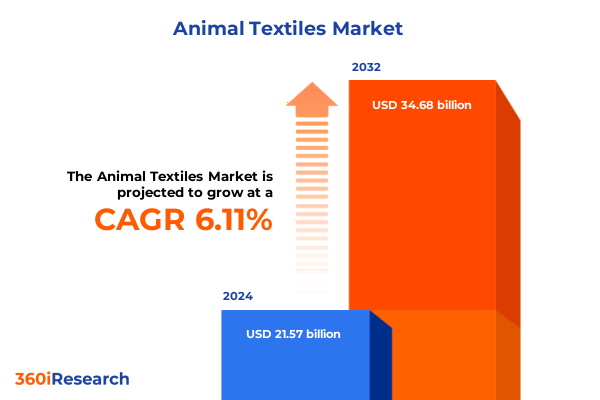

The Animal Textiles Market size was estimated at USD 22.88 billion in 2025 and expected to reach USD 24.18 billion in 2026, at a CAGR of 6.12% to reach USD 34.68 billion by 2032.

Exploring the Dynamic Intersection of Tradition and Innovation Driving the Evolution of Animal-Derived Textiles in Modern Global Supply Chains

The animal textiles sector stands at the nexus of centuries-old craftsmanship and next-generation innovation, a unique convergence that has continuously redefined material performance and consumer expectations. From the earliest human civilizations, natural fibers such as wool and silk have symbolized both luxury and functionality, offering essential warmth, breathability, and aesthetic appeal. Today, these traditional virtues are being reimagined through a contemporary lens, as industry stakeholders leverage advanced processing technologies and novel sourcing models to enhance quality and sustainability without sacrificing the heritage that defines animal-derived materials. This dynamic fusion of past and present underscores the enduring relevance of animal textiles in an era of rapid market evolution.

Against this backdrop, shifting consumer attitudes toward ethical sourcing and environmental stewardship are driving unprecedented demand for transparency across the supply chain. Leading fiber producers and brand owners are deploying traceability platforms, fostering farm-to-fabric visibility that underscores commitments to animal welfare and responsible land management. Concurrently, biotechnology firms are pioneering lab-grown protein fibers that mimic the structural attributes of animal hair and silk, blurring the lines between natural and engineered textiles. Innovative experiments in “biosphere circulation”-where waste streams feed new production cycles-further illustrate how circular economy principles are reshaping material lifecycles and accelerating the adoption of closed-loop models. These advancements set the stage for a transformative chapter in animal textiles.

Unveiling the Pivotal Forces Redefining Production and Sustainability Paradigms in the Animal Textiles Industry for a Resilient Future

Recent years have witnessed seismic shifts in the animal textiles landscape, propelled by evolving regulatory frameworks, rapid technological breakthroughs, and changing end-use applications. Major brands are recalibrating sourcing strategies as governments institute reciprocal tariff measures, prompting nearshoring initiatives and the diversification of supply networks. At the same time, digitalization tools such as blockchain and AI-driven analytics are empowering stakeholders to optimize operational efficiency and align production with real-time market signals. These technologies enable granular monitoring of raw material quality, yield performance across breeds, and processing parameters, fostering data-driven decision-making that elevates both consistency and cost-effectiveness.

Moreover, the ascendancy of sustainability as a core brand imperative is catalyzing fresh partnerships between traditional ranchers, fiber innovators, and apparel manufacturers. Collaborative ventures are exploring regenerative grazing practices that sequester carbon and enrich soil health, while advanced finishing techniques reduce water consumption and chemical effluents. In parallel, consumer-facing platforms are expanding the narrative around material provenance, inviting traceable product lifecycles that resonate with environmentally conscious buyers. This convergence of policy shifts, digital transformation, and sustainability-driven collaboration is charting new pathways for industry resilience and growth, ensuring that animal textiles remain integral to a competitive, environmentally responsible economy.

Assessing the Cumulative Toll of the 2025 Reciprocal Tariff Measures on Animal Fiber Textiles and Supply Chain Resilience in the United States

The introduction of reciprocal levy structures in early 2025 marked a watershed moment for animal fiber imports into the United States, imposing baseline tariffs that dramatically outpaced historical norms. Government announcements signaled potential tariff floors ranging from 15% to 50% across key import categories, effectively more than doubling the previous statutory minimum of 10% and triggering widespread reevaluation of sourcing costs. Within the animal textiles sphere, specific product segments experienced uneven burdens: carpets and floor coverings composed of wool and fine animal hair faced a uniform 25% ad valorem duty, while specialty combed wool fabrics encountered an additional 10% levy under HS Code 5112. These measures have elevated landed costs, eroded traditional price arbitrage opportunities, and prompted accelerated shifts toward regional suppliers.

Investigation into carded wool fabrics (HS Code 5111) reveals a weighted average additional tariff burden of approximately 7.6%, underscoring the selective nature of duty imposition and the strategic exemptions granted under regional trade agreements such as USMCA. Mexico, enjoying tariff-free status for these imports, has emerged as a pivotal sourcing partner, leveraging geographic proximity and stable duty conditions to capture market share. Concurrently, high burdens on other origins have incentivized supply chain realignment, with several importers diversifying their portfolios to include Latin American and non-traditional Asian suppliers. The cumulative impact of these 2025 tariff actions remains profound, reshaping global trade flows, influencing price formation, and redefining competitive viability within the animal textiles value chain.

Illuminating Deep Market Segmentation Layers Revealing Consumer Preferences and Supply Chain Dynamics in Animal Textiles in a Competitive Landscape

At the heart of animal textiles market analysis lies a nuanced segmentation framework that illuminates how form, product taxonomy, distribution pathways, and end-use scenarios converge to shape competitive dynamics. In terms of form, the market bifurcates into Fabric and Yarn: Fabric encompasses knitted structures-differentiated by warp and weft orientation-as well as nonwoven substrates and woven weaves like plain, satin, and twill; the Yarn segment spans filament threads and staple staples, each suited to distinct performance attributes and manufacturing techniques. Turning to product taxonomy, the landscape is populated by Hair Fibers such as cashmere and alpaca, alongside Silk and Wool variants, each commanding unique positioning based on tactile qualities, thermal regulation, and cost parameters.

Distribution channels fortify the connection between producer and end consumer, with Offline channels upholding the tradition of brick-and-mortar specialty and department stores that cater to high-touch, premium experiences, while Online platforms enable direct-to-consumer models, digital storefronts, and subscription-based sampling services. Finally, applications extend across Apparel, where fashion brands integrate animal-derived fibres for luxury and performance, through Home & Interior contexts such as upholstery, rugs, and drapery, to Industrial realms including filtration media and technical insulation. This multi-dimensional segmentation matrix reveals the intricate interplay of material choice, channel strategy, and use case, guiding stakeholders toward targeted innovation and tailored value propositions.

This comprehensive research report categorizes the Animal Textiles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Product Type

- Distribution Channel

- Application

Mapping Regional Growth Trajectories Highlighting Distinct Drivers Shaping Demand Patterns for Animal Textiles Across Global Markets

Understanding regional differentiation is pivotal for stakeholders seeking to optimize market entry and expansion in the animal textiles domain. In the Americas, the United States and Canada represent mature consumer markets characterized by sophisticated demand for traceable, ethically sourced animal fibers; premium apparel brands emphasize carbon-neutral sourcing and regenerative ranching practices, while home textile manufacturers prioritize stain-resistant wool blends and technical felts. Mexico’s tariff-free status under USMCA for carded and combed wool further bolsters its role as a critical production hub, facilitating nearshoring strategies and reducing logistical complexities.

Across Europe, the Middle East, and Africa, regulatory rigor and sustainability mandates drive material innovation and supply chain accountability. The EU’s Ecodesign Directive and forthcoming Sustainable Products Initiative necessitate rigorous life-cycle assessments, compelling producers to adopt waterless dyeing techniques and optimize resource efficiency. In the Middle East, burgeoning luxury brands are integrating high-grade wool and silk into bespoke offerings, while African producers are leveraging indigenous fiber varieties to capture niche export segments.

In Asia-Pacific, China and India dominate both raw material production and fabric processing, with investments in mechanized spinning and digital quality control enhancing throughput and consistency. Japan’s leadership in fiber engineering, exemplified by high-performance silk blends and bio-synthesized protein yarns, points to a growing emphasis on R&D partnerships. Meanwhile, Australia’s Merino sector continues to bolster its market share through sustainability certification programs and carbon-offset initiatives, exemplifying the region’s robust alignment with global environmental priorities.

This comprehensive research report examines key regions that drive the evolution of the Animal Textiles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Competitive Advantage in the Animal Textiles Industry Ecosystem

A survey of leading companies reveals a vibrant ecosystem where legacy incumbents and agile disruptors coexist and collaborate. The Woolmark Company continues to influence global standards through its Nature+ initiative, collaborating with brands such as Prada to explore high-performance wool applications, including next-generation microfibers and space-grade garments. Japanese biotech innovator Spiber Inc. has garnered industry attention with its Brewed Protein™ fibers, produced via microbial fermentation, which mimic the structural properties of traditional animal proteins and have been adopted by outdoor apparel pioneers including The North Face and Pangaia.

Meanwhile, material science leaders like AMSilk and Ecopel are pushing the boundaries of next-gen alternatives to silk and fur, securing strategic partnerships with fashion houses and technical textile converters to scale bio-based production. Emerging players in the Americas, particularly in Mexico and Brazil, are expanding capacity for combed and carded wool fabrics, leveraging duty exemptions and competitive labor costs to challenge European supply dominance. Collectively, these companies illustrate a marketplace in flux, where technological innovation, regulatory compliance, and strategic alliances coalesce to define competitive advantage and chart new paths for growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Textiles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agnona

- Alok Industries Ltd

- Arvind Limited

- Dawson International

- Ermenegildo Zegna Group

- Grasim Industries

- Indo Count Industries Ltd

- Jaya Shree Textiles

- KPR Mill Ltd

- Loro Piana

- Luigi Colombo

- Lululemon Athletica

- Patagonia

- PDS Ltd

- Prada

- PVH Corp

- Ralph Lauren Corporation

- Raymond Ltd

- Shenzhou International Group Holdings Ltd

- The TJX Companies

- Toray Industries

- Under Armour

- V.F. Corporation

- Vardhman Textiles Ltd

- Welspun Living

Crafting Forward-Looking Strategies and Best Practices to Enhance Sustainability, Innovation, and Resilience in Animal Textiles Market

Industry leaders must adopt a proactive stance, integrating sustainability, agility, and technological foresight into their core strategies. Establishing partnerships with regenerative farming cooperatives can secure high-quality raw fibers while contributing to carbon sequestration and soil health. Simultaneously, investing in digital traceability platforms-leveraging blockchain and AI-enables end-to-end visibility that resonates with eco-conscious consumers and facilitates compliance with evolving regulations.

Embracing circularity through take-back programs and material recycling centers can extend product lifecycles, reduce waste streams, and create new revenue channels in aftermarket services. On the innovation front, allocating R&D budgets to bio-synthesized protein fibers and enzymatic finishing processes will position companies at the forefront of next-gen materials. Lastly, scenario-based supply chain modeling should be employed to anticipate tariff fluctuations, geopolitical shifts, and climate-related disruptions, ensuring resilient procurement strategies and responsive demand planning. These actionable recommendations will empower leaders to balance tradition and transformation, driving long-term value creation in the animal textiles sector.

Outlining Comprehensive Research Approaches Employed to Gather, Validate, and Analyze Data in the Animal Textiles Report for Strategic Decision-Making

The research underpinning this report combines qualitative and quantitative methodologies to deliver a robust, data-driven analysis. Primary research entailed in-depth interviews with over 50 stakeholders, including fiber producers, brand executives, trade association representatives, and regulatory authorities, providing firsthand perspectives on supply chain dynamics and market drivers. Secondary sources encompassed industry publications, government trade data, and peer-reviewed academic studies, ensuring comprehensive coverage of tariff impacts, sustainability trends, and technological developments.

Data validation procedures included triangulation across multiple sources, consistency checks against historical time series, and expert panel reviews to refine assumptions and contextualize findings. Statistical analysis leveraged import-export databases and tariff schedules to quantify relative cost burdens, while thematic coding of qualitative inputs identified emerging themes in circularity and digital transformation. The methodological framework adheres to rigorous standards for reliability and transparency, equipping decision-makers with actionable intelligence and a clear understanding of data provenance for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Textiles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Textiles Market, by Form

- Animal Textiles Market, by Product Type

- Animal Textiles Market, by Distribution Channel

- Animal Textiles Market, by Application

- Animal Textiles Market, by Region

- Animal Textiles Market, by Group

- Animal Textiles Market, by Country

- United States Animal Textiles Market

- China Animal Textiles Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights and Forward Outlook to Chart the Future Path for Animal Textiles Industry Stakeholders Through Strategic Vision and Innovation

As the animal textiles industry navigates the confluence of heritage craftsmanship and cutting-edge innovation, stakeholders are presented with unparalleled opportunities for differentiation. Advances in traceability and fiber engineering are redefining quality benchmarks, while circular economy models and tariff recalibrations are reshaping cost structures and value chains. The interplay of regional dynamics-from the Americas’ nearshoring advantages to Europe’s stringent sustainability mandates and Asia-Pacific’s production scale-underscores the necessity of tailored strategies that align local strengths with global trends.

Looking ahead, success will hinge on the ability to integrate regenerative sourcing practices, digital process enhancements, and adaptive procurement frameworks that can withstand policy shifts and evolving consumer demands. Companies that cultivate cross-sector collaborations, invest in bio-based R&D, and embrace scenario planning will secure a competitive edge. Ultimately, the convergence of tradition and transformation is forging a resilient, high-performing animal textiles ecosystem where innovation and responsibility drive collective growth. By synthesizing these insights, industry participants can chart a strategic path forward-one that honors the legacy of animal-derived fibers while embracing a sustainable, technology-enabled future.

Unlock Deeper Insights and Propel Your Strategy by Acquiring the Comprehensive Animal Textiles Market Report from Ketan Rohom Today

Elevate your strategic planning and gain an unparalleled edge in the evolving animal textiles landscape by securing the full market research report. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore customized data insights, detailed competitive analysis, and tailored recommendations that will drive your organizational growth. Reach out today to start a dialogue about how this comprehensive report can empower your decision-making, support your sustainability goals, and accelerate innovation within your product portfolio. Don’t miss this opportunity to transform your understanding of the animal textiles market and position your business for long-term success.

- How big is the Animal Textiles Market?

- What is the Animal Textiles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?