formulations that address high-fiber byproducts in feed, alongside probiotic solutions tailored to regional pathogen profiles. Liquid feed supplements and pelletized blends are gaining favor due to ease of incorporation within integrated farm systems. Additionally, e-commerce platforms in China, India, and Southeast Asian markets are revolutionizing distribution by coupling technical guidance with digital ordering, enhancing accessibility for smallholder and industrial producers alike.

This comprehensive research report examines key regions that drive the evolution of the Animal Intestinal Health market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles and Innovations of Leading Players Driving Growth, Collaboration, and Competitive Differentiation in Animal Gut Health

Leading players in the intestinal health arena are distinguished by their strategic investments in biotechnology, formulation expertise, and collaborative partnerships. Major enzyme manufacturers are expanding proprietary portfolios to include multi-enzyme complexes tailored to specific feed ingredients, while downstream feed companies are forging joint ventures with microbial producers to co-develop customized probiotic blends. This confluence of upstream innovation and downstream application expertise is reshaping competitive dynamics and driving consolidation in the value chain.

At the same time, agile biotech startups specializing in microbial strain discovery are challenging incumbents with precision-engineered probiotics designed for targeted pathogen inhibition and immune modulation. These firms are increasingly collaborating with academic institutions and contract research organizations to accelerate strain validation and regulatory approval. Larger integrators are acquiring or licensing these platforms to complement their existing additive portfolios and enhance technical service offerings for end-users.

Distribution channel strategies are also evolving, as leading companies deploy omnichannel models that integrate traditional direct sales forces with digital marketing and e-commerce capabilities. This dual approach not only broadens market reach but also enables data-driven customer engagement, providing insights into usage patterns and efficacy feedback. By balancing scale with specialization, these companies are securing competitive differentiation and positioning themselves as end-to-end solution providers in animal intestinal health.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Intestinal Health market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Vista

- AdvaCare Pharma

- Archer Daniels Midland Company

- BASF SE

- Bluestar Adisseo Co., Ltd.

- Cargill, Incorporated

- Evonik Industries AG

- International Flavors & Fragrances Inc.

- Kemin Industries, Inc.

- Kerry Group plc

- Koninklijke DSM N.V.

- Novonesis A/S

- Zoetis Inc.

Pragmatic, Actionable Recommendations for Industry Leaders to Advance Animal Intestinal Health Innovation, Efficiency, and Market Expansion

Industry leaders seeking to navigate complex trade environments and evolving end-user demands should prioritize strategic initiatives that reinforce supply chain resilience and innovation agility. Establishing dual-sourcing agreements for critical enzymes and microbial strains can mitigate tariff exposure while safeguarding continuity of supply. Concurrently, investing in fermentation and downstream formulation capabilities within domestic markets can unlock cost efficiencies and bolster responsiveness to regulatory shifts.

From an R&D perspective, harnessing microbiome analytics and in-feed sensor data to develop precision nutrition solutions will enable more nuanced gut health interventions. Collaborative research partnerships with academic institutions and technology vendors can accelerate product development timelines, while co-marketing agreements with feed integrators ensure seamless market entry. Additionally, embedding sustainability metrics into product value propositions-such as tracking reductions in greenhouse gas emissions and antibiotic usage-will resonate with increasingly eco-conscious consumers and regulators.

On the commercial front, blending direct sales outreach with targeted digital engagement can optimize customer acquisition and retention. Leveraging e-commerce platforms to provide technical support content, dosing calculators, and case studies fosters deeper customer relationships and repeat business. By aligning these approaches with tailored regional strategies-addressing the unique regulatory and production characteristics of each geography-leaders can capture emerging opportunities and sustain growth in the dynamic intestinal health market.

Comprehensive Research Methodology Outlining the Integrated Primary and Secondary Approaches, Expert Validation, and Data Synthesis Protocols

This analysis integrates comprehensive secondary research with targeted primary interviews to ensure robust and actionable insights. Secondary sources encompass scientific journals, regulatory publications, and trade association reports that elucidate the latest gut health innovations, policy developments, and supply chain structures. These findings were triangulated through detailed primary discussions with industry executives, formulation scientists, and farm-level practitioners to validate trends and capture practical implementation challenges.

Market segmentation was developed using a layered approach, dissecting product types, animal categories, application forms, formulation formats, and distribution channels. Data synthesis protocols involved cross-referencing ingredient usage patterns, adoption rates in key production systems, and feedback from technical sales teams. Quality assurance measures included peer review of draft findings by subject matter experts and iterative alignment with publicly available regulatory updates to verify compliance considerations.

By combining these methodological pillars, the report delivers a nuanced understanding of the animal intestinal health landscape that balances academic rigor with commercial applicability. Stakeholders can trust that the recommendations and insights presented herein are grounded in validated evidence, ensuring confidence in strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Intestinal Health market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Intestinal Health Market, by Product Type

- Animal Intestinal Health Market, by Animal Type

- Animal Intestinal Health Market, by Formulation

- Animal Intestinal Health Market, by Application

- Animal Intestinal Health Market, by Distribution Channel

- Animal Intestinal Health Market, by Region

- Animal Intestinal Health Market, by Group

- Animal Intestinal Health Market, by Country

- United States Animal Intestinal Health Market

- China Animal Intestinal Health Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Insights Emphasizing the Strategic Imperatives, Emerging Opportunities, and Future Directions in Animal Intestinal Health Markets

The evolving landscape of animal intestinal health presents both challenges and opportunities for stakeholders across the value chain. Rapidly shifting consumer preferences, stringent regulatory frameworks, and trade uncertainties demand that companies adopt agile innovation and supply chain strategies. At the same time, breakthroughs in enzyme technologies, probiotic engineering, and digital nutrition platforms are unlocking new pathways to optimize gut integrity, feed efficiency, and animal welfare.

As the industry moves forward, collaboration between biotechnology firms, feed integrators, academic institutions, and regulatory bodies will be crucial to driving sustainable growth. Companies that invest in localized production, data-enabled precision solutions, and omnichannel engagement models are best positioned to capture emerging market segments. Ultimately, a strategic emphasis on intestinal health will not only enhance productivity and profitability but also align animal agriculture with broader sustainability and public health goals.

Take the Next Step in Optimizing Your Animal Health Strategy by Partnering with Ketan Rohom to Access the Full Market Research Report

To explore how these insights can be applied to your organization’s strategic roadmap and secure a competitive edge, reach out directly to Ketan Rohom, the Associate Director of Sales & Marketing. By partnering with him, you will gain immediate access to the comprehensive animal intestinal health report, which delves into the latest technological breakthroughs, regional regulations, and tariff implications that are reshaping the industry. Engaging with Ketan will enable your team to make data-driven investment decisions, tailor your product development pipeline, and optimize supply chain strategies against evolving trade policies.

Don’t miss the opportunity to leverage exclusive findings that inform actionable growth strategies across enzymes, organic acids, phytogenics, prebiotics, and probiotics portfolios. Connect with Ketan Rohom today to discuss customized licensing options, group purchasing incentives, and advisory sessions designed to accelerate innovation and market expansion. Your next step toward unlocking robust intestinal health solutions for poultry, swine, ruminants, aquaculture, and companion animals starts here.

- How big is the Animal Intestinal Health Market?

- What is the Animal Intestinal Health Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?