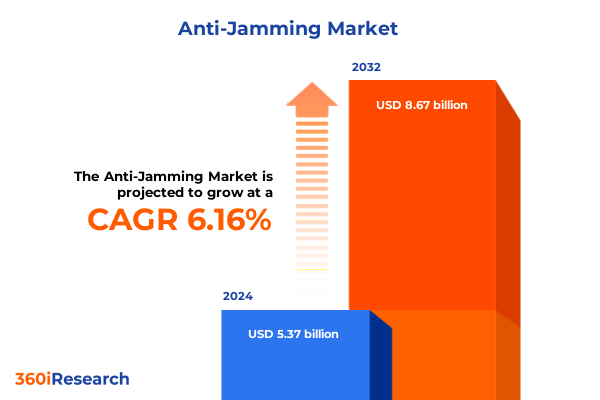

The Anti-Jamming Market size was estimated at USD 5.69 billion in 2025 and expected to reach USD 6.03 billion in 2026, at a CAGR of 6.19% to reach USD 8.67 billion by 2032.

Charting the Unseen Battlefront of Signals: An Introduction to the Critical Role of Anti-Jamming Technologies in Modern Electronic Warfare and Communications

The growing complexity and sophistication of electronic warfare have placed anti-jamming solutions at the forefront of national security and commercial communications strategies. Modern conflicts and critical infrastructures increasingly rely on resilient signal integrity in environments prone to intentional interference. As adversaries adopt more advanced jamming techniques, from narrowband to adaptive digital signal disruption, organizations across defense, transportation, and telecommunications must recalibrate their approaches to safeguarding operational continuity. Furthermore, the rapid proliferation of unmanned aerial systems and satellite-based services underscores the urgency of developing systems that can dynamically detect, analyze, and neutralize jamming attempts while maintaining seamless connectivity.

In addition to heightened threat landscapes, technological advancements are propelling anti-jamming solutions into novel domains. Innovations in beamforming, real-time signal analysis, and artificial intelligence-driven direction finding enable unprecedented levels of detection accuracy and response agility. At the same time, regulatory bodies are tightening standards to address spectrum security, prompting manufacturers and service providers to integrate advanced signal processing software and resilient hardware architectures. Consequently, industry leaders face the dual challenge of accelerating innovation cycles while navigating evolving compliance requirements, all against a backdrop of intensifying global competition and strategic partnerships.

Unveiling the Transformational Shifts Redefining Anti-Jamming Capabilities Through Technological Innovation, Evolving Threat Landscapes, and Strategic Synergies

The anti-jamming landscape has undergone transformative shifts driven by the convergence of artificial intelligence, advanced materials, and cloud-native architectures. Machine learning algorithms now power adaptive filters that distinguish between benign signal anomalies and malicious jamming attempts in real time, significantly reducing false alarms and enabling proactive countermeasures. Simultaneously, developments in miniaturized, software-defined radio platforms have facilitated the deployment of anti-jamming receivers across airborne, ground, naval, and spaceborne systems, expanding defense and commercial applications alike. Moreover, open systems architectures are fostering interoperability, allowing disparate subsystems to share threat intelligence seamlessly and orchestrate coherent defense strategies.

Beyond technological innovation, collaborations between traditional defense contractors and emerging software specialists are reshaping the competitive dynamics. Strategic alliances and joint ventures are accelerating the integration of cloud-based management software with on-premises signal processing suites, ensuring that updates and threat intelligence propagate across networks with minimal latency. Additionally, the adoption of beamforming and spoofing detection technologies is redefining how systems distinguish genuine transmissions from deceptive interference, laying the groundwork for next-generation platforms that can autonomously adjust frequency usage to maintain signal fidelity. These collective shifts signify not just incremental improvements, but a fundamental evolution in how anti-jamming solutions are conceived, developed, and deployed.

Analyzing the Cascading Effects of 2025 United States Tariffs on Anti-Jamming Hardware, Software, and Service Supply Chains and Market Dynamics

In 2025, new United States tariffs imposed on electronic components and subsystems critical to anti-jamming hardware and software have reverberated across the supply chains of defense, telecommunications, and aerospace industries. Manufacturers reliant on imported semiconductors and specialized jamming transceivers have encountered increased production costs, prompting many to seek domestic suppliers or to accelerate in-house component development. Meanwhile, service providers that depend on global talent and expertise for consulting and maintenance have had to revise contractual structures to mitigate cost inflations. This tariff regime has also incentivized alliances between U.S. firms and allied international partners to maintain strategic access to high-precision components without incurring prohibitive fees.

Consequently, the reshaped cost structures are influencing procurement decisions and long-term planning for both government agencies and commercial enterprises. End users in civil aviation and maritime applications are weighing the benefits of onshore assembly against the risk of obsolescence due to divergent technology timelines. At the same time, the military’s emphasis on air, land, and naval platforms has driven accelerated investment in domestic signal processing software and beamforming modules, seeking to balance security imperatives with budgetary constraints. These cascading impacts underscore how fiscal policy decisions, while aiming to bolster domestic industry, can also prompt strategic realignments and operational recalibrations throughout the anti-jamming ecosystem.

Deciphering Complex Market Segmentation to Illuminate Nuanced Insights Across Hardware, Services, Software, Platforms, Technologies, Frequencies, and End Users

A comprehensive examination of product-based segmentation reveals that hardware remains a vital pillar, with anti-jamming receivers and jammers demanding robust design, precision calibration, and resilience against evolving threats. Concurrently, services encompassing consulting and maintenance are becoming indispensable for ensuring system longevity and aligning deployments with mission-specific requirements. On the software front, management platforms facilitate centralized control and threat visibility across distributed nodes, while signal processing suites leverage advanced algorithms to enhance detection and mitigation performance.

When viewed through the lens of application, solutions tailored to civil aviation must adhere to stringent regulatory certifications for both commercial and general aviation, balancing safety requirements with operational efficiency. In maritime contexts, anti-jamming deployments serve commercial shipping lanes and pleasure vessels, each with unique endurance and form-factor constraints. Military applications across air, land, and naval theaters demand rigorous specifications and interoperability standards. Platform-based distinctions further differentiate offerings, as airborne systems prioritize weight and power considerations, ground deployments focus on mobility and ruggedization, naval installations emphasize corrosion resistance and range, and spaceborne payloads require radiation-hardened components.

Technological segmentation highlights beamforming’s role in spatial filtering, direction finding’s capacity for precise emitter localization, signal analysis’s ability to identify anomalous patterns, and spoofing detection’s importance in verifying transmission authenticity. Frequency-based considerations span C Band, L Band, and S Band allocations, each offering trade-offs in propagation characteristics and interference susceptibility. Finally, end-user segmentation into defense, industrial, telecom, and transportation sectors underscores diverse procurement drivers, regulatory imperatives, and mission-critical performance thresholds that collectively shape the anti-jamming landscape.

This comprehensive research report categorizes the Anti-Jamming market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Application

- Platform

- Technology

- Frequency

- End User

Mapping Divergent Regional Dynamics to Reveal How Americas, Europe Middle East Africa, and Asia Pacific Regions Are Shaping Anti-Jamming Trends and Adoption

Regional dynamics reveal that the Americas continue to drive innovation through robust defense budgets and a strong ecosystem of established manufacturers and startups collaborating on next-generation anti-jamming capabilities. In the United States, programmatic investments and cross-agency partnerships accelerate the development of AI-driven signal processing solutions, while Canada’s focus on Arctic communication resilience is fostering specialized hardware adaptations. Transitioning to Europe, Middle East, and Africa, regional priorities are influenced by geopolitical considerations, with NATO members investing in interoperable systems that can integrate seamlessly across multinational exercises, and Gulf states channeling resources toward naval and aerospace anti-jamming platforms to safeguard critical infrastructure.

Meanwhile, in Asia-Pacific, burgeoning telecommunications networks and the proliferation of commercial satellite services are catalyzing demand for advanced spoofing detection and beamforming modules. Japan and South Korea are at the forefront of semiconductor-driven innovation, yielding high-performance components optimized for both civilian and defense applications. Simultaneously, India’s growing space ambitions are driving investments in spaceborne anti-jamming payloads, and Australia’s strategic alliances are expanding capability development in airborne and maritime domains. These diverging yet interconnected regional trends underscore the importance of localization strategies, strategic partnerships, and regulatory alignment for stakeholders seeking to navigate the global anti-jamming market.

This comprehensive research report examines key regions that drive the evolution of the Anti-Jamming market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators to Highlight How Key Companies Are Driving Competition and Collaboration in the Anti-Jamming Market

Key players in the anti-jamming arena are distinguished by their proprietary innovations, strategic partnerships, and comprehensive solution portfolios that span hardware, software, and services. Leading defense integrators leverage decades of military contract experience to deliver turnkey systems for air, land, naval, and space platforms, frequently collaborating with AI specialists to embed adaptive signal processing capabilities. Meanwhile, technology pioneers focused on beamforming and direction finding are forging alliances with telecommunications operators to retrofit commercial networks with anti-jamming enhancements, addressing the growing risk of intentional interference in critical infrastructure.

Additionally, software companies specializing in management platforms and signal analysis algorithms are emerging as indispensable collaborators, enabling device-agnostic oversight and rapid threat response across distributed deployments. Maintenance and consulting firms are differentiating themselves by offering predictive analytics and condition-based maintenance models, ensuring that anti-jamming systems maintain peak performance over prolonged operational cycles. Collectively, these diverse capabilities highlight a competitive landscape characterized by convergence, where cross-domain expertise and integrated offerings determine which companies secure pivotal contracts and shape the future trajectory of anti-jamming solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Jamming market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus Defence and Space

- BAE Systems plc

- Boeing Defence, Space & Security

- Chemring Technology Solutions Limited

- Collins Aerospace

- Elbit Systems Ltd.

- HENSOLDT AG

- Infinidome Ltd.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Mayflower Communications Company, Inc.

- MetaKSAN Defence Industry Inc.

- Northrop Grumman Corporation

- NovAtel Inc.

- QinetiQ Group plc

- Raytheon Technologies Corporation

- Rohde & Schwarz GmbH & Co. KG

- Saab AB

- Safran Electronics & Defense

- Singapore Technologies Kinetics Pte Ltd

- ST Engineering Ltd.

- Thales Group

- U-Blox Holding AG

- Ultra Electronics Holdings plc

Empowering Industry Leaders with Actionable Strategies to Foster Innovation, Strengthen Resilience, and Capitalize on Emerging Opportunities in Anti-Jamming

Industry leaders must prioritize a dual approach that balances rapid innovation with resilient supply chain strategies. Investing in modular hardware and software architectures will allow organizations to integrate emerging detection algorithms and countermeasure techniques without extensive overhauls. Simultaneously, establishing partnerships with a diversified network of component suppliers-including domestic foundries and allied international manufacturers-can mitigate the impact of future tariff fluctuations or geopolitical disruptions.

Moreover, fostering collaborative research ecosystems that include defense agencies, academic institutions, and commercial operators will accelerate breakthroughs in beamforming, spoofing detection, and AI-driven direction finding. Leadership teams should also engage proactively with regulatory bodies to shape standards and spectrum management policies, ensuring that anti-jamming solutions remain compliant and interoperable. Finally, embedding predictive maintenance and remote diagnostic services within solution portfolios can enhance system uptime and deliver measurable value to end users, reinforcing long-term partnerships and driving sustainable market growth.

Detailing a Rigorous and Transparent Research Methodology Grounded in Multi-Source Data Collection and Expert Validation for Robust Anti-Jamming Insights

This research employs a multi-faceted methodology combining primary interviews with industry executives, technical experts, and end users across defense, aviation, maritime, and telecommunications sectors. Secondary research sources include patent databases, regulatory filings, and peer-reviewed publications, ensuring a comprehensive understanding of technological advancements and compliance landscapes. Quantitative data collection focuses on tracking tariff schedules, procurement patterns, and execution timelines for key projects, enabling an evidence-based view of cost structures and procurement drivers.

To validate findings, statistical triangulation techniques reconcile disparate data points, while scenario planning workshops with subject matter experts test the resilience of identified trends against potential market disruptions. A structured scoring model assesses vendors based on innovation capacity, solution integration, and customer satisfaction metrics. Throughout this process, adherence to rigorous ethical standards and data security protocols ensures the integrity and confidentiality of all collected information.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Jamming market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Jamming Market, by Product

- Anti-Jamming Market, by Application

- Anti-Jamming Market, by Platform

- Anti-Jamming Market, by Technology

- Anti-Jamming Market, by Frequency

- Anti-Jamming Market, by End User

- Anti-Jamming Market, by Region

- Anti-Jamming Market, by Group

- Anti-Jamming Market, by Country

- United States Anti-Jamming Market

- China Anti-Jamming Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Critical Findings to Convey the Strategic Imperatives and Future Trajectories in Anti-Jamming Solutions for Stakeholders and Decision Makers

The confluence of advanced signal processing, geopolitical policy shifts, and evolving threat landscapes sets the stage for a new era in anti-jamming solutions. Organizations that invest in modular, AI-driven architectures will be best positioned to counter sophisticated jamming techniques while maintaining operational agility. Strategic collaborations between hardware developers, software innovators, and service providers will catalyze synergies that extend system capabilities across platforms and regions.

Moreover, proactive engagement with regulatory authorities and diversified supply chain alignment will serve as critical buffers against policy-driven disruptions. Region-specific strategies tailored to defense priorities in the Americas, interoperability mandates in Europe, and technology-driven growth in Asia-Pacific will enable stakeholders to capitalize on unique market drivers. Ultimately, the ability to integrate seamless threat detection, adaptive countermeasures, and predictive maintenance will determine which organizations lead the charge in securing resilient communications across civilian and military domains.

Connect with Ketan Rohom to Access Exclusive Market Intelligence and Secure Your Competitive Edge in Anti-Jamming Through a Comprehensive Research Report

Elevate your strategic positioning by partnering with Ketan Rohom, Associate Director of Sales & Marketing, for access to a meticulously researched anti-jamming market report. Engage directly to explore tailored insights and customized recommendations that address your organization’s unique challenges and ambitions. Through this collaboration, you will gain privileged visibility into competitive landscapes, advanced technology evaluations, and region-specific analyses that empower decisive actions. Don’t let competitors outpace you; reach out to secure your copy of this definitive study and harness the knowledge needed to excel in the rapidly evolving anti-jamming domain.

- How big is the Anti-Jamming Market?

- What is the Anti-Jamming Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?