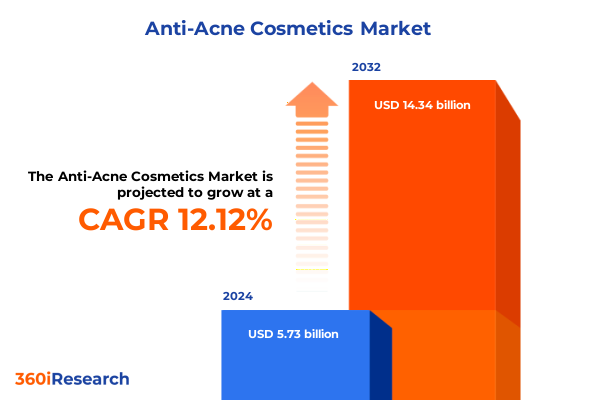

The Anti-Acne Cosmetics Market size was estimated at USD 6.37 billion in 2025 and expected to reach USD 7.08 billion in 2026, at a CAGR of 12.28% to reach USD 14.34 billion by 2032.

Navigating the Rising Tide of Acne Care: Understanding the Ubiquitous Demand for Effective Anti-Acne Cosmetics Across Demographics

Acne remains the most common dermatological condition, affecting nearly fifty million Americans each year and impacting up to eighty-five percent of adolescents at some stage in their lives. The American Academy of Dermatology’s updated guidelines underscore that both topical regimens-such as benzoyl peroxide and retinoids-and systemic treatments are foundational to effective management, with a growing emphasis on combining modalities to enhance outcomes and minimize resistance. This ubiquity of acne across age groups and its significant psychosocial burden have intensified demand for specialized cosmetic solutions that not only address breakouts but also promote long-term skin health and confidence

Embracing Technological Breakthroughs and Consumer-Centric Transformations Shaping the Future of Anti-Acne Skincare Innovation

The last two years have seen anti-acne skincare leap forward through cutting-edge technologies that place the consumer at the center of innovation. Artificial intelligence and machine learning now power personalized diagnostics, enabling virtual skin analyzers to recommend formulations tailored to individual pore size, sebum levels, and barrier integrity. Major brands are investing in AI-driven shade matching and condition tracking tools, while biotech startups collaborate on blockchain-certified ingredient transparency, reflecting a shift from one-size-fits-all to truly bespoke anti-acne regimens

Simultaneously, biotechnology and genomics are reshaping product development, with early adopters leveraging genetic profiling and microbiome analysis to create formulations that target acne at its root causes. Genomic insights guide ingredient selection for inflammation modulation and sebum regulation, while prebiotic and probiotic actives foster a balanced skin ecosystem. Though the full potential of genomics-infused skincare remains on the horizon, pilot programs illustrate a future where at-home testing informs clinical-grade treatments, bridging the gap between dermatology and cosmetics

Parallel to tech-driven personalization, the clean beauty movement continues to influence anti-acne offerings. Sustainability claims and ingredient transparency have become critical purchase drivers, particularly among Millennials and Gen Z, who favor formulations that merge botanical actives with proven anti-inflammatory agents. Brands are reformulating existing lines to incorporate biodegradable packaging, cruelty-free processing, and ethically sourced ingredients such as aloe vera and tea tree oil. This convergence of efficacy and eco-ethos underscores a broader consumer desire for products that heal skin without compromising environmental responsibility

Assessing the Far-Reaching Consequences of the 2025 U.S. Trade Tariffs on the Anti-Acne Cosmetics Supply Chain and Pricing

In April 2025, the United States implemented reciprocal trade tariffs that introduced a baseline duty of ten percent on all imports, with escalated rates reaching as high as fifty-four percent on specific countries and product categories. This sweeping policy encompasses beauty and personal care ingredients, exerting pressure on supply chains that have long relied on cost-effective sourcing from Asia and Europe. The uncertainty around tariff schedules has led to stockpiling raw materials, while manufacturers brace for potential margin erosion and delayed new product launches amid regulatory complexity

Anti-acne cosmetics feel the impact acutely, as key actives like azelaic acid, salicylic acid, and specialty botanical extracts often cross multiple borders during formulation and packaging. The added duties on primary packaging components sourced from China and Southeast Asia have necessitated price increases that range from ten to twenty-five percent at retail, undermining affordability for value-conscious consumers. Brands are responding by reformulating with tariff-exempt ingredients, renegotiating long-term supply contracts, and exploring domestic alternatives to mitigate further cost escalations and maintain product integrity

To adapt, some manufacturers are relocating production facilities to regions with favorable trade agreements, including Mexico and certain APAC nations. However, transitioning manufacturing footprints requires extensive validation and re-qualification of ingredient suppliers, creating both logistical hurdles and capital investment demands. Smaller indie brands, in particular, face the prospect of margin compression severe enough to threaten viability, giving rise to consolidation among agile manufacturers that can leverage scale to absorb tariff shocks

Unlocking Critical Insights from Comprehensive Segmentation Analysis to Illuminate Consumer Preferences and Market Dynamics

The market’s structure reflects a nuanced mosaic of product, channel, consumer, treatment, formulation, price, age, and skin-type criteria, each driving distinct preferences and purchasing behaviors. Creams and lotions dominate when consumers seek hydrating yet mattifying solutions, while oil-free gels find favor among those prioritizing lightweight textures and rapid absorption. Masks and serums attract users looking for targeted, treatment-level interventions, and cleansers maintain their role as the essential first step, with some brands combining gentle surfactants with active antimicrobial ingredients to disrupt acne-causing pathogens. Within these formats, further subcategories such as mattifying versus moisturizing creams, or oil-free versus soothing gels, address the spectrum of skin profiles and environmental conditions.

Distribution channels offer another layer of insight: e-commerce has surged through mobile apps and web portals, enabling subscription models and interactive diagnostics, whereas pharmacies and drugstores remain vital for trusted, dermatologist-recommended regimens. Specialty stores appeal to consumers seeking curated, premium experiences, and supermarkets & hypermarkets cater to mass-market lines where price sensitivity is paramount. End-user distinctions also guide product narratives-teen-focused formulations emphasize acne prevention and gentle control, women-targeted ranges balance efficacy with anti-aging benefits, men’s products leverage simplified routines and matteness, and unisex lines aim for broad appeal. Meanwhile, treatment intents vary from prevention and repair to aggressive treatment, and formulations span chemical actives like benzoyl peroxide and salicylic acid to natural botanicals such as aloe vera and tea tree oil. Price segmentation divides the landscape into mass, premium (mid and high tier), and luxury (including ultra-luxury) tiers, while age demographics-teen, young adult, mature adult, and middle aged & above-influence marketing tone and ingredient portfolios. Skin-type considerations add final granularity, distinguishing between normal, oily, sensitive, and combination variants, with dry or oily combination sub-profiles further refining consumer targeting.

This comprehensive research report categorizes the Anti-Acne Cosmetics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Treatment Type

- Formulation

- Price Range

- Age Group

- Skin Type

- End User

- Distribution Channel

Gaining Strategic Perspectives on Regional Trends and Growth Potentials Across the Americas, EMEA, and Asia-Pacific Markets

The Americas lead global consumption of anti-acne cosmetics, driven by the United States’ mature skincare landscape and rapidly evolving digital ecosystems. North American brands have pioneered telehealth integrations, offering virtual dermatologist consultations alongside direct-to-consumer subscription boxes and AI-driven regimen planners. Consumer appetite for personalized routines remains robust, supported by high internet penetration and a willingness to invest in premium products that promise both cosmetic and wellness benefits. This digital-first approach underpins strong performance in mobile app sales, with Gen Z and Millennials fueling growth through social commerce channels and influencer-led campaigns

In Europe, Middle East & Africa, regulatory frameworks and trade dynamics shape market access and pricing. The European cosmetics industry has rallied against additional U.S. import duties, calling for coordinated policy responses to preserve competitiveness and safeguard the “Made in Europe” brand equity. Local manufacturers benefit from stringent ingredient regulations that bolster consumer trust in safety and efficacy. Meanwhile, affluent Gulf Cooperation Council markets and select African urban centers exhibit rising demand for dermatologist-endorsed anti-acne ranges, reflecting increasing healthcare spending and greater awareness of skin infrastructure across diverse climates

Asia-Pacific represents the fastest-growing region, with legacy powerhouses such as South Korea and Japan driving both innovation and export. K-beauty’s hallmark of multi-step routines and fermentation-based actives faces pressure from U.S. tariffs, leading brands to accelerate local manufacturing in the Americas and Mexico. Simultaneously, rising economic prosperity in China, India, and Southeast Asia expands the middle-class consumer base, spurring demand for accessible anti-acne solutions that blend traditional botanical knowledge with advanced sensor-based diagnostics. This fusion of heritage and technology positions APAC as a crucible for next-generation formulations and regional partnerships to serve an expanding, digitally savvy audience

This comprehensive research report examines key regions that drive the evolution of the Anti-Acne Cosmetics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Industry Players Driving Innovation and Competitive Strategies in the Anti-Acne Cosmetics Arena

Leading brands are embracing AI and data analytics to deepen consumer engagement and accelerate innovation. Clinique’s clinical-grade acne serum integrates encapsulated retinoids with hydrating hyaluronic acid, leveraging AI models to forecast demand and optimize inventory across North America and Europe. Proactiv’s three-step AI consultation platform has delivered a forty-one percent uptick in conversion rates, supported by machine-learning algorithms that tailor product recommendations to individuals’ skin metrics. Similarly, Murad’s probiotic-infused cleanser, which received U.S. Food and Drug Administration clearance as a dermo-cosmetic, underscores how supplementing traditional antimicrobial approaches with live-culture technology can drive clinical differentiation and consumer trust

Dermatologist endorsement and scientific rigor remain core to brand credibility. Neutrogena continuously refines its OTC systems by integrating micronized benzoyl peroxide and offering teledermatology consultations through its mobile app, enhancing real-time follow-up and adherence. La Roche-Posay’s emphasis on thermal spring water and hypoallergenic compositions resonates with consumers prone to inflammatory acne, as the brand’s clinic partnerships validate outcomes in sensitive skin cohorts. Meanwhile, The Ordinary has surged through ingredient transparency, promoting single-active formulations such as salicylic acid and niacinamide at mass-market price points. This clear-label strategy has broadened consumer trust and spawned a wave of indie brands that mimic The Ordinary’s minimalist ethos while delivering targeted acne solutions

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Acne Cosmetics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Clinique Laboratories, LLC

- Colorescience, Inc.

- COSRX Inc.

- CP Skin Health Group, Inc.

- Dr.Jart+ by Have & Be USA, Inc.

- Galderma Group

- GLOWBIOTICS

- HUM Nutrition Inc.

- JMSR, Inc.

- Johnson & Johnson Services, Inc.

- KOSÉ Corporation

- L’Oréal S.A.

- Obagi Cosmeceuticals LLC

- Revision Skincare

- SESDERMA USA LLC

- Taro Pharmaceutical Industries Ltd.

- The BeautyHealth Company

- The Mentholatum Company

- Unilever PLC

Accelerating Success with Actionable Recommendations for Industry Stakeholders to Navigate Future Challenges and Capitalize on Emerging Opportunities

Industry leaders should harness advanced analytics to refine consumer segmentation, predicting unmet needs and guiding product development with real-world usage data. By integrating point-of-sale, e-commerce, and clinical feedback streams, companies can create dynamic, adaptive roadmaps that respond instantly to emerging breakout patterns and ingredient preferences. Embracing circular economy principles-such as refillable packaging and ingredient upcycling-can strengthen brand resilience against tariff fluctuations while appealing to eco-conscious consumers.

Partnerships between biotechs, dermatology clinics, and digital health platforms are poised to redefine efficacy standards. Establishing co-development agreements for microbiome-targeted therapies and leveraging telehealth networks can accelerate time-to-market for novel anti-acne treatments. Investing in inclusive R&D that addresses diverse skin tones and conditions will broaden market reach and preempt regulatory scrutiny around algorithmic bias in AI diagnostic tools.

Finally, brands must cultivate agile supply chains that can pivot between international and domestic sourcing based on tariff developments. Long-term agreements with multiple suppliers, regional warehousing strategies, and nearshore manufacturing partnerships will serve as vital safeguards against geopolitical disruptions, ensuring continuity in product availability and price stability.

Detailing Robust Research Methodology and Data Validation Processes Underpinning the Integrity of This Anti-Acne Cosmetics Market Study

This study synthesizes insights from primary interviews with dermatologists, formulators, and retail executives, complemented by a rigorous secondary review of industry reports, regulatory filings, and trade publications. Diverse data sources were triangulated to validate emerging trends and calibrate qualitative findings against objective market indicators.

Quantitative analysis employed statistical sampling of consumer purchase data across key channels, while sentiment analysis of social media and review platforms provided nuanced understanding of feature-level preferences. Ingredient flow assessments used customs records and tariff schedules to map cost impacts, and scenario modeling projected supply chain resilience under multiple trade-policy environments.

Quality control measures included peer review of methodology by academic dermatology researchers and an advisory board comprised of industry veterans. All data extraction and coding adhered to best practices for reproducibility, ensuring that conclusions are both transparent and defensible.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Acne Cosmetics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Acne Cosmetics Market, by Product Type

- Anti-Acne Cosmetics Market, by Treatment Type

- Anti-Acne Cosmetics Market, by Formulation

- Anti-Acne Cosmetics Market, by Price Range

- Anti-Acne Cosmetics Market, by Age Group

- Anti-Acne Cosmetics Market, by Skin Type

- Anti-Acne Cosmetics Market, by End User

- Anti-Acne Cosmetics Market, by Distribution Channel

- Anti-Acne Cosmetics Market, by Region

- Anti-Acne Cosmetics Market, by Group

- Anti-Acne Cosmetics Market, by Country

- United States Anti-Acne Cosmetics Market

- China Anti-Acne Cosmetics Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2544 ]

Concluding Insights Emphasizing Key Takeaways and Strategic Implications for Stakeholders in the Anti-Acne Cosmetics Ecosystem

As the anti-acne cosmetics landscape continues to evolve, the convergence of personalization technologies, sustainable formulations, and agile supply chains will define winners and losers. Brands that invest in AI-enabled diagnostics and data-driven product refinement will deepen consumer trust, while those that align with sustainability imperatives will capture ethical market share.

Navigating tariff headwinds requires preemptive supply-chain realignment and strong supplier partnerships, particularly for raw materials and packaging components. Dermatologist collaborations remain a powerful lever to reinforce credibility, and expanding telehealth integrations will further blur lines between clinical treatment and cosmetic care.

Ultimately, success hinges on an omnichannel approach that seamlessly links e-commerce, brick-and-mortar, and digital health experiences, ensuring consistent brand narratives and accessible solutions. Stakeholders that embrace these strategic imperatives will be well-positioned to lead the next generation of anti-acne innovation.

Empower Your Strategic Decisions with Exclusive Access to Our Anti-Acne Cosmetics Market Report from Associate Director Ketan Rohom

To explore the full depth of these findings and secure a competitive edge in the evolving anti-acne cosmetics landscape, connect with Ketan Rohom, Associate Director of Sales & Marketing, for personalized guidance on how this research can inform your strategic priorities. Engage with our expert team to tailor this report’s insights to your organization’s unique needs and accelerate your market success with data-driven decision making and actionable intelligence.

- How big is the Anti-Acne Cosmetics Market?

- What is the Anti-Acne Cosmetics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?