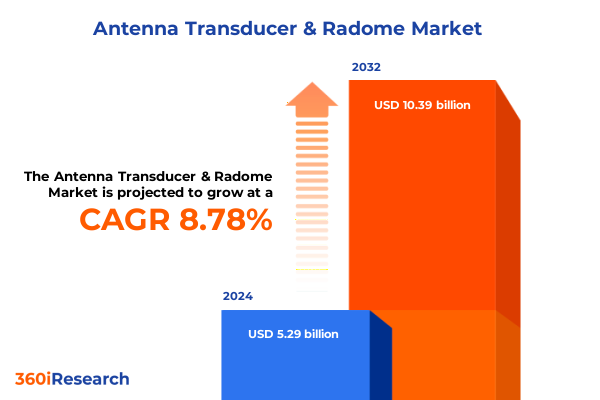

The Antenna Transducer & Radome Market size was estimated at USD 5.70 billion in 2025 and expected to reach USD 6.14 billion in 2026, at a CAGR of 8.95% to reach USD 10.39 billion by 2032.

Unveiling the Foundation of Antenna Transducer and Radome Market Dynamics Shaping Contemporary Connectivity Paradigms

The rapid convergence of antenna transducer and radome technologies is reshaping multiple industries, driving unparalleled advances in connectivity, sensing, and defense applications worldwide. As stakeholders from government contractors to commercial network operators pursue ever-more sophisticated performance benchmarks, understanding this evolving ecosystem has become critical for informed decision-making. The interplay between transducer design innovations and radome material science is enabling the next wave of high-frequency, high-throughput systems, yet it also introduces fresh challenges in manufacturing precision, environmental resilience, and regulatory compliance.

This executive summary provides a concise yet thorough examination of the key market forces at play. It highlights transformative shifts that are accelerating adoption, delves into the impact of recent United States tariff policies, and presents segmentation and regional analyses that illuminate the most promising growth vectors. Additionally, insights into leading companies’ strategies and actionable recommendations will equip you with a roadmap to navigate competitive landscapes, technology disruptions, and geopolitical headwinds. By distilling complex information into clear, strategic takeaways, this summary serves as a vital resource for executives, product managers, and investors aiming to capitalize on emerging opportunities within the antenna transducer and radome domain.

Examining How Next-Generation Beamforming and Advanced Material Science Are Redefining Antenna Transducer and Radome Technologies

In recent years, a confluence of factors has accelerated transformative shifts across the antenna transducer and radome landscape. Advances in digital beamforming, driven by the maturation of active electronically scanned array technologies, are redefining system-level architectures. These innovations have triggered a departure from traditional reflector-based configurations toward more agile flat panel and passive electronically scanned array designs that offer superior beam steering capabilities without mechanical movement.

Meanwhile, the explosive demand for high-throughput satellite services and 5G infrastructure has elevated the strategic importance of materials innovation. Composite radome structures leveraging next-generation polymers and nano-engineered coatings are enhancing electromagnetic transparency, environmental durability, and weight optimization. Global defense priorities are likewise fostering R&D investment in radome formulations that withstand extreme thermal cycles, while civilian markets are adopting cost-efficient fiberglass and PTFE variants to drive economies of scale.

Simultaneously, the deployment of multi-band, multifunctional platforms is erasing the once-clear boundaries between commercial, defense, and automotive applications. This convergence has underscored the need for flexible manufacturing processes, adaptive supply chain frameworks, and modular design philosophies that can cater to diverse customer requirements. As a result, companies that can seamlessly integrate transducer and radome innovations are gaining a strategic advantage, setting the stage for a new era of wireless connectivity and sensing solutions.

Understanding the Operational and Strategic Reverberations of 2025 Tariff Shifts on Antenna Transducer and Radome Supply Chains

The landscape of antenna transducer and radome markets has been significantly influenced by evolving United States tariff measures, particularly those implemented in 2025. Adjustments in duty structures have prompted manufacturers to re-evaluate component sourcing strategies, import substitution plans, and regional manufacturing footprints. The reclassification of specific composite materials under higher duty bands has increased landed costs for critical radome components, placing pressure on profit margins and compelling procurement teams to explore alternative material blends that comply with domestic content thresholds.

Conversely, protective tariffs on certain transducer subassemblies have catalyzed investment in local production capabilities, encouraging joint ventures and capacity expansions within North America. This realignment has fostered greater collaboration between equipment OEMs and contract manufacturers, accelerating technology transfer and reducing lead times. However, the ripple effects of these tariff revisions extend beyond cost implications; supply chain complexity has intensified as cross-border compliance requirements evolve, necessitating enhanced traceability and supplier auditing processes.

Ultimately, while these tariff changes introduce new operational complexities, they also create an impetus for innovation. Companies that proactively adapt by localizing critical manufacturing steps and redesigning components for tariff-tolerant material classes will be best positioned to sustain cost competitiveness. As regulatory frameworks continue to develop, stakeholders must remain vigilant, leveraging market intelligence to anticipate further policy shifts and minimize disruption to their strategic roadmaps.

Unraveling the Multidimensional Segmentation Framework That Drives Targeted Growth Within Antenna Transducer and Radome Markets

A nuanced understanding of market segmentation is essential to unlock opportunities across product, frequency band, technology, and end‐user dimensions. When evaluating radome offerings, the differentiation between composite, fiberglass, and PTFE variants informs critical trade‐offs in electromagnetic transparency, structural integrity, and cost efficiency. At the same time, transducer designs span horn, microstrip, parabolic reflector, and patch architectures, each presenting unique performance characteristics and manufacturing complexities that cater to distinct application scenarios.

Layered atop these product considerations is the relevance of frequency band segmentation. Offerings in C, Ka, Ku, L, S, and X bands serve divergent connectivity and sensing requirements-from long‐distance, high‐capacity satellite links in Ka and Ku bands to low‐latency, tactical data exchanges in L and S bands. Technology paradigms further refine market positioning, as active electronically scanned arrays deliver unmatched beam agility while flat panel and passive electronically scanned arrays balance cost and performance, and traditional reflector antennas remain favored for large‐scale, high‐power installations.

Finally, end‐user distinctions underscore the heterogeneity of demand across aerospace, automotive, consumer electronics, defense, maritime, and telecom sectors. Each end‐market enforces its own quality standards, certification processes, and procurement cycles, influencing product development timelines and go‐to‐market strategies. By integrating these segmentation lenses, businesses can pinpoint niche applications, align product roadmaps with emerging requirements, and optimize resource allocation to the most lucrative market pockets.

This comprehensive research report categorizes the Antenna Transducer & Radome market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Frequency Band

- Technology

- End User

Illuminating Diverse Regional Market Dynamics and Investment Patterns Across Americas, EMEA, and Asia-Pacific Landscapes

Regional dynamics play a pivotal role in shaping the competitive contours of the antenna transducer and radome industry. In the Americas, robust aerospace and defense spending, paired with increasing demand for broadband connectivity across rural areas, has stimulated investments in both transducer modernization and radome upgrades. Leading OEMs focus on scaling production capabilities domestically to adhere to regulatory preferences for local content, while innovative startups are pioneering lightweight composite formulations to capture adjacent commercial markets.

Across Europe, the Middle East, and Africa, a diverse confluence of requirements-from satellite broadband initiatives in North Africa to naval radar modernization in the Arabian Gulf-drives demand for customized radome solutions. Stricter environmental and safety regulations within the European Union have accelerated the adoption of eco‐friendly materials and testing protocols, influencing design cycles and supplier qualifications. In the same region, defense modernization programs are prioritizing electronic warfare resilience, bolstering opportunities for transducer suppliers specializing in multi‐function apertures.

The Asia‐Pacific landscape is characterized by rapid infrastructure rollout and expanding maritime connectivity projects. Key markets invest heavily in S and C band systems for coastal surveillance, while consumer electronics manufacturers drive growth in high‐frequency patch antennas for next‐generation smartphones. Domestic champions in the region leverage government incentives to build end‐to‐end manufacturing ecosystems, challenging global players to differentiate through technological superiority and after‐sales service excellence.

This comprehensive research report examines key regions that drive the evolution of the Antenna Transducer & Radome market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Maneuvers and Collaborative Models That Drive Competitive Advantage Among Leading Industry Players

Leading stakeholders in the antenna transducer and radome sphere are navigating a complex environment through varied strategic postures. Several prominent players have doubled down on integrated platform development, merging transducer design expertise with proprietary radome material formulations to deliver turnkey solutions that simplify customer adoption. Collaborative ventures between OEMs and material science innovators are becoming commonplace, fostering co‐development agreements that accelerate time to market while sharing R&D risk.

At the same time, a cohort of agile midsize companies is capturing niche segments by excelling in rapid prototyping and customization. These organizations leverage digital twins and additive manufacturing techniques to iterate designs swiftly, catering to specialized mission requirements or bespoke commercial applications. They also employ flexible pricing models and modular contract structures, appealing to prime contractors and system integrators seeking supply chain resilience.

Even the largest diversified conglomerates are recalibrating their strategies, divesting non‐core assets and forging strategic alliances with telecommunications carriers, satellite operators, and defense ministries. Through these partnerships, established players are broadening their reach into adjacent service domains, such as network deployment and managed radar solutions, thereby creating new revenue streams beyond traditional hardware sales.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antenna Transducer & Radome market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cobham Limited

- Honeywell International Inc.

- Israel Aerospace Industries Ltd.

- Kongsberg Defence & Aerospace AS

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Saab AB

- Thales S.A.

Embedding Modular Innovation, Supply Chain Digitization, and Cross-Sector Collaborations to Sustain Competitive Leadership

Industry leaders should prioritize the integration of modular design principles within both antenna and radome development processes to accelerate product customization and reduce time to deployment. By establishing cross‐functional innovation teams that bridge materials science, RF engineering, and digital simulation capabilities, organizations can streamline R&D cycles and respond more dynamically to emerging customer needs. Furthermore, adopting an open architecture framework will facilitate third‐party component integration, expanding the addressable market and lowering barriers to entry for new partnerships.

Market participants must also invest in supply chain digitization initiatives that enhance end‐to‐end visibility and compliance management. Implementing blockchain or IoT‐enabled traceability solutions can mitigate tariff--related disruptions, ensure material provenance, and reinforce quality assurance. Concurrently, engaging with regulatory bodies to influence evolving standards for radome environmental testing and transducer electromagnetic performance will position forward‐thinking companies as trusted industry leaders.

Finally, leaders should explore joint development programs with satellite operators, defense agencies, and telecommunications carriers to co‐innovate next‐generation systems. These collaborative efforts can unlock procurment efficiencies, align technology roadmaps with network evolution, and secure early adopter validation for breakthrough transducer-radome integrations. By executing these recommendations, industry stakeholders will strengthen competitive moats and capitalize on the accelerating demand for advanced connectivity solutions.

Detailing the Comprehensive Multiphase Research Framework Combining Secondary Analysis, Trade Data, and Executive Insights

This analysis is grounded in a rigorous, multi‐tiered research methodology combining comprehensive secondary and primary data collection. The secondary phase involved an extensive review of industry literature, regulatory filings, patent databases, and technical white papers to map existing technology trajectories and material innovations. In parallel, proprietary trade data and customs documentation were analyzed to identify recent shifts in tariff classifications and import----export volumes relevant to radome and transducer components.

The primary research phase entailed in‐depth interviews with senior executives at leading OEMs, contract manufacturers, and end‐users across aviation, defense, telecom, and maritime sectors. These conversations provided qualitative insights into strategic priorities, procurement challenges, and technology adoption drivers. Supplemental quantitative data was gathered through targeted surveys of design engineers and supply chain managers, enabling trend validation and cross‐segment comparisons.

To ensure analytical robustness, forecasting and scenario planning tools were employed to model the impact of policy changes, technology disruptions, and regional demand fluctuations. Data triangulation techniques were applied throughout to reconcile disparate information sources, while sensitivity analyses assessed the resilience of key findings against alternative market developments. This methodological approach underpins the reliability of the insights and recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antenna Transducer & Radome market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antenna Transducer & Radome Market, by Product Type

- Antenna Transducer & Radome Market, by Frequency Band

- Antenna Transducer & Radome Market, by Technology

- Antenna Transducer & Radome Market, by End User

- Antenna Transducer & Radome Market, by Region

- Antenna Transducer & Radome Market, by Group

- Antenna Transducer & Radome Market, by Country

- United States Antenna Transducer & Radome Market

- China Antenna Transducer & Radome Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Strategic Insights on Technology Convergence, Policy Impacts, and Collaborative Pathways to Market Leadership

The intricate interplay between advanced transducer architectures and radome material innovations is reshaping the competitive landscape, demanding a holistic understanding of technology, policy, and end‐user dynamics. As digital beamforming, next‐generation composites, and evolving tariff structures converge, companies must adapt their strategies to navigate an increasingly interconnected ecosystem. The segmentation insights underscore that success lies in aligning product development with specific frequency band needs, technology paradigms, and sectoral applications, while regional analyses highlight the necessity of tailoring approaches to local regulatory and procurement environments.

Key company profiles reveal a spectrum of strategic postures-from integrated platform providers focusing on turnkey solutions to nimble specialists capitalizing on rapid prototyping capabilities. This diversity of approaches confirms that no single playbook guarantees success; rather, the ability to orchestrate partnerships, embrace open innovation, and maintain supply chain agility will be the key differentiators. Leaders who implement the actionable recommendations-modular design, supply chain digitization, and collaborative R&D-will be best positioned to harness emerging opportunities and mitigate risks.

In summary, the antenna transducer and radome market stands at a pivotal juncture. Strategic foresight, grounded in rigorous research and fortified by decisive execution, will define winners in this dynamic landscape. Stakeholders equipped with the insights contained in this report will possess the clarity and direction needed to lead in an era of accelerating technological and geopolitical change.

Empower Your Strategic Growth Through Direct Engagement With Our Sales Leader to Unlock Tailored Insights From This Comprehensive Report

To seize the full strategic potential of your organization’s antenna transducer and radome initiatives, engaging directly with Ketan Rohom, the Associate Director of Sales & Marketing, is the most effective next step. With deep expertise in translating complex technical insights into actionable commercial strategies, Ketan provides personalized guidance on leveraging the market intelligence contained within this comprehensive research report. By partnering with him, you can customize your analysis to address unique organizational challenges, prioritize investment areas, and align product development roadmaps with identified growth segments.

Reach out to Ketan to discuss tailored executive briefings, deeper dive workshops, and bespoke data visualization services that go beyond static report insights. His consultative approach ensures that you can navigate regulatory shifts, technology transitions, and competitive dynamics with confidence, accelerating your time to market. Don’t let emerging opportunities within radome composites, advanced transducer architectures, or regional demand shifts pass you by. Contact Ketan today to secure your organization’s competitive edge and drive measurable results from market intelligence.

- How big is the Antenna Transducer & Radome Market?

- What is the Antenna Transducer & Radome Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?