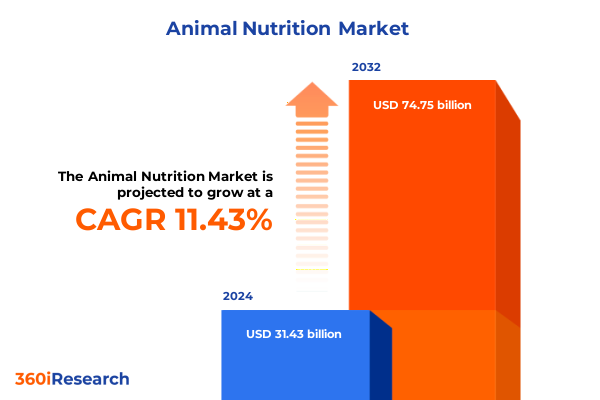

The Animal Nutrition Market size was estimated at USD 35.03 billion in 2025 and expected to reach USD 38.77 billion in 2026, at a CAGR of 11.43% to reach USD 74.75 billion by 2032.

Emerging Dynamics in Animal Nutrition Highlight the Critical Role of Innovative Feed Solutions and Evolving Industry Drivers

The animal nutrition sector has emerged as a linchpin in the global food supply chain, driving both economic growth and sustainability imperatives. Robust demand for high-quality protein, coupled with intensifying resource constraints, has elevated the significance of feed formulation and additive innovation across livestock, aquaculture, and companion animal segments. In recent years, stakeholders have responded to rising consumer scrutiny over animal welfare, environmental impact, and product traceability by adopting more stringent production standards. Regulatory bodies are now mandating reductions in antibiotic usage, while retailers and end consumers increasingly prioritize sustainably sourced and nutrient-optimized feed solutions. As a result, the industry is witnessing a paradigm shift toward more tailored and data-driven nutrition strategies that aim to optimize animal health, feed conversion ratios, and overall operational efficiency.

Against this backdrop, technological advancements and evolving trade dynamics are reshaping the landscape of ingredient sourcing, formulation capabilities, and distribution networks. Producers must navigate a complex web of regional regulations, tariff regimes, and logistical challenges while simultaneously meeting rising expectations for quality, safety, and environmental stewardship. In this context, a strategic understanding of the latest innovations, market drivers, and potential bottlenecks is essential for decision-makers seeking to maintain competitiveness and resilience. This executive summary distills the most critical insights across transformative trends, trade impacts, segmentation dynamics, regional considerations, and competitive strategies, setting the stage for informed action and sustainable growth in the evolving animal nutrition arena.

Technological and Sustainability Revolutions Are Reshaping Feed Production and Nutritional Strategies Across Livestock and Aquaculture Sectors

Innovation is rapidly redefining feed production and delivery, driven by the convergence of digital technologies and sustainability priorities. Data-driven analytics and artificial intelligence are enabling precision feeding approaches that tailor nutrient blends to specific animal requirements, reducing waste and environmental footprint while enhancing productivity. The integration of Internet of Things (IoT) sensors across farms and feed mills provides real-time monitoring of animal behavior, health biomarkers, and feed intake, allowing nutritionists to calibrate formulations with unprecedented accuracy. Simultaneously, sustainability has transitioned from a differentiator to a baseline expectation, prompting manufacturers to explore circular economy feed ingredients such as insect meal, agro-industrial byproducts, and algal biomass to alleviate reliance on traditional crops and marine resources. These resource-efficient alternatives not only support environmental goals but also help shield producers from supply chain volatility and commodity price swings.

Advancements in gut microbiome modulation represent another transformative area, with probiotics, prebiotics, and precision enzyme blends enhancing nutrient absorption, immune function, and antimicrobial reduction. By harnessing molecular-level insights into microbial communities, companies are developing tailored additive portfolios that target specific health outcomes and performance benchmarks. Meanwhile, regulatory frameworks in key markets are coalescing around stricter limits on antibiotic and antimicrobial use, accelerating the adoption of natural growth promoters and disease-control agents. Taken together, these innovations point toward a future where highly customized, sustainable, and technology-enabled feed solutions define competitive advantage and drive more resilient production systems. citeturn0search0turn0search1

Escalating Trade Measures and Tariff Adjustments Are Exerting Broad-Based Pressures on Ingredient Costs and Supply Chain Resilience in 2025

Trade policy developments in early 2025 have introduced new complexities into ingredient sourcing and cost management for animal nutrition producers. In March, the United States imposed 25 percent tariffs on imports originating from Mexico and Canada, alongside an increase from 10 to 20 percent on Chinese-origin feed ingredients, chemicals, and machinery components. These measures prompted concerns about retaliatory duties on U.S. agricultural exports, with China announcing additional levies on chicken, wheat, corn, and aquatic products, and the European Union considering countermeasures on cereals and essential premix inputs. Such shifts threaten to elevate input costs for critical nutrient sources-including amino acids, minerals, and specialty feed additives-and challenge supply chain resilience for both compounders and end users. citeturn1search0turn1search1

In response to mounting trade tensions, a temporary 90-day tariff reduction with China offers short-term relief, lowering reciprocal duties on key feed ingredients to an effective rate of 30 percent, down from 115 percent previously in place. While this pause alleviates some immediate pressures on importers and exporters, uncertainty remains as negotiations progress and policymakers weigh longer-term adjustments. Producers are consequently prioritizing diversification of supplier bases, strategic inventory management, and deeper collaboration with ingredient manufacturers to buffer against future disruptions. As a result, agility in procurement strategies and transparency in cross-border operations are becoming indispensable for maintaining cost competitiveness and uninterrupted supply in 2025 and beyond. citeturn1search4

Nuanced Insights Into How Animal Type, Ingredient Profiles, Feed Forms, Targeted Applications and Distribution Channels Define Market Opportunities

Diverse animal species exhibit unique nutritional needs and market dynamics, shaping the demand for tailored feed formulations across aquaculture, companion animals, equine, poultry, ruminants, and swine. Within aquaculture, growth in crustacean and finfish farming has driven interest in novel protein sources and optimized lipid profiles to support rapid growth cycles, while mollusk cultivation benefits from mineral-enriched feed blends. The companion animal segment continues to expand premium offerings for cats and dogs, focusing on functional ingredients such as joint-support compounds and digestive health enhancers. In equine nutrition, specialized forage-based diets and targeted supplement portfolios meet the high-performance demands of sport and leisure markets. Poultry producers partition focus among broiler operations, layer flocks, and turkey integration, each requiring precise amino acid balancing to achieve mortality reduction, egg production goals, or meat yield targets. Within ruminants, cattle feedlot operators and sheep and goat enterprises are increasingly incorporating fermentation-based additives to mitigate enteric methane emissions and enhance fiber utilization. Swine nutrition remains centered on phase-specific diets for breeders, grower-finisher units, and wean-to-finish herds, leveraging precise micronutrient calibration to support rapid lean growth and sow fertility.

Ingredients span foundational nutrients and specialty additives, from essential amino acids-such as lysine, methionine, threonine, and tryptophan-to fatty acids rich in omega-3 and omega-6 profiles. Enzyme blends, including carbohydrases, phytases, lipases, and proteases, unlock complex carbohydrates and improve feed digestibility, while probiotic and prebiotic solutions promote gut health and immune resilience. Form preferences bifurcate into dry and liquid modalities, each offering distinct shelf-life, handling, and application advantages across feed mills and on-farm blending operations. Application-driven demand focuses on disease control through antimicrobials and vaccines, feed preservation via antioxidants, enzymes, and organic acids, growth promotion, and nutrient supplementation to meet species- and phase-specific requirements. Distribution channels range from well-established offline networks of distributors and integrators to rapidly expanding online platforms, where digital procurement portals and e-commerce ecosystems are reshaping buyer-supplier interactions and enabling rapid access to specialty feed inputs.

This comprehensive research report categorizes the Animal Nutrition market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Ingredient Type

- Form

- Application

- Distribution Channel

Regional Variations Illustrate Distinct Drivers, Regulatory Landscapes and Demand Patterns Shaping Animal Nutrition Markets Globally

Regional dynamics exert a profound influence on the shape and trajectory of animal nutrition markets worldwide. In the Americas, robust production systems in North and South America benefit from integrated value chains, where advanced feed mill capacity, strong grain supplies, and innovation hubs in the United States, Brazil, and Argentina drive cutting-edge product development. Demand for precision nutrition and sustainability-linked solutions is high, as producers face regulatory pressure to reduce environmental impact and enhance animal welfare. Logistics networks are well-established, yet fluctuations in currency and export policies introduce periodic cost pressures that require agile procurement strategies.

Europe, the Middle East, and Africa present a mosaic of regulatory frameworks and consumption patterns. Stricter European Union regulations on antibiotic reduction, along with evolving animal welfare standards, have accelerated the adoption of natural growth promoters and gut health enhancers. Meanwhile, Middle Eastern and North African markets are expanding protein production to balance growing domestic consumption and import dependence. Sub-Saharan Africa shows nascent aquaculture and poultry growth, underpinned by development programs and foreign direct investment in feed mill infrastructure.

Asia-Pacific leads volume growth, driven by rapidly expanding aquaculture in China and Southeast Asia, alongside intensifying poultry and swine operations in India. Government initiatives incentivize adoption of feed additives that reduce emissions and improve feed conversion efficiency, responding to both food security imperatives and climate commitments. Import reliance for soy protein, amino acids, and minerals underscores the importance of trade relationships with major exporters. Meanwhile, the digital transformation of procurement and farm management platforms in the region is revolutionizing access to ingredients and technical support.

This comprehensive research report examines key regions that drive the evolution of the Animal Nutrition market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Are Advancing Strategic Collaborations, Innovative Product Launches and Sustainability Initiatives to Gain Competitive Edge

The competitive arena in animal nutrition is characterized by a blend of global conglomerates and specialized innovators advancing strategic partnerships, targeted acquisitions, and research collaborations. Leading agribusiness and ingredient manufacturers are aligning with technology firms to deploy data analytics and traceability platforms, ensuring transparency from raw material sourcing through to on-farm application. Mergers and acquisitions have centered around capabilities in sustainable ingredient production, such as microbial proteins and plant-based enzymes, while collaborations with academic institutions are fueling pipeline development in gut health and next-generation feed additives.

Simultaneously, progressive mid-sized enterprises are carving niche positions by focusing on premium pet and equine nutrition, leveraging direct-to-consumer channels and lifestyle branding. These players excel in rapid product iteration and personalized customer engagement, often underpinned by digital ordering systems and subscription models. At the same time, contract research organizations and specialized feed consultants have grown in prominence, offering formulary optimization, in-field trial management, and data-driven performance benchmarking. Together, this ecosystem of incumbents and disruptors underscores a shift toward open innovation networks, where cross-sector collaboration and co-development are central to capturing differentiated market share and responding to dynamic customer needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Nutrition market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Agri Ltd.

- Adisseo France S.A.S.

- Alltech Inc.

- Archer-Daniels-Midland Company

- BASF SE

- Biomin Holding GmbH

- Cargill Incorporated

- Charoen Pokphand Foods PCL

- De Heus Animal Nutrition

- DSM-Firmenich AG

- Elanco Animal Health Incorporated

- Evonik Industries AG

- ForFarmers N.V.

- Jefo Nutrition Inc.

- Kemin Industries Inc.

- Lallemand Inc.

- Novus International Inc.

- Nutreco N.V.

- Pancosma SA

- Perstorp Holding AB

- Phibro Animal Health Corporation

- Provimi Holding B.V.

- Trouw Nutrition

- Vilomix A/S

- Zoetis Inc.

Practical Steps and Strategic Investments Are Essential for Industry Leaders to Navigate Disruption and Capitalize on Emerging Animal Nutrition Trends

To navigate the accelerating pace of industry transformation, companies must adopt multifaceted strategies that integrate technological innovation, sustainability commitments, and supply chain resilience. Establishing strategic alliances with digital platform providers can facilitate real-time monitoring of feed performance and animal health metrics, enabling rapid formulation adjustments and predictive maintenance of feed equipment. Concurrently, investing in alternative protein research-such as insect-based meals, algae-derived lipids, and upcycled agro-industrial byproducts-will diversify supply sources and mitigate exposure to commodity volatility.

Embracing circular economy principles by partnering with food and beverage processors to valorize byproducts can reduce feed production costs while enhancing brand sustainability credentials. Further, cultivating deep, collaborative relationships with key ingredient suppliers and co-investing in local blending facilities can strengthen regional agility and buffer against trade disruptions. Leadership teams should also integrate environmental, social, and governance (ESG) metrics into product development roadmaps, aligning feed portfolios with emerging regulatory expectations and consumer transparency demands. By combining technological agility, strategic partnerships, and sustainability-driven R&D, industry leaders will be well-positioned to capitalize on emerging market opportunities and secure long-term competitive advantage.

Robust Mixed-Method Research Framework Integrates Primary, Secondary Data and Analytical Rigor to Ensure Comprehensive Animal Nutrition Insights

The findings presented in this summary derive from a rigorous mixed-method research framework that integrates primary and secondary data sources. Primary research included in-depth interviews with C-level executives, nutritionists, and technical experts across feed manufacturers, integrators, and end-user operations in major producing regions. These discussions were complemented by structured surveys conducted with farm managers, veterinarians, and procurement officers to capture nuanced insights on feed performance, procurement challenges, and innovation adoption.

Secondary research encompassed an extensive review of trade publications, regulatory filings, patent databases, and financial reports to map competitive dynamics, technological breakthroughs, and policy developments. Industry associations and government agencies provided quantitative data on trade flows, tariff adjustments, and ingredient supply metrics. All data were triangulated through cross-validation techniques to ensure consistency and accuracy. Analytical rigor was maintained through standardized data normalization processes, while thematic synthesis and scenario analysis tools were applied to identify key trends and potential inflection points. This robust approach ensures comprehensive coverage of market drivers, challenges, and strategic imperatives in the evolving animal nutrition landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Nutrition market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Nutrition Market, by Animal Type

- Animal Nutrition Market, by Ingredient Type

- Animal Nutrition Market, by Form

- Animal Nutrition Market, by Application

- Animal Nutrition Market, by Distribution Channel

- Animal Nutrition Market, by Region

- Animal Nutrition Market, by Group

- Animal Nutrition Market, by Country

- United States Animal Nutrition Market

- China Animal Nutrition Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Synthesis of Key Findings Emphasizes the Imperative for Innovation, Sustainability and Strategic Collaboration in Animal Nutrition

Recurring themes throughout the analysis highlight the imperative for the animal nutrition industry to embrace innovation, sustainability, and strategic collaboration. Precision feeding and digital integration are no longer experimental concepts but foundational elements for optimizing feed efficiency and animal performance. Sustainability, from ingredient sourcing to carbon footprint reduction, has become a baseline requirement across major markets. Simultaneously, evolving trade policies and tariff regimes demand agile procurement strategies and diversified supplier portfolios to maintain cost competitiveness and ensure uninterrupted ingredient flow.

Segmentation insights underscore the necessity of tailoring feed solutions to the unique needs of different animal species, production phases, and regional contexts. Companies that master the art of customization-whether through specialized amino acid profiles, microbiome-targeted additives, or phase-specific premixes-will capture premium market segments and foster deeper customer loyalty. Finally, collaborative innovation networks, spanning global conglomerates, mid-sized pioneers, and technical research partners, are central to navigating complexity and accelerating time to market. By aligning strategic action with these core imperatives, industry stakeholders can drive sustainable growth and resilience in an increasingly dynamic animal nutrition ecosystem.

Unlock In-Depth Actionable Market Intelligence and Partner With Ketan Rohom to Access the Full Animal Nutrition Market Research Report Tailored to Your Needs

Ready to elevate your strategic decisions with in-depth market intelligence tailored to the animal nutrition landscape? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our comprehensive report will equip you with actionable insights and competitive advantages. Engage in a personalized consultation, receive a detailed proposal outlining scope and deliverables, and secure priority access to the full dataset and expert analysis. Whether you seek custom benchmarking, targeted segment deep dives, or scenario planning, Ketan will guide you through every step to ensure the research aligns perfectly with your business objectives. Don’t miss the opportunity to transform data into decisive action and lead the market with confidence-reach out today and propel your animal nutrition strategies forward.

- How big is the Animal Nutrition Market?

- What is the Animal Nutrition Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?