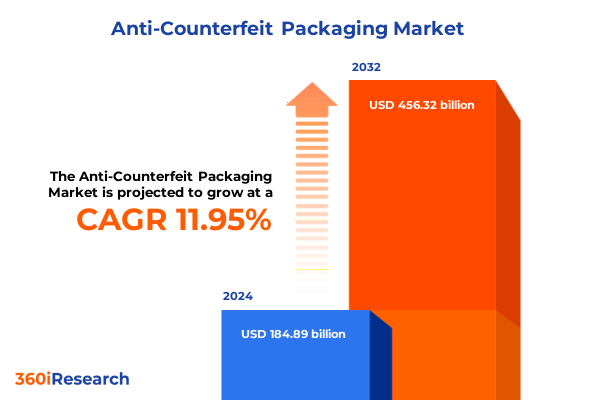

The Anti-Counterfeit Packaging Market size was estimated at USD 207.48 billion in 2025 and expected to reach USD 226.67 billion in 2026, at a CAGR of 11.91% to reach USD 456.32 billion by 2032.

Navigating the Complexities of Counterfeit Threats and the Rising Imperative of Advanced Packaging Security in Today’s Global Supply Chains

Counterfeit goods have emerged as a pervasive threat that transcends industry boundaries, undermining brand integrity, eroding consumer trust, and exposing supply chains to significant legal and financial liabilities. As global markets become more interconnected, illicit actors exploit gaps in packaging security to introduce fake products into legitimate distribution channels. This proliferation of sophisticated fraud schemes demands a comprehensive response that addresses vulnerabilities at every touchpoint, from raw material sourcing to end-use delivery.

In response to these challenges, packaging has evolved from a purely functional barrier to an integrated security solution embedded with advanced authentication features. Technologies such as covert inks, holographic elements, and serialized barcodes are now converging with emerging digital platforms to enable real-time verification and traceability. These innovations not only deter counterfeiters but also empower stakeholders to maintain visibility across the supply chain, facilitating swift identification and removal of suspicious items.

This executive summary presents a strategic overview of the anti-counterfeit packaging ecosystem, highlighting transformative shifts in technology adoption, the impact of United States tariff measures in 2025, and critical segmentation, regional, and competitive insights. By examining these dimensions, decision makers can develop targeted initiatives to fortify their packaging security frameworks and safeguard brand reputation in an era defined by relentless counterfeiting threats.

Exploring the Technological Innovations and Strategic Alliances Driving a Paradigm Shift in Counterfeit Prevention Across Packaging Ecosystems Worldwide

The landscape of anti-counterfeit packaging is undergoing a significant paradigm shift driven by converging technological innovations and strategic alliances. Traditional deterrents such as overt authentication features are now complemented by sophisticated digital platforms that leverage blockchain and the Internet of Things to create end-to-end traceability. In parallel, partnerships between packaging specialists and software providers are fostering integrated ecosystems where physical and digital safeguards collaborate seamlessly.

Artificial intelligence and machine learning are increasingly central to these transformations, enabling automated authentication at scale and predictive analysis of counterfeiting patterns. These capabilities are being embedded within packaging via printed electronics and smart sensors, converting passive containers into active data nodes. Consequently, stakeholders can harness real-time analytics to detect anomalies, streamline recall processes, and generate actionable intelligence for continuous improvement.

Moreover, the democratization of consumer-facing verification tools-such as mobile apps that scan covert marks-has shifted the power balance toward end users. This trend is reinforcing brand engagement while amplifying the deterrent effect of anti-counterfeit measures. As a result, industry leaders are forging cross-sector alliances that blend packaging expertise with digital innovation to address the evolving threat landscape and deliver comprehensive security solutions.

Assessing the Cumulative Impact of 2025 United States Tariff Measures on Global Anti-Counterfeit Packaging Supply Chains and Material Sourcing Strategies

The introduction of new United States tariff measures in 2025 has had a pronounced cumulative effect on global anti-counterfeit packaging supply chains and material sourcing strategies. Higher duties on key substrates such as security inks, holographic films, and specialty papers have increased the landed cost of advanced security components. In turn, manufacturers are reevaluating supplier relationships and exploring alternative materials to mitigate cost pressures without compromising authentication performance.

These tariff adjustments have also accelerated reshoring initiatives as organizations seek to reduce exposure to import levies and logistical bottlenecks. Domestic production hubs for packaging substrates and printing technologies are gaining prominence, fostering closer collaboration between converters, technology developers, and brand owners. This regionalization helps streamline quality control and compliance oversight, reinforcing packaging integrity at its source.

Simultaneously, the evolving duty structure is prompting investment in process optimization and waste reduction across the value chain. Manufacturers are adopting lean production techniques and digital inventory management to offset tariff-induced cost increases. By integrating advanced analytics and automated workflow controls, the sector is navigating the dual imperatives of affordability and robust counterfeit protection in a highly dynamic trade environment.

Uncovering Key Segmentation Insights to Tailor Anti-Counterfeit Packaging Solutions Across Technology Material Printing Authentication and End Use Channels

In the analysis of market segmentation, the technology type dimension reveals distinct adoption trajectories across barcode, covert authentication, holography, overt visual devices, security inks, and watermark solutions. One-dimensional barcodes and QR codes continue to underpin serialization programs, while invisible ink, microtext, and nanotext techniques within covert authentication are gaining traction for high-value items. Diffractive and dot matrix holography complement these methods by providing overt visual deterrents that reinforce brand authenticity.

Packaging material selection further influences security outcomes, with composite films offering multi-layered protection, glass and metal substrates delivering tamper-evidence, and plastic and paperboard solutions balancing cost efficiency and environmental considerations. Printing technology also plays a crucial role, as digital and offset platforms enable rapid iteration of security features, while flexographic, intaglio, letterpress, and screen processes support high-resolution covert marks and tactile deterrents.

Authentication method preferences vary by risk profile, with digital serialization and forensic analysis favored in regulated sectors such as pharmaceuticals and luxury goods. Covert ink techniques remain indispensable for covert channels, while overt methods support consumer-level verification. End use industries from automotive to consumer electronics, food and beverage to pharmaceuticals, are determining their anti-counterfeit strategies based on product lifecycle, distribution complexity, and regulatory requirements. Finally, distribution channels-whether offline networks or online platforms-affect security design, as e-commerce growth necessitates lightweight, tamper-resistant formats integrated with digital verification APIs.

This comprehensive research report categorizes the Anti-Counterfeit Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Packaging Material

- Printing Technology

- Authentication Method

- End Use Industry

- Distribution Channel

Highlighting Regional Dynamics and Growth Drivers Shaping Anti-Counterfeit Packaging Strategies in the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics play a pivotal role in shaping anti-counterfeit packaging strategies and adoption rates. In the Americas, regulatory frameworks in the United States and Canada are driving mandatory serialization and traceability requirements, particularly in pharmaceuticals and food safety. These regulations are catalyzing investments in state-of-the-art covert and overt authentication features, while cross-border harmonization efforts seek to streamline compliance across NAFTA and neighboring markets.

In Europe, Middle East, and Africa, stringent EU directives on consumer protection and customs enforcement are influencing packaging security standards. Countries in the Gulf Cooperation Council are enhancing anti-counterfeit legislation, incentivizing adoption of integrated digital authentication systems. Across Africa, fragmented regulatory landscapes and informal trade channels present unique challenges, prompting collaborative initiatives between public agencies and private stakeholders to develop scalable, cost-effective solutions.

Asia-Pacific remains the largest manufacturing hub for both legitimate and counterfeit goods, driving a dual imperative for robust anti-counterfeit measures. China’s Quality Inspection and Quarantine Authority and India’s Directorate of Industrial Policy and Promotion are implementing localized mandates that encourage domestic development of security inks and digital serialization platforms. Meanwhile, Southeast Asian economies are rapidly adopting cloud-based traceability tools to mitigate the proliferation of counterfeit products in e-commerce and traditional retail.

This comprehensive research report examines key regions that drive the evolution of the Anti-Counterfeit Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategies and Innovations from Leading Anti-Counterfeit Packaging Providers Driving Competitive Advantage and Market Leadership via Partnerships

Leading providers of anti-counterfeit packaging solutions are differentiating themselves through integrated technology stacks, strategic partnerships, and specialized service offerings. Key players are expanding their portfolios beyond standalone authentication features to deliver end-to-end supply chain visibility platforms that tie physical security elements to digital back-ends. These offerings typically encompass covert inks, holographic overlays, serialized barcodes, and cloud-based verification dashboards.

Collaborations between packaging converters and software innovators are accelerating the development of modular authentication platforms. Such alliances enable rapid deployment of tailored solutions for specific verticals, whether it involves forensic marker integration in pharmaceuticals or tamper-evident labels for luxury goods. In addition, the emergence of consortia among brand owners, technology vendors, and regulatory bodies is fostering interoperability standards that reduce integration friction and enhance data sharing.

Investment in research and development remains a core differentiator, with industry leaders allocating significant resources to next-generation materials and digital security protocols. These efforts focus on embedding printable electronics, leveraging near-field communication (NFC), and advancing blockchain-enabled traceability networks. Through these innovations and collaborative frameworks, top providers are positioned to support clients in navigating regulatory complexities and evolving counterfeit threats.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Counterfeit Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D AG

- 3M Company

- Agfa-Gevaert Group

- AlpVision SA

- AlpVision SA

- Ampacet Corporation

- Atlantic Zeiser GmbH by Coesia Group

- Authentix Inc.

- Avery Dennison Corporation

- CCL Industries Inc.

- DuPont de Nemours, Inc.

- EDGYN SAS

- Giesecke+Devrient GmbH

- ITL Group by Gooch & Housego PLC

- Microtag Temed Ltd.

- SATO Holdings Corporation

- Sicpa Holding S.A.

- Sicpa Holding S.A.

- SML Group

- Transpacks Technogies Pvt. Ltd.

- Uflex Limited

- Zebra Technologies Corp.

Proposing Actionable Recommendations for Industry Leaders to Strengthen Packaging Security Enhance Traceability and Foster Collaboration across Stakeholders

To fortify packaging security frameworks, industry leaders should prioritize the integration of physical and digital authentication solutions into unified platforms. By adopting interoperable technologies such as serialized barcodes linked to blockchain-based tracking systems, stakeholders can achieve granular visibility and rapid response capabilities. Establishing common data standards and APIs across the value chain will further enable seamless information exchange between manufacturers, distributors, and enforcement agencies.

Strategic collaboration with regulatory authorities and cross-industry alliances is essential for establishing harmonized compliance guidelines and combating counterfeiting at scale. Companies can accelerate innovation by participating in pilot programs that test emerging technologies-such as printable electronics and AI-driven pattern recognition-under real-world conditions. Parallel investments in workforce training and consumer education will amplify the effectiveness of these technical measures by fostering end-user engagement and awareness of authenticity verification methods.

Finally, organizations must adopt a continuous improvement mindset by embedding feedback loops into their anti-counterfeit initiatives. Leveraging data analytics from verification endpoints, recall incidents, and market surveillance can surface emerging fraud vectors and inform iterative enhancements. This proactive, data-driven approach will empower decision makers to stay ahead of agile counterfeit networks and protect brand equity in an increasingly dynamic global marketplace.

Detailing the Rigorous Research Methodology Employed to Gather Insights through Primary and Secondary Sources Ensuring Data Integrity and Analytical Robustness

This study employed a dual-phase research methodology designed to ensure robust, data-driven insights. The primary research phase included in-depth interviews with packaging converters, authentication technology vendors, brand protection managers, and regulatory officials across key regions. These discussions provided qualitative perspectives on technology adoption drivers, pain points in supply chain compliance, and emerging counterfeiting tactics.

Building upon these findings, the secondary research phase involved comprehensive analysis of industry publications, patent filings, trade association reports, and regulatory documentation. Proprietary databases were leveraged to map product launches, strategic partnerships, and M&A activity. Triangulation of primary and secondary inputs enabled validation of trends and identification of gaps in existing literature.

Quantitative data analysis incorporated thematic coding of qualitative interviews and cross-referencing of technology adoption rates with regional regulatory developments. A rigorous peer-review process ensured analytical accuracy and minimized bias. The resulting framework integrates segmentation, regional dynamics, and competitive intelligence to deliver a holistic perspective on the anti-counterfeit packaging landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Counterfeit Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Counterfeit Packaging Market, by Technology Type

- Anti-Counterfeit Packaging Market, by Packaging Material

- Anti-Counterfeit Packaging Market, by Printing Technology

- Anti-Counterfeit Packaging Market, by Authentication Method

- Anti-Counterfeit Packaging Market, by End Use Industry

- Anti-Counterfeit Packaging Market, by Distribution Channel

- Anti-Counterfeit Packaging Market, by Region

- Anti-Counterfeit Packaging Market, by Group

- Anti-Counterfeit Packaging Market, by Country

- United States Anti-Counterfeit Packaging Market

- China Anti-Counterfeit Packaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding Perspectives on the Critical Role of Anti-Counterfeit Packaging in Safeguarding Brand Equity Supply Chains and Consumer Trust in a Complex Market

Anti-counterfeit packaging stands as a critical bulwark against the multifaceted threats posed by illicit trade, protecting brand equity, consumer safety, and the integrity of global supply chains. As counterfeiters adopt increasingly sophisticated techniques, packaging security has evolved into a strategic imperative that blends material science, digital innovation, and cross-sector collaboration. This confluence of factors highlights the necessity of an integrated approach, harnessing both overt and covert authentication features alongside real-time verification technologies.

The insights presented in this summary underscore the importance of aligning segmentation strategies with technology capabilities, material considerations, and end-use requirements. Regional nuances and tariff influences further shape the deployment of security solutions, demanding agile sourcing models and localized expertise. At the same time, collaboration among technology providers, brand owners, and regulatory bodies is key to establishing interoperable standards and driving large-scale adoption.

Ultimately, organizations that embrace a holistic anti-counterfeit packaging strategy-grounded in data-driven decision making and continuous innovation-will be best positioned to safeguard their market position and maintain consumer trust. The path forward requires vigilance, adaptability, and strategic investment in the technologies and partnerships that will define the future of packaging security.

Engage with Ketan Rohom Associate Director Sales and Marketing to Secure Anti-Counterfeit Packaging Insights and Elevate Your Strategic Decision Making

Engaging with Ketan Rohom, Associate Director Sales and Marketing, will equip decision makers with invaluable insights into the evolving anti-counterfeit packaging landscape. His expertise bridges advanced authentication technologies and commercial strategy to help stakeholders navigate complex regulatory environments and optimize supply chain resilience. By initiating this dialogue, organizations can gain tailored guidance on implementing robust packaging solutions that align with their brand protection objectives and operational imperatives.

Early engagement with Ketan Rohom ensures access to exclusive data inputs, high-impact case studies, and best-practice frameworks designed to accelerate time-to-value. His consultative approach fosters collaborative workshops and strategic planning sessions that drive consensus across cross-functional teams. Prospective clients can benefit from custom demonstrations of cutting-edge technologies, from covert inks to digital serialization platforms, reinforcing confidence in their anti-counterfeit investments.

To elevate your strategic decision making and secure a competitive advantage in an increasingly complex global market, connect with Ketan Rohom today. This partnership will empower you to deploy comprehensive anti-counterfeit packaging insights and actionable recommendations, ensuring enduring protection of brand equity, consumer trust, and supply chain integrity.

- How big is the Anti-Counterfeit Packaging Market?

- What is the Anti-Counterfeit Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?