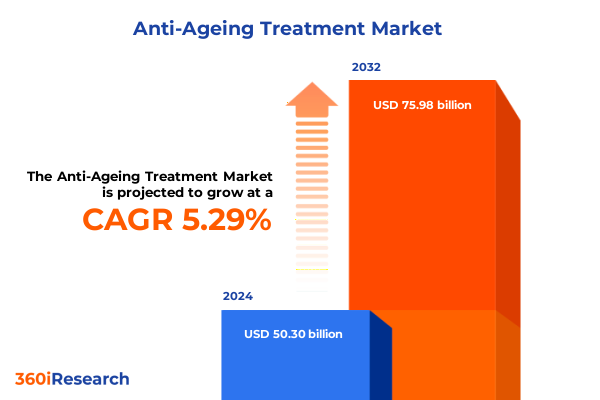

The Anti-Ageing Treatment Market size was estimated at USD 52.21 billion in 2025 and expected to reach USD 54.19 billion in 2026, at a CAGR of 5.50% to reach USD 75.98 billion by 2032.

Pioneering the Future of Anti-Ageing Treatments through Innovative Science, Consumer-Centered Design, and Holistic Wellness Strategies

The anti-ageing treatment arena has entered an era defined by rapid scientific advancements and evolving consumer priorities. Rising longevity expectations and an increasingly health-conscious demographic have converged to create unparalleled demand for innovative solutions that address the visible and underlying effects of ageing. Consequently, businesses at the forefront of skin science and wellness are exploring novel formulations, delivery mechanisms, and diagnostic tools to meet sophisticated consumer expectations. Amidst this surge of innovation, stakeholders across the value chain-from raw material suppliers to clinical practitioners-are recognizing the need for integrated strategies that balance efficacy, safety, and user experience.

As public awareness of preventative care accelerates, the market’s focus has shifted from remedial to prophylactic approaches, emphasizing interventions that preserve skin integrity over time. This transition has elevated the role of targeted actives, cutting-edge devices, and data-driven personalization, ultimately reshaping how anti-ageing solutions are conceptualized, developed, and marketed. With global populations ageing and younger cohorts seeking pre-emptive skincare regimens, the industry stands at a pivotal juncture where traditional beauty ideals intersect with a broader wellness ethos. In this context, the insights and guidance provided in the following sections serve as a cornerstone for stakeholders aiming to navigate the complexities of the modern anti-ageing treatment landscape and to capitalize on emerging avenues for sustainable growth.

Embracing Transformative Shifts: Integrating Biotechnology Breakthroughs, Personalized Formulations, and Digital Health in Anti-Ageing Care

Over the past few years, transformative shifts have redefined the landscape of anti-ageing treatments, driven by breakthroughs in biotechnology, precision medicine, and digital health integration. Novel peptide-based compounds, bioengineered growth factors, and microbiome-modulating technologies have expanded the palette of active ingredients available to formulators. Simultaneously, the rise of advanced delivery systems-such as microneedling, radiofrequency skin tightening, and laser-based therapies-has enhanced treatment efficacy while minimizing invasiveness. As a result, companies are now devising hybrid solutions that combine topical agents with device-driven protocols to achieve synergistic outcomes.

Moreover, the personalization trend has matured beyond simple skin typing, leveraging insights from genetic profiling and artificial intelligence to tailor regimens in real time. Digital health platforms capture continuous feedback on treatment performance, enabling dynamic adjustments that optimize patient experiences and outcomes. In parallel, sustainability and clean beauty mandates are prompting material scientists to source ecofriendly actives and develop biodegradable formulations. Therefore, the industry’s current trajectory reflects a holistic vision, integrating scientific rigor, experiential design, and environmental stewardship to foster long-term consumer trust and loyalty.

Navigating the Cumulative Effects of Elevated United States Tariffs in 2025 on Global Supply Chains and Consumer Accessibility

In 2025, the implementation of elevated tariffs on select beauty and skincare imports has introduced new complexities for manufacturers and distributors in the United States. The incremental levies have increased landed costs for a variety of key actives and devices sourced predominantly from European and Asian production hubs. Consequently, supply chain managers have been compelled to reassess vendor agreements, explore nearshoring options, and renegotiate long-term contracts to mitigate margin erosion. In addition to logistical reconfigurations, organizations have accelerated their focus on vertical integration, with several opting to establish domestic formulation and packaging facilities.

These strategic adjustments, however, have not been without ramifications for pricing and consumer accessibility. While some companies have absorbed a portion of the additional duties to maintain competitive shelf pricing, others have implemented tiered price structures that reflect the true cost basis. Regulators, industry associations, and trade groups are engaging in ongoing dialogues to clarify classification guidelines and seek relief for critical medical-grade inputs. Amid these developments, businesses that adopt flexible sourcing strategies, coupled with agile supply chain analytics, are better positioned to sustain continuity and preserve their brand reputation despite tariff-induced headwinds.

Unveiling Key Segmentation Insights to Tailor Treatment Strategies across Diverse Product Types, Channels, and Application Areas

The anti-ageing treatment market exhibits a variety of segmentation dimensions that illuminate unique consumer behaviors and product preferences. When analyzing by treatment type, cosmetic interventions-ranging from chemical peels and cryotherapy to dermal fillers, Botox injections, laser skin resurfacing, microdermabrasion, microneedling, and radiofrequency skin tightening-dominate the high-investment end of the spectrum, whereas topical approaches, including anti-ageing creams and serums, antioxidants, peptides, retinoids, and sunscreens, cater to daily regimen integration. Transitioning to gender segmentation, female consumers continue to represent the core demand engine, yet male uptake is growing as grooming and wellness norms shift.

Examining distribution channels reveals that digital platforms are assuming an increasingly vital role, with brand websites and e-marketplaces capturing a significant share of discretionary spend, complemented by pharmacies, drug stores, and specialty retail outlets that provide in-person expert consultation. Lastly, end user applications-spanning body care, eye care, and facial care-underscore the need for targeted formulations and service protocols that address specific anatomical zones and age-related concerns. Recognizing these differentiated paths to purchase and product engagement enables stakeholders to refine their portfolio strategies and tailor communication to resonate with distinct consumer segments.

This comprehensive research report categorizes the Anti-Ageing Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Gender

- Distribution Channel

- End User Application

Analyzing Regional Dynamics and Growth Drivers in the Americas, Europe Middle East and Africa, and Asia-Pacific Markets for Anti-Ageing Solutions

Regional dynamics within the anti-ageing treatment sphere reveal salient variations in consumer behavior, regulatory frameworks, and technological adoption. In the Americas, robust demand is fueled by high disposable incomes, widespread dermatological awareness, and established e-commerce ecosystems that facilitate direct-to-consumer engagement. As a result, North America remains a litmus test for novel interventions and product launches, while Latin America exhibits a growing appetite for minimally invasive cosmetic procedures supported by competitive pricing.

Turning to Europe, Middle East & Africa, Europe’s maturity is characterized by stringent safety protocols, a proliferation of medical aesthetics clinics, and a vibrant natural ingredients movement. Meanwhile, the Middle East market is embracing luxury skincare offerings, propelled by affluent demographics and strong brand affinity, and emerging African markets are exploring anti-ageing solutions as disposable incomes rise and beauty standards globalize.

In the Asia-Pacific region, rapid urbanization, heightened beauty consciousness, and government initiatives supporting biotechnology innovation have combined to drive exponential growth. Major markets such as China, Japan, and South Korea continue to pioneer next-generation ingredients and devices, setting trends that resonate across other regions. Understanding these diverse regional contours is essential for stakeholders seeking to align their market entry and expansion strategies with local nuances and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Anti-Ageing Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Shaping Innovation and Strategic Collaborations in the Anti-Ageing Treatment Market Landscape

Key industry participants are differentiating their market positions through innovation, strategic partnerships, and targeted acquisitions. Leading cosmetics and personal care conglomerates have intensified investment in R&D centers dedicated to anti-ageing actives, fostering collaborations with biotech firms to license novel peptides and growth factors. At the same time, multinational medical device manufacturers are broadening their portfolios to include noninvasive skin tightening platforms and integrated diagnostic tools that complement topical regimens.

Niche brands and start-ups are also reshaping competitive dynamics by championing micro-targeted solutions, such as AI-driven skin analysis apps and subscription-based personalized skincare plans. Several players have introduced male-focused lines to capture the expanding men’s grooming segment, while others emphasize clean beauty credentials and transparent supply chains to appeal to ethically driven consumers. Strategic alliances between formulation experts, clinical research institutions, and digital health providers underscore a convergence of capabilities aimed at delivering holistic, data-backed outcomes. Monitoring these evolving alliances and innovation pipelines offers a window into the future direction of the anti-ageing treatment market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Ageing Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allergan Plc

- Alma Lasers Ltd.

- Amorepacific Corporation

- AVON Products, Inc.

- Beiersdorf AG

- Coty Inc.

- Dermalogica

- DSM N.V.

- Galderma S.A.

- GlaxoSmithKline PLC

- Hologic Inc.

- Johnson & Johnson Services, Inc.

- Kao Corporation

- L’Oréal S.A.

- Mary Kay Inc.

- Merck KGaA

- Natura & Co.

- Nu Skin Enterprises, Inc.

- Pierre Fabre S.A.

- Shiseido Company, Limited

- Solta Medical, Inc.

- Syneron Medical Ltd.

- The Estée Lauder Companies Inc.

- The Procter & Gamble Company

- Unilever PLC

Delivering Actionable Recommendations for Industry Leaders to Drive Competitive Advantage, Optimize Operations, and Enhance Customer Engagement

Industry leaders seeking to solidify their competitive advantage in the anti-ageing domain should prioritize forging upstream partnerships with biotech innovators to secure early access to cutting-edge actives. Simultaneously, adopting flexible manufacturing frameworks that accommodate local production hubs and on-demand scaling can mitigate tariff exposure and enhance supply stability. As digital channels continue to reshape consumer interactions, brands must invest in proprietary e-commerce platforms and AI-driven personalization engines that streamline product discovery and foster long-term loyalty.

Moreover, expanding into underserved segments-such as male grooming, body care beyond facial applications, and preventative wellness bundles-can unlock additional revenue streams. Companies that integrate sustainability and transparency into their ingredient sourcing and commoditize traceability features will resonate with environmentally conscious audiences. Finally, operational excellence initiatives, including predictive analytics for inventory management and outcome-based clinical validation studies, will support evidence-based marketing claims and improve regulatory navigation. By executing these strategic imperatives in concert, leaders can drive growth, differentiate offerings, and reinforce their position at the vanguard of anti-ageing innovation.

Outlining Rigorous Research Methodology Leveraging Secondary Data, Expert Interviews, and Analytical Frameworks for Robust Market Insights

This research leverages a robust methodology combining extensive secondary data analysis with primary research insights to ensure comprehensive coverage and validity. Initially, an exhaustive review of public domain resources-such as academic publications, patents, regulatory filings, and industry white papers-provided a foundational understanding of ingredient innovations, procedural advancements, and market dynamics. Building upon this, qualitative interviews were conducted with dermatologists, aesthetic practitioners, supply chain executives, and senior marketing leaders to capture experiential perspectives and strategic priorities.

Quantitative data was triangulated through structured surveys targeting end users and distribution partners across key regions, enabling cross-validation of demand patterns and purchasing behaviors. Analytical frameworks, including segmentation matrices and SWOT analyses, were applied to dissect competitive positioning and growth levers. All findings underwent a multi-stage validation process, featuring expert panel reviews and internal consistency checks, to ensure accuracy and actionable relevance. Although market estimates and forecasts fall outside the scope of this summary, the underlying research approach guarantees that the conclusions drawn reflect the latest evolving trends and stakeholder expectations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Ageing Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Ageing Treatment Market, by Treatment Type

- Anti-Ageing Treatment Market, by Gender

- Anti-Ageing Treatment Market, by Distribution Channel

- Anti-Ageing Treatment Market, by End User Application

- Anti-Ageing Treatment Market, by Region

- Anti-Ageing Treatment Market, by Group

- Anti-Ageing Treatment Market, by Country

- United States Anti-Ageing Treatment Market

- China Anti-Ageing Treatment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Reflections on Emerging Trends, Strategic Implications, and Future Pathways in the Evolving Anti-Ageing Treatment Landscape

In summary, the anti-ageing treatment landscape is undergoing a paradigm shift fueled by scientific breakthroughs, personalized delivery systems, and integrated digital solutions. Elevated tariffs in the United States have underscored the importance of supply chain agility and localized operations, while segmentation analysis reveals nuanced consumer preferences across treatment types, gender, distribution channels, and application areas. Regional insights further highlight the divergent growth trajectories in the Americas, Europe Middle East & Africa, and Asia-Pacific, each shaped by unique regulatory, cultural, and economic factors.

Key players are responding through strategic collaborations, expansive product portfolios, and targeted innovations that address emerging niches and demographic cohorts. To thrive in this dynamic environment, organizations must execute data-driven strategies, prioritize sustainable and transparent practices, and harness advanced analytics to anticipate consumer needs. As the industry propels forward, the alliances formed, technologies adopted, and operational models refined today will define market leadership and dictate success in the evolving anti-ageing sector.

Connect with Ketan Rohom to Unlock Comprehensive Market Research Insights and Drive Informed Decisions in Anti-Ageing Treatment Investments

Unlock unparalleled insights into the anti-ageing treatment market by partnering with Ketan Rohom, Associate Director, Sales & Marketing. Benefit from a tailored consultation that delves into critical market drivers, emerging opportunities, and competitive landscapes. Engage directly with an expert to address your specific strategic priorities and uncover hidden growth avenues. Elevate your decision-making process with actionable data, proprietary analysis, and a deep understanding of regulatory complexities. Don’t miss the chance to transform your business approach with high-impact intelligence that accelerates product development, enhances market positioning, and maximizes ROI. To secure your comprehensive market research report and gain the competitive edge needed to lead in the anti-ageing treatment sector, reach out to Ketan Rohom today.

- How big is the Anti-Ageing Treatment Market?

- What is the Anti-Ageing Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?