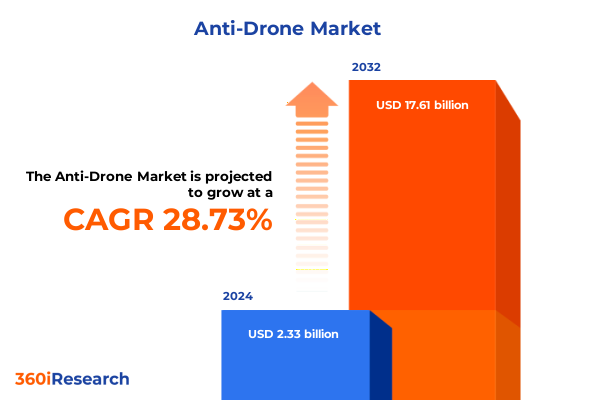

The Anti-Drone Market size was estimated at USD 2.94 billion in 2025 and expected to reach USD 3.73 billion in 2026, at a CAGR of 27.62% to reach USD 16.25 billion by 2032.

Global Anti-Drone Threat Response Accelerates Amid Proliferation of Unmanned Aerial Vehicles Challenging Traditional Security Models

Across global conflict zones and secure facilities, the surge in unmanned aerial vehicle deployments has transformed drones from niche reconnaissance tools into strategic assets and persistent threats. Recent engagements in South Asia, where India and Pakistan introduced large-scale drone operations during border skirmishes, underscore the vital need for robust countermeasures as geopolitical tensions accelerate unmanned warfare capabilities. As non-state actors and state militaries increasingly leverage swarm tactics and weaponized drones, defenders are racing to consolidate detection and neutralization solutions into cohesive defense architectures.

Simultaneously, national budgets are pivoting to prioritize airspace security technologies. In 2023 alone, the U.S. government allocated hundreds of millions of dollars toward advancing anti-drone solutions, reflecting growing recognition of aerial threats to critical infrastructure, events, and military bases. Leading defense contractors are responding with versatile designs, such as BAE Systems’ Malloy T-150, which integrates a laser-guided rocket payload to intercept adversarial UAVs while maintaining rapid role-switch capability for reconnaissance or cargo missions.

However, amid rapid technological adoption, regulatory and operational complexities persist. In many jurisdictions, stringent airspace regulations limit the deployment of jamming and interception systems near airports and populated venues. Moreover, interoperability challenges arise when integrating legacy radar, RF, and acoustic sensors with emerging AI-driven analytics platforms. Stakeholders therefore face the dual imperative of accelerating capability deployments while navigating evolving legal frameworks that govern counter-UAV measures.

Technological and Strategic Shifts Transforming Anti-Drone Defense Architectures Through AI Integration and Autonomous Countermeasures

The anti-drone landscape is witnessing a paradigm shift as advanced sensor fusion and autonomous countermeasures redefine aerial defense postures. Artificial intelligence and machine learning algorithms now enable systems to differentiate hostile drones from benign UAVs, reduce false positives, and orchestrate real-time neutralization tactics across multiple effectors. These AI-driven solutions enhance situational awareness by correlating data streams from radar, radio frequency analysis, and electro-optical/infrared sensors into a unified threat picture, facilitating rapid decision cycles.

Concurrently, directed-energy weapons are moving from conceptual prototypes to fieldable assets. High-energy laser and microwave systems offer pinpoint engagement capabilities, neutralizing small drones without generating collateral damage or expending traditional munitions. This evolution toward hard-kill, non-kinetic options reflects an industry-wide commitment to scalable and cost-effective counter-UAS installations. Companies are now blending these energy-based neutralizers with cyber takeover modules that seize control of rogue UAVs, leveraging GPS spoofing and RF jamming to subvert hostile operations.

Moreover, the drive toward autonomy is accelerating the development of fully automated counter-drone networks. Platforms equipped with AI-enabled detection and response modules can autonomously identify target characteristics, evaluate engagement protocols, and deploy the appropriate countermeasure-all within milliseconds. This level of integration promises to reduce operator workload, minimize human error, and ensure persistent defense coverage in dynamic threat environments.

Rising Tariff Pressures and Trade Barriers Disrupt Anti-Drone Supply Chains and Drive Domestic Production Strategies in the United States

As part of broader trade policy revisions, the United States introduced new levies in early 2025 that encompass critical components used in counter-UAV systems. Tariffs on radar modules, RF amplifiers, and specialized microelectronics imported from key trading partners are contributing to increased input costs and supply chain realignments. Defense manufacturers reliant on these supply networks face pressure to absorb higher expenses or pass them downstream, potentially affecting procurement timelines and budget allocations.

The ripple effects of these trade barriers are prompting leading firms to reconsider sourcing strategies. Several companies are expediting partnerships with domestic suppliers, investing in local production facilities to mitigate tariff exposure and align with policies mandating U.S.-made defense components. While this shift fosters long-term supply chain resilience, it demands significant upfront capital for retooling and workforce development. Smaller enterprises, in particular, must navigate financing constraints as they expand manufacturing footprints to comply with evolving federal directives.

Despite the short-term uncertainties, the tariff environment has catalyzed innovation in software-centric detection architectures that reduce hardware dependencies. By transitioning to cloud-based analytics, subscription licensing models, and modular sensor suites, industry stakeholders are cultivating flexible solutions that can adapt to changing trade landscapes without compromising performance or compliance.

In-Depth Segmentation Analysis Reveals Crucial Insights on Technology, Range, Platform, Application, and Vertical Dynamics Shaping Anti-Drone Innovations

Examination of the market across technological domains reveals distinct trends in both countermeasure and monitoring segments. In the countermeasure arena, high-energy lasers and cyber takeover systems are emerging as preferred neutralization methods for high-value targets, while nets, net guns, and RF jammers continue to address low-cost or swarm threats. Conversely, monitoring solutions are integrating acoustic microphones, optical camera arrays, and radar with RF analyzers, enabling precise classification of UAV types before engagement.

Analyzing operational range differentiators, systems with coverage under five kilometers are widely deployed for site-specific security, such as airport perimeters and critical infrastructure nodes. Extended-range platforms exceeding five kilometers are gaining traction for wide-area surveillance across border zones and expansive industrial complexes, reflecting a strategic balance between localized defense and regional area denial requirements.

Platform segmentation further influences procurement priorities. Ground-based installations are favored for fixed-site protection, while handheld units provide rapid deployment capabilities for first responders and security forces. Unmanned aerial vehicle–based counter-UAS platforms, conversely, offer dynamic interception potential, shadowing hostile drones and deploying countermeasures at optimal engagement windows.

Application-driven insights highlight a progression from alerting and detection phases toward advanced classification and tracking capabilities, culminating in precise locating of drone threat origins for forensic analysis. Finally, vertical market dynamics underscore critical infrastructure and public venue operators as early adopters in the commercial sector, with homeland security agencies and military organizations demanding integrated, multi-layered systems to address evolving regulatory and operational mandates.

This comprehensive research report categorizes the Anti-Drone market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Range

- Platform

- Application

- Verticals

Comprehensive Regional Dynamics Uncovered Highlighting Americas, EMEA, and Asia-Pacific Strategic Priorities in Counter-Drone Deployment and Collaboration

In the Americas, robust defense budgets and stringent aviation safety standards have accelerated adoption of counter-UAV systems across government and commercial sectors. U.S. agencies are increasingly integrating AI-powered sensor fusion with directed-energy and kinetic neutralizers to safeguard critical infrastructure and high-profile events, signaling a shift toward comprehensive layered defenses that deter emerging UAV threats.

Across Europe, the Middle East, and Africa, regional alliances and collaborative frameworks are shaping deployment strategies. European nations are harmonizing regulatory standards to facilitate cross-border counter-drone operations, while Middle Eastern governments are investing heavily in advanced CUAV platforms that blend local manufacturing with international partnerships. African states are piloting anti-drone solutions to protect resource extraction sites and urban centers, reflecting growing recognition of drone misuse risks in both industrial and security contexts.

In Asia-Pacific, escalating drone conflicts and strategic tensions have prompted governments to prioritize indigenous development of counter-UAS technologies. Regional powers are entering joint ventures with global defense firms to localize production of radar and RF detection systems, while smaller nations are acquiring portable jamming and interception kits to secure maritime boundaries and island territories. The resulting ecosystem fosters innovation while addressing critical supply chain considerations in a geo-strategically complex theater.

This comprehensive research report examines key regions that drive the evolution of the Anti-Drone market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Players Driving Anti-Drone Market Evolution Through Innovative Technologies, Strategic Partnerships, and Sustainable Growth Initiatives

Key industry players are leveraging strategic partnerships and targeted R&D initiatives to maintain competitive advantage in the counter-UAV landscape. BAE Systems’ acquisition of Malloy Aeronautics and subsequent localization of drone motor production underscores its commitment to reducing dependency on external suppliers while delivering dual-use platforms capable of both neutralization and reconnaissance. Similarly, major defense primes are expanding directed-energy portfolios, with high-energy laser and microwave systems undergoing rigorous field trials to validate efficacy against evolving drone designs.

Emerging technology firms are focusing on software-centric frameworks that integrate cloud analytics, AI-driven threat classification, and real-time data sharing networks. These companies are cultivating subscription-based service models to complement traditional hardware offerings, enabling recurring revenue streams and enhanced customer engagement. Concurrently, strategic alliances between sensor specialists and communication infrastructure providers are facilitating end-to-end detection-to-response architectures that streamline procurement cycles.

To address the demands of both defense and commercial clients, several vendors are emphasizing modularity and scalability. Platforms designed to accommodate plug-and-play sensor packages allow operators to upgrade capabilities over time without complete system replacement. This approach not only aligns with evolving threat profiles but also mitigates total cost of ownership concerns, particularly for resource-constrained agencies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Drone market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Lockheed Martin Corporation

- RTX Corporation

- Airbus SE

- Thales Group

- Israel Aerospace Industries Ltd.

- Rafael Advanced Defense Systems Ltd.

- BAE Systems PLC

- L3Harris Technologies, Inc.

- Accipiter Radar Technologies Inc.

- Adani Enterprises Limited

- Advanced Radar Technologies S.A.

- Bharat Electronics Limited (BEL)

- Blighter Surveillance Systems Limited

- CERBAIR

- D-Fend Solutions AD Ltd.

- Dedrone Holdings, Inc. by Axon Enterprise, Inc.

- DroneShield Limited

- Dymstec, Co., Ltd.,

- Elbit Systems Ltd.

- Excelitas Technologies Corp.

- Fortem Technologies, Inc.

- General Dynamics Corporation

- Hensoldt AG

- High Point Aerotechnologies, Inc. by DZYNE Technologies, LLC

- INDRA SISTEMAS, S.A.

- Leidos Holdings, Inc.

- Leonardo S.p.A.

- M2K Technologies Private Limited

- Mistral Solutions Pvt. Ltd.

- Northrop Grumman Corporation

- QinetiQ Group PLC

- Rheinmetall AG

- Robin Radar Systems B.V.

- Rohde & Schwarz GmbH & Co KG

- SAAB AB

- Safran S.A.

- Sensofusion Oy

- Shoghi Communications Ltd.

- Singapore Technologies Engineering Ltd

- Spotter Global

- Teledyne FLIR LLC

- The Boeing Company

- Toshiba Corporation

- Zen Technologies Limited

Actionable Recommendations for Industry Leaders to Optimize Counter-Drone Strategies, Strengthen Supply Chains, and Accelerate Technological Adoption

Industry leaders should prioritize diversification of component sourcing to mitigate exposure to tariff-induced cost volatility. By establishing strategic supplier agreements across multiple regions and investing in domestic manufacturing capabilities, organizations can safeguard production continuity and manage price fluctuations effectively. In parallel, firms must accelerate adoption of AI-driven analytics to streamline threat detection workflows and enhance the precision of neutralization protocols.

Incorporating modular system architectures is critical to maintaining flexibility in the face of shifting operational requirements. Companies should design platforms that support incremental upgrades to sensors, countermeasures, and software modules, ensuring resilience against obsolescence while optimizing capital expenditure. Moreover, embracing service-oriented business models-such as managed detection and response offerings-can foster recurring revenue streams and deepen customer relationships.

Collaboration with regulatory bodies remains essential to shape conducive legal frameworks for counter-UAS deployment. Engaging proactively with aviation authorities and law enforcement agencies will help define compliance standards, clarify operational boundaries, and accelerate system certification processes. Such engagement not only reduces time-to-market but also strengthens stakeholder trust in emerging counter-drone solutions.

Robust Methodological Framework Outlining Primary and Secondary Research Approaches Ensuring Data Integrity and Comprehensive Market Validation

This research employs a robust methodological framework combining secondary and primary research phases to ensure comprehensive market insights. Secondary research involved analysis of publicly available resources, including government defense briefings, industry white papers, and credible news outlets, to establish an initial understanding of anti-drone technology developments and geopolitical drivers.

Primary research consisted of structured interviews with industry experts, technology vendors, and end-user representatives from defense, homeland security, and commercial sectors. These engagements provided qualitative validation of market trends, supply chain dynamics, and regulatory impacts. Data triangulation techniques were applied throughout to reconcile discrepancies and reinforce the reliability of findings.

Quantitative data points were corroborated through cross-referencing multiple sources, ensuring integrity in reporting on technology adoption, regional deployment patterns, and tariff-related cost implications. The iterative validation process incorporated expert reviews to refine insights and ensure alignment with real-world operational experiences.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Drone market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Drone Market, by Technology

- Anti-Drone Market, by Range

- Anti-Drone Market, by Platform

- Anti-Drone Market, by Application

- Anti-Drone Market, by Verticals

- Anti-Drone Market, by Region

- Anti-Drone Market, by Group

- Anti-Drone Market, by Country

- United States Anti-Drone Market

- China Anti-Drone Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Conclusion Summarizing Critical Insights and Emphasizing the Strategic Imperatives Guiding Future Anti-Drone Market Developments

The strategic landscape of counter-UAS solutions is evolving rapidly as drone threats diversify in both scale and sophistication. Technological convergence-anchored by AI-enabled sensor fusion, directed-energy neutralizers, and autonomous engagement protocols-has elevated airspace defense from reactive measures to proactive, networked architectures.

Simultaneously, trade policy shifts and tariff pressures are reshaping supply chain strategies, driving a renewed focus on domestic manufacturing and component diversification. Segmentation analyses reveal that technology preferences, platform choices, and application requirements are tightly interwoven, underscoring the importance of modular, scalable systems that can adapt to unique operational contexts.

Regionally, collaborative frameworks across the Americas, EMEA, and Asia-Pacific are fostering knowledge exchange and harmonized regulatory approaches, while strategic partnerships between established defense primes and emerging innovators are accelerating capability deployment. As industry participants embrace actionable recommendations-spanning supply chain resilience, modular design, and regulatory engagement-they will be well-positioned to navigate uncertainty and capitalize on the transformative potential of next-generation anti-drone technologies.

Take the Next Step Today by Connecting with Ketan Rohom to Access the Comprehensive Anti-Drone Market Research Report Tailored for Strategic Decision-Making

Don’t let evolving drone threats catch your organization unprepared. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive access to the full anti-drone market research report. Equip your strategic initiatives with in-depth analysis, customized insights, and actionable intelligence tailored to your needs. Contact Ketan today to secure your competitive advantage and drive informed decision-making in the rapidly transforming counter-UAV landscape.

- How big is the Anti-Drone Market?

- What is the Anti-Drone Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?