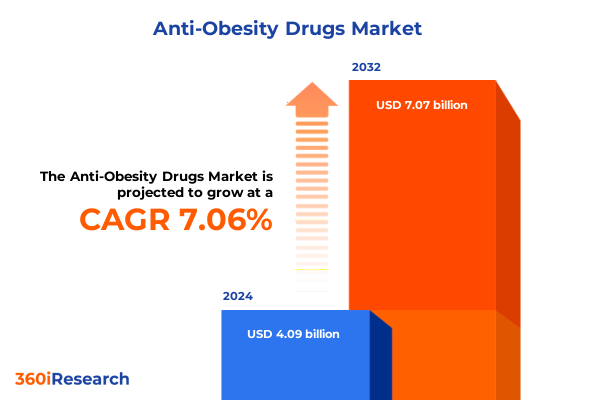

The Anti-Obesity Drugs Market size was estimated at USD 4.38 billion in 2025 and expected to reach USD 4.67 billion in 2026, at a CAGR of 7.07% to reach USD 7.07 billion by 2032.

Innovative Breakthroughs and Evolving Therapeutic Strategies Are Redefining the Global Anti-Obesity Treatment Paradigm in 2025

Obesity has emerged as a global health crisis, affecting more than two and a half billion adults worldwide, of whom nearly 890 million live with obesity as of 2022. This alarming trend is mirrored in the United States, where adult obesity prevalence has plateaued at approximately 40%, even as severe obesity continues to rise among certain demographic groups. The complex interplay of environmental, genetic, and behavioral factors has propelled a shift toward pharmaceutical interventions that can offer sustained clinical benefit beyond traditional lifestyle modifications.

In recent years, glucagon-like peptide-1 receptor agonists have spearheaded this transformation, delivering unprecedented weight reduction outcomes and moving obesity care into a new therapeutic era. The FDA’s acceptance of a once-daily oral semaglutide formulation underscores the transition toward more patient-convenient modalities that meet evolving treatment preferences. At the same time, regulatory bodies are recognizing multiple indications for novel agonists, reshaping expectations for chronic weight management as an integral component of comprehensive metabolic care.

The therapeutic frontier has further expanded with dual agonists such as tirzepatide receiving approval for conditions beyond diabetes, including obstructive sleep apnea, and semaglutide gaining kidney disease risk-reduction claims following the Phase 3 FLOW trial. Emerging oral small molecules like orforglipron promise greater manufacturing efficiency and broader affordability, offering a complementary pathway to peptide-based injections.

Beyond the GLP-1 class, established compounds such as naltrexone-bupropion, orlistat, phentermine-topiramate, and select SGLT2 inhibitors are being revisited for their metabolic benefits, enabling clinicians to tailor regimens to patient-specific needs and comorbidity profiles. This expanding pharmacologic toolkit is supported by digital health platforms and telemedicine programs that enhance real-world adherence, patient education, and outcome monitoring. As a result, stakeholders across the care continuum-from clinicians to payers-are redefining obesity not just as a lifestyle issue but as a chronic disease demanding multifaceted intervention strategies.

Groundbreaking Therapeutic Modalities and Regulatory Advances Propel the Anti-Obesity Drug Landscape Toward Unprecedented Clinical and Commercial Potential

The anti-obesity therapeutic landscape is undergoing transformative shifts driven by regulatory milestones, technological innovation, and intensifying competition. Early in 2025, the FDA recognized tirzepatide’s efficacy in obstructive sleep apnea, marking the first approval of its class for a non-diabetic comorbidity and signaling a broadening of obesity care paradigms beyond glycemic control. Subsequently, semaglutide’s extension into chronic kidney disease risk reduction further cemented the platform’s versatility and reflected growing confidence in GLP-1 agonists as multifunctional metabolic agents.

Alongside these approvals, oral delivery formats have gained momentum. Novo Nordisk’s New Drug Application for an oral semaglutide formulation represents a pivotal moment for patient-centered care, affording greater convenience and potentially driving adherence among populations hesitant to initiate injectable regimens. Concurrently, Eli Lilly’s orforglipron has demonstrated significant weight loss in Phase 3 trials, offering a non-peptide alternative that could lower manufacturing costs and broaden global access.

The competitive landscape is intensifying with the impending entry of generics. Dr. Reddy’s Laboratories is preparing to launch its own semaglutide offering across multiple international markets as patents expire, setting the stage for price competition and increased treatment accessibility. At the same time, the proliferation of off-brand compounding operations has prompted professional societies and regulators to caution against safety risks associated with substandard formulations.

These simultaneous developments-diversified delivery options, expanding indications, generic competition, and heightened quality oversight-underscore the sector’s dynamic trajectory. Stakeholders must remain vigilant, as regulatory reviews, payer coverage decisions, and real-world evidence generation will continue to refine clinical practice and commercial strategies in the coming years.

Assessing How Recent United States Tariff Policies Introduce Supply Chain Disruptions and Cost Pressures Across the Anti-Obesity Drug Industry

In 2025, escalating U.S. tariffs on pharmaceuticals have introduced significant cost pressures and supply chain complexities for anti-obesity drug manufacturers. Effective April 5, a 10% global tariff on imported goods-including active pharmaceutical ingredients, medical devices, and packaging-was implemented to bolster domestic production, prompting many companies to reassess cross-border sourcing strategies. More stringent reciprocal duties of up to 245% on select Chinese imports have compounded these challenges, particularly affecting suppliers of key starting materials critical to GLP-1 peptide synthesis.

This heightened tariff environment has immediate implications for production economics. U.S. reliance on Chinese APIs-accounting for nearly half of domestic generic drug inputs-means that many manufacturers are absorbing elevated costs or exploring alternative sourcing from India and other markets. However, reshoring production remains a long-term proposition, as establishing FDA-compliant facilities can require multi-billion-dollar investments and several years to achieve operational readiness.

To mitigate disruption, leading pharmaceutical companies are accelerating investment in U.S. manufacturing infrastructure. AstraZeneca’s announcement of a $50 billion plan to expand research, development, and production capacity across multiple states illustrates a broader industry pivot toward onshore capabilities, particularly for high-demand therapies including investigational weight-loss drugs. Despite these commitments, smaller innovator and generic firms may face more acute financial strain, with some industry analyses forecasting potential drug shortages or delayed launches if tariff volatility persists.

Given the ongoing uncertainty around tariff exemptions and Section 232 investigations, companies must adopt agile supply chain strategies, diversify API partnerships, and engage proactively with policymakers. In doing so, they can navigate the evolving trade landscape while preserving access to vital anti-obesity treatments.

Decoding Market Dynamics Through Product Type Dosage Form Administration Routes and End Users to Unveil Strategic Growth Levers

A nuanced understanding of market dynamics emerges when evaluating product classes, dosage forms, administration routes, and end-user channels. Therapeutic innovation is led by GLP-1 agonists, which dominate current development pipelines alongside established treatments such as naltrexone-bupropion, orlistat, phentermine-topiramate, and emerging SGLT2 inhibitors. Each product type offers distinct efficacy and safety profiles, guiding tailored therapy selection based on patient characteristics and comorbidities.

Formulation diversity further underscores the imperative for customized approaches. Oral capsules and tablets appeal to patients seeking simplicity, while injectable formats remain the standard for peptide-based modalities. Prefilled pens and vials enable precise dose titration and convenience, particularly in outpatient and homecare settings where ease of administration can directly influence adherence and outcomes.

The route of administration also shapes clinical workflows and patient engagement. Injectable therapies span autoinjector, prefilled pen, and vial-based delivery, affording flexibility for providers and patients managing long-term regimens. Nasal delivery systems have attracted interest for rapid drug absorption, though they face formulation stability challenges. Meanwhile, oral preparations bolster accessibility, opening opportunities for broad patient adoption with minimal training requirements.

End-user differentiation encompasses hospitals, specialized clinics, and homecare environments, each presenting unique adoption drivers. Hospitals integrate obesity therapeutics within multidisciplinary care teams, leveraging inpatient initiation protocols and postoperative management. Specialized obesity and metabolic clinics focus on comprehensive lifestyle and pharmacologic interventions, while homecare models prioritize remote monitoring and telehealth support. Understanding these segmentation layers equips stakeholders to align resource allocation, channel partnerships, and support services with evolving market needs.

This comprehensive research report categorizes the Anti-Obesity Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Dosage Form

- Route Of Administration

- End User

Unraveling Distinct Regional Drivers and Barriers in the Americas EMEA and Asia-Pacific to Customize Anti-Obesity Strategies for Maximum Impact

Geographic variation plays a pivotal role in shaping market access, reimbursement, and adoption trajectories. In the Americas, well-established regulatory frameworks and broad payer coverage have accelerated uptake of GLP-1 agonists, with managed care programs increasingly embracing outcomes-based contracts. However, disparities persist across socio-economic strata and rural-urban divides, driving initiatives to improve patient education and community-based intervention schemes.

In the Europe, Middle East, and Africa region, heterogeneous healthcare systems and reimbursement policies create complex market entry environments. While Western European nations have adopted cost-effectiveness thresholds to guide coverage decisions, emerging markets in the Middle East and Africa are prioritizing local manufacturing partnerships to address affordability and supply continuity. Regional harmonization efforts, such as mutual recognition agreements for regulatory filings, are gaining traction as a means to streamline cross-border launches.

Asia-Pacific represents a landscape of contrasts, with high-income markets like Japan and Australia demonstrating rapid technology adoption, while lower-income countries face challenges related to infrastructure and affordability. In China and India, domestic production of generics and biosimilars promises to expand access, yet regulatory agencies are emphasizing pharmacovigilance and quality assurance to safeguard patient safety. Cross-sector collaborations with digital health providers are emerging as a key enabler, leveraging mobile platforms to support adherence, remote monitoring, and data collection.

These regional nuances necessitate bespoke market entry and commercialization strategies that account for local regulatory requirements, reimbursement frameworks, and healthcare delivery models. By aligning global ambitions with regional imperatives, companies can optimize resource allocation, accelerate adoption, and deliver value to diverse patient populations.

This comprehensive research report examines key regions that drive the evolution of the Anti-Obesity Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Positioning Partnerships and Innovations Among Leading Pharma Players Shaping the Future of Anti-Obesity Therapies

The competitive landscape in anti-obesity therapeutics is spearheaded by a handful of industry leaders, each pursuing differentiated approaches to R&D, manufacturing, and commercialization. Novo Nordisk maintains a commanding presence with its semaglutide franchise and an extensive pipeline that includes multiple delivery formats and indications, underscoring its commitment to metabolic disease innovation. The company’s robust investment in oral and combination therapies further highlights its strategic foresight in addressing emerging patient preferences.

Eli Lilly has rapidly risen to prominence with tirzepatide, securing approvals for diabetes, weight management, and obstructive sleep apnea. Lilly’s partnership with Chugai to develop orforglipron amplifies its small-molecule capabilities and signals an intent to broaden access through cost-effective manufacturing platforms. Additionally, Lilly’s collaborations with digital health firms aim to integrate pharmacotherapy with behavior-change support.

Generic and specialty pharmaceutical companies are gearing up for market entry as key patents expire. Dr. Reddy’s Laboratories is poised to introduce a semaglutide generic across 87 countries, while other Indian players like Sun Pharma and Cipla stand ready to leverage patent cliffs to capture regional market share. Concurrently, licensing alliances between Western pharma and Chinese biotech innovators, such as Sciwind’s ecnoglutide partnership talks, reflect a globalization of R&D partnerships designed to accelerate clinical development and market reach.

Smaller biotech companies and academic spin-outs are contributing to the innovation pipeline with novel modalities, including dual and triple agonists and combination products that target multiple metabolic pathways. Strategic acquisitions and in-licensing deals are intensifying as larger players seek to bolster their portfolios and secure first-mover advantage in emerging therapy niches. This dynamic ecosystem, characterized by deep R&D investments and cross-sector collaborations, will continue to redefine competitive positioning in the years ahead.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Obesity Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alvogen Iceland EHF

- Amgen Inc

- Arena Pharmaceuticals Inc

- AstraZeneca plc

- Bayer AG

- Boehringer Ingelheim International GmbH

- Currax Pharmaceuticals LLC

- Eli Lilly and Company

- F Hoffmann La Roche Ltd

- GlaxoSmithKline plc

- Innovent Biologics Inc

- LG Chem Ltd

- Merck and Co Inc

- Novo Nordisk A S

- Pfizer Inc

- Rhythm Pharmaceuticals Inc

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd

- VIVUS LLC

- Zydus Lifesciences Ltd

Strategic Imperatives and Practical Roadmaps for Industry Leaders to Accelerate Adoption Commercialization and Sustainable Value Creation in Obesity Care

Industry leaders should prioritize diversification of manufacturing and supply chains to mitigate tariff-driven cost pressures and reduce dependency on single-source API suppliers. By establishing strategic alliances with regional contract development and manufacturing organizations, companies can maintain production continuity and optimize cost structures in the face of evolving trade policies.

Investment in patient-centric delivery formats remains essential. Expanding oral small-molecule pipelines and advancing autoinjector technologies will meet the growing demand for convenient self-administration. Integrating wearable sensors and digital adherence tools within therapeutic regimens can further enhance real-world effectiveness and position stakeholders favorably in value-based contracting discussions.

Collaboration with payers to design outcomes-based agreements is crucial to align pricing with demonstrated long-term benefits. Leveraging robust real-world data to validate reductions in comorbidity risks and healthcare utilization will strengthen coverage negotiations and facilitate broader access across public and private payers.

Companies are advised to cultivate cross-sector partnerships, combining pharmacologic innovation with telehealth platforms, behavioral coaching, and nutritional support. A holistic approach that addresses both medical and lifestyle dimensions of obesity care can differentiate solutions and foster patient loyalty.

Finally, a commitment to health equity is imperative. Tailoring programs to underserved and rural populations through community engagement and decentralized trial designs will expand reach, generate actionable insights, and fulfill corporate social responsibility objectives.

Transparent and Rigorous Multi-Source Research Framework Incorporating Expert Interviews Quantitative Analyses and Data Triangulation for Valid Insights

This research leverages a comprehensive multi-source framework, integrating secondary data from peer-reviewed journals, regulatory filings, and industry press releases with proprietary databases tracking product pipelines and clinical trial outcomes. Regulatory milestone analysis was informed by FDA and EMA public documents, while tariff impact assessments drew on trade policy briefings and published financial disclosures from leading pharmaceutical companies.

To enrich quantitative insights, primary interviews were conducted with senior executives, clinical thought leaders, and supply chain experts, enabling triangulation of perspectives on emerging therapeutic modalities, manufacturing strategies, and payer reimbursement trends. These qualitative interactions were supplemented by data modeling techniques to assess scenario outcomes related to trade policy shifts and generic market entry.

Regional market dynamics were evaluated through detailed country-level profiling, encompassing regulatory pathway comparisons, reimbursement landscape mapping, and stakeholder ecosystem analyses. Segmentation studies incorporated product type, dosage form, route of administration, and end-user channel evaluations to identify strategic growth levers and adoption barriers.

All findings underwent rigorous validation via internal peer review and cross-referencing with external market intelligence reports. This methodology ensures a balanced, objective, and actionable resource for stakeholders navigating the evolving anti-obesity therapeutics sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Obesity Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Obesity Drugs Market, by Product Type

- Anti-Obesity Drugs Market, by Dosage Form

- Anti-Obesity Drugs Market, by Route Of Administration

- Anti-Obesity Drugs Market, by End User

- Anti-Obesity Drugs Market, by Region

- Anti-Obesity Drugs Market, by Group

- Anti-Obesity Drugs Market, by Country

- United States Anti-Obesity Drugs Market

- China Anti-Obesity Drugs Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Critical Findings and Future Outlook to Empower Stakeholders with Actionable Intelligence in the Dynamic Anti-Obesity Therapeutics Sector

The anti-obesity therapeutics sector stands at an inflection point, characterized by groundbreaking clinical advances, expanding delivery modalities, and dynamic policy landscapes. Recent regulatory approvals have extended therapeutic indications beyond traditional metabolic endpoints, while oral and small-molecule innovations promise to reshape patient journeys and broaden market accessibility. At the same time, heightened U.S. tariffs and patent expirations are redefining manufacturing strategies and competitive positioning, underscoring the need for agile supply chain models and diversified sourcing.

Segmentation analysis reveals that nuanced strategies tailored to product classes, dosage formats, administration routes, and end-user channels will be critical for optimizing commercial success. Regional insights highlight divergent payer frameworks and regulatory environments that demand customized market entry approaches, from outcome-based contracting in the Americas to local manufacturing partnerships in EMEA and digital health integration across the Asia-Pacific.

Leading pharmaceutical companies are driving growth through strategic R&D collaborations, generic launches, and robust investment in onshore production capabilities. Yet, the true potential of anti-obesity therapies will only be realized through a patient-centric model that integrates pharmacotherapy with behavioral support, real-world monitoring, and equitable access initiatives.

By synthesizing these critical findings, stakeholders are equipped with the intelligence needed to make informed decisions, mitigate emerging risks, and capitalize on the transformative opportunities that lie ahead in obesity care.

Engage with an Industry Expert to Secure Customized Market Intelligence and Drive Strategic Decisions in Anti-Obesity Therapeutics Today

For tailored insights and strategic guidance in the rapidly evolving anti-obesity therapeutics sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market intelligence report and drive informed decision-making today

- How big is the Anti-Obesity Drugs Market?

- What is the Anti-Obesity Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?