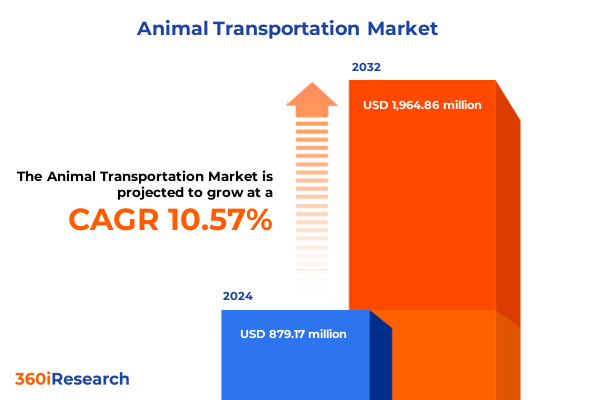

The Animal Transportation Market size was estimated at USD 960.16 million in 2025 and expected to reach USD 1,048.93 million in 2026, at a CAGR of 10.77% to reach USD 1,964.85 million by 2032.

Setting the Stage for a Comprehensive Exploration of the Animal Transportation Industry’s Core Drivers, Evolving Dynamics, Market Complexities, and Stakeholder Imperatives

The animal transportation industry operates at the intersection of logistical precision, regulatory complexity, and profound ethical considerations. Over the past decade, advances in vehicle design, traceability technologies, and welfare protocols have converged to reshape how companion animals, livestock, and specialized species traverse national and international routes. Simultaneously, evolving stakeholder expectations - from carriers to pet owners and from large-scale agribusinesses to zoological institutions - necessitate a holistic appreciation of both operational efficiencies and stringent welfare standards.

In this context, understanding the multifaceted nature of animal transportation is imperative for industry professionals and policymakers alike. From the micro-level challenges of ensuring stable microclimates within transport enclosures to the macro-level demands of harmonizing diverse regulatory regimes, today’s landscape is defined by constant evolution. As global trade networks expand, so too do the complexities associated with managing live cargo while maintaining the highest standards of health and safety.

By situating this study amid current industry trends and emerging pressures, this introduction provides a solid foundation for exploring transformative shifts, tariff impacts, segmentation insights, regional variances, and strategic imperatives. Readers will gain a comprehensive vantage point that frames subsequent analyses and establishes the critical issues shaping the present and future trajectories of animal transportation.

Identifying Pivotal Technological Innovations, Regulatory Reforms, and Consumer Demands That Are Reshaping the Animal Transportation Ecosystem’s Future Trajectory

The animal transportation sector is undergoing rapid transformation driven by intersecting forces of technological innovation, regulatory reform, and shifting consumer expectations. Emerging digital platforms now enable real-time monitoring of vehicle telemetry and animal health metrics, granting unprecedented transparency across the supply chain. At the same time, scrutiny from animal welfare organizations has accelerated the adoption of advanced temperature control systems and stress-minimizing handling procedures.

Moreover, regulatory frameworks have evolved to impose more rigorous standards on carriers and shippers, prompting enhancements in facility accreditation, personnel training, and documentation protocols. These policy shifts, in turn, encourage collaboration between industry stakeholders and health authorities to create unified guidelines that streamline cross-border movements while safeguarding animal wellbeing. Furthermore, demographic and cultural trends - such as the growth in urban pet ownership and the renewed interest in exotic species trade - are catalyzing niche service offerings and differentiated carrier solutions.

Collectively, these transformative shifts are not isolated; they intersect and amplify one another, creating increasingly complex operational landscapes. As companies respond to these converging dynamics, their ability to integrate new technologies, comply with evolving mandates, and anticipate consumer demands will determine their competitive positioning. This section unpacks how each pivotal trend influences carrier economics, service portfolios, and ultimately, stakeholder value throughout the transportation continuum.

Analyzing the Layered Effects of 2025 United States Tariff Measures on Cross-Border Live Animal Movements, Carrier Economics, and Service Network Viability

The implementation of layered tariff measures by United States authorities in 2025 has introduced new cost considerations and competitive pressures across live animal transportation corridors. Rooted in broader trade policy adjustments, these tariffs have targeted a range of import and export activities, affecting both livestock and exotic species shipments. The cumulative effect has been a recalibration of carrier pricing strategies, as surcharges tied to tariff classifications are integrated into service quotes and contractual agreements.

In addition, the heightened administrative burden associated with tariff compliance has prompted many carriers to bolster their customs expertise and automate classification workflows. Consequently, operational timelines for cross-border movements have extended, requiring deeper coordination among carriers, handlers, and regulatory agencies. At the same time, domestic suppliers and carriers have explored alternative routing and modal mixes to mitigate the financial impact of applied duties.

These strategic responses to tariff pressures underscore the importance of agility and cost visibility in an environment where policy shifts can rapidly alter economic fundamentals. As companies adjust their network configurations and pricing frameworks, the interplay between tariff obligations and service reliability will remain a defining challenge. This section examines the cumulative impact of these measures on carrier margins, customer agreements, and the broader viability of animal transport lanes.

Uncovering Intricate Market Patterns Through Animal Type Classifications, Transportation Modes, Service Offerings, and Distinct Commercial vs Individual End Users

Market dynamics in animal transportation reveal nuanced behaviors when segmented by the type of animal, modes of transportation employed, service typologies, and the nature of end users. Companion animal movements, encompassing birds, cats, and dogs, have seen sustained growth in premium door-to-door services as pet owners prioritize comfort and minimal transit time. Equine transport, by contrast, often hinges on specialized road and air carriers offering direct airport-to-airport solutions, driven by high-value client expectations and the critical need to maintain equine health during transit. Meanwhile, exotic animals and zoo specimens require bespoke intermodal sequences, blending sea and air segments with strict port-to-port protocols to adhere to global conservation and CITES regulations. Livestock shipments such as cattle, poultry, sheep, and swine predominantly leverage road networks with tailored door-to-door offerings for short-haul domestic routes, while larger rail and sea options emerge as cost-effective alternatives for longer cross-border flows.

Service types further differentiate market behaviors: airport-to-airport models excel where speed is paramount, notably in emergency relocations and high-value movements; door-to-door services command premium pricing through end-to-end care; and port-to-port arrangements offer scalable solutions for bulk livestock and stable animal freight. Additionally, commercial end users - agricultural enterprises, breeding operations, and zoological institutions - often negotiate multi-year contracts with carriers to secure capacity and dedicated resources, while individual end users typically engage ad-hoc, single-ride services oriented around pet relocations and small animal transfers.

Through this lens, strategic investments and service innovations can be aligned to the specific requirements of each segment, enabling carriers to optimize asset utilization, refine pricing frameworks, and deliver tailored customer experiences across a fragmented yet interdependent market.

This comprehensive research report categorizes the Animal Transportation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Transportation Mode

- Service Type

- End User

Highlighting Regional Distinctions Across the Americas, Europe-Middle East-Africa, and Asia-Pacific That Influence Demand Profiles, Infrastructure Capacities, and Regulatory Frameworks

Global demand for animal transportation services manifests distinct regional profiles shaped by economic development, regulatory rigor, and infrastructure maturity. In the Americas, a robust agricultural sector drives substantial volumes of livestock movements, while pet relocation services flourish in response to dynamic migration and household pet ownership trends. Carriers in this region face a dual imperative: modernizing refrigerated road and rail assets for domestic corridors, and enhancing air freight integrations for transcontinental movements. Conversely, Europe, the Middle East, and Africa present a mosaic of regulatory stringency, wherein European Union member states enforce comprehensive animal welfare and traceability frameworks, whereas emerging economies in Africa pursue infrastructural investments to catalyze trade in livestock and zoological specimens. This heterogeneity demands carriers maintain flexible compliance teams and varied service portfolios to address disparate national requirements.

Meanwhile, Asia-Pacific markets exhibit some of the fastest growth trajectories, propelled by expanding aquaculture, intensive livestock production, and burgeoning pet ownership in urban centers. Rapid port expansions and new dedicated air corridors are being developed to accommodate live animal imports and exports, and local carriers are increasingly partnering with global logistics providers to deliver scalable end-to-end solutions. Yet, infrastructure gaps in rural areas and regulatory discrepancies between neighboring jurisdictions continue to challenge seamless animal movements.

By understanding these regional distinctions-from infrastructure investments in refrigerated transport to the rigor of welfare regulations-industry participants can more effectively tailor their asset deployments, compliance strategies, and strategic partnerships to capitalize on localized opportunities and mitigate cross-border complexities.

This comprehensive research report examines key regions that drive the evolution of the Animal Transportation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Initiatives, Operational Differentiators, and Collaborative Partnerships Among Leading Players Driving Competitive Advantage in Animal Transportation

Leading organizations in animal transportation differentiate themselves through a combination of technological integration, strategic alliances, and specialized service portfolios. Pioneers in telematics and sensor-based tracking have set new benchmarks for real-time visibility, enabling clients to monitor animal welfare parameters and logistical milestones through unified digital dashboards. At the same time, collaborations between carriers and veterinary service providers have yielded proprietary handling protocols and emergency response frameworks that enhance service reliability for high-value movements.

Other market leaders have pursued vertical integration strategies, controlling feeder networks and port-to-port operations to secure capacity and optimize asset utilization. Such integrated models reduce handoff points and associated welfare risks, while providing negotiating leverage in tariff and fuel surcharge discussions. In parallel, several carriers have established dedicated sustainability teams focused on carbon offsetting and biosecurity measures, responding to growing stakeholder demands for environmentally responsible transport practices.

Furthermore, the competitive landscape is punctuated by a wave of strategic mergers and joint ventures, uniting regional expertise with global network reach. These partnerships reinforce service resilience amid regulatory shifts and enable rapid deployment of specialized equipment across markets. Ultimately, the success of these corporate initiatives underscores the importance of agility, collaborative innovation, and customer-centric service design in securing long-term leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Transportation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bolloré Logistics SA

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics S.A.

- DB Schenker AG

- DHL Global Forwarding GmbH

- DSV Panalpina A/S

- FedEx Express (FedEx Corporation)

- Kühne + Nagel International AG

- Luxury Pet Express

- Nippon Express Co., Ltd.

- Pacific Pet Transport

- Pet Air Carrier LLC

- Pet Van Lines

- PetRelocation, Inc.

- Royal Paws Pet Transportation

- Starwood Animal Transport

- Texas Animal Control Solutions

- TLC Pet Transport, Inc.

- UPS Supply Chain Solutions (United Parcel Service, Inc.)

- World Pet Travel

Definitive Strategic Imperatives and Best Practice Frameworks to Drive Growth, Enhance Efficiency, and Foster Sustainability in the Animal Transportation Sector

To thrive in an environment characterized by regulatory complexity and rising customer expectations, industry leaders must adopt a set of cohesive strategic imperatives. First, investing in end-to-end digital platforms that provide comprehensive tracking, predictive analytics, and automated compliance checks will streamline operations and enhance transparency for both commercial and individual clients. By leveraging data insights to anticipate delays and proactively manage welfare parameters, carriers can differentiate through elevated service reliability.

Moreover, strengthening partnerships with veterinary and biosecurity experts is critical for reinforcing animal health protocols and emergency response capabilities. Cross-sector collaborations can facilitate standardized handling procedures and unified documentation, ultimately reducing transit times and mitigating risk. In addition, expanding multimodal networks-particularly integrating optimized rail-air and road-sea sequences-enables companies to balance cost pressures from tariff regimes with the need for prompt delivery and welfare adherence.

Finally, embedding sustainability into core business models-through investments in low-emission vehicles, carbon footprint tracking, and industry certifications-will align operations with emerging regulatory frameworks and stakeholder expectations. By pursuing this holistic set of recommendations, industry leaders can drive operational efficiency, fortify compliance, and capture new growth opportunities in the evolving animal transportation sector.

Detailing a Rigorous Multi-Stage Research Framework Combining Primary Stakeholder Interviews and Secondary Data Validation to Ensure Insight Reliability

This study employs a multi-stage methodology designed to ensure the integrity, relevance, and depth of insights delivered. Primary research was conducted through structured interviews and roundtable discussions with over 50 senior executives spanning carriers, veterinary authorities, wildlife conservation bodies, and agribusiness operators. These engagements provided firsthand perspectives on operational challenges, technology adoption, and regional regulatory dynamics.

Complementing primary inputs, secondary research encompassed a rigorous review of governmental regulations, industry white papers, and peer-reviewed journals to validate emerging trends and benchmark best practices. Trade association publications and international standards documentation were scrutinized to map key compliance frameworks across major markets. Furthermore, a proprietary database of carrier performance metrics and service portfolios was analyzed to identify strategic differentiators and competitive patterns.

Throughout, data triangulation techniques were applied to reconcile discrepancies between primary and secondary sources, ensuring consistency and accuracy. Finally, expert validation sessions with a select advisory panel refined the report’s conclusions and verified actionable recommendations. This comprehensive methodological approach guarantees that the findings presented reflect both granular operational realities and broader strategic imperatives, equipping stakeholders with reliable intelligence for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Transportation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Transportation Market, by Animal Type

- Animal Transportation Market, by Transportation Mode

- Animal Transportation Market, by Service Type

- Animal Transportation Market, by End User

- Animal Transportation Market, by Region

- Animal Transportation Market, by Group

- Animal Transportation Market, by Country

- United States Animal Transportation Market

- China Animal Transportation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Illuminate Future-Ready Strategies and Opportunities Within the Continuously Evolving Animal Transportation Landscape

The animal transportation landscape stands at a pivotal juncture where technological advancement, regulatory evolution, and stakeholder expectations converge to redefine industry norms. Insights gleaned from this study highlight the necessity for carriers and shippers to embrace digital visibility tools, fortify welfare protocols, and navigate tariff structures with precision. Additionally, segmentation and regional analyses reveal that bespoke service offerings, tailored to specific animal types and localized regulatory environments, unlock superior efficiency and customer satisfaction.

Looking ahead, organizations that integrate sustainable practices and collaborative partnerships will not only meet emerging compliance mandates but also foster brand trust and resilience against market disruptions. By synthesizing the core findings across transformative shifts, tariff impacts, and strategic responses, this concluding section underscores the imperatives for agility, innovation, and customer-centricity.

In sum, decision-makers equipped with the strategic frameworks outlined herein will be well positioned to capture evolving opportunities, mitigate risks, and chart a forward-looking trajectory in an industry defined by constant change and profound responsibility.

Seize Specialized Market Intelligence and Transform Your Strategy by Engaging with Ketan Rohom for a Detailed Animal Transportation Industry Analysis Report

To gain a decisive advantage in navigating the complexities of today’s animal transportation environment, we invite decision-makers to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. By partnering with Ketan, organizations will access a meticulously crafted report that blends rigorous research, real-world case studies, and strategic insights tailored to inform critical investment and operational decisions. Whether addressing cross-border compliance, vehicle optimization, or end-user satisfaction, this comprehensive analysis delivers actionable intelligence necessary to refine business models and anticipate market shifts. Engage now to secure proprietary data, expert interpretation, and a competitive roadmap that ensures your organization remains at the forefront of this dynamic sector. Make contact today to procure the full report and advance your strategic objectives with unparalleled confidence.

- How big is the Animal Transportation Market?

- What is the Animal Transportation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?