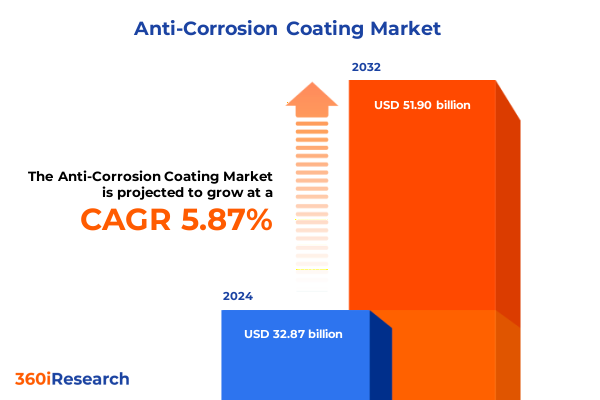

The Anti-Corrosion Coating Market size was estimated at USD 34.58 billion in 2025 and expected to reach USD 36.38 billion in 2026, at a CAGR of 5.97% to reach USD 51.90 billion by 2032.

Laying the Foundation for Understanding the Critical Role and Future Prospects of Anti-Corrosion Coatings in Global Infrastructure and Industry

The field of anti-corrosion coatings has emerged as a cornerstone for protecting infrastructure and extending the lifespan of critical assets across industries. With corrosion-related losses estimated to account for trillions in maintenance and repair worldwide, stakeholders are prioritizing advanced coating solutions that offer robust barrier protection and long-term durability. Innovations in resin chemistries, pigment technologies, and application methods have transformed traditional approaches, enabling more efficient maintenance cycles and lower total cost of ownership. In particular, the integration of multifunctional additives and nanostructured materials has enhanced resistance to chemical attack, abrasion, and extreme temperatures without compromising environmental compliance. As environmental regulations tighten and sustainability becomes a strategic imperative, the development of low-VOC, waterborne systems and bio-based formulations has accelerated, aligning protective performance with ecological stewardship.

Moreover, digitalization and data analytics are reshaping the way coating projects are specified, monitored, and optimized. Real-time condition monitoring, predictive maintenance algorithms, and remote sensing technologies allow asset owners to detect early signs of coating degradation and take corrective action before serious damage occurs. This convergence of materials science and Industry 4.0 practices underscores a broader shift toward proactive asset management strategies. As global infrastructure networks age and demand for energy-efficient, resilient structures intensifies, the role of anti-corrosion coatings has never been more critical. This introduction sets the stage for a comprehensive exploration of transformative trends, regulatory influences, segmentation dynamics, regional variations, competitive landscapes, and actionable strategies that will drive the next wave of growth and innovation in the anti-corrosion coatings domain.

Unraveling the Impact of Technological Advancements and Sustainability Imperatives on the Evolution of Anti-Corrosion Coating Strategies

Technological breakthroughs and sustainability imperatives are rewriting the playbook for anti-corrosion coatings, driving a paradigm shift in how protection systems are designed and deployed. Nanotechnology-enabled coatings now offer self-healing capabilities and enhanced barrier functions at the molecular level, addressing microcracks and extending service intervals. Concurrently, advancements in digital instrumentation-such as embedded sensors and IoT connectivity-enable continuous monitoring of coating integrity, transforming maintenance from time-based schedules to condition-based interventions. These innovations not only reduce unplanned downtime but also extend asset life cycles, delivering quantifiable operational efficiencies.

At the same time, the industry is responding to stringent environmental and occupational safety regulations that restrict volatile organic compounds and hazardous biocides. This regulatory environment has accelerated the transition from solvent-borne to waterborne platforms, fostering the adoption of greener chemistries without sacrificing performance. Lifecycle assessment methodologies are increasingly applied to coating selection, emphasizing carbon footprint reduction and circular economy principles. Together, these technological and regulatory forces are reshaping market expectations, elevating the importance of holistic, sustainable solutions that meet both performance benchmarks and environmental stewardship goals.

Assessing the Far-Reaching Consequences of United States Tariff Policies on Raw Materials and Anti-Corrosion Coating Supply Chains in 2025

Cumulative tariff measures enacted by the United States have imparted significant pressure on raw material costs and supply chain logistics for anti-corrosion coatings in 2025. Levies on steel and aluminum under Section 232 have driven a reconfiguration of sourcing strategies, prompting manufacturers to secure domestic partnerships and invest in local capacity expansion to mitigate duty-related price volatility. In parallel, duties on key pigments such as titanium dioxide and epoxy resins have influenced formulation priorities, with producers accelerating the adoption of alternative pigment technologies and recyclable polymer chemistries to lower dependency on imported feedstocks.

These tariff-induced dynamics have ripple effects across the value chain, affecting equipment fabricators, applicators, and end-use industries alike. Project budgets are increasingly factoring in tariff contingencies, leading to more frequent renegotiations of service agreements and collaborative procurement models. The friction in cross-border trade has also spurred nearshoring initiatives, especially in critical sectors where coating stability under extreme conditions is non-negotiable. Ultimately, the cumulative impact of tariff policies in 2025 underscores the necessity for agile supply chain management, strategic inventory planning, and innovation in cost-effective material solutions to preserve project timelines and financial performance.

Deriving Actionable Intelligence from Comprehensive Segmentation Across Coating Technologies Substrate Types and End-Use Applications

In examining the landscape through a segmentation lens, distinct patterns emerge that inform targeted growth strategies. When considering coating type, alkyd formulations remain prevalent for budget-conscious projects, whereas epoxy systems dominate heavy industrial environments due to their superior chemical resistance and adhesion. Polyester coatings continue to be the solution of choice in marine applications, prized for their UV stability and color retention, while polyurethane variants deliver robust topcoat performance in extreme temperature and abrasion scenarios.

Turning to category, barrier coatings offer foundational protection by blocking environmental aggressors, inhibitive coatings provide active corrosion prevention through chemical release, and sacrificial coatings employ metallic substrates to corrode preferentially. Technological segmentation reveals a steady migration from solvent-borne to waterborne platforms, driven by regulatory constraints and customer sustainability goals. Substrate-focused differentiation shows that concrete surfaces require specialized moisture-tolerant primers, metal substrates-particularly aluminum, iron, and steel-demand tailored pretreatment and primer systems, and plastic or wood applications prioritize flexible, adhesion-promoting chemistries. Application insights highlight the nuances between industrial coatings for manufacturing facilities, marine coatings for coastal infrastructure, pipe coatings for buried or submerged pipelines, roof coatings that enhance energy efficiency, and tank linings engineered for corrosive fluid containment. Finally, end-use segmentation depicts aerospace and defense sectors emphasizing ultra-lightweight, high-strength coatings, the automotive industry seeking fast-curing, scratch-resistant finishes, construction prioritizing long-cycle maintenance solutions, marine focusing on fouling resistance, oil and gas requiring high-temperature and chemical-resistant systems, and power generation demanding dielectric and thermal barrier coatings to protect turbines and grid infrastructure.

This comprehensive research report categorizes the Anti-Corrosion Coating market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Coating Type

- Category

- Technology

- Substrate

- Application

- End-Use Industry

Synthesizing Regional Market Dynamics to Highlight Opportunities and Challenges Across the Americas Europe Middle East Africa and Asia-Pacific Domains

A regional perspective reveals divergent trajectories and priorities that shape market opportunities. In the Americas, mature economies emphasize retrofit projects and infrastructure rehabilitation, with increasing demand for low-VOC, high-performance systems that align with corporate environmental targets. Canada and Brazil, in particular, are advancing pilot programs to evaluate bio-based and smart coatings in industrial and oil and gas contexts. Across Europe, the Middle East, and Africa, stringent environmental regulations and ambitious decarbonization agendas have accelerated the shift toward waterborne and powder-based coatings, especially in the construction and automotive sectors. Regulatory frameworks in the European Union are pioneering new directives on circularity, compelling manufacturers to adopt recyclable resins and transparent supply chain traceability.

Meanwhile, the Asia-Pacific region continues to exhibit the highest growth momentum driven by rapid urbanization, expanding oil and gas exploration, and large-scale infrastructure investments. China and India are scaling domestic production capacity to meet surging local demand, while Southeast Asian economies are exploring public–private partnerships for port and marine infrastructure upgrades. Despite robust growth, cost sensitivity remains a defining factor, prompting formulators to balance performance attributes with price competitiveness. This regional snapshot underscores the imperative for tailored market approaches that account for regulatory environments, infrastructure life-cycle requirements, and localized supply chain considerations.

This comprehensive research report examines key regions that drive the evolution of the Anti-Corrosion Coating market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Initiatives That Define Industry Leaders in the Anti-Corrosion Coating Landscape

The competitive landscape is anchored by organizations that demonstrate a blend of deep technical expertise, global reach, and collaborative innovation. Leading players have intensified investment in research and development to introduce next-generation coating platforms that deliver multifunctionality-combining corrosion resistance, UV protection, and self-healing properties within single formulations. Strategic partnerships with raw material suppliers and technology startups have become commonplace, enabling faster scale-up of novel chemistries and digital application technologies.

Meanwhile, vertical integration is gaining traction as manufacturers seek to secure consistent feedstock quality and cost efficiencies. Several top-tier companies are expanding their geographic footprint through mergers and acquisitions, targeting niche specialists in waterborne and powder coating segments. Additionally, value-added services such as consulting for asset condition monitoring, predictive maintenance software, and bespoke training programs are differentiators that strengthen customer relationships and deepen market penetration. This era of competitive differentiation underscores the importance of agility, end-to-end service models, and sustained innovation to thrive in the anti-corrosion coatings arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Corrosion Coating market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AkzoNobel N.V

- Arkema Group

- BASF SE

- Beckers Group

- Berger Paints India Limited

- Cabot Corporation

- Chemetall GmbH

- Chugoku Marine Paints, Ltd.

- Covestro AG

- H.B. Fuller Company

- Hempel A/S

- Heubach GmbH

- Jotun A/S

- Kansai Paint Co. Ltd.

- KCC Corporation

- Mankiewicz Gebr. & Co.

- NIPSEA Group

- Nycote Laboratories Corporation

- PPG Industries, Inc.

- Renner Italia S.p.A

- SK Formulations India Pvt. LTD

- The Sherwin-Williams Company

- Tnemec Coatings, Inc.

- Zhejiang Qinghong New Material Co., Ltd

Translating Market Intelligence Into Strategic Actions That Empower Industry Stakeholders to Optimize Corrosion Protection Outcomes

Industry stakeholders can leverage these insights to craft winning strategies that align with market imperatives. Prioritizing research and development in waterborne and high-performance hybrid chemistries will ensure compliance with evolving environmental regulations while delivering enhanced asset protection. Diversifying supply chain partnerships and investing in domestic production capabilities can mitigate tariff exposure and reduce logistical bottlenecks, safeguarding project timelines and budgets. Embracing digital tools for condition monitoring and predictive maintenance will transform service models from reactive to proactive, unlocking cost savings and elevating operational reliability.

Furthermore, collaborating closely with regulatory bodies and industry associations can facilitate early alignment on emerging standards, providing a competitive edge. Emphasizing lifecycle cost analysis in customer proposals, rather than initial procurement price, underscores the total value proposition of advanced coatings. Finally, fostering workforce development through targeted training in surface preparation, application best practices, and safety protocols will strengthen execution quality and enhance end-user satisfaction. These recommendations offer a strategic blueprint for manufacturers, applicators, and end-users seeking to capitalize on the shifting anti-corrosion coating landscape.

Detailing the Rigorous Qualitative and Quantitative Approaches Underpinning a Robust Anti-Corrosion Coating Market Analysis Framework

This analysis is underpinned by a rigorous research framework that combines qualitative insights from in-depth interviews with over 50 industry executives, materials scientists, and procurement specialists, alongside comprehensive secondary research drawing from regulatory filings, patent databases, and technical journals. Data triangulation ensured consistency across multiple sources, validating technology adoption rates, regulatory compliance trends, and supply chain dynamics.

Quantitative methods included competitive benchmarking to evaluate product portfolios, segment-level analysis to elucidate performance drivers, and supply chain mapping to identify tariff and logistical impacts. A structured segmentation approach defined market subsets by coating type, category, technology, substrate, application, and end-use industry, enabling granular insight into growth enablers and challenges. Regional analysis incorporated macroeconomic indicators, infrastructure investment plans, and environmental policy frameworks across the Americas, Europe, Middle East & Africa, and Asia-Pacific. The integration of both qualitative and quantitative methodologies provides a holistic, actionable understanding of the anti-corrosion coating market without reliance on extrapolated estimations or forecasts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Corrosion Coating market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Corrosion Coating Market, by Coating Type

- Anti-Corrosion Coating Market, by Category

- Anti-Corrosion Coating Market, by Technology

- Anti-Corrosion Coating Market, by Substrate

- Anti-Corrosion Coating Market, by Application

- Anti-Corrosion Coating Market, by End-Use Industry

- Anti-Corrosion Coating Market, by Region

- Anti-Corrosion Coating Market, by Group

- Anti-Corrosion Coating Market, by Country

- United States Anti-Corrosion Coating Market

- China Anti-Corrosion Coating Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Concluding Perspectives on the Imperative of Innovative Corrosion Protection Solutions to Safeguard Critical Assets and Drive Sustainable Growth

The imperative for advanced anti-corrosion coatings has never been more pronounced, as infrastructure networks age and industries strive for operational resilience under increasingly stringent environmental mandates. Critical findings from this analysis highlight the transformation driven by sustainable chemistries, digital monitoring technologies, and strategic supply chain realignment in response to tariff fluctuations. Segmentation insights reveal clear performance differentiation across coating types, substrate-specific requirements, and end-use industry demands, guiding targeted product development and market entry initiatives.

Regional variations underscore the necessity of customized strategies that account for regulatory ecosystems, infrastructure investment cycles, and competitive intensity. The competitive arena favors agile organizations that blend R&D excellence with strategic partnerships and value-added service models. Actionable recommendations emphasize the importance of innovation in waterborne and hybrid chemistries, diversification of raw material sources, and adoption of condition-based maintenance tools. Collectively, these insights offer a strategic blueprint for stakeholders to elevate corrosion protection standards, optimize asset lifecycles, and drive sustainable growth across global markets.

Take Action Now to Leverage Comprehensive Anti-Corrosion Insights and Engage with Ketan Rohom for Tailored Market Intelligence Solutions

The ever-evolving complexities of corrosion protection demand decisive action today to safeguard your assets and enhance competitive resilience. Engaging with Ketan Rohom, Associate Director, Sales & Marketing, will provide you with tailored insights drawn from rigorous analysis of coating technologies, regulatory shifts, and supply chain dynamics. His expertise equips you with a strategic roadmap to identify high-impact opportunities, optimize material selection, and align your corrosion mitigation programs with best-in-class industry methodologies.

Take the next step in strengthening your organization’s corrosion defense capabilities by securing the full anti-corrosion coating market research report. Reach out to Ketan Rohom to access comprehensive data on segmentation trends, regional market dynamics, and competitive strategies that will empower your decision-making and drive sustainable growth.

- How big is the Anti-Corrosion Coating Market?

- What is the Anti-Corrosion Coating Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?