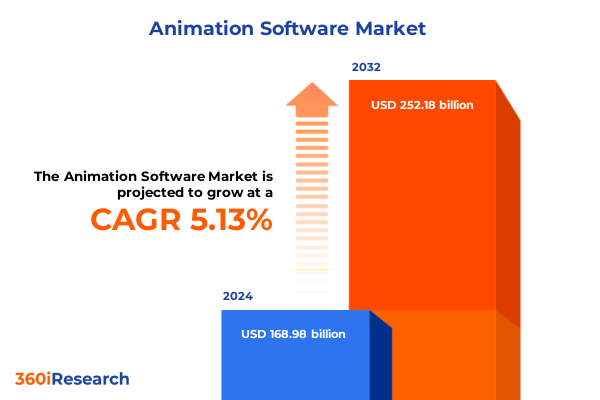

The Animation Software Market size was estimated at USD 174.98 billion in 2025 and expected to reach USD 181.20 billion in 2026, at a CAGR of 5.35% to reach USD 252.18 billion by 2032.

Explore the dynamic evolution of animation software and uncover how cutting-edge tools are reshaping workflows, creativity, and collaboration across industries

In an era defined by digital experiences, animation software has emerged as a cornerstone of content creation across sectors-advertising campaigns, blockbuster films, immersive gaming, and educational platforms are leveraging dynamic visuals to engage audiences and convey complex narratives. Modern animation solutions extend beyond traditional 2D flourishes; they encompass advanced 3D pipelines, motion graphics, and real-time engines that support interactive experiences, underscoring the industry’s pivot towards ever-more sophisticated production workflows

Transitioning from monolithic desktop applications to cloud-native platforms, the animation landscape is witnessing the democratization of creative tools, enabling globally distributed teams to collaborate seamlessly. The convergence of AI-driven automation with real-time rendering capabilities has accelerated production cycles, reduced manual overhead, and empowered artists to focus on storytelling rather than technical hurdles

Unleashing unprecedented capabilities through AI integration, real-time rendering, and cloud collaboration unlocking new frontiers in animation production

Artificial intelligence has rapidly evolved from a theoretical concept into an indispensable asset within animation software, driving significant productivity gains and creative enhancements. Generative AI tools are now capable of automating repetitive tasks-such as frame interpolation, texture creation, and character rigging-liberating artists to focus on high-level storytelling and design work. This trend was highlighted at the 2025 NAB Show, where studios showcased how AI systems are automating post-production indexing and enabling culturally nuanced content localization, transforming AI into a strategic creative partner

Real-time rendering has emerged as a game-changer, allowing animators to visualize complex scenes instantly and iterate in situ without lengthy render farms. By integrating GPU-accelerated engines into mainstream animation suites, artists gain immediate feedback on lighting, shading, and motion, shortening production timelines by up to 40% and fostering iterative experimentation that enhances creative outcomes

Simultaneously, the rise of cloud-based workflows has unlocked global collaboration, enabling geographically dispersed teams to co-author projects in shared environments. Virtual production techniques-combining real-time CG, motion capture, and VR-are breaking down physical boundaries and empowering smaller studios to compete on large-scale productions. These cloud-native platforms streamline asset management and project coordination, reflecting an industry-wide shift towards flexible, on-demand pipelines that scale with project demands

Assessing the broad-reaching consequences of the 2025 United States tariffs on cost structures, supply chains, and strategic decisions in animation software

The United States’ 2025 tariff measures have introduced steep duties on electronic and hardware components imported from key manufacturing hubs such as China, Taiwan, and South Korea, driving up procurement costs for essential animation production equipment. These tariffs, which include rates as high as 34% on tech equipment from China and Taiwan, have exerted upward pressure on costs for servers, GPUs, and networking gear-critical assets for rendering and real-time visualization-thereby reshaping project budgets and procurement strategies

Supply chain disruptions have compelled animation studios and GPU-as-a-Service providers to navigate complex sourcing challenges. While some entities exploit the USMCA assembly loophole to re-export duty-free components assembled in Mexico or Canada, others face delays and unpredictability in hardware delivery schedules. These dynamics are prompting providers to hedge by stockpiling inventory, exploring alternative manufacturing sites, and reevaluating long-term vendor partnerships to maintain operational continuity

Strategically, many organizations are accelerating their shift towards cloud-based rendering and storage to mitigate capital exposure to imported hardware. Concurrent investments in domestic chip production-bolstered by the U.S. CHIPS Act-and diversified vendor portfolios are emerging as best practices. Infrastructure and operations leaders are also adopting hybrid cloud-on-premises architectures to balance cost efficiency with performance requirements, ensuring resilience against future tariff escalations and geopolitical risks

Uncover insights from segmentation across operating systems, licensing models, platforms, software types, applications, deployment modes, and end users

Operating system diversity underpins the animation software ecosystem, where Windows environments continue to dominate corporate studios due to enterprise integration, while Linux platforms gain traction among visual effects houses for their stability and open-source flexibility. Mac OS retains a loyal following among freelance creatives and design studios, driven by its user-friendly interface and seamless integration with industry-standard design tools.

Licensing models have undergone a profound shift, as subscription offerings surpass perpetual licenses in popularity. Recurring fee structures deliver predictable revenue streams for vendors while ensuring animators receive continuous updates, security patches, and new feature rollouts. Nonetheless, legacy perpetual licenses remain relevant for studios with long-term, unchanging production pipelines seeking cost certainty.

Platform segmentation is evolving in tandem with consumption patterns: desktop applications remain essential for high-fidelity renders and complex 3D character work, whereas mobile apps offer creative flexibility for quick edits and concept prototyping on the go. Web-based interfaces are also gaining ground, enabling remote asset review and lightweight animation tasks without local installations.

Software type variation-from motion graphics and stop-motion simulation to immersive 3D and traditional 2D frameworks-caters to a spectrum of creative objectives. Each toolset aligns with unique visual storytelling needs, whether it’s crafting cinematic effects, generating character-driven narratives, or producing educational explainer sequences.

Application-specific capabilities reflect the market’s breadth: advertising and marketing campaigns leverage dynamic visuals to capture audience attention, educational institutions employ animations to simplify complex subjects, film and television studios integrate CGI for narrative depth, and gaming pipelines demand real-time engines and physics-driven interactivity to engage players.

Deployment strategies span cloud-based infrastructures for elastic scaling and collaborative editing, as well as on-premises setups offering maximum data control and security. The choice often hinges on project scale, data sensitivity, and budget constraints.

End-user profiles range from advertising agencies seeking rapid asset production to architecture and engineering firms requiring precision visualization, healthcare organizations utilizing animated models for patient education, and media and entertainment companies aiming for high-impact storytelling. Each user segment drives distinct product requirements, shaping feature roadmaps and support services.

This comprehensive research report categorizes the Animation Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Licensing Model

- Platform

- Software Type

- Application

- Deployment

- End User

Illuminating regional dynamics driving animation software adoption and innovation across the Americas, Europe Middle East Africa, and Asia-Pacific markets

In the Americas, North America stands at the forefront of animation software adoption, buoyed by the presence of leading studios such as Disney, DreamWorks, and Industrial Light & Magic. The region’s robust digital infrastructure, strong creative talent pool, and deep venture capital ecosystem support ongoing innovation in VFX, real-time engines, and AI-driven workflows. The United States alone accounts for the lion’s share of global animation technology investments, reflecting its role as a pioneer in entertainment, gaming, and advertising applications

Europe, the Middle East, and Africa (EMEA) present a nuanced landscape: Western Europe benefits from established media and automotive sectors that leverage animation software for both commercial content and industrial visualization, while markets in the Middle East are experiencing rapid growth driven by infrastructure development and increasing consumption of streaming video content. High-profile initiatives in the UAE and Saudi Arabia are fostering local production studios and creative hubs, expanding the region’s footprint in global animation and VFX collaboration

Asia-Pacific emerges as the fastest-growing market, led by China’s booming media sector and India’s thriving outsourcing ecosystem. Japan and South Korea continue to set benchmarks in film, gaming, and technology integration, while Southeast Asian markets are rapidly adopting cloud-based and AI-powered animation tools to fuel e-learning, advertising, and local entertainment content. This convergence of talent, investment, and technological innovation positions the Asia-Pacific region as the next frontier for scalable, cost-efficient animation production

This comprehensive research report examines key regions that drive the evolution of the Animation Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling animation software leaders unleashing AI-driven creativity, cloud-native workflows, and collaborative tools reshaping digital content production

Adobe maintains its industry leadership by integrating generative AI across its Creative Cloud suite, with recent launches such as the Firefly Video Model enhancing Premiere Pro’s Generative Extend and Media Intelligence features. These tools enable editors to automate clip extension, locate relevant footage in vast archives in seconds, and translate captions into 27 languages, thereby streamlining narrative workflows and global content distribution

Autodesk continues to augment its flagship Maya and 3ds Max applications through strategic AI and cloud innovations. The introduction of the Machine Learning Deformer accelerates character animation by providing real-time deformation approximations, while Flow Animating in Context delivers shot continuity within Maya’s timeline. The addition of the Golaem crowd simulation plugin and expanded OpenUSD support underscores Autodesk’s commitment to scalable, pipeline-integrated solutions

Toon Boom’s Harmony and Storyboard Pro products steer the 2D animation sector forward with Harmony 25’s Breakdown Pose Assistant and non-destructive layer effects, coupled with its new Ember AI toolset which automates masking, image expansion, and resolution upscaling to accelerate scene setup and post-production. These enhancements empower artists to iterate rapidly while preserving artistic intent

As an open-source innovator, Blender continues to foster community-driven development, exemplified by Blender 4.0’s Bone Collections, Asset Shelf, and Cycles light linking capabilities that enhance rigging, asset management, and shader control. With Blender 4.4’s Action Slots feature, animators benefit from a unified Action system that streamlines keyframe workflows, further reinforcing Blender’s role as a versatile, cost-effective animation platform

Epic Games’ Unreal Engine democratizes real-time animation with MetaHuman 5.6 integration and in-editor animation pipeline improvements-featuring Physics Integration in Control Rig and Anim Next’s unified animation framework-enabling high-fidelity digital human creation and dynamic scene authoring directly within the engine environment

This comprehensive research report delivers an in-depth overview of the principal market players in the Animation Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Akeytsu

- Autodesk, Inc.

- Blender Institute B.V.

- Cascadeur

- Clip Studio Paint

- Corel Corporation

- Daz 3D, Inc.

- Epic Games, Inc.

- Foundry Visionmongers Ltd.

- Maxon Computer GmbH

- Moho

- NewTek, Inc.

- NVIDIA Corporation

- Pixologic, Inc.

- Reallusion Inc.

- Side Effects Software Inc.

- Smith Micro Software, Inc.

- Toon Boom Animation Inc.

- Unity Technologies SF

Formulating practical, forward-looking strategies to harness innovation, refine workflows, and strengthen competitive positioning in animation software sectors

Industry leaders should prioritize the integration of AI-driven tools to automate repetitive tasks and enhance creative expression, ensuring teams can focus on high-value storytelling rather than technical complexities. Investment in machine learning deformers, generative rendering, and intelligent asset management will yield efficiency gains and foster innovation.

A robust hybrid infrastructure strategy that balances cloud scalability with on-premises control can mitigate future tariff impacts while optimizing performance. Studios should explore multi-cloud partnerships and leverage regional data centers to maintain resilience against hardware supply disruptions and regulatory shifts.

Tailoring product deployments to specific end-user needs-whether in education, healthcare, or gaming-requires nuanced pricing and licensing models. Offering modular subscription tiers, educational discounts, and enterprise licenses will drive adoption across diverse segments while creating predictable revenue streams.

Building strategic alliances with hardware vendors, technology partners, and local production studios can secure preferential access to emerging technologies and foster collaborative ecosystems. Such collaborations will be critical to navigating geopolitical uncertainties, accelerating R&D efforts, and expanding global market reach.

Finally, cultivating in-house talent through targeted training programs and partnerships with educational institutions will bridge the skills gap. Empowering teams with certification and hands-on experience in AI, virtual production, and real-time engines will ensure sustainable growth and competitive differentiation.

Outlining a rigorous, multi-faceted research methodology combining primary expertise and secondary data to ensure comprehensive market intelligence

This analysis combines primary research-through in-depth consultations with industry experts, creative directors, and technology vendors-with secondary data sourced from reputable publications, regulatory filings, and enterprise whitepapers. Expert interviews provided qualitative perspectives on emerging trends, adoption barriers, and strategic imperatives. Secondary data offered quantitative context around technology penetration, regional growth patterns, and competitive positioning.

Data triangulation and cross-referencing ensured the insights reflect a balanced view of market dynamics. Proprietary frameworks guided the segmentation and regional analyses, while scenario modeling accounted for external variables such as tariff changes and macroeconomic headwinds. This rigorous methodology underpins the strategic recommendations and regional forecasts presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animation Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animation Software Market, by Licensing Model

- Animation Software Market, by Platform

- Animation Software Market, by Software Type

- Animation Software Market, by Application

- Animation Software Market, by Deployment

- Animation Software Market, by End User

- Animation Software Market, by Region

- Animation Software Market, by Group

- Animation Software Market, by Country

- United States Animation Software Market

- China Animation Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing the critical takeaways and reinforcing the strategic importance of embracing innovation in the evolving animation software ecosystem

The animation software landscape is undergoing a profound transformation spurred by AI, cloud collaboration, and real-time production technologies. These shifts are redefining creative workflows, accelerating time-to-market, and enabling studios of all sizes to deliver high-impact visual content. Regional dynamics illustrate a maturing North American market, an emerging EMEA sector driven by local production initiatives, and a rapidly expanding Asia-Pacific ecosystem.

Strategic agility-manifested through diversified supply chains, hybrid deployment models, and collaborative partnerships-will be essential to navigate geopolitical complexities and maintain innovation momentum. By aligning product roadmaps with segmentation-driven insights and regional priorities, industry leaders can unlock sustainable growth and reinforce their market positions. Ultimately, embracing these trends will not only optimize operational efficiency but also elevate the artistry and impact of animated storytelling.

Connect directly with Associate Director of Sales & Marketing to secure comprehensive animation software market research report and unlock strategic insights

I invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure comprehensive access to our in-depth animation software market research report and unlock tailored strategic insights that will inform your next steps.

- How big is the Animation Software Market?

- What is the Animation Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?