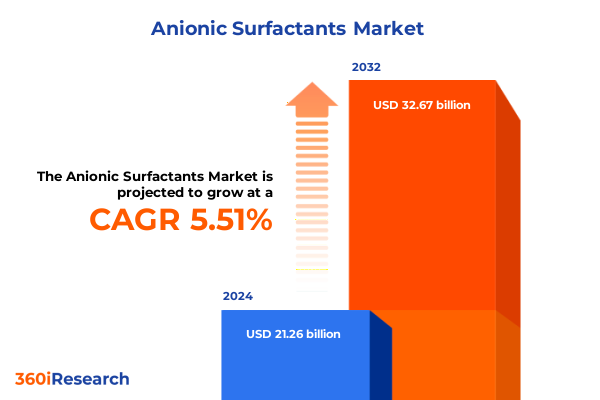

The Anionic Surfactants Market size was estimated at USD 10.90 billion in 2025 and expected to reach USD 12.03 billion in 2026, at a CAGR of 12.44% to reach USD 24.79 billion by 2032.

Unveiling the central significance of anionic surfactants across diverse sectors and providing a roadmap to capitalize on emerging industry dynamics

Anionic surfactants represent a pivotal class of amphiphilic compounds widely utilized across a broad spectrum of industrial and consumer applications. Characterized by their negatively charged hydrophilic head and hydrophobic tail, these molecules facilitate the reduction of surface tension, enabling efficient emulsification, dispersal of particles, and solubilization of organic compounds. From detergents and personal care formulations to agrochemical dispersants and oilfield operations, the versatility of anionic surfactants underpins their indispensable role in modern manufacturing and product development. Recent years have witnessed a growing emphasis on tailor-made anionic surfactant structures designed to deliver enhanced performance attributes, such as improved biodegradability, lower toxicity profiles, and compatibility with next-generation formulation technologies.

Moreover, this executive summary endeavors to distill the most critical findings from an extensive evaluation of the anionic surfactant landscape, offering a strategic lens through which to interpret current industry dynamics. By synthesizing insights on product innovations, regulatory shifts, and supply chain developments, this introduction establishes the foundation for a comprehensive exploration of market drivers, segmentation paradigms, and regional peculiarities. Stakeholders will find actionable context regarding emerging sustainability imperatives, evolving consumer expectations, and competitive strategies that define the trajectory of anionic surfactant applications worldwide.

Within the following pages, stakeholders will discover distilled perspectives on emerging formulation trends, value chain resilience strategies, and actionable pathways to capitalize on shifting consumer and regulatory landscapes. By integrating a multi-dimensional view of material science developments and macroeconomic influences, this introduction paves the way for a detailed exploration of market segmentation, competitive positioning, and region-specific dynamics.

Exploring the transformations reshaping the anionic surfactant landscape through innovation, sustainability, and regulatory evolution driving new opportunities

In recent years, the anionic surfactant landscape has undergone profound transformations driven by technological breakthroughs, shifting regulatory frameworks, and evolving consumer demands. Advances in green chemistry have paved the way for proprietary feedstock innovations, enabling manufacturers to transition from traditional petrochemical precursors toward renewable and bio-based raw materials. This shift not only addresses sustainability mandates but also stimulates a wave of novel molecular architectures engineered to offer superior performance in demanding formulation environments.

Simultaneously, digitalization initiatives are reshaping production methodologies across the value chain. Automated process controls, real-time analytics, and predictive maintenance protocols have become instrumental in optimizing yield, minimizing waste, and ensuring consistent product quality. These digital innovations align with an overarching industry push toward circular economy principles, wherein resource efficiency and lifecycle accountability are paramount. Furthermore, regulatory agencies are intensifying scrutiny on environmental and health-related parameters, compelling formulators to invest in rigorous toxicity assessments and biodegradability testing.

These collective forces are converging to redefine the future of anionic surfactant innovation, making it imperative for organizations to continuously adapt their R&D and operational blueprints to stay ahead of the curve.

Analyzing the cumulative effects of United States tariffs in 2025 on anionic surfactant supply chains, cost structures, and strategic sourcing decisions

The imposition of new United States tariffs in early 2025 has markedly altered the cost dynamics and supply chain configurations for anionic surfactant producers and end users. Targeted levies on key feedstocks and imported intermediates have introduced additional cost layers, compelling manufacturers to reevaluate procurement strategies and renegotiate supplier agreements. These cumulative tariffs have reverberated across the value chain, with downstream formulators experiencing incremental cost pressures that challenge margin stability.

In response to these developments, many stakeholders have pivoted toward diversifying their sourcing portfolios, seeking alternative suppliers in tariff-exempt regions and localizing production to shield against further trade fluctuations. Some companies have accelerated investments in domestic manufacturing assets, aiming to circumvent external duties and strengthen control over raw material quality. Meanwhile, transportation and logistics networks have been optimized to consolidate shipments, reduce duties per unit, and improve overall supply resilience. This strategic realignment underscores the criticality of agile procurement frameworks capable of rapidly adjusting to policy shifts.

Looking ahead, continuous monitoring of tariff revisions and trade negotiations will be indispensable. In parallel, proactive engagement with policymakers and participation in industry forums can shape future tariff deliberations and advocate for balanced trade outcomes that support ongoing industrial transformation. Companies that proactively engage with industry associations and leverage tariff engineering techniques-such as tariff classification optimization and in-bond processing-can mitigate cost burdens while maintaining access to high-performance anionic surfactant chemistries.

Revealing segmentation insights into anionic surfactant product types, application niches, form variations, end use industries, and distribution channel dynamics

Segmentation of the anionic surfactant market illuminates nuanced distinctions across product type, application, end-use industry, form, and distribution channels, each offering unique insights into demand patterns and growth vectors. When evaluating product type, it becomes clear that Alcohol Ether Sulfate commands substantial focus due to its superior foaming and cleaning performance, while Alpha Olefin Sulfonate presents advantages in cold-water solubility. Linear Alkyl Benzene Sulfonate remains a staple for heavy-duty cleaning formulations, Sulfonated Oil finds niche utility in industrial operations, and Sulfosuccinate excels in personal care applications requiring mild surfactant systems.

Application segmentation further refines market understanding by highlighting critical end markets. Within agricultural chemistry, anionic surfactants enhance the efficacy of both herbicide and pesticide formulations by improving wetting and spreading characteristics. In the household segment, surfactants tailored to dishwashing and laundry deliver optimized soil removal and fabric care benefits. Industrial cleaning demands specialized grades for institutional sanitation, precision metal cleaning, and surface treatment, whereas oilfield chemical formulations leverage drilling fluid and enhanced oil recovery chemistries. Personal care applications rely on bespoke surfactant blends for body wash, shampoo, and toothpaste to balance cleansing efficacy with skin and hair compatibility.

Examining end-use industry trajectories reveals that the agriculture sector depends heavily on high-performance surfactants to boost crop protection formulations, while household care continues to drive volume adoption. Industrial and institutional uses across automotive cleaning, food processing, and healthcare hygiene underscore the versatility of anionic systems. Form analysis underscores the prevalence of liquid concentrates and solutions for high-throughput operations, contrasted with granule and spray-dried powders designed for storage stability and precise dosing. Finally, distribution channel dynamics reveal a shift toward diversified networks encompassing direct sales, distributor partnerships, and the burgeoning influence of e-commerce platforms and manufacturer websites.

This comprehensive research report categorizes the Anionic Surfactants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Distribution Channel

- Application

- End-Use Industry

Highlighting regional distinctions in the anionic surfactant market across Americas, Europe Middle East & Africa, and Asia-Pacific offering strategic opportunities

Regional heterogeneity within the anionic surfactant market underscores distinctive drivers and challenges across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, North American demand is propelled by stringent environmental regulations and consumer trends favoring green and bio-based surfactants, spurring investments in renewable feedstocks and advanced processing technologies. Latin America’s growing industrial and agricultural sectors create robust downstream demand, particularly for surfactants that enhance herbicide formulation efficiency and address tropical climate performance constraints. Supply chain optimization remains a critical focus, as companies seek localized production to reduce exposure to cross-border trade tariffs and logistical bottlenecks.

Across Europe, Middle East & Africa, regulatory rigor in the European Union drives rigorous lifecycle assessments and renewable content mandates, fostering innovation in surfactant chemistries that meet eco-friendly criteria. In the Middle East, oil and gas sector activities stimulate demand for specialized anionic surfactants in drilling fluids and enhanced recovery processes, while rapidly advancing chemical parks facilitate local manufacturing. African markets exhibit nascent but accelerating adoption, particularly in household care and agrochemical formulations, where cost-effective surfactant grades are pivotal for emerging economies seeking balanced performance and affordability.

The Asia-Pacific region presents a multifaceted landscape, characterized by mature demand in established markets such as Japan and South Korea, where product differentiation and premium performance are key. China’s expansive chemical industry continues to scale production, driving competition on cost and volume, while India’s agrochemical sector fuels demand for wetting agents and dispersion surfactants. Additionally, Southeast Asian economies demonstrate a rising preference for eco-certified surfactants in personal care and institutional cleaning, reflecting growing environmental consciousness and regulatory alignment with global sustainability trends.

This comprehensive research report examines key regions that drive the evolution of the Anionic Surfactants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading companies shaping the anionic surfactant industry through innovation, strategic partnerships, and sustainability-driven growth trajectories

Leading players in the anionic surfactant landscape are leveraging a combination of innovation pipelines, strategic partnerships, and targeted acquisitions to strengthen their competitive positioning. Companies with robust research and development capabilities are focusing on the design of next-generation eco-friendly surfactants that align with stringent regulatory frameworks and evolving consumer preferences. Proprietary biotechnological processes and catalytic advancements are being adopted to enhance process efficiency, reduce energy consumption, and lower the overall environmental footprint of production facilities.

Strategic alliances between chemical manufacturers and specialty formulation houses are creating synergies that accelerate the commercialization of high-performance surfactant blends. Joint ventures aimed at expanding manufacturing capacities in key geographies are enabling companies to mitigate tariff exposures and respond swiftly to regional demand fluctuations. Furthermore, acquisitions of niche players with specialized chemistries are serving as a conduit for larger firms to diversify product portfolios and enter adjacent market segments such as personal care and oilfield chemicals.

Sustainability is emerging as a cornerstone of corporate strategy, with top-tier companies setting ambitious targets for renewable content incorporation and greenhouse gas reduction. Supply chain transparency initiatives, including third-party certifications and blockchain-enabled traceability, are being deployed to reinforce brand integrity and meet stakeholder expectations. Looking forward, the competitive landscape is expected to intensify as emerging biotechnology firms introduce novel enzyme-based surfactants and established players expand green portfolio offerings. Staying abreast of these strategic moves is crucial to identify partnership and acquisition targets that complement existing capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anionic Surfactants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Acuro Organics Limited

- Akzo Nobel N.V.

- BASF SE

- Chemische Fabrik Schärer & Schläpfer AG

- Chemtex Speciality Limited

- Clariant AG

- Croda International Plc

- Dow Inc.

- Dyna Glycols Pvt. Ltd.

- Evonik Industries AG

- Galaxy Surfactants Limited

- Huntsman International LLC

- Johnson Matthey

- Kao Corporation

- Kao Group Companies

- Kensing, LLC

- KLK OLEO

- Lubrizol Corporation

- Matangi Industries

- Nouryon Chemicals International B.V.

- Solvay S.A.

- Stepan Company

Delivering actionable recommendations for industry leaders to optimize supply chains, elevate sustainability, and drive competitive advantage in the surfactant

Industry leaders can unlock significant value by adopting a multifaceted approach that emphasizes agility, sustainability, and technological integration. Firstly, strengthening supply chain resilience through strategic sourcing diversification will reduce vulnerability to trade policy shifts and raw material price volatility. Collaborative frameworks with multiple feedstock suppliers, combined with local manufacturing partnerships, can streamline logistics and bolster production continuity.

Secondly, adopting green chemistry principles across the product development lifecycle will not only ensure compliance with tightening environmental regulations but also resonate with end-customers prioritizing eco-conscious solutions. Investing in renewable feedstock research and process intensification techniques can deliver performance parity with traditional chemistries while enhancing the environmental profile of surfactant formulations.

Thirdly, digital transformation initiatives should be accelerated to optimize manufacturing operations. Implementing predictive maintenance systems, advanced process controls, and digital supply chain platforms provides real-time visibility into production metrics and inventory flows, enabling proactive decision-making and minimizing operational disruptions. In addition, leveraging data analytics to identify performance bottlenecks and forecast demand patterns can drive incremental efficiency gains.

Finally, fostering collaborative innovation ecosystems with academia, technology startups, and cross-industry consortia can catalyze breakthrough developments. By cultivating talent pipelines and co-innovation partnerships, organizations can fast-track the commercialization of novel surfactant technologies and maintain a competitive edge in a rapidly evolving market environment. This comprehensive strategy will position leaders to capitalize on emerging trends and deliver sustainable value creation.

Outlining the robust research methodology combining primary interviews, secondary data analysis, and validation processes to ensure reliability of insights

The insights presented in this summary are grounded in a rigorous research methodology that combines primary and secondary data collection with systematic validation techniques. Primary research involved in-depth interviews with key opinion leaders, including senior executives at surfactant manufacturers, formulation scientists, procurement specialists, and regulatory experts. These discussions provided firsthand perspectives on emerging product innovations, supply chain dynamics, and the regulatory landscape shaping the anionic surfactant sector.

Secondary research encompassed a comprehensive review of trade journals, regulatory filings, patent databases, and technical publications to map historical trends and technological trajectories. Publicly available financial reports and sustainability disclosures from leading industry participants were analyzed to identify strategic priorities and investment patterns. Data points were triangulated across multiple sources to ensure consistency and reliability.

To further enhance the robustness of our findings, quantitative data was subjected to cross-sectional and longitudinal analyses, examining correlations between raw material costs, trade policies, and demand indicators. Expert validation workshops were conducted to refine interpretations and resolve discrepancies. Finally, all research adheres to ethical guidelines and confidentiality protocols, ensuring that proprietary information remains protected while delivering transparent and unbiased insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anionic Surfactants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anionic Surfactants Market, by Product Type

- Anionic Surfactants Market, by Form

- Anionic Surfactants Market, by Distribution Channel

- Anionic Surfactants Market, by Application

- Anionic Surfactants Market, by End-Use Industry

- Anionic Surfactants Market, by Region

- Anionic Surfactants Market, by Group

- Anionic Surfactants Market, by Country

- United States Anionic Surfactants Market

- China Anionic Surfactants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Summarizing key takeaways on anionic surfactant industry trends, strategic implications, and the road ahead for informed decision making and innovation

As the anionic surfactant industry continues to evolve under the influence of sustainability imperatives, technological breakthroughs, and shifting trade policies, stakeholders must remain vigilant in adapting their strategic frameworks. The transformative shifts outlined in this report underscore the need to balance innovation with environmental stewardship, leveraging green chemistry and digitalization to maintain competitive differentiation. Navigating the cumulative impact of the United States tariffs introduced in 2025 requires a proactive approach to supply chain optimization and tariff engineering, ensuring secure access to critical feedstocks while controlling cost pressures.

Segmentation insights reveal that nuanced understanding of product types, application niches, end-use industries, form factors, and distribution channels will be instrumental in aligning offerings with customer requirements. Regional analysis highlights the diverse market drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific, each presenting distinct opportunities for tailored strategies. Moreover, the competitive landscape is increasingly defined by companies that successfully integrate sustainability targets with technological excellence, forging partnerships and expanding capabilities through strategic acquisitions.

Overall, this summary encapsulates the multifaceted nature of the anionic surfactant industry, equipping stakeholders with the strategic context needed to navigate a landscape defined by technological advancement and shifting regulatory imperatives. The insights herein are designed to support informed decision making and foster innovation that addresses both market demands and sustainability objectives.

Connect with Ketan Rohom to access the full strategic market analysis report and empower your organization with in-depth anionic surfactant intelligence

To gain comprehensive access to the full strategic analysis of the anionic surfactant market and unlock tailored insights that will inform your next generation of formulation and supply chain strategies, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. His deep expertise in surfactant technology and industry trends ensures you will receive personalized support in aligning these findings with your organizational objectives. Through a direct consultation, Ketan can provide further clarification on the methodologies used, dissect the implications of emerging regulatory frameworks, and offer bespoke recommendations to accelerate your innovation roadmap.

Engaging with Ketan will grant you privileged entry to detailed data sets, proprietary case studies, and advanced segmentation matrices that extend beyond this summary. Whether you are evaluating new product development pathways, optimizing procurement strategies amidst fluctuating tariffs, or exploring regional market expansion, this collaboration will empower your teams with the foresight required to make decisive, data-driven choices. To initiate your consultation with Ketan, simply reach out via our secure inquiry portal to schedule a personalized briefing. Discover how this report can illuminate new growth pathways, optimize product formulations, and fortify your competitive posture in an ever-evolving industry environment.

- How big is the Anionic Surfactants Market?

- What is the Anionic Surfactants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?