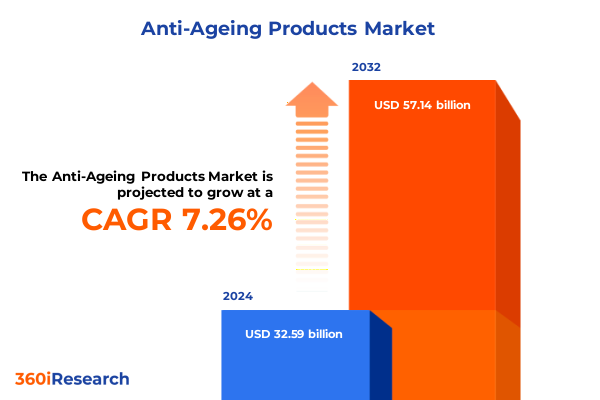

The Anti-Ageing Products Market size was estimated at USD 34.89 billion in 2025 and expected to reach USD 37.36 billion in 2026, at a CAGR of 7.30% to reach USD 57.14 billion by 2032.

Unveiling the Foundational Pillars That Define the Contemporary Anti-Aging Sector Through Consumer Insights and Scientific Milestones

The anti-aging market has evolved from a niche segment focused on basic topical applications to a sophisticated ecosystem driven by scientific innovation, holistic wellness principles, and nuanced consumer demands. Over the past decade, heightened consumer awareness around preventive self-care combined with an increasing global aging population have elevated anti-aging products from luxury indulgences to essential components of daily health regimens. As expectations have risen, brands have sought to integrate dermatological breakthroughs, biotechnology applications, and nutraceutical approaches to deliver multi-dimensional benefits. This convergence has not only expanded the functional scope of creams and serums but has also underscored the importance of efficacy, transparency, and personalized experiences.

Momentum in product innovation is further bolstered by regulatory agencies prioritizing safety assessments alongside rapid approvals for clinically validated ingredients. Advances in molecular biology have unlocked new pathways for stimulating collagen synthesis, targeting free radicals, and modulating gene expression, which in turn inform formulation strategies. Meanwhile, digital platforms have empowered consumers with access to peer reviews, scientific white papers, and virtual consultations, elevating the role of education in purchase decisions. Consequently, success in this landscape depends on a brand’s ability to blend compelling clinical narratives with user-centric delivery systems, thus redefining the essence of anti-aging solutions in today’s market.

Examining the Major Technological and Consumer-Driven Transformations Reshaping the Future of Anti-Aging Solutions Across Scientific, Digital, and Holistic Wellness Domains

Rapid advancements in biotechnology and digital tools have catalyzed transformative shifts in the anti-aging arena, ushering in a new era of targeted, data-driven solutions. Artificial intelligence and machine learning now enable predictive skin analysis, empowering brands to formulate personalized serums that adapt in real time to an individual’s unique dermal profile. Simultaneously, innovations in delivery mechanisms-such as liposomal encapsulation and micro-needle patches-enhance ingredient penetration while maximizing tolerability. These developments have disrupted traditional product cycles, compelling stakeholders to pivot toward agile research-and-development frameworks that embrace continuous iteration.

Consumer preferences have also undergone a profound metamorphosis, with sustainability and ethical sourcing becoming non-negotiable criteria. Demand for plant-derived active compounds has surged, prompting formulators to explore novel botanical extracts and upcycled byproducts as efficacious anti-aging agents. Furthermore, the rise of experiential retail environments-integrating virtual try-on technologies and skin-health kiosks-reflects a broader shift toward immersive engagement. These converging forces of technological prowess and evolving consumer values are redefining value propositions across the anti-aging spectrum, driving brands to innovate at unprecedented speed and scale.

Unraveling the Comprehensive Effects of 2025 United States Tariff Policies on Anti-Aging Supply Chains, Raw Material Costs, Pricing Structures, and Innovation Dynamics

The introduction of comprehensive tariff measures by the United States in 2025 has exerted multifaceted pressures on anti-aging product manufacturers, particularly those reliant on key imported raw materials and specialized packaging components. Suppliers of hyaluronic acid, peptides, and high-purity botanical extracts have encountered increased duties on their exports, leading to higher landed costs and compressing product margin. Simultaneously, tariffs on advanced delivery systems, including microcapsules and proprietary encapsulation technologies, have compounded cost challenges, compelling brands to reevaluate sourcing strategies and negotiate volume-based concessions to offset duty escalations.

In response to these headwinds, industry participants have accelerated diversification initiatives, forging strategic partnerships with domestic biotech firms and nearshoring critical ingredient production. Brands that previously imported injectable formulations-such as neurotoxin-based treatments and dermal fillers-have begun localizing fill-and-finish processes to mitigate customs delays and minimize exposure to fluctuating trade policies. Moreover, research collaborations between U.S. academic institutions and private laboratories have gained momentum, enabling access to cutting-edge active compounds under preferential licensing terms. As stakeholders continue to adapt procurement models and refine cost-management frameworks, resilience in the anti-aging value chain is emerging as a defining competitive advantage.

Offering Strategic Insights into Anti-Aging Market Segmentation Spanning Product Categories Active Ingredients Age Cohorts Distribution Channels and Demographics

The anti-aging market’s segmentation offers strategic clarity for product development and targeted marketing efforts. Product portfolios span multifunctional topical offerings-encompassing body lotions that nourish larger surface areas, day creams formulated for UV protection, eye creams designed to address delicate skin zones, and night creams that leverage enhanced regenerative cycles-as well as injectables, which range from wrinkle-reducing botulinum toxin applications to volumizing dermal fillers. Mask formulations further diversify the landscape, with clay masks detoxifying and refining pores, cream masks delivering intensive hydration, and sheet masks facilitating the swift infusion of high-concentration actives. Meanwhile, serums harness molecularly precise ingredients-hyaluronic acid boosts hydration at a cellular level, peptide complexes stimulate reparative processes, retinol accelerates cellular turnover to smooth textures, and vitamin C combats oxidative stress-complemented by ingestible supplements that support systemic anti-aging benefits.

Analyzing segmentation through the lens of active ingredients reveals distinct consumer journeys and price tiers. Collagen-centric formulations resonate with those focused on structural support, while hyaluronic acid products capture audiences prioritizing immediate plumpness and moisture retention. Peptide-based serums attract consumers seeking scientifically advanced repair, with retinol offerings appealing to individuals aiming for visible rejuvenation, and vitamin C derivatives appealing to those emphasizing brightening and antioxidant protection. Age-specific cohorts also influence purchasing behavior; individuals between twenty-five and thirty-four often adopt preventive regimens featuring lightweight serums and day creams, while those aged thirty-five to forty-four show a growing interest in potent actives and injectable treatments. As consumers progress into the forty-five to fifty-four range, multifunctional formulations combining hydration, firming, and pigmentation strategies gain prominence, and those over fifty-five increasingly value comprehensive skincare systems supported by both topicals and oral supplements.

Distribution channels further shape engagement and access dynamics. Offline environments-from department stores offering prestige sampling experiences to pharmacies and drug stores emphasizing science-backed credibility, as well as specialty stores presenting curated natural or luxury assortments-cater to tactile evaluation and expert consultation. In contrast, online platforms unlock convenience and wider reach, whether via branded e-commerce websites featuring tailored quiz-driven recommendations or third-party marketplaces providing competitive pricing and peer reviews. Finally, gender-based demography underscores distinct product positioning strategies: female consumers often gravitate toward ritualized self-care applications with multifaceted sensory appeals, while male consumers show increasing interest in streamlined, multifunctional formulations that integrate seamlessly into simpler grooming routines.

This comprehensive research report categorizes the Anti-Ageing Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Active Ingredient

- Age Group

- Distribution Channel

- User Demography

Illuminating Regional Nuances in Consumer Preferences Regulatory Frameworks and Growth Opportunities across Americas EMEA and Asia-Pacific Anti-Aging Markets

Regional dynamics in the anti-aging sphere reveal both universal trends and localized nuances that influence product strategies and growth trajectories. In the Americas, established healthcare infrastructure and high consumer spending power have propelled demand for both premium topical formulations and medical aesthetic services. Regulatory alignment with health authorities fosters confidence in clinically tested actives, while robust distribution networks-from luxury retail corridors to widespread pharmacy chains-support omnichannel engagement. Consumer interest in clean-label formulations and ethical sourcing further shapes innovation pipelines, with North American audiences particularly receptive to plant-derived cosmeceuticals and minimally invasive treatment options.

Across Europe, the Middle East, and Africa, the anti-aging ecosystem is characterized by varied regulatory frameworks and diverse cultural perceptions of aging. Western European markets prioritize sustainability credentials, driving product developers to validate ingredient traceability and eco-conscious packaging. Simultaneously, demand for dermatologist-recommended treatments sustains strong growth in clinical segments, including injectable therapies. In the Middle East, a growing emphasis on aesthetic enhancement intersects with high luxury spending, encouraging bespoke product launches and premium service models. Meanwhile, emerging markets in Africa are gradually embracing both natural ingredient trends and advanced skincare routines, supported by expanding e-commerce infrastructure and rising digital literacy.

The Asia-Pacific region represents a dynamic convergence of innovation, tradition, and scale. East Asian markets, particularly South Korea and Japan, continue to lead in pioneering formulation technologies, from micro-encapsulation to novel peptide complexes. Consumer sophistication in these territories drives early adoption of cutting-edge serums and sheet mask innovations, while cross-border e-commerce platforms accelerate the diffusion of popular brands. In South Asia and Southeast Asia, youthful demographics and an expanding middle class underpin growth in accessible, multifunctional anti-aging products, with a rising focus on skin brightening and UV defense. Regulatory harmonization efforts and investments in local ingredient sourcing are further enhancing market resilience, making the region a critical epicenter for future product breakthroughs.

This comprehensive research report examines key regions that drive the evolution of the Anti-Ageing Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Leading Anti-Aging Industry Players and Their Strategic Approaches to Innovation Portfolio Diversification and Competitive Positioning

Key industry incumbents have adopted differentiated strategies to maintain competitive positioning within the anti-aging market. Leading multinational beauty conglomerates have leveraged their extensive R&D capabilities and global distribution channels to launch portfolio expansions that bridge prestige skincare and medical aesthetic solutions. These players have invested heavily in clinical trials, collaborating with academic institutions to substantiate efficacy claims for novel peptides and growth factors. Meanwhile, specialist aesthetic companies have concentrated on injectable segments, refining botulinum toxin formulations and innovative dermal filler compounds to cater to demand for minimally invasive facial rejuvenation procedures.

Digital-native brands have disrupted traditional models by embedding direct-to-consumer frameworks into their growth strategies. By harnessing data analytics and digital marketing, these companies deliver hyper-targeted product recommendations and personalized subscription services. Strategic acquisitions and partnerships with biotech startups have enabled these brands to integrate proprietary delivery systems and unique active compounds, further differentiating their offerings. At the same time, cross-sector alliances between skincare companies and nutritional supplement manufacturers highlight the growing intersection between dermatology and holistic wellness, expanding the competitive landscape and offering new avenues for cross-promotion and bundled solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Ageing Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allergan Plc

- Amorepacific Corporation

- Avon Products, Inc.

- Beiersdorf AG

- Clarins S.A.

- Coty Inc.

- Dior

- DSM N.V.

- Galderma S.A.

- GlaxoSmithKline PLC

- Johnson & Johnson Services, Inc.

- Kao Corporation

- LVMH Moët Hennessy Louis Vuitton SE

- L’Oréal S.A.

- Mary Kay Inc.

- Merck KGaA

- Natura & Co.

- Natura Cosmetic S.A.

- Nu Skin Enterprises, Inc.

- Pierre Fabre S.A.

- RoC Laboratoires S.A.

- Shiseido Company, Limited

- The Estée Lauder Companies Inc.

- The Procter & Gamble Company

- Unilever PLC

Presenting Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends and Strengthen Market Leadership through Innovation Sustainability and Customer Engagement

To excel in this dynamic environment, industry leaders should prioritize the integration of advanced research platforms with agile development pipelines. By allocating resources to collaborative partnerships with biotech innovators and academic laboratories, organizations can accelerate the identification of next-generation active compounds and delivery vectors. Concurrently, strengthening supply chain visibility through digital traceability tools will enhance resilience against fluctuating trade policies and raw material constraints. Brands should further invest in end-to-end consumer analytics, leveraging real-time feedback loops to optimize formulation iterations and tailor messaging across targeted demographics.

Sustainability must underpin both product design and operational practices. Adopting circular packaging systems, sourcing ethically certified botanicals, and publicizing transparent lifecycle assessments will resonate with eco-conscious consumers and fortify brand trust. Additionally, expanding omnichannel capabilities-such as integrating virtual skin consultations, AI-driven recommendation engines, and seamless e-commerce fulfillment-will foster deeper engagement and superior customer experiences. Finally, developing segmented go-to-market strategies that address the preferences of each age cohort, gender demographic, and distribution channel will enable precise resource allocation and maximize return on marketing investment.

Detailing the Rigorous Research Methodology Employed to Ensure Accurate, High-Quality, and Actionable Insights in the Anti-Aging Market Analysis

The insights presented in this report are underpinned by a comprehensive research methodology designed to ensure accuracy, depth, and relevance. Primary research comprised interviews with dermatologists, aesthetic practitioners, ingredient suppliers, and leading brand representatives, providing first-hand perspectives on formulation challenges, regulatory considerations, and consumer adoption patterns. These qualitative inputs were rigorously validated against secondary data sources, including peer-reviewed publications, industry patents, and specialized trade journals, to triangulate findings and identify emerging trends.

Quantitative analysis involved the synthesis of extensive commercial databases, cross-referenced with corporate financial disclosures and transaction records, to map out competitive positioning, product launch timelines, and geographic revenue distributions. Advanced statistical techniques, such as cluster analysis and regression modeling, were employed to detect correlations between ingredient usage and consumer preferences. A multi-tiered review process, consisting of internal subject matter experts and external industry advisors, ensured that the final deliverables met stringent quality standards and provided actionable insights for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Ageing Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Ageing Products Market, by Product Type

- Anti-Ageing Products Market, by Active Ingredient

- Anti-Ageing Products Market, by Age Group

- Anti-Ageing Products Market, by Distribution Channel

- Anti-Ageing Products Market, by User Demography

- Anti-Ageing Products Market, by Region

- Anti-Ageing Products Market, by Group

- Anti-Ageing Products Market, by Country

- United States Anti-Ageing Products Market

- China Anti-Ageing Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Principal Findings into a Cohesive Narrative Emphasizing Critical Success Factors and Strategic Imperatives for Anti-Aging Stakeholders

The collective findings underscore a market in transition-fuelled by converging scientific breakthroughs, shifting consumer expectations, and evolving regulatory landscapes. Stakeholders that excel will be those who demonstrate agility in innovation, underpinned by robust data frameworks and collaborative networks. Brands that integrate sustainable practices throughout their value chains, from ingredient sourcing to end-of-life product stewardship, are poised to capture heightened consumer loyalty and mitigate reputational risk. Equally, organizations that leverage digital technologies to personalize experiences and streamline operations will unlock new efficiency gains and differentiation in a crowded marketplace.

Ultimately, success in the modern anti-aging sector demands a holistic approach that balances scientific rigor with consumer-centric storytelling. As product offerings expand beyond surface-level treatments to encompass systemic wellness solutions, companies must align cross-functional teams-研发, marketing, regulatory, and supply chain-to deliver cohesive, high-impact strategies. By staying attuned to regional nuances, tariff impacts, and segmentation dynamics, industry stakeholders can navigate uncertainty and accelerate value creation throughout the product lifecycle.

Engage with Associate Director of Sales and Marketing Ketan Rohom to Secure Your Definitive Anti-Aging Market Research Report and Propel Strategic Growth

To gain an in-depth understanding of the evolving anti-aging landscape and to leverage data-driven insights for strategic decision-making, we invite you to engage directly with our Associate Director of Sales and Marketing, Ketan Rohom. He offers personalized consultations to discuss how this comprehensive market research report can address your specific challenges-whether you aim to refine your product portfolio, optimize your go-to-market approach, or support stakeholder presentations with robust, validated data. By partnering with Ketan, you will secure early access to exclusive strategic recommendations, methodological details, and proprietary competitive intelligence. Act now to position your organization at the forefront of innovation and consumer satisfaction in the anti-aging sector by reaching out to Ketan Rohom and securing your copy of this definitive market research report today

- How big is the Anti-Ageing Products Market?

- What is the Anti-Ageing Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?