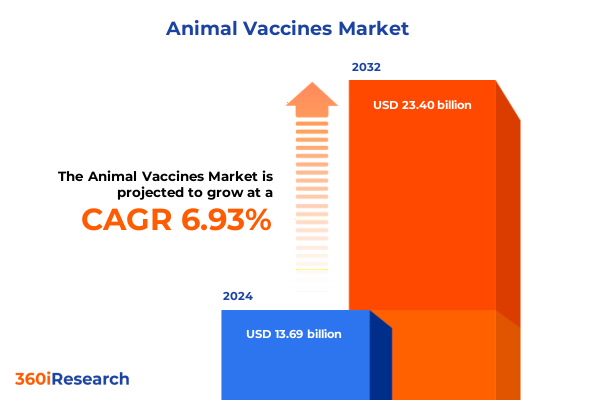

The Animal Vaccines Market size was estimated at USD 14.58 billion in 2025 and expected to reach USD 15.53 billion in 2026, at a CAGR of 6.99% to reach USD 23.40 billion by 2032.

Understanding the Urgent Need and Strategic Importance of Animal Vaccines in Safeguarding Livestock and Companion Animal Health

The global animal vaccine market is at a pivotal juncture, driven by the convergence of heightened disease surveillance, evolving pathogen dynamics, and expanding adoption of advanced immunization technologies. In recent years, outbreaks of highly pathogenic avian influenza, foot-and-mouth disease, and emerging zoonoses such as porcine reproductive and respiratory syndrome have underscored the strategic importance of robust vaccination programs across both livestock and companion animal segments. Simultaneously, growing consumer awareness of food safety and animal welfare has prompted regulatory bodies and industry stakeholders to prioritize preventive measures that safeguard animal health and public well-being.

Within this context, the animal health industry is experiencing accelerated innovation, exemplified by breakthroughs in vaccine platforms and delivery systems. Pharmaceutical leaders and biotechnology startups alike are investing heavily in next-generation vaccines that promise enhanced efficacy, broader protection, and streamlined administration. As a result, veterinarians, producers, and pet owners are better equipped to combat existing diseases and preemptively address emerging threats. This introductory section sets the stage for a comprehensive analysis of market dynamics, transformative trends, policy implications, and strategic considerations essential for stakeholders seeking to navigate and thrive in this rapidly evolving landscape.

Exploring Major Technological and Collaborative Transformations That Are Redefining the Animal Vaccine Landscape Globally

Recent advancements in vaccine science have ushered in transformative shifts that are redefining the animal vaccine landscape. Among the most notable developments, mRNA-based platforms have emerged as a powerful tool for rapid vaccine development and scalable production. The U.S. government’s allocation of $590 million to Moderna for its H5N1 mRNA bird flu vaccine exemplifies this shift, underscoring confidence in messenger RNA’s potential to deliver targeted, adaptable immunizations on unprecedented timelines. Similarly, Merck Animal Health’s USDA approval of its NOBIVAC® NXT Canine Flu H3N2 vaccine highlights the first commercial application of RNA-particle technology in veterinary medicine, signaling a new era of precision vaccination that leverages synthetic biology for optimized immune responses.

Alongside genetic vaccines, the industry is witnessing growing investment in recombinant platforms and vector technologies. In Asia-Pacific, over 40% of regional manufacturers are actively integrating alternative delivery systems such as needle-free oral and intranasal formulations to improve compliance and animal welfare. This diversification of vaccine modalities reflects an emphasis on field-readiness and cost-efficiency, especially in resource-constrained settings.

Regulatory frameworks are evolving to accommodate these novel modalities, with agencies streamlining conditional licensing pathways for emergency and high-consequence disease vaccines. In parallel, supply chain decentralization and domestic manufacturing initiatives are gaining momentum, mitigating risks associated with international trade tensions. Collectively, these transformative shifts are converging to enable faster response to disease outbreaks, bolster supply chain resilience, and expand access to life-saving immunizations across diverse animal populations.

Assessing the Cumulative Impact of New U.S. Tariff Policies on Animal Vaccine Supply Chains, Cost Structures, and Clinical Practices

In 2025, a series of tariff adjustments implemented by U.S. trade authorities have exerted significant pressure on the animal vaccine supply chain, disrupting cost structures and clinical practices. Following policy changes under the current administration, the average U.S. tariff rate rose dramatically from 2.5% to approximately 27%, marking the highest level recorded since the early 20th century. Although certain veterinary drugs and immunobiologics have been granted exemptions, the majority of raw ingredients and finished vaccine doses imported from major manufacturing hubs remain subject to these elevated duties.

Veterinary distributors operating on narrow margins have found it challenging to absorb the added costs, leading to immediate downstream impacts on end-users. Distributors report that a 25% tariff on imported bulk antigens and adjuvants has necessitated price increases for clinics and producers in order to maintain operational viability. These rising expenses have forced some veterinary practices to reevaluate inventory levels and seek local sourcing alternatives, despite limited domestic production capacity for specialized vaccine platforms.

On the clinical front, practitioners have begun to witness shifts in preventive care protocols as cost-sensitive clients defer or modify vaccine programs. Large-animal veterinarians warn that even modest price hikes can lead to postponements in critical immunization schedules, risking herd immunity gaps and potential disease resurgence. As the tariff environment continues to evolve, stakeholders across the value chain are exploring strategic responses that balance cost-containment with the imperative to sustain robust animal health outcomes.

Uncovering Market Dynamics Through In‐Depth Analysis of Product Platforms, Animal Categories, Disease Targets, Administration Routes, and Distribution Channels

A nuanced understanding of market segmentation reveals critical insights into the drivers of vaccine adoption and innovation. When examining product categories, inactivated formulations remain foundational for many bacterial and viral disease prevention efforts, particularly in large-scale livestock operations. Live attenuated vaccines continue to play a central role where durable, broad-spectrum immunity is required, while the emergence of mRNA vaccines has introduced a high-flexibility option for rapid strain updates. Recombinant platforms have gained traction for challenging targets, and subunit vaccines offer safety advantages in sensitive populations.

Segmentation by animal type highlights distinct market needs and development trajectories. Companion animals, specifically cats and dogs, are integral to the revenue mix for many manufacturers, driving demand for specialized parasitic and viral immunizations. In contrast, livestock segments encompassing cattle, poultry, sheep, and swine rely on robust vaccination schedules paired with biosecurity measures to maintain herd and flock health at scale.

Deconstructing disease categories further clarifies product prioritization. Bacterial infections such as Clostridial and E. coli demand inactivated and toxoid approaches, while leptospirosis and Pasteurella vaccines underpin herd protection strategies. Parasitic challenges, including ectoparasites and endoparasites, have catalyzed interest in novel antigen constructs. Viral infections ranging from avian influenza strains to foot-and-mouth disease and rabies drive diversified R&D pipelines focused on both live and subunit formulations.

Route of administration and distribution channels are equally pivotal. Injectable vaccines delivered intramuscularly, intravenously, or subcutaneously dominate high-volume livestock applications, whereas oral vaccines offer practical advantages in mass administration. Tertiary distribution through online pharmacies, retail drugstores, and veterinary clinics underscores the importance of channel optimization to ensure timely access and compliance across end-user segments.

This comprehensive research report categorizes the Animal Vaccines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Animal Type

- Disease Type

- Route of Administration

- Distribution Channel

Revealing Distinct Growth Drivers and Investment Priorities Across the Americas, Europe Middle East & Africa, and Asia-Pacific Animal Vaccine Markets

Across the Americas, strategic investments by government agencies and private consortia are strengthening disease preparedness and vaccine accessibility. The U.S. Department of Agriculture’s Animal and Plant Health Inspection Service allocated $22.2 million under the 2018 Farm Bill to enhance prevention, early detection, and rapid response capabilities for high-consequence animal diseases. By funding state-led diagnostic network expansions and replenishing countermeasure stockpiles, APHIS is reinforcing national biosecurity and supporting domestic vaccine stability.

In Europe, the regulatory landscape governed by the European Medicines Agency fosters uniform quality standards and encourages cross-border collaborations. As of 2024, approximately 48 million cattle and 80 million pigs have received scheduled vaccinations, reflecting the region’s commitment to controlling zoonotic threats and ensuring trade continuity. High per-capita pet ownership and stringent animal health laws further drive demand for premium vaccine platforms in Western Europe, while Eastern European markets exhibit significant growth potential fueled by rising agricultural investments.

The Asia-Pacific region is emerging as a growth powerhouse, underpinned by rapid urbanization, expanding livestock populations, and robust government support. Local manufacturers are scaling inactivated vaccine production and pioneering recombinant approaches to address endemic and pandemic threats. Moreover, more than 40% of regional producers are integrating digital health monitoring tools to optimize immunization schedules and improve animal welfare outcomes. Country-specific initiatives, such as tailored foot-and-mouth disease programs in Southeast Asia, underscore the region’s strategic focus on customized vaccine solutions.

This comprehensive research report examines key regions that drive the evolution of the Animal Vaccines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Product Approvals, Capacity Expansions, and Technological Breakthroughs by Leading Animal Vaccine Companies

Leading animal health companies are actively reshaping market trajectories through targeted product launches, capacity expansions, and research investments. Zoetis received a conditional USDA license for its Avian Influenza Vaccine, H5N2 Subtype, Killed Virus for chickens, enabling critical emergency response capabilities in the face of HPAI outbreaks that have affected over 150 million birds since 2022. This approval reflects Zoetis’s commitment to delivering high-impact biologics and supporting national stockpile replenishment efforts.

Merck Animal Health has committed $895 million to expand its De Soto, Kansas biologics manufacturing facility, enhancing freeze-drying and filling capacities for large-molecule vaccines and strengthening U.S. production resilience. Complementing this, the company inaugurated a $1 billion vaccine manufacturing site in Durham, North Carolina, to bolster domestic supply amid shifting trade policies. In the companion animal segment, Merck’s USDA-approved NOBIVAC® NXT Canine Flu H3N2 vaccine represents the first RNA-particle technology platform in veterinary medicine, providing a new frontier in precision immunization.

Elanco Animal Health unveiled its TruCan Ultra CIV bivalent canine influenza vaccine, covering both H3N2 and H3N8 strains, and securing USDA approval in July 2025. This launch offers broader protection and addresses a critical need for socially active dogs and those with respiratory vulnerabilities. Concurrently, Elanco’s $130 million investment to expand its Elwood, Kansas facility underscores the company’s focus on scaling monoclonal antibody and vaccine capacity to support future innovation pipelines.

Boehringer Ingelheim introduced VAXXITEK® HVT+IBD+H5, a trivalent poultry vaccine leveraging COBRA technology to deliver cross-clade protection against H5 avian influenza alongside immunity against Marek’s disease and Infectious Bursal Disease. The vaccine’s hatchery-based administration and DIVA capabilities underscore Boehringer’s dedication to holistic and sustainable poultry health solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Vaccines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Biogénesis Bagó S.A.

- BioVaxys Technology Corporation

- Boehringer Ingelheim International GmbH

- Brilliant Bio Pharma Private limited

- Ceva Santé Animale

- China Animal Husbandry Industry Co., Ltd.

- Dalan Animal Health

- Elanco Animal Health Inc.

- Endovac Animal Health, LLC by Immvac Inc.

- Hester Biosciences Limited

- HIPRA, S.A.

- Indian Immunologicals Limited

- Kemin Industries, Inc.

- Merck KGaA

- Neogen Corporation

- Phibro Animal Health Corporation

- SAN Vet Holding GmbH

- Sanofi S.A.

- Seppic S.A.

- Torigen Pharmaceuticals Inc.

- Vaxxinova GmbH

- VEROVACCiNES GmbH

- Vetigenics, LLC

- Vetoquinol SA

- Virbac, Inc.

- Zoetis Inc.

Delivering Strategic Recommendations for Industry Leaders to Enhance Resilience, Accelerate Innovation, and Optimize Market Differentiation

Industry leaders must adopt a proactive stance to mitigate market uncertainties and capitalize on evolving opportunities. First, companies should diversify their supply chains by developing regional manufacturing hubs and forging partnerships with contract development and manufacturing organizations. This strategy reduces exposure to tariff risks and shipping delays while enhancing local regulatory alignment.

Second, organizations should accelerate investment in advanced platform technologies, including mRNA, RNA-particle, and recombinant vaccines. By integrating modular production capabilities and flexible production lines, companies can respond rapidly to disease emergences and support real-time strain updates. Third, engaging with regulatory authorities to streamline conditional approval pathways and harmonize DIVA standards will facilitate faster market entry and broader adoption of innovative immunizations.

Fourth, industry stakeholders must deepen customer engagement through digital health platforms that support vaccine tracking, cold-chain monitoring, and compliance analytics. These tools not only improve vaccination coverage but also generate actionable data to refine future product iterations. Finally, decision-makers should leverage segmentation insights to tailor portfolios to specific animal populations, disease burdens, and distribution channels, ensuring that resource allocation aligns with market needs and maximizes return on R&D investment.

Detailing the Robust Mixed-Method Research Approach That Underpins Accuracy and Insight in Animal Vaccine Market Analysis

This executive summary is built upon a rigorous research methodology that combines quantitative and qualitative approaches. Secondary research included analysis of regulatory filings, government press releases, and peer-reviewed publications to validate disease incidence, funding allocations, and approval pathways. Primary interviews with veterinary practitioners, supply chain executives, and R&D leaders provided contextual insights into real-world challenges and adoption drivers.

Market segmentation and regional trends were corroborated through data triangulation, integrating independent industry reports, official USDA and APHIS disclosures, and company press releases. Financial and operational metrics for leading companies were cross-verified with regulatory databases and investor presentations to ensure accuracy. Furthermore, comparative analysis of trade policies, tariff schedules, and legislative frameworks was conducted to assess the macroeconomic environment influencing the animal vaccine landscape.

The research process adhered to established best practices in market intelligence, including iterative validation cycles, peer reviews, and sensitivity analyses to stress-test assumptions. This comprehensive approach ensures that the findings and strategic recommendations presented herein are robust, relevant, and actionable for stakeholders across the animal health ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Vaccines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Vaccines Market, by Product

- Animal Vaccines Market, by Animal Type

- Animal Vaccines Market, by Disease Type

- Animal Vaccines Market, by Route of Administration

- Animal Vaccines Market, by Distribution Channel

- Animal Vaccines Market, by Region

- Animal Vaccines Market, by Group

- Animal Vaccines Market, by Country

- United States Animal Vaccines Market

- China Animal Vaccines Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Core Market Findings and Strategic Implications to Guide Decision Makers in Animal Vaccine Innovation

The animal vaccine market is experiencing a period of profound transformation driven by technological breakthroughs, regulatory evolution, and shifting trade dynamics. Platforms such as mRNA and RNA-particle vaccines are redefining development timelines, while domestic manufacturing initiatives and strategic supply chain realignments are mitigating risks posed by tariff volatility. Segmentation analyses reveal diverse needs across product types, animal categories, disease targets, and distribution channels, underscoring the importance of tailored strategies for maximum impact.

Regional insights illustrate a landscape of both maturity and emerging opportunity, with North America’s robust government support complementing Europe’s regulatory harmonization and Asia-Pacific’s rapid market expansion. Leading companies are responding with aggressive investments in production capacity, strategic product approvals, and collaborative partnerships, positioning themselves to capture growth across companion and livestock segments.

To succeed in this dynamic environment, industry participants must embrace agile innovation frameworks, deepen customer-centric engagement, and pursue diversified sourcing models. By aligning R&D and commercial efforts with evolving disease landscapes and policy priorities, stakeholders can ensure sustainable market leadership and advance global animal health objectives.

Contact Ketan Rohom to Secure the Animal Vaccine Market Research Report and Unlock Tailored Strategic Insights

For an in-depth exploration of the opportunities and challenges in the animal vaccine market, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your access to the comprehensive research report. Ketan can guide you through customized insights and strategic frameworks designed to support your organization’s objectives, whether you seek to refine your market entry strategy, optimize product portfolios, or navigate complex regulatory and trade environments. Engage with Ketan to discuss tailored data solutions, subscription options, and how this detailed analysis can empower your decision-making. Elevate your approach to animal vaccine innovation by connecting with Ketan Rohom for a personalized consultation and report purchase experience.

- How big is the Animal Vaccines Market?

- What is the Animal Vaccines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?