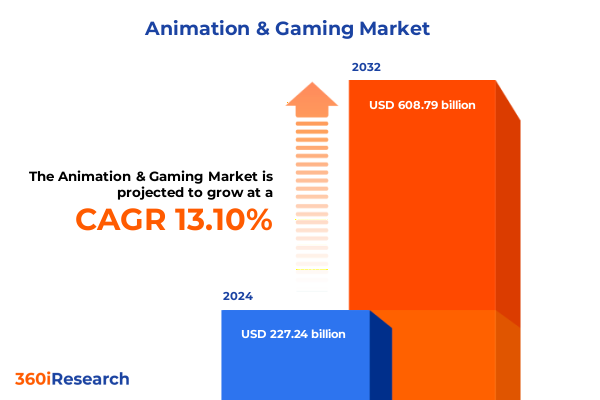

The Animation & Gaming Market size was estimated at USD 255.56 billion in 2025 and expected to reach USD 287.74 billion in 2026, at a CAGR of 13.20% to reach USD 608.79 billion by 2032.

Setting the Stage for Industry Evolution by Exploring Critical Dynamics and Emerging Forces Shaping the Future of Animation and Gaming Experiences

The animation and gaming industries are undergoing a profound metamorphosis driven by technological breakthroughs, evolving consumer behaviors, and converging creative disciplines. As traditional boundaries between content creation and interactive entertainment continue to blur, stakeholders across the value chain must adapt to an environment characterized by rapid innovation and complex regulatory landscapes. This executive summary sets the stage by framing the critical factors currently shaping the sector’s trajectory, from the rise of immersive experiences to the integration of artificial intelligence in content workflows.

In recent years, studios and developers have navigated a landscape where consumer expectations are elevated by advancements in visualization, real-time rendering, and network capabilities. Audience engagement metrics have become increasingly sophisticated, reflecting shifts toward personalized, on-demand content consumption. Concurrently, emerging business models in subscription services, cloud deployments, and cross-platform monetization have opened new revenue streams while challenging established paradigms. Against this backdrop, mergers, partnerships, and strategic alliances are proliferating as companies seek to consolidate capabilities and expand market reach.

Drawing on the latest industry data and regulatory developments, this introduction provides a concise yet comprehensive overview of the forces influencing production pipelines, distribution channels, and user engagement strategies. It lays the foundation for subsequent sections, which delve deeper into transformative shifts, policy impacts, segmentation insights, regional dynamics, company strategies, actionable recommendations, research methodologies, and forward-looking conclusions.

Uncovering the Pivotal Technological, Demographic, and Creative Transformations That Are Redefining How Audiences Engage with Animation and Gaming

The animation and gaming ecosystem is being redefined by a series of interconnected transformations spanning creative techniques, distribution infrastructures, and audience demographics. On the technological front, real-time engines originally designed for game development are now integral to animation pipelines, enabling iterative content creation and enhanced visual fidelity. This convergence has accelerated rendering speeds and democratized access to sophisticated tools, empowering independent creators and bolstering competitive differentiation.

Simultaneously, augmented reality and virtual reality are no longer niche experiences but are moving toward mainstream adoption as hardware becomes more affordable and content variety expands. Mobile gaming has tapped into these immersive formats, leading to experiential narratives that blend physical and virtual environments. Cloud gaming platforms have also matured, delivering high-end experiences on low-spec devices and expanding the potential addressable audience.

Demographically, the consumer base is broadening as the above-35 age group exhibits increased engagement, drawn by simulations and narrative-driven content, while the youth segment gravitates toward dynamic, social experiences such as battle royale and streaming-enabled play. Gen Z and millennials are influencing design philosophy, demanding authenticity, social connectivity, and community-driven content. Creators are responding by integrating live-service mechanics, episodic storytelling, and user-generated content frameworks.

In this shifting landscape, cross-industry collaborations between educational institutions, entertainment companies, and advertising agencies are pioneering new forms of branded experiences. As distribution channels diversify-from direct downloads to streaming services-stakeholders must navigate a multichannel environment that prioritizes flexibility, performance optimization, and seamless user interfaces. These transformative shifts underscore the need for agile strategies to capitalize on emerging opportunities and mitigate evolving challenges.

Assessing the Effects of 2025 United States Tariff Policy on Production, Distribution, and Cost Structures in the Animation and Gaming Sectors

In early 2025, a new set of tariff policies imposed by the United States government introduced import duties on select hardware components, software services, and digital goods associated with animation and gaming production. The rationale centered on protecting domestic manufacturing of semiconductors and promoting local content creation. However, the downstream effects have been multifaceted, influencing cost structures, supply chain resilience, and distribution strategies.

Production studios that rely on imported GPUs, specialized processors, and motion capture equipment have encountered incremental cost pressures. These expenditures are being partially absorbed through internal efficiencies and workflow automation, yet many organizations have had to reroute procurement processes toward alternative suppliers in regions with favorable trade agreements. Consequently, lead times for critical components have increased, prompting studios to rethink inventory management and invest in predictive analytics to forecast demand fluctuations.

On the distribution side, digital storefronts have adjusted pricing models to reflect new cost baselines, affecting consumer purchasing power and in-game monetization strategies. Subscription services and cloud gaming providers have explored localized data centers and regional licensing agreements to mitigate cross-border tariff implications. While some companies have negotiated tariff exemptions or leveraged FTAs to secure reduced rates, others have realigned content release schedules to synchronize with promotional windows outside peak tariff periods.

Despite the initial headwinds, this environment has catalyzed a reevaluation of global partnerships and supply chain configurations. Studios are increasingly forging alliances with domestic component manufacturers and exploring onshore production facilities for hardware peripherals. The cumulative impact of these tariff measures has underscored the importance of diversified sourcing, agile cost-management frameworks, and regulatory monitoring to sustain operational continuity.

Illuminating In-Depth Segmentation Insights Spanning Offerings, Platforms, Demographics, Content Types, End-Users, and Distribution Channels in the Industry

The industry’s complexity is best understood by examining segmentation across multiple dimensions, each revealing unique dynamics and growth vectors. When considering offerings, animation encompasses a spectrum from traditional 2D workflows to advanced 3D environments, motion graphics, and artisanal stop motion techniques. Each subcategory draws on distinct skill sets and toolchains, with 3D animation advancing rapidly through procedural generation and physics-based simulation, while motion graphics emphasizes data visualization and branding applications. Gaming, by contrast, spans formats from AR-driven mobile titles to graphically intensive console and PC experiences, with cloud gaming emerging as a transformative force that decouples hardware constraints.

Platform segmentation unveils divergent usage patterns and technical requirements. Console gaming is dominated by flagship hardware, including Nintendo Switch’s hybrid design, PlayStation’s next-gen capabilities, and Xbox’s ecosystem integration. Mobile experiences on Android and iOS are optimized for touch interfaces and location-based services, while PC gaming on Windows, MacOS, and Linux caters to a mix of casual and hardcore audiences. The web-based segment leverages browser technologies, with HTML5 facilitating cross-device compatibility and browser-based engines supporting lightweight, instant-play titles.

Age-based segmentation highlights the varied content preferences across life stages. The under-18 demographic gravitates toward high-energy, competitive action and social interaction, whereas the 18 to 35 age group balances social gaming with immersive narrative experiences. Above-35 consumers increasingly seek simulation and adventure genres that offer strategic depth and real-world application themes. Content-type segmentation further refines these preferences by classifying titles as action, adventure, or simulation. Action gaming subdivides into fighting, shooter, and survival mechanics, while adventure titles span platformers, puzzle-based challenges, and role-playing epics, and simulation experiences range from construction and management to life simulation and vehicle operation.

The end-user dimension differentiates enterprise applications-such as virtual production pipelines for media companies, educational gamification in institutions, and branded experiences by advertising agencies-from individual consumer entertainment. Distribution channels round out the segmentation framework by delineating direct download models, online storefront aggregators, and streaming services that provide subscription or ad-supported access. This holistic segmentation analysis illuminates critical inflection points where targeted investments and tailored strategies can unlock value and enhance market positioning.

This comprehensive research report categorizes the Animation & Gaming market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offerings

- Gaming Platform

- Age Group

- Content Type

- End-User

- Distribution Channel

Comparative Regional Dynamics Highlighting Market Behaviors and Growth Drivers across the Americas, Europe Middle East and Africa and Asia-Pacific Territories

Regional dynamics reveal that growth trajectories and operational priorities differ markedly across the Americas, Europe Middle East & Africa, and Asia-Pacific markets. In the Americas, the United States remains a global hub for both animation production and gaming innovation, buoyed by a robust ecosystem of independent studios and established publishers. Canada continues to attract multinational investments due to favorable tax incentives and a deep talent pool, while Latin American markets are emerging as hubs for outsourcing, localization services, and cost-effective content development.

In Europe Middle East & Africa, Western European nations lead in adopting cutting-edge technologies, with the United Kingdom and Germany driving immersive media research and supporting strong indie developer communities. The region’s regulatory environment emphasizes data privacy, content standards, and consumer protection, influencing monetization frameworks and cross-border distribution. Emerging markets in Eastern Europe and the Middle East are gaining traction through government-backed creative incubators, while African nations are demonstrating rapid mobile adoption, laying the groundwork for local gaming ecosystems and digital storytelling traditions.

Asia-Pacific stands out for its scale and diversity, with mature markets in Japan and South Korea pioneering console and PC gaming, and a burgeoning mobile-first culture across Southeast Asia. China’s accelerated embrace of cloud gaming and live-streamed content has reshaped consumption models, fostering integrated social commerce and in-game economies. Meanwhile, Australia and New Zealand serve as strategic testbeds for new formats and regulatory sandbox environments. Across the region, public-private partnerships are supporting skills development, infrastructure expansion, and cross-border IP collaborations, reinforcing Asia-Pacific’s central role in the industry’s evolution.

This comprehensive research report examines key regions that drive the evolution of the Animation & Gaming market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Strategic Postures, Collaborative Ventures, and Innovation Pipelines of Leading Animation and Gaming Enterprises Steering Industry Growth

The sector’s competitive landscape features a blend of long-standing conglomerates and agile newcomers, each employing distinct strategies to capture audience attention and monetize digital experiences. Major console manufacturers continue to invest heavily in exclusive titles and hardware innovations, leveraging subscription bundles and ecosystem lock-in to maximize lifetime value. Studio giants are integrating transmedia storytelling across film, television, and interactive platforms, creating immersive franchises that span multiple touchpoints.

In animation, leading production houses are collaborating with technology firms to integrate machine learning into rigging, texture generation, and voice synthesis workflows, thus reducing manual effort and accelerating project timelines. Gaming publishers are augmenting traditional development roadmaps with live-service content, seasonal events, and user-generated modding platforms that foster community engagement and retention. Independent developers are increasingly securing funding through venture capital and crowdfunding, focusing on niche genres and storytelling experiments that differentiate them from mainstream offerings.

Mergers and strategic alliances are reshaping the competitive field, with cross-border partnerships facilitating content localization and joint R&D investments. Specialized middleware providers and engine developers are forging co-marketing agreements with platform operators to embed proprietary tools in next-gen workflows. Furthermore, major cloud service providers are deepening ties with gaming and animation studios to offer integrated solutions spanning compute, storage, AI, and analytics, thereby streamlining end-to-end pipelines.

These strategic postures illustrate a broader trend toward convergence, as companies seek to bundle creative assets, technology stacks, and distribution channels into cohesive offerings. Understanding these competitive maneuvers is essential for identifying collaboration prospects and anticipating shifts in market dominance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animation & Gaming market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aardman Animations Limited

- Activision Blizzard Inc. by Microsoft Corp.

- Adobe Inc.

- Anibrain Digital Technologies Private Limited

- Bandai Namco Entertainment Inc.

- Bonfire Studios, Inc.

- Electronic Arts Inc.

- Epic Games, Inc.

- Framestore Limited

- Kevuru Games

- NCSOFT Corporation

- NetEase Inc.

- Nintendo Co. Ltd.

- Reliance Industries Ltd.

- Sony Group Corporation

- Take-Two Interactive Software, Inc.

- Technicolor Group

- The Foundry Visionmongers Ltd.

- The Walt Disney Company

- TOEI ANIMATION Co. Ltd.

- Toonz Media Group

- Unity Technologies

- Valve Corporation

- WB Television Group

Charting Strategic Roadmaps and Tactical Initiatives Industry Leaders Must Embrace to Capitalize on Emerging Opportunities in Animation and Gaming

Industry players must prioritize strategic investments in next-generation technologies, with particular emphasis on AI-driven asset creation, real-time rendering, and cloud-based delivery frameworks. Cultivating partnerships with semiconductor manufacturers and cloud providers will enhance supply chain resilience and performance scalability. At the same time, fostering interoperability standards and open APIs can reduce friction between tools, platforms, and user ecosystems.

A proactive approach to regulatory engagement is also critical. Leaders should establish ongoing dialogues with policymakers to influence tariff frameworks and content regulations, ensuring that industry perspectives are considered in trade negotiations and intellectual property discussions. By participating in cross-industry consortia, organizations can collectively advocate for balanced policies that promote innovation while protecting domestic interests.

From a talent perspective, developing multidisciplinary curricula that combine technical, creative, and business skills will address emerging competency gaps. Collaboration with educational institutions and vocational programs can facilitate workforce pipelines equipped to handle advanced production techniques and data-driven decision-making. Meanwhile, implementing internal upskilling initiatives, mentorship programs, and knowledge-sharing platforms will bolster organizational agility and foster a culture of continuous improvement.

Finally, a customer-centric mindset is paramount. Executives should leverage advanced analytics and community feedback loops to refine content roadmaps, pricing models, and loyalty programs. By aligning product development cycles with nuanced consumer insights and testing emerging features in sandbox environments, companies can accelerate time to market, enhance user satisfaction, and secure long-term engagement.

Detailing Rigorous Qualitative and Quantitative Research Approaches Employed to Gather, Validate, and Analyze Data Driving Animation and Gaming Market Insights

This report’s findings are underpinned by a rigorous research methodology that integrates both qualitative and quantitative approaches to ensure robustness and reliability. Primary research included in-depth interviews with studio executives, technology providers, policy analysts, and end users across major markets. These dialogues provided firsthand perspectives on operational challenges, adoption drivers, and strategic priorities.

Secondary research involved the systematic review of industry publications, technology whitepapers, regulatory filings, and financial disclosures. Cross-referencing multiple data sources enabled triangulation of insights and validation of trends related to tariffs, regional policies, and segment growth dynamics. Special attention was paid to international trade reports and customs records to quantify the impact of new tariff measures on hardware imports and service agreements.

Analytical frameworks such as SWOT analysis, scenario planning, and technology readiness assessments facilitated comprehensive evaluations of market drivers and barriers. Segmentation matrices were developed to map out submarket interactions across offerings, platforms, demographics, content types, end users, and distribution channels. Regional impact models incorporated macroeconomic indicators, digital infrastructure indices, and regulatory environments to illustrate comparative market behaviors.

Throughout the process, data integrity protocols ensured that only credible, up-to-date information was included. All sources were vetted for relevance, recency, and methodological transparency. The resulting insights reflect a balanced synthesis of qualitative narratives and quantitative evidence, equipping decision makers with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animation & Gaming market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animation & Gaming Market, by Offerings

- Animation & Gaming Market, by Gaming Platform

- Animation & Gaming Market, by Age Group

- Animation & Gaming Market, by Content Type

- Animation & Gaming Market, by End-User

- Animation & Gaming Market, by Distribution Channel

- Animation & Gaming Market, by Region

- Animation & Gaming Market, by Group

- Animation & Gaming Market, by Country

- United States Animation & Gaming Market

- China Animation & Gaming Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Synthesizing Key Learnings and Forward-Looking Perspectives That Empower Stakeholders to Navigate the Evolving Animation and Gaming Landscape with Confidence

The animation and gaming industries stand at a pivotal junction, where the interplay of technological innovation, policy shifts, and consumer evolution dictates future trajectories. Real-time rendering, AR/VR adoption, and cloud-based delivery are no longer experimental concepts but fundamental components of modern content ecosystems. Tariff policies have underscored the necessity of supply chain diversification and regulatory foresight, while segmentation analysis reveals diverse consumer preferences that demand tailored strategies.

Regional variations highlight both global interconnectedness and local nuances, from the Americas’ production hubs to Europe Middle East & Africa’s regulatory mosaic and Asia-Pacific’s scale-driven growth. Competitive strategies are coalescing around convergence, with leading firms bundling creative and technological assets to create end-to-end solutions. Yet, the one constant remains the audience: their appetite for immersive, authentic, and socially integrated experiences continues to drive innovation.

As stakeholders chart the path forward, they must balance efficiency with creativity, compliance with agility, and global ambitions with regional sensitivities. This synthesis of key learnings and forward-looking perspectives empowers decision makers to navigate uncertainties, seize opportunities, and forge resilient strategies that will define the next era of animation and gaming.

Take Action Now to Secure Your Comprehensive Market Research Report on the Animation and Gaming Industry Insights by Engaging with Ketan Rohom for Strategic Support

Don’t miss the opportunity to deepen your understanding of the rapidly evolving animation and gaming arenas through a comprehensive market research report tailored to your strategic needs. Engaging with Ketan Rohom will connect you directly with an expert who can guide you through key findings, answer any inquiries, and align insights with your unique business objectives.

By collaborating with Ketan Rohom, you will gain clarity on critical trends, regulatory impacts, technology trajectories, and consumer behaviors that are shaping industry dynamics. This personalized engagement ensures that you can leverage actionable intelligence to drive innovation, optimize resource allocation, and strengthen competitive positioning.

Initiate the next phase of your growth strategy by securing this detailed report. Reach out to Ketan Rohom today to schedule a consultation, discuss custom research parameters, and unlock the full potential of data-driven decision-making. Elevate your market knowledge, accelerate time to insight, and stay ahead of competitors by leveraging this exclusive collaboration opportunity.

- How big is the Animation & Gaming Market?

- What is the Animation & Gaming Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?