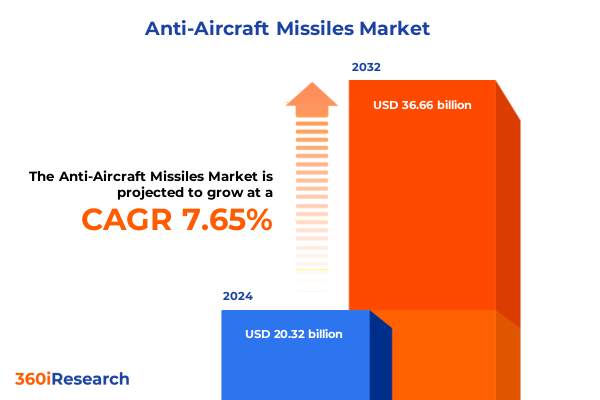

The Anti-Aircraft Missiles Market size was estimated at USD 3.35 billion in 2025 and expected to reach USD 3.49 billion in 2026, at a CAGR of 4.60% to reach USD 4.60 billion by 2032.

Exploration of the strategic imperative driving innovation and investment in anti-aircraft missile systems amid evolving aerial threats across global defense theaters

The contemporary defense landscape is defined by an accelerating arms race in aerial threat capabilities and countermeasures. As potential adversaries develop increasingly sophisticated platforms-ranging from stealth fighters and unmanned aerial systems to hypersonic glide vehicles-the imperative for advanced anti-aircraft missile systems has never been greater. The intersection of emerging threats and shifting geopolitical fault lines has prompted defense agencies worldwide to re-evaluate their layered air defense architectures, seeking solutions that deliver precision engagement, rapid intercept capability, and seamless integration across domains.

Against this backdrop, defense contractors and system integrators are under pressure to innovate at pace. Research and development resources are being allocated toward next-generation seekers, data fusion algorithms, and interoperable network-centric command and control frameworks. Concurrently, budgetary constraints and heightened scrutiny over defense spending demand demonstrable cost-efficiency and lifecycle value. In this environment, stakeholders are focused on balancing performance enhancements with supply chain resilience, workforce readiness, and regulatory compliance to ensure that air defense programs remain both cutting-edge and sustainable.

Mapping the transformative shifts reshaping anti-aircraft missile development through technological breakthroughs, threat evolution, and integration into multi-domain defense architectures

Over the past five years, the anti-aircraft missile landscape has been transformed by a convergence of technological breakthroughs and operational imperatives. Artificial intelligence and machine learning algorithms now underpin adaptive threat discrimination and target prioritization, enabling interceptors to autonomously respond to dynamic engagement scenarios. Additionally, advances in seeker technologies-ranging from multi-spectral imaging infrared to active electronically scanned array radar-have enhanced detection ranges and countered stealth features with unprecedented fidelity.

Simultaneously, the proliferation of low-cost drones and swarming tactics has catalyzed novel counter-drone capabilities with rapid-fire countermeasures and directed-energy solutions. This shift highlights the industry’s pivot toward modular, scalable architectures that can accommodate both kinetic and non-kinetic payloads. As a result, interoperability with broader combat management systems and joint force networks has become a design imperative, ensuring that anti-aircraft assets operate as a cohesive node within integrated air and missile defense ecosystems.

Assessing the cumulative impact of United States tariffs implemented in 2025 on supply chain dynamics, procurement costs, and strategic partnerships within the missile ecosystem

The United States’ implementation of new tariffs in 2025 has introduced both cost pressures and strategic recalibrations within the defense supply chain. Components such as advanced microelectronics, specialized alloys, and precision guidance sensors have experienced increased procurement costs, prompting prime contractors to re-examine their sourcing strategies. Consequently, there has been a surge in domestic supplier qualification programs aimed at mitigating exposure to tariff volatility and optimizing total lifecycle expenditures.

These policy changes have also fostered deeper collaboration between U.S. defense firms and allied manufacturing partners. Through co-development agreements and licensed production arrangements, companies are redistributing manufacturing and assembly workflows to navigate tariff thresholds while preserving technology transfer controls. In parallel, government‐led industrial base initiatives are incentivizing the localization of critical sub-assemblies and the expansion of additive manufacturing capabilities, further buttressing long-term supply chain resilience.

Key segmentation insights revealing how missile type, propulsion, guidance, range, end user, launch platform, and warhead classifications define market differentiation and capabilities

Insight into missile market segmentation reveals how distinctive technical and operational parameters drive procurement decisions and capability benchmarks. Based on missile type, systems vary significantly in platform integration and performance metrics, with air-to-air interceptors prioritizing agility and seeker agility, anti-ballistic solutions focusing on exoatmospheric intercept accuracy, and surface-to-air defenses balancing range with mobility. When exploring propulsion system segmentation, hybrid propellants offer a middle ground between the rapid impulse of solid formulations and the sustained thrust of liquid systems, each demanding unique handling and logistic support considerations.

Guidance system differentiation introduces further complexity. Command guidance systems excel in networked engagements but rely on robust datalinks, whereas infrared homing variants-divided into imaging infrared and infrared search and track-deliver passive target acquisition under minimal electronic signature. Laser-guided interceptors, distinguished by beam riding and semi-active laser modes, enable high precision against small or maneuvering threats. Radar guidance architectures, encompassing active, passive, and semi-active radar seekers, offer long-range detection and engagement but necessitate sophisticated counter-countermeasure resilience.

Further segmentation by range category outlines distinct operational roles for long-range systems tasked with theater-wide defense, medium-range assets bridging point and area defense, and short-range interceptors serving as the final protective layer. The end-user segmentation underscores varied platform ecosystems: air force requirements emphasize high-altitude, rapid response coverage; army doctrines favor mobile ground-based launchers; naval forces integrate ship-based vertical launch cells; and coast guard operations adopt lightweight, rapid-deploy systems for asymmetric maritime threats. Launch platform segmentation similarly bifurcates airborne launchers mounted on fighters or UAVs, ground-based batteries embedded within combined arms brigades, and ship-based installations on surface combatants. Finally, warhead type segmentation highlights the role of fragmentation warheads in counter-UAS scenarios, high explosive charges for general air defense, and nuclear payloads as strategic deterrent options.

This comprehensive research report categorizes the Anti-Aircraft Missiles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Missile Type

- Propulsion System

- Guidance System

- Range Category

- Launch Platform

- Warhead Type

- End User

Analyzing regional dynamics that underscore how defense spending, geopolitical tensions, and industrial capacity in the Americas, EMEA, and Asia-Pacific influence anti-aircraft missile deployment

Regional dynamics exert a profound influence on the development, acquisition, and deployment of anti-aircraft missiles. In the Americas, defense budgets have been driven by modernizing legacy systems to counter near-peer threats, supported by strong industrial bases in North America and rising collaboration with South American partners. This trend underscores a shift toward multifunctional systems capable of engaging both conventional aircraft and emerging unmanned platforms, reflecting the region’s integrated joint force doctrine.

Moving eastward, Europe, the Middle East, and Africa present a mosaic of geopolitical challenges and procurement philosophies. NATO members continue to prioritize interoperability and collective defense postures, extending their multi-layered air missile defenses through coordinated systems trials and joint procurement. Meanwhile, in the Gulf region, high stakes over regional security have spurred rapid acquisitions of proven long-range and medium-range systems, often underpinned by technology transfer agreements. Across sub-Saharan Africa, smaller defense budgets are channelled into scalable short-range solutions to address asymmetric threats, with international suppliers offering turnkey packages to meet diverse security needs.

In Asia-Pacific, escalating territorial disputes and the emergence of advanced aerial threats have prompted robust defense spending. Regional powers are investing in indigenous missile programs while forging strategic partnerships for co-development and licensed production. The emphasis here lies in layered defense doctrines that integrate short-range point defense with medium-range area denial and developing interoperable architectures aligned with allied forces. These dynamics underscore how each region calibrates its anti-aircraft missile strategies to unique threat profiles, budgetary allocations, and industrial competencies.

This comprehensive research report examines key regions that drive the evolution of the Anti-Aircraft Missiles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling key company insights that highlight how leading defense contractors leverage innovation, collaboration, and market positioning to drive competitiveness in anti-aircraft missile systems

Leading defense contractors are distinguishing themselves through targeted R&D investments, strategic partnerships, and robust manufacturing footprints. One tier-one prime has advanced its seeker technology by embedding edge computing capabilities directly within the missile, enabling mid-course updates and cooperative engagement with other interceptors. Another global player is expanding its propulsion portfolio, integrating hybrid propellant test cells within its European facilities to address the dual imperatives of rapid response and sustained thrust.

Collaboration between primes and specialized subsystem providers continues to intensify. Several firms have entered joint ventures to co-develop digital twin environments for virtual testing, reducing both time-to-field and cost overruns. Concurrently, a subset of companies is leveraging additive manufacturing to produce complex warheads and nozzle structures with reduced part counts, streamlining assembly and enhancing reliability. In the services domain, maintenance, repair, and overhaul (MRO) providers are incorporating condition-based monitoring and predictive analytics to extend system availability across extended deployments. Together, these insights illustrate how market leaders are aligning technological innovation with operational support models to reinforce their competitive positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Aircraft Missiles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus

- Almaz-Antey Air and Space Defense Corporation

- BAE Systems

- Bharat Dynamics Limited

- Denel SOC Ltd

- Diehl Defence GmbH & Co. KG

- Elbit Systems Ltd.

- Hanwha Corporation

- Kongsberg Gruppen ASA

- Lockheed Martin Corporation

- MBDA

- MBDA SAS

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd

- Raytheon Technologies Corporation

- RTX Corporation

- Saab AB

- Tata Advanced Systems Limited

- THALES Group

- Toshiba Infrastructure Systems & Solutions Corporation

Strategic recommendations for industry leaders to capitalize on emerging technologies, optimize supply chains, and forge partnerships that strengthen their anti-aircraft missile market presence

To capitalize on the trajectory of anti-aircraft missile advancements, industry leaders should prioritize several strategic initiatives. First, integrating artificial intelligence within open-architecture frameworks will enable more adaptive engagement algorithms, enhancing response times against unpredictable threats. Simultaneously, investing in modular system designs can allow for rapid sensor or warhead swaps, ensuring that fielded units remain mission-relevant as threat profiles evolve.

Parallel efforts should focus on supply chain diversification. Establishing secondary and tertiary sources for critical electronic components and specialty materials will mitigate tariff and geopolitical risks while supporting just-in-time production models. In addition, forging deeper linkages with academic and small-to-medium enterprise innovators can infuse fresh technologies into established product roadmaps without the overhead of in-house R&D. Finally, developing lifecycle support services under performance-based logistics contracts will align supplier incentives with system availability and readiness metrics, ultimately delivering better value to end users and fostering long-term partnerships.

Defining a rigorous research methodology that combines primary interviews, secondary data triangulation, and quantitative analysis to ensure robust anti-aircraft missile market intelligence

Our research methodology comprised a multi-tiered approach to ensure rigorous, unbiased market intelligence. The primary phase included in-depth interviews with defense procurement officers, system integrators, and technical subject matter experts to capture firsthand perspectives on capability gaps, acquisition hurdles, and operational feedback. This qualitative input was complemented by secondary analysis of publicly available defense white papers, government budgetary reports, and academic publications, enriching the broader context with historical program data and policy frameworks.

To validate our findings, we employed data triangulation techniques, cross-referencing interview insights with open-source satellite imagery for production footprint assessments and procurement contract databases for spend analysis. Proprietary quantitative models were then applied to normalize disparate metrics and identify recurring patterns in system deployment, technology adoption, and program lifecycle stages. Throughout the process, iterative hypothesis testing ensured that emerging themes were systematically vetted and refined, culminating in a comprehensive intelligence package that reflects both strategic trends and operational realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Aircraft Missiles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Aircraft Missiles Market, by Component Type

- Anti-Aircraft Missiles Market, by Missile Type

- Anti-Aircraft Missiles Market, by Propulsion System

- Anti-Aircraft Missiles Market, by Guidance System

- Anti-Aircraft Missiles Market, by Range Category

- Anti-Aircraft Missiles Market, by Launch Platform

- Anti-Aircraft Missiles Market, by Warhead Type

- Anti-Aircraft Missiles Market, by End User

- Anti-Aircraft Missiles Market, by Region

- Anti-Aircraft Missiles Market, by Group

- Anti-Aircraft Missiles Market, by Country

- United States Anti-Aircraft Missiles Market

- China Anti-Aircraft Missiles Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1908 ]

Drawing conclusions on the future trajectory of anti-aircraft missile systems amid technological convergence, shifting threats, and geopolitical realignments across global defense landscapes

The future of anti-aircraft missile systems will be shaped by the confluence of advancing sensor fusion, autonomous engagement logic, and resilient supply chain architectures. Stakeholders who embrace a modular, software-defined approach will gain an edge in adapting to unforeseen threat vectors-be it hypersonic glide vehicles or increasingly sophisticated drone swarms. Moreover, the capacity to integrate kinetic interceptors with directed-energy systems in a unified network will redefine multi-layered defense strategies.

As procurement authorities recalibrate spending toward digital ecosystem enablers and performance-based support contracts, suppliers must realign their operating models to prioritize lifecycle value and readiness outcomes. Geopolitical realignments, emerging alliances, and evolving export control regimes will further influence cross-border collaborations and technology transfers. In navigating this complex horizon, organizations that balance innovation speed with risk-mitigation frameworks will be best positioned to deliver decisive air defense capabilities across the spectrum of modern warfare.

Maximize your strategic advantage in the anti-aircraft missile sector with an exclusive personalized briefing from Associate Director of Sales and Marketing

To gain a comprehensive edge in the rapidly advancing anti-aircraft missile market, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. He can provide a personalized walkthrough of the full market research report, tailoring insights to your strategic priorities and organizational objectives. This exclusive briefing will equip your leadership team with the critical intelligence needed to navigate supply chain complexities, partner effectively with top defense contractors, and align investment decisions with emerging technology trends. Reach out now to secure your competitive advantage and ensure your initiatives are backed by the most detailed and actionable market analysis available.

- How big is the Anti-Aircraft Missiles Market?

- What is the Anti-Aircraft Missiles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?