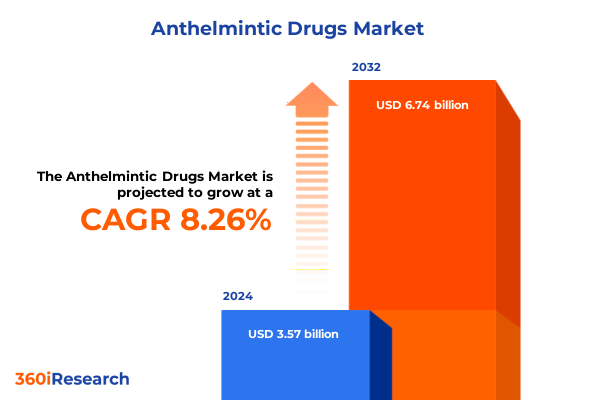

The Anthelmintic Drugs Market size was estimated at USD 3.86 billion in 2025 and expected to reach USD 4.17 billion in 2026, at a CAGR of 8.28% to reach USD 6.74 billion by 2032.

Exploring the Critical Role of Anthelmintic Therapeutics in Global Health and Livestock Management Amidst Emerging Resistance Challenges

Anthelmintic therapeutics have long been an indispensable component of animal health management and human parasitic disease control, yet recent shifts in pathogen resistance, regulatory scrutiny, and technological advances are reshaping the contours of this critical pharmaceutical segment. The rising prevalence of helminth infections in both livestock and companion animals has galvanized industry stakeholders to reevaluate legacy treatment approaches while prioritizing innovation that can deliver higher efficacy and safety margins. Concurrently, human health initiatives in endemic regions are increasingly relying on integrated mass drug administration programs that hinge on sustainable drug supply and the mitigation of emerging drug resistance.

As these interlocking forces exert new pressures, anthelmintic developers and distributors must navigate a landscape where efficacy against a broad spectrum of parasite species is paramount, yet where the threat of resistance looms as a potential obstacle to long‐term treatment success. Stakeholders from drug discovery, regulatory affairs, supply chain management, and sales must converge around a holistic understanding of evolving scientific breakthroughs-such as next‐generation macrocyclic lactones and novel combination therapies-and adapt strategic roadmaps accordingly. This introduction establishes the foundational context for exploring transformative shifts, tariff‐driven constraints, segmentation insights, regional dynamics, competitive landscapes, and actionable recommendations that follow in this executive summary.

Navigating Industry Transformations Fueled by Novel Molecules, Regulatory Agility, and Advanced Digital Health Solutions

The anthelmintic domain is undergoing transformative shifts driven by converging advances in medicinal chemistry, resistance surveillance methodologies, and digital health platforms that deliver data‐driven insights. New molecular scaffolds are emerging from high‐throughput screening initiatives, exploiting parasite‐specific ion channels and neuromuscular targets to overcome the reduced sensitivities that have undermined earlier compound classes. At the same time, precision dosing technologies, enabled by wearable sensors and telemedicine solutions, are refining the administration of oral and parenteral formulations to ensure optimal therapeutic windows and minimize off-target effects.

These scientific and technological breakthroughs are complemented by a paradigm shift in regulatory frameworks. Global authorities are accelerating pathways for combination therapies and recently approved compounds, recognizing the urgency of addressing multi‐drug resistant helminths. Coupled with expanded collaboration across public health agencies, veterinary associations, and commercial developers, this regulatory agility is setting the stage for more nimble product launches and lifecycle management strategies. Furthermore, digital traceability systems are fostering enhanced supply chain transparency, reinforcing the integrity of drug distribution and reducing the risk of counterfeit or substandard treatments entering vulnerable markets.

Collectively, these dynamics are redefining stakeholder expectations across the value chain. Developers are prioritizing platforms that integrate real‐world evidence and advanced analytics, while veterinarians and human healthcare providers are increasingly relying on data‐driven decision support tools. Investors and strategic buyers are also compelled to reassess portfolios, seeking assets with differentiated resistance profiles and adaptable formulation technologies. This convergence of science, regulation, and digital innovation underscores the magnitude of change and the expansive opportunity to reshape the future of anthelmintic therapy.

Assessing the Far-Reaching Consequences of 2025 US Tariff Policies on Anthelmintic Drug Supply Chains and Operational Resilience

The introduction of new tariff policies in the United States during 2025 has imposed a complex set of operational and financial challenges on the anthelmintic drug supply chain. By increasing import duties on active pharmaceutical ingredients sourced from key global manufacturing hubs, these measures have elevated raw material costs for both established and emerging drug classes. Manufacturers have faced heightened pressure to renegotiate supplier contracts, localize critical processes, and explore alternative sourcing strategies, all while maintaining compliance with stringent Good Manufacturing Practice (GMP) standards.

In response, many stakeholders have recalibrated logistics networks to accelerate turnaround times and reduce exposure to cross‐border trade frictions. Distribution partners have expanded domestic warehousing capacities to buffer supply disruptions, and strategic alliances with regional producers have been forged to secure uninterrupted ingredient flow. At the same time, price adjustments have been communicated downstream, impacting procurement budgets for veterinary clinics, hospital pharmacies, and large‐scale mass drug administration programs. This realignment has stimulated more rigorous cost‐efficiency analyses, fostering collaborative dialogues among contract manufacturing organizations, research laboratories, and end users.

Despite short‐term cost escalations, the tariff‐driven impetus toward supply chain localization has accelerated investments in regional manufacturing capabilities. Over the long term, this trend may yield enhanced resilience against future trade policy shifts and bolster the capacity to innovate through integrated research‐production ecosystems. As stakeholders continue to adapt contractual frameworks and optimize production footprints, the industry at large is poised to emerge with stronger domestic infrastructure that supports both commercial growth and public health imperatives.

Delving into Comprehensive Segmentation Perspectives Illuminating Drug Classes, Animal Models, Administration Routes, Formulations and Sales Channels

An in-depth analysis of the anthelmintic segment reveals distinct patterns across multiple dimensions of product and channel segmentation, each carrying strategic implications. When considering drug classes, benzimidazoles continue to underpin core therapeutic protocols due to their broad‐spectrum efficacy and well-established safety profiles; however, imidazothiazoles and tetrahydropyrimidines command growing attention in veterinary applications, especially for parasite strains demonstrating benzimidazole reduced sensitivity. Meanwhile, macrocyclic lactones are increasingly positioned as premium assets, offering extended duration of action against resistant helminth populations and fueling targeted portfolio expansions.

Examining animal type segmentation, companion animal health programs have driven innovations in palatable oral suspensions and topical formulations tailored for cats and dogs, emphasizing ease of administration and owner adherence. For food producing animals such as cattle, poultry, sheep, goats, and swine, injectable and oral bolus forms remain central to herd health management, often integrated with digital dosing trackers and herd health analytics. In the human space, adult and pediatric indications have seen a resurgence of tablet regimens optimized for mass drug administration campaigns, with dose standardization facilitating equitable distribution in endemic regions.

Routes of administration exert a profound influence on product development and commercial positioning. Oral dosing remains the largest channel due to its versatility across species and cost advantages, while parenteral routes are valued for rapid onset and targeted delivery in intensive veterinary settings. Topical options have carved out niches in companion and small ruminant care, addressing localized infestation sites. Correspondingly, formulation strategies reflect these preferences: injectable formulations garner investment for high-value herd interventions, oral suspensions prioritize palatability for pets, and tablets support large‐scale public health initiatives.

Finally, sales channel segmentation underscores evolving customer engagement models. Digital pharmacies have expanded accessibility for routine companion animal treatments, while retail pharmacy networks complement traditional veterinary distributors and hospital settings. Specialized veterinary distributors and hospital clinics continue to leverage consultative selling and bundled service offerings. Each channel’s dynamics inform commercial approaches that align product characteristics with customer needs, underscoring the importance of segmentation-informed strategies to optimize reach and value capture.

This comprehensive research report categorizes the Anthelmintic Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Animal Type

- Route Of Administration

- Formulation

- Sales Channel

Uncovering Regional Nuances in Anthelmintic Demand Across the Americas, EMEA, and Asia-Pacific Reflecting Diverse Veterinary and Therapeutic Priorities

Regional dynamics shape anthelmintic demand profiles, reflective of agricultural practices, companion animal ownership patterns, and public health priorities. In the Americas, integrated livestock operations drive steady uptake of long-acting injectables for cattle and swine, while robust companion animal markets in North America accelerate the adoption of premium oral and topical products. Regulatory harmonization efforts between the United States and Canada have also streamlined cross-border product approvals, reinforcing supply chain efficiencies and fostering collaborative research initiatives.

Across Europe, the Middle East, and Africa, divergent economic and climatic conditions generate a mosaic of requirements. Western Europe emphasizes high-precision dosing technologies, including sensor-enabled administration tools, supported by strong pharmacovigilance infrastructures. Conversely, emerging markets in the Middle East and parts of Africa present significant growth opportunities for low-cost tablet programs designed for mass deworming campaigns. Regulatory frameworks in this region are increasingly converging under pan-regional bodies to facilitate expedited approvals for critical public health interventions, thereby enhancing the availability of trusted anthelmintic options.

In the Asia-Pacific arena, the interplay of large-scale aquaculture and smallholder farming systems drives substantial demand for benzimidazoles and macrocyclic lactones. Nations with intensive poultry and swine industries prioritize injectable and oral bolus forms that can be seamlessly integrated into feed and water systems. Simultaneously, rising disposable incomes in urban centers have spurred growth in companion animal segments, with consumers seeking veterinarian-recommended oral suspension products. Governments in the region are also investing in parasite surveillance and resistance mapping programs, underpinning data-driven policy decisions and targeted drug utilization strategies.

This comprehensive research report examines key regions that drive the evolution of the Anthelmintic Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Competitive Positioning of Leading Biopharma Entities Driving Innovation in Anthelmintic Drug Development

Innovative breakthroughs and strategic alliances among leading pharmaceutical and animal health companies are reshaping the competitive landscape for anthelmintics. Established global players maintain strong portfolios across benzimidazoles and macrocyclic lactones, leveraging extensive R&D pipelines and integrated manufacturing assets to support global distribution. These industry titans are also investing in next-generation combinations that target multiple parasite life stages and mitigate the risk of resistance development.

Mid-sized biopharma and specialized animal health firms are differentiating through niche applications, such as extended-release injectable platforms for high-value livestock and targeted pediatric formulations for human deworming. Strategic partnerships between these agile specialists and larger contract manufacturing organizations have accelerated clinical timelines and enabled market entry in priority geographies. Moreover, several pure-play biotech companies are exploring innovative modalities, including peptide-based helminth-immune modulators, which promise to complement chemical anthelmintics and reduce reliance on traditional drug classes.

Across the competitive spectrum, companies are embracing digital tools to enhance end-user engagement and adherence. Mobile dosing apps, remote treatment monitoring, and telemedicine service bundles are increasingly bundled with drug products, reinforcing value-added offerings. These integrated solutions not only strengthen customer loyalty but also generate real-world data that can inform post-launch surveillance and future product enhancements. As industry leaders compete on the dual fronts of technological innovation and therapeutic differentiation, the race to establish sustainable resistance management strategies will be a key determinant of long-term success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anthelmintic Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aden Healthcare

- Anikem Laboratories

- Bayer AG

- Boehringer Ingelheim International GmbH

- Ceva Sante Animale

- Cipla Limited

- Dechra Pharmaceuticals PLC

- Dr.Reddys Laboratories Inc.

- Edenbridge Pharmaceuticals LLC

- GlaxoSmithKline PLC

- Green Cross Remedies

- Healthy Life Pharma Private Limited

- Johnson & Johnson Services, Inc.

- Kosher Pharmaceuticals

- Lineage Therapeutics Inc

- Lupin Limited

- Mankind Pharma Ltd.

- McKesson Corporation

- Merck & Co., Inc.

- Norbrook Laboratories Limited

- Novartis AG

- Sankur Pharmaceuticals Pvt. Ltd

- Takeda Pharmaceutical Company Limited

- Virbac S.A.

- Weefsel Pharma

Strategic Imperatives and Forward-Looking Recommendations Empowering Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks

To navigate the evolving anthelmintic landscape, industry leaders should prioritize integrated research models that leverage real-world evidence and advanced resistance mapping tools. By embedding sentinel surveillance networks in key animal and human populations, developers can rapidly detect shifts in parasite sensitivity and adapt compound libraries accordingly. This proactive approach will be crucial to sustaining therapeutic efficacy and extending product lifecycles.

Investment in dual-target combination therapies represents a high-value opportunity, particularly where synergistic modes of action can mitigate resistance risk. Prioritizing partnerships between chemistry, manufacturing and controls (CMC) specialists and translational research teams will accelerate combination optimization and streamline regulatory interactions. Concurrently, organizations must bolster digital engagement platforms to drive adherence, harnessing mobile applications and remote monitoring to capture usage data and reinforce treatment protocols.

Supply chain resilience must remain at the forefront of strategic planning, given the lessons learned from recent tariff disruptions. Establishing regional manufacturing hubs with flexible capacity can buffer against policy shifts and logistical constraints. Risk-adjusted sourcing strategies, coupled with collaborative planning with contract manufacturing partners, will safeguard essential ingredient availability. Finally, fostering consultative relationships with veterinary and human health stakeholders-through education, training, and data sharing-will enhance market access and reinforce the value proposition of advanced anthelmintic offerings.

Outlining Rigorous Research Methodology and Analytical Frameworks Underpinning Comprehensive Insights into the Anthelmintic Drug Landscape

This report integrates a multi-stage methodology combining primary research, secondary intelligence, and advanced analytical techniques to deliver a holistic view of the anthelmintic drug ecosystem. Primary research consisted of in-depth interviews with key opinion leaders, including parasitologists, veterinary pharmacologists, regulatory affairs specialists, and supply chain executives across major geographies. These insights were complemented by a comprehensive review of peer-reviewed literature, patent filings, clinical trial registries, and regulatory databases.

Secondary research involved systematic analysis of industry publications, conference proceedings, and company disclosures to map technological progress, competitive activities, and market access trends. Data synthesis was achieved through proprietary frameworks that align product attributes with segmentation dimensions, enabling nuanced cross-sectional comparisons. Advanced resistance modeling tools and scenario analyses were employed to assess the potential impact of emerging policy shifts, such as the 2025 US tariffs, on supply chain viability and cost structures.

All input data were triangulated through rigorous quality checks and validation exercises. Key themes were distilled using thematic analysis approaches, while quantitative insights were derived from synthesized data sets without extrapolating market forecasts. The methodology ensures that the final insights are grounded in verifiable evidence and reflect the multifaceted realities of therapeutic development, distribution, and end-user adoption.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anthelmintic Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anthelmintic Drugs Market, by Drug Class

- Anthelmintic Drugs Market, by Animal Type

- Anthelmintic Drugs Market, by Route Of Administration

- Anthelmintic Drugs Market, by Formulation

- Anthelmintic Drugs Market, by Sales Channel

- Anthelmintic Drugs Market, by Region

- Anthelmintic Drugs Market, by Group

- Anthelmintic Drugs Market, by Country

- United States Anthelmintic Drugs Market

- China Anthelmintic Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Takeaways and Future Outlook for Anthelmintic Therapeutics within Complex Biological, Regulatory and Market Environments

In synthesizing the core findings, it is evident that anthelmintic drug developers and stakeholders must adapt to a rapidly shifting terrain characterized by emerging resistance profiles, regulatory evolution, and supply chain realignments. The rise of novel compound classes and combination therapies offers a pathway to circumvent resistance challenges, yet success will hinge on integrated surveillance and agile development frameworks.

Regional and segmentation insights illuminate the importance of tailored strategies: from sustained injectable programs in North American livestock operations to scalable tablet regimens for human deworming initiatives in emerging economies. Competitive dynamics underscore the need for multifaceted value propositions, combining advanced formulations, digital enablers, and consultative sales approaches to secure long-term market positioning.

Moving forward, the imperative for resilience-both in product efficacy and operational continuity-will define the organizations that lead the next wave of innovation in anthelmintic therapeutics. By embracing data-driven decision making, strategic partnerships, and flexible supply chain architectures, industry leaders can navigate uncertainties and capitalize on the evolving opportunities within this vital healthcare domain.

Unlock Exclusive Insights into Anthelmintic Drug Dynamics with Direct Support from Ketan Rohom for Strategic Advantage

For personalized guidance on leveraging deep-dive insights into drug resistance trends, supply chain resilience, and segmentation-driven strategies, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). He can tailor a presentation of the report’s full scope to your organization’s objectives and ensure you secure exclusive access to the definitive research on the anthelmintic drug landscape. Engage today and empower your strategic initiatives with the robust intelligence and actionable data you need to stay ahead in this critical therapeutic domain

- How big is the Anthelmintic Drugs Market?

- What is the Anthelmintic Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?