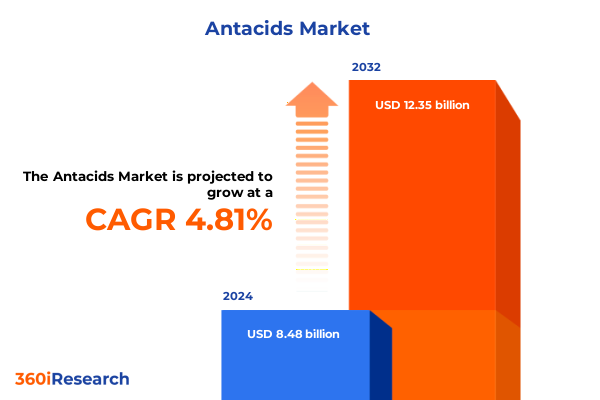

The Antacids Market size was estimated at USD 8.88 billion in 2025 and expected to reach USD 9.31 billion in 2026, at a CAGR of 4.82% to reach USD 12.35 billion by 2032.

Unveiling how antacids are shaping digestive wellness solutions in a competitive landscape and driving innovation through patient-centric approaches

Antacids have long served as frontline solutions for alleviating digestive discomfort, offering rapid pH balancing in the gastrointestinal tract and restoring daily comfort for millions of consumers. As digestive health concerns become more prevalent due to changes in diet, stress levels, and lifestyle habits, the demand for effective over-the-counter antacid therapies continues to intensify. This executive summary delivers a comprehensive overview of current industry developments, framing the antacid sector within today’s dynamic healthcare ecosystem and laying the groundwork for strategic decision-making.

This introduction sets the stage by highlighting the pivotal role of antacids in managing dyspepsia, heartburn, and acid reflux. It underscores how evolving consumer expectations-driven by preferences for convenient formats, clean-label ingredients, and rapid onset of action-are reshaping product innovation. Moreover, it outlines the report’s scope, which spans transformative market shifts, regulatory influences, segmentation insights, regional variations, key corporate strategies, and pragmatic recommendations to guide market participants through an increasingly complex landscape.

Examining paradigm shifts that are redefining antacid development from formulation breakthroughs to digital health integration and consumer engagement strategies

The antacid market is undergoing transformative shifts as novel formulation technologies converge with advances in digital health engagement. In recent years, manufacturers have increasingly adopted sophisticated delivery mechanisms such as microencapsulation and sustained-release matrices to enhance bioavailability and extend symptomatic relief. At the same time, a growing segment of health-conscious consumers is seeking natural and clean-label antacid options, prompting the introduction of products leveraging plant-based compounds and minimized synthetic excipients.

Beyond product innovation, the proliferation of e-commerce platforms and telehealth consultations is redefining how antacids are discovered, recommended, and purchased. Digital channels have accelerated direct-to-consumer marketing, enabling personalized communications and data-driven targeting. Concurrently, regulatory bodies have updated labeling guidelines to demand greater transparency around active ingredients and potential interactions, reinforcing the need for robust compliance and consumer education strategies. Together, these converging forces are propelling the industry toward more integrated, consumer-focused solutions that blend convenience, efficacy, and safety.

Analyzing the cascading effects of the United States 2025 tariff adjustments on antacid sourcing, pricing strategies, and supply chain resilience

In 2025, the United States implemented revised tariffs affecting key raw materials used in antacid manufacturing, including magnesium compounds, aluminum derivatives, and bicarbonate salts. These cumulative tariff adjustments have introduced upward pressure on input costs, compelling manufacturers to reassess sourcing strategies and adjust pricing structures. As a direct consequence, some companies have initiated dual-sourcing agreements to mitigate supply risk and preserve margin stability.

Moreover, the tariff landscape has spurred a renewed focus on domestic supply chain resilience. Several antacid producers have explored nearshoring opportunities and contracted with U.S.-based chemical suppliers to circumvent import duties and shorten lead times. While these adaptations have buffered against sudden cost spikes, they also necessitate investments in supplier audits and quality assurance protocols. Consequently, tariff-driven cost fluctuations are catalyzing more strategic procurement practices, greater transparency in vendor relationships, and an emphasis on long-term supply chain partnerships.

Uncovering critical insights into antacid market segmentation by formulation, active ingredients, and distribution channels to guide strategic decisions

A nuanced understanding of market segmentation is essential for identifying growth levers and tailoring product portfolios. Based on form, the industry is studied across effervescent tablets, gels, liquids, powders, and tablets. Effervescent tablets have gained traction among active consumers who value rapid dissolution and portability, whereas gels and liquids continue to appeal to patients prioritizing immediate relief without chewing. Meanwhile, traditional tablets and powders maintain a loyal following due to cost efficiency and straightforward dosing.

When viewed through the lens of active ingredient, the market is studied across aluminum hydroxide, calcium carbonate, combination formulations, magnesium hydroxide, and sodium bicarbonate. Calcium carbonate formulations are often favored for their high neutralizing capacity, while magnesium hydroxide enjoys popularity for milder gastric irritation profiles. Combination formulations offer synergistic benefits, balancing rapid onset from one ingredient with sustained effect from another. Both aluminum-based and bicarbonate-based antacids serve specific clinical niches, influencing product positioning and labeling considerations.

Distribution channel segmentation reveals critical differences in consumer access and purchasing behavior, with the market studied across hospital pharmacy, online retail, retail pharmacy, and supermarket/hypermarket. Hospital pharmacies often handle acute care protocols and bulk purchasing for inpatient use, whereas retail pharmacies emphasize pharmacist-led recommendations and loyalty programs. Online retail is rapidly expanding, driven by digital convenience and subscription models, and supermarkets or hypermarkets leverage high foot traffic to offer value-based promotions.

This comprehensive research report categorizes the Antacids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Active Ingredient

- Form

- Flavor

- Therapeutic Application

- Distribution Channel

Revealing the nuanced regional variations in antacid demand across the Americas, EMEA, and Asia-Pacific and their strategic implications

Regional dynamics play a fundamental role in shaping antacid demand and product strategies. In the Americas, widespread awareness of gastrointestinal health and well-developed over-the-counter channels encourage strong consumer uptake. Healthcare awareness campaigns and direct-to-consumer advertising further amplify product visibility, particularly for established brands in mature markets such as the United States and Canada.

Conversely, Europe, Middle East & Africa reflects a multifaceted regulatory environment, with each jurisdiction imposing distinct labeling requirements and permissible ingredient thresholds. Western European markets lean toward premium, branded formulations with documented clinical efficacy, while emerging economies in Eastern Europe and the Middle East see steadily rising demand for cost-effective generic and private-label options. Africa continues to present an opportunity for growth, supported by expanding healthcare infrastructure and increasing urbanization.

In the Asia-Pacific region, rapid modernization of healthcare delivery systems and rising disposable incomes are driving accelerated adoption of antacid therapies. Online marketplaces operate alongside traditional pharmacy channels, enabling consumers in urban centers to access both international and local brands. Meanwhile, evolving dietary patterns and growing awareness of digestive wellness propel category expansion in countries such as China, India, and Australia.

This comprehensive research report examines key regions that drive the evolution of the Antacids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading industry players in the antacid space and analyzing their innovation strategies, partnerships, and competitive positioning

Leading companies in the antacid industry are deploying multifaceted strategies to maintain and expand their market positions. Large diversified healthcare corporations continue to invest in R&D for novel delivery systems and enhanced palatability, seeking to differentiate their offerings through incremental innovation and brand recognition. By contrast, specialty pharmaceutical firms are forging strategic alliances with contract manufacturers to accelerate product launches and access niche segments.

Several global players are actively leveraging acquisitions to broaden their product portfolios and strengthen presence in high-growth markets. These mergers facilitate cross-border distribution synergies and create opportunities for co-marketing adjacent gastrointestinal therapies. At the same time, digital-first newcomers are entering the space with direct-to-consumer models, capitalizing on social media engagement and subscription-based replenishment services to build brand loyalty.

Sustainability and corporate responsibility have also emerged as competitive differentiators. Companies are reformulating packaging to reduce plastic usage and sourcing raw materials through ethically audited supply chains. These initiatives resonate with environmentally conscious consumers and support broader reputational objectives within the healthcare community.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antacids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Adcock Ingram Limited Co.

- Advance Pharmaceutical Inc.

- Akums Drugs and Pharmaceuticals Ltd.

- Alkem Laboratories Ltd.

- AstraZeneca UK Ltd

- Bayer AG

- Boehringer Ingelheim International GmbH,

- CIPLA LIMITED

- Dr. Reddy’s Laboratories Ltd

- GlaxoSmithKline plc

- Haleon plc

- Johnson & Johnson Services, Inc.

- Novartis AG

- Perrigo Company plc

- Pfizer Inc

- Procter & Gamble Co.

- Reckitt Benckiser Group plc

- Safetec of America, Inc.

- SPI Pharma by ABFI

- Sun Pharmaceutical Industries Ltd

- Takeda Pharmaceutical Company Limited

- WellSpring Pharmaceutical Corporation

- Zydus Lifesciences Limited

Empowering antacid industry leaders with strategic action plans for innovation acceleration, supply chain optimization, and customer-centric growth

Industry leaders should prioritize investment in next-generation formulations that enhance onset speed and palatability while minimizing excipient load. Collaborations with material science experts can unlock opportunities for proprietary delivery technologies, creating barriers to entry and elevating product differentiation. In parallel, companies must reevaluate procurement strategies to foster resilient supplier networks, incorporating dual sourcing and nearshoring to guard against tariff volatility.

Additionally, embracing digital channels offers a pathway to deepen consumer engagement and drive repeat purchases. Implementing data analytics platforms will enable segmentation of end users based on purchase patterns and symptom profiles, allowing for targeted messaging and personalized recommendations. From a channel perspective, strengthening partnerships with retail pharmacies through co-branded educational campaigns can reinforce trust and increase shelf visibility, while tailored promotions in supermarkets and hypermarkets can capture value-seeking shoppers.

Sustainability initiatives warrant sustained focus, as eco-friendly packaging and transparent sourcing practices bolster brand image and appeal to environmentally aware demographics. Finally, ongoing monitoring of regulatory evolutions will ensure that marketing claims remain compliant, safeguarding brand integrity and consumer confidence.

Outlining the rigorous research methodology employed to deliver comprehensive insights and ensure data integrity for antacid market analysis

This research leverages a mixed-methods approach combining both qualitative and quantitative techniques to ensure comprehensive and reliable insights. Primary research involved in-depth interviews with senior executives across pharmaceutical manufacturers, distributors, and key opinion leaders to capture firsthand perspectives on market dynamics, challenges, and emerging opportunities.

Secondary research constituted an extensive review of publicly available regulatory filings, clinical study repositories, industry association publications, and peer-reviewed journals focused on digestive health therapeutics. Data triangulation was applied to validate findings, cross-referencing interview insights with historical trend analyses and regional sales data. A robust segmentation framework underpins the analysis, delineating form, active ingredient, and distribution channel variables to reveal nuanced patterns of consumer behavior.

To further ensure methodological rigor, the study adhered to ethical guidelines and confidentiality agreements, safeguarding proprietary information contributed by stakeholders. Geographic coverage spanned the Americas, Europe, Middle East & Africa, and Asia-Pacific, allowing for robust regional comparison and strategic relevance for global participants.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antacids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antacids Market, by Active Ingredient

- Antacids Market, by Form

- Antacids Market, by Flavor

- Antacids Market, by Therapeutic Application

- Antacids Market, by Distribution Channel

- Antacids Market, by Region

- Antacids Market, by Group

- Antacids Market, by Country

- United States Antacids Market

- China Antacids Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing the pivotal findings and outlining the strategic outlook that will shape the antacid industry’s future direction

In summary, the antacid market stands at a pivotal juncture where innovation, regulatory complexity, and evolving consumer preferences converge. Advanced formulation technologies and digital engagement platforms are propelling the sector forward, while recent tariff adjustments underscore the necessity of agile supply chain strategies. Detailed segmentation analysis highlights the importance of tailoring product offerings by form, active ingredient, and channel to meet diverse consumer needs.

Regional insights reveal distinct growth drivers in the Americas, EMEA, and Asia-Pacific, each presenting unique regulatory and consumer landscapes that demand localized approaches. Key industry players are navigating this environment through strategic partnerships, targeted acquisitions, and sustainable initiatives, setting the stage for competitive differentiation. By embracing the recommended action plans-focusing on formulation innovation, channel optimization, and supply chain resilience-companies can secure a robust position in the rapidly evolving antacid sector and deliver meaningful benefits to end users.

Connect with the Associate Director of Sales & Marketing to unlock the complete antacid market study and drive strategic competitive advantage

I invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to explore the full antacid market research report and uncover the critical insights you need to stay competitive. By engaging directly with Ketan, you’ll receive personalized guidance on how to apply these findings within your organization’s unique context, ensuring that your strategic decisions are backed by robust data and expert analysis.

Reach out today to secure access to the comprehensive study, including in-depth analyses, proprietary segmentation frameworks, and forward-looking recommendations. Don’t miss the opportunity to equip your leadership team with actionable intelligence that drives innovation, optimizes supply chains, and targets high-impact growth areas in the evolving antacid landscape.

- How big is the Antacids Market?

- What is the Antacids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?