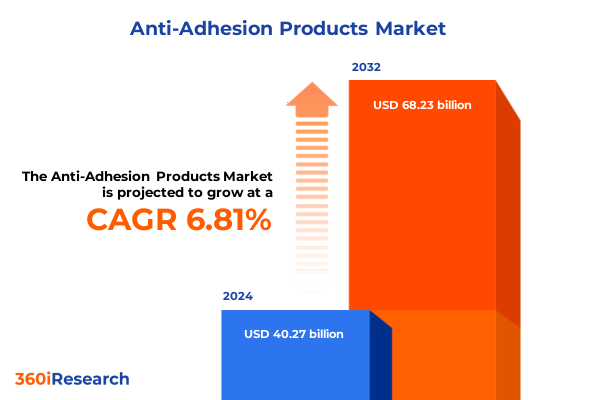

The Anti-Adhesion Products Market size was estimated at USD 42.86 billion in 2025 and expected to reach USD 45.63 billion in 2026, at a CAGR of 6.86% to reach USD 68.23 billion by 2032.

Innovative Breakthroughs and Rising Surgical Demands Drive the Evolution of Anti-Adhesion Therapies in Modern Healthcare Systems

Advancements in minimally invasive surgical techniques alongside growing clinical awareness of postoperative complications have propelled anti-adhesion products to the forefront of perioperative care. Increasing procedural volumes across cardiovascular, general, gynecological, and orthopedic surgeries have heightened the need for reliable adhesion prevention, leading to a surge in innovation across pharmaceutical gels, physical barriers, and combination modalities. As surgeons demand more effective and user-friendly solutions, manufacturers are responding with novel formulations and delivery systems designed to integrate seamlessly into varied operative workflows.

Moreover, interdisciplinary collaboration between device engineers and pharmaceutical scientists has accelerated the development of next-generation adhesion prevention therapies. Regulatory bodies have demonstrated flexibility by fast-tracking approvals for products that demonstrate clear patient benefit and cost-effectiveness. Consequently, the landscape now features a diversified portfolio of products ranging from heparin-based gels and hyaluronic acid barriers to icodextrin solutions and advanced polymer matrices. As the clinical community adopts these innovations, the stage is set for continued refinement and broader acceptance of anti-adhesion strategies.

Shifting Surgical Practices and Regulatory Frameworks Redefine the Anti-Adhesion Product Landscape for Enhanced Clinical Outcomes

The transformation of surgical practices over the past decade has reshaped the anti-adhesion market by placing a premium on minimally invasive approaches. Laparoscopic and robotic-assisted procedures, which reduce tissue trauma and improve recovery times, have created new requirements for adhesion prevention products that can be delivered through smaller incisions. Consequently, delivery systems have evolved to accommodate advanced trocars and laparoscopic instruments, ensuring that gels and films remain viable in closed environments.

Simultaneously, convergence between drug-delivery platforms and bioresorbable barrier technologies has emerged as a decisive trend. Manufacturers have embraced combination products that leverage both mechanical and pharmacological mechanisms to minimize the risk of fibrotic tissue formation. At the same time, regulatory frameworks in both the United States and major global markets have adapted to evaluate these hybrid solutions more efficiently, promoting accelerated clinical adoption. As a result, the market has witnessed a gradual shift from single-mechanism barriers toward integrated therapies that offer enhanced protection against adhesion development, aligning product capabilities with evolving surgical standards.

Assessing the Ramifications of Evolving U.S. Tariff Policies on Anti-Adhesion Product Supply Chains and Cost Structures Across Surgical Markets

The cumulative impact of recent U.S. tariff policies has reverberated across the anti-adhesion supply chain, particularly affecting raw materials and component imports. Tariffs on certain medical-grade polymers and specialized surfactants have raised input costs, prompting manufacturers to reassess sourcing strategies. In response, several producers have accelerated efforts to develop domestic supply agreements, reducing reliance on international suppliers and mitigating tariff exposure.

At the same time, increased costs have been partially offset by gradual process optimization and economies of scale. Companies have invested in lean manufacturing techniques and strategic inventory management to cushion the impact of duty fluctuations. As a result, while end users have experienced modest price adjustments, the overall market has demonstrated resilience by adopting innovative cost-containment measures. Looking ahead, continued dialogue with trade authorities and proactive logistics planning will be essential to navigate the evolving landscape of U.S. tariff regulations and sustain product affordability.

Diverse Product Forms Application Settings and Distribution Channels Illuminate Critical Segmentation Patterns in Anti-Adhesion Therapy Adoption

In dissecting product segmentation, the anti-adhesion landscape encompasses combination products that marry mechanical barriers with active pharmaceutical agents, standalone pharmaceutical gels such as heparin-based formulations, hyaluronic acid matrices, and icodextrin solutions, alongside purely physical barrier films and meshes. Applications extend across cardiovascular surgery where precision barrier placement is critical, general surgical procedures requiring broad coverage, gynecological interventions that demand biocompatible resorbable materials, and orthopedic surgeries with unique spatial challenges. End users range from high-volume hospital operating rooms providing comprehensive post-surgical care, to ambulatory surgical centers that emphasize rapid turnover, and clinics where cost efficiency and ease of use drive product selection.

Distribution channels are equally diverse, spanning direct sales forces that engage surgical teams in real time, hospital pharmacies leveraging institutional formularies, online pharmacies offering convenience for outpatient settings, and retail pharmacies serving patient-managed initiatives. This multifaceted segmentation underscores the need for tailored strategies that address product design, regulatory approval pathways, end-user training requirements, and channel-specific marketing approaches to optimize market penetration across each distinct segment.

This comprehensive research report categorizes the Anti-Adhesion Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Distribution Channel

Regional Dynamics Highlight Variances in Clinical Practices Reimbursement Policies and Growth Opportunities for Anti-Adhesion Solutions Globally

Regional variations play a pivotal role in shaping the adoption trajectory of anti-adhesion therapies. In the Americas, robust reimbursement frameworks and consolidated healthcare systems facilitate swift integration of advanced barrier technologies, with payers often recognizing the long-term value of reduced readmissions and complication rates. Consequently, this region tends to lead in the adoption of premium combination products and is frequently selected for pivotal clinical studies that drive global regulatory submissions.

In Europe, Middle East & Africa markets, regulatory harmonization across the European Union coexists with reimbursement disparities among member states, resulting in a nuanced path to market. Manufacturers must navigate localized health technology assessment protocols while tailoring training and support to diverse clinical environments. Meanwhile, emerging markets in the Middle East and Africa show growing interest in cost-effective physical barriers, signaling opportunities for modular product offerings. Across Asia-Pacific, escalating healthcare investments, expanding surgical infrastructure, and government initiatives to enhance postoperative care are fueling demand for both established and emerging anti-adhesion modalities. Local partnerships and technology transfers are becoming increasingly important for navigating regulatory requirements and ensuring timely market entry within this dynamic region.

This comprehensive research report examines key regions that drive the evolution of the Anti-Adhesion Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Insights Reveal Strategic Partnerships Innovation Pipelines and Operational Priorities Among Leading Anti-Adhesion Industry Players

Leading industry players are advancing their competitive positioning through strategic collaborations, targeted research and development initiatives, and selective acquisitions. Established medical device manufacturers are investing in specialized production lines to support high-purity polymer synthesis, while biopharmaceutical companies are expanding their portfolios to include resorbable barrier materials. These efforts reflect a convergence of capabilities designed to deliver differentiated product profiles and accelerate time to market.

Emerging entrepreneurs and smaller innovators are carving niches by focusing on adjunct technologies such as targeted drug-elution systems and smart barrier materials responsive to inflammatory biomarkers. Partnerships between technology startups and academic research institutions are generating preclinical data that may underpin next-generation therapies. Meanwhile, multinational corporations are leveraging their global distribution networks to streamline market access and build synergies across therapeutic areas. The resultant competitive landscape is marked by a balance between established players driving scale and agility-focused organizations championing rapid innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Adhesion Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acell Inc.

- AdhexPharma

- Baxter International Inc.

- CGBio Inc.

- CollPlant Holdings Ltd.

- Heraeus Medical

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson

- PlantTec Medical GmbH

- Sanofi S.A.

- SJV Yishengtang

Strategic Imperatives for Industry Stakeholders to Navigate Innovation Challenges Optimize Resource Allocation and Advance Patient-Centric Adhesion Prevention

Industry leaders seeking to strengthen their market position should prioritize the development of modular platform technologies that can be customized for specific surgical applications, thereby bolstering both clinical versatility and cost efficiency. Cultivating close collaborations with surgeon thought leaders and multidisciplinary care teams will yield deeper insights into user preferences and procedural nuances, informing iterative product enhancements. Furthermore, establishing real-world evidence programs in partnership with healthcare institutions can generate robust clinical and economic data, facilitating favorable reimbursement decisions.

In parallel, organizations must fortify supply chain resilience by diversifying raw material sources, investing in domestic manufacturing capabilities, and leveraging advanced analytics to anticipate disruptions. Engaging early with regulatory agencies to align on novel product pathways can accelerate approvals and reduce time to market. Finally, integrating digital health solutions-for example, intraoperative guidance systems linked to barrier placement techniques-can amplify product value and foster stronger stakeholder engagement throughout the continuum of surgical care.

Robust Multi-Source Data Gathering Expert Consultation and Rigorous Analytical Frameworks Underpin Comprehensive Anti-Adhesion Market Research Methodology

This research leverages a triangulated methodology combining extensive secondary research with targeted primary interviews and proprietary data validation techniques. Secondary sources included peer-reviewed clinical journals, regulatory agency publications, patent databases, and industry white papers, ensuring comprehensive coverage of technological developments and market dynamics. Primary research involved in-depth discussions with key opinion leaders, including senior surgeons, procurement specialists, and reimbursement experts, to capture real-world insights and validate emerging trends.

Quantitative analyses were performed using structured data collection frameworks, while qualitative findings were subject to expert panel reviews to enhance accuracy and relevance. Regional advisory boards provided localized context, particularly for navigating complex regulatory and reimbursement landscapes in Europe, Middle East & Africa and Asia-Pacific. All findings have undergone rigorous quality checks and consistency assessments, ensuring that the resulting report offers a robust foundation for strategic decision-making in the evolving anti-adhesion products market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Adhesion Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Adhesion Products Market, by Product Type

- Anti-Adhesion Products Market, by Application

- Anti-Adhesion Products Market, by End User

- Anti-Adhesion Products Market, by Distribution Channel

- Anti-Adhesion Products Market, by Region

- Anti-Adhesion Products Market, by Group

- Anti-Adhesion Products Market, by Country

- United States Anti-Adhesion Products Market

- China Anti-Adhesion Products Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Market Evolution Clinical Drivers and Strategic Opportunities to Chart a Clear Path Forward in Anti-Adhesion Product Development

The landscape of anti-adhesion products is defined by dynamic interplay among technological innovation, evolving clinical practices, and shifting regulatory and economic conditions. As minimally invasive techniques become the standard of care, the demand for adaptable, high-performance adhesion barriers continues to accelerate. Market segmentation analysis reveals diverse opportunities across product types, surgical applications, and distribution channels, underscoring the importance of tailored strategies to address the unique requirements of each end user and geography.

Regional insights highlight the necessity of nuanced market entry plans that align with local reimbursement structures and clinical adoption patterns. Meanwhile, competitive intelligence points to a growing ecosystem of partnerships and specialized R&D efforts that will shape the next generation of adhesion prevention therapies. By synthesizing these drivers, stakeholders can identify strategic priorities that optimize clinical impact and operational efficiency. Consistent application of the key recommendations outlined in this report will position organizations to lead in the pursuit of safer surgical experiences and improved patient outcomes.

Empower Your Strategic Decisions Today by Securing This Comprehensive Anti-Adhesion Products Report Through Direct Engagement with Our Sales Leadership

To secure access to comprehensive insights and data-driven strategies that will elevate your organization’s position in the anti-adhesion products landscape, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. By engaging with this report, you gain exclusive guidance on navigating complex regulatory frameworks, optimizing supply chain resilience, and capitalizing on emerging clinical applications tailored to your goals.

Act now to transform uncertainty into strategic advantage. Reach out today to obtain the full market research report and equip your executive team with the actionable intelligence needed to drive sustained growth and innovation in anti-adhesion therapy development.

- How big is the Anti-Adhesion Products Market?

- What is the Anti-Adhesion Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?