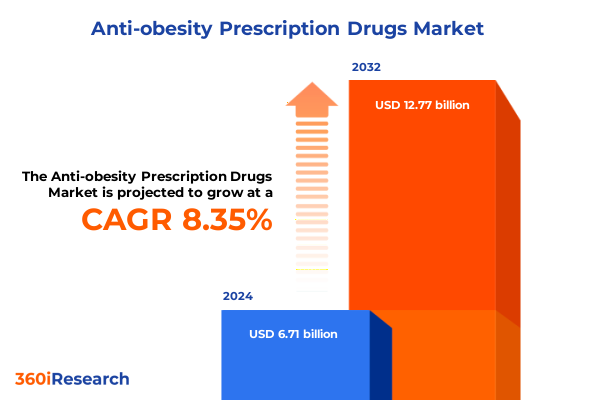

The Anti-obesity Prescription Drugs Market size was estimated at USD 7.25 billion in 2025 and expected to reach USD 7.84 billion in 2026, at a CAGR of 8.40% to reach USD 12.77 billion by 2032.

Setting the Stage for Crucial Breakthrough Advances in Anti-Obesity Drug Therapies as We Confront a Growing Global Health Imperative

The global rise in obesity has propelled anti-obesity prescription drugs into the forefront of modern healthcare solutions, marking a pivotal shift away from traditional lifestyle interventions alone to pharmacological strategies that deliver clinically substantive results. This period has witnessed unprecedented interest from leading biopharma companies seeking to leverage novel molecular targets and delivery mechanisms, ultimately redefining standards of care. As patient populations demand more effective and sustainable weight management options, the industry’s response through research, development, and commercialization of innovative therapies has never been more critical.

Amid accelerating prevalence rates, policymakers, payers, and healthcare providers are intensifying their focus on long-term management of obesity as a chronic disease. This transformation underscores the necessity for therapies that extend beyond symptomatic treatment to address underlying metabolic dysfunctions. Consequently, the market environment is characterized by heightened regulatory scrutiny, robust clinical trial pipelines, and cross-sector collaborations designed to unlock synergistic approaches involving combination regimens and adjunct digital health platforms. By spotlighting the latest advancements and stakeholder dynamics, this introduction sets the stage for a deeper exploration of how these prescription drugs are reshaping patient outcomes and industry trajectories.

Unveiling How Technological Innovations and Regulatory Reforms Are Catalyzing a New Era in Weight-Management Pharmaceuticals

The anti-obesity drug landscape is undergoing transformative shifts driven by breakthroughs in molecular biology, advances in patient engagement through digital therapeutics, and evolving reimbursement frameworks. Over the past few years, the emergence of GLP-1 agonists with superior efficacy profiles has spurred a cascade of investment into next-generation compounds that aim to deliver enhanced safety and convenience. Simultaneously, regulators in major markets have accelerated approval pathways, recognizing the urgent public health need and granting conditional authorizations that facilitate early patient access while post-market studies evaluate real-world effectiveness.

Parallel to pharmacological innovations, integration of remote monitoring tools and telemedicine platforms has redefined patient management by enabling personalized dosing regimens and real-time adherence support. This convergence of drug and digital health is forging new paradigms for chronic care, where behavioral insights complement pharmacodynamics to drive sustained weight reduction. Moreover, payers are piloting outcome-based contracting models, shifting risk-sharing toward manufacturers that can demonstrate tangible improvements in comorbidities such as type 2 diabetes and cardiovascular disease. Taken together, these dynamics signify a strategic inflection point, as industry players recalibrate development pipelines and commercialization strategies in response to a more sophisticated, data-driven market environment.

Examining the Complex Ripple Effects of New Tariff Policies on Production Costs, Supply Chains, and Patient Access in 2025

In 2025, the cumulative impact of newly implemented United States tariffs on pharmaceutical ingredients and finished formulations has introduced fresh complexities into the anti-obesity market. Tariffs applied to key active pharmaceutical ingredients and specialty excipients have elevated production costs for both domestic and international manufacturers, prompting companies to reevaluate sourcing strategies and supply chain resilience. These measures, initially intended to protect local industry and incentivize domestic manufacturing, have also provoked critical discussions on balancing national economic objectives with patient affordability and global competitiveness.

Manufacturers have responded by diversifying raw material suppliers, engaging in long-term supplier agreements, and exploring in-house synthesis capabilities to mitigate cost pressures. Equally, logistics providers and contract manufacturing organizations are adapting warehousing and distribution frameworks to absorb tariff-related fluctuations, ensuring continuity of supply. From a payer perspective, the cost increases have fueled negotiations around formulary placement and rebate structures, with private and public payers demanding greater transparency and value-based outcomes to offset higher list prices. Looking forward, sustained collaboration among manufacturers, policymakers, and healthcare stakeholders will be paramount to align tariff policy with broader public health priorities and to preserve patient access to life-changing therapies.

Revealing the Multifaceted Dynamics of Drug Classes, Administration Modes, Distribution Paths, and End-User Settings Shaping Market Progression

Diving into segmentation insights reveals nuanced drivers that underpin the anti-obesity drug landscape. Broadly, the market is categorized by drug class, where GLP-1 agonists such as semaglutide, liraglutide, exenatide, and dulaglutide have emerged as frontrunners due to superior efficacy and favorable safety profiles, while amylin analogs exemplified by pramlintide are leveraged for their complementary metabolic benefits. Parallel to this, lipase inhibitors such as orlistat and serotonin receptor modulators like lorcaserin occupy specific roles for patient cohorts requiring alternative mechanisms of action.

When viewed through the lens of administration route, injectable therapies dominate recent development efforts, with prefilled pens and auto-injectors gaining prominence for their ease of use, although vials and syringes remain relevant for certain clinical settings. Meanwhile, oral formulations in capsule and tablet formats continue to address patient preferences for convenience, particularly in decentralized care environments. Distribution pathways further stratify market engagement, as traditional offline channels such as pharmacies and ambulatory centers coexist alongside rapidly growing online platforms that cater to telehealth-based prescribing and home delivery.

Finally, end-user segmentation underscores the diverse healthcare touchpoints where obesity therapies are deployed. Hospitals and ambulatory care centers often initiate treatment in acute or transitional phases, whereas home care settings facilitate long-term adherence. Specialty clinics, spanning endocrinology, general practice, and dedicated weight loss centers, have become key hubs for patient education and multidisciplinary care models. This segmentation framework highlights the importance of tailored strategies that optimize product positioning, educational initiatives, and service models according to distinct therapeutic classes, administration preferences, channel capabilities, and end-user requirements.

This comprehensive research report categorizes the Anti-obesity Prescription Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Administration Route

- End User

- Distribution Channel

Highlighting the Diverse Regulatory Landscapes, Reimbursement Models, and Growth Trajectories Span the Americas, EMEA, and Asia-Pacific Regions

Regional dynamics in the anti-obesity landscape display marked variation in regulatory environments, reimbursement paradigms, and growth potential across the Americas, Europe, Middle East & Africa, and Asia-Pacific. Within the Americas, a combination of proactive regulatory approvals and robust insurer support in the United States has accelerated adoption of innovative therapies, while Latin American markets focus on expanding affordable access through public health initiatives. In contrast, European and Middle Eastern policymakers emphasize rigorous health technology assessments and outcome-based reimbursement schemes, fostering an environment where cost-effectiveness data and real-world evidence drive market entry decisions.

Across Asia-Pacific, heterogeneous healthcare infrastructures lead to divergent market trajectories. Established markets such as Japan and Australia benefit from streamlined regulatory processes and mature specialty clinic networks, whereas emerging markets in Southeast Asia and India are witnessing nascent growth propelled by rising obesity prevalence and government-led awareness campaigns. Importantly, digital health adoption rates vary widely, influencing the pace at which remote monitoring and telemedicine can augment pharmacotherapy regimens. These regional nuances demand tailored engagement strategies, where localized clinical evidence, patient support programs, and stakeholder partnerships are calibrated to align with each region’s unique healthcare priorities and market dynamics.

This comprehensive research report examines key regions that drive the evolution of the Anti-obesity Prescription Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing How Strategic Alliances, R&D Pipelines, and Evidence Generation Define Leadership in the Evolving Pharmaceutical Ecosystem

Key players in the anti-obesity prescription drug arena are harnessing strategic collaborations, pipeline fortification, and geographic expansion to cement their competitive positions. Leading pharmaceutical innovators with established portfolios are leveraging real-world evidence studies to substantiate benefits in comorbid conditions, enhancing value propositions for payers and providers. Meanwhile, biotech firms focus on next-generation molecules that promise differentiated efficacy or novel mechanisms of action, frequently partnering with academic institutions to accelerate discovery and early-stage trials.

The competitive intensity is further heightened by alliances between drug developers and technology firms, aiming to integrate connected devices and AI-driven analytics into treatment pathways. Mergers and acquisitions have emerged as a key tactic to acquire proprietary delivery platforms or diagnostic biomarkers that optimize patient selection. At the same time, regional specialist companies are forging distribution agreements to amplify their presence in high-growth markets. Collectively, these strategies underscore an ecosystem where innovation, evidence generation, and strategic partnerships converge to drive sustained growth and competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-obesity Prescription Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alizyme Limited

- Amgen Inc.

- AstraZeneca PLC

- BioCon Limited

- Boehringer Ingelheim International GmbH

- CHEPLAPHARM Arzneimittel GmbH

- Currax Pharmaceuticals LLC

- Eli Lilly and Company

- F. Hoffmann‑La Roche Ltd.

- Gelesis Holdings, Inc.

- GlaxoSmithKline PLC

- Hanmi Pharm.Co., Ltd.

- HK inno.N Corporation

- Innovent Biologics, Inc.

- Merck & Co., Inc.

- Novo Nordisk A/S

- Orexigen Therapeutics, Inc.

- Pfizer Inc.

- Reddy’s Laboratories Limited

- Rhythm Pharmaceuticals, Inc.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceuticals Company Limited

- Verdiva Pharma Inc.

- Vivus LLC

- Zydus Lifesciences Limited

Implementing Strategic Innovations, Value-Based Contracts, and Integrated Patient Programs to Secure Competitive Advantage in Anti-Obesity Therapies

Industry leaders seeking to capitalize on the anti-obesity opportunity should prioritize differentiated product development that addresses distinct metabolic pathways and patient preferences. Emphasizing combination therapies and personalized dosing regimens can create meaningful clinical differentiation, while embedding digital health tools enhances adherence and long-term outcomes. From a commercial perspective, forging value-based contracts with payers that tie reimbursement to patient-centric endpoints fosters alignment around shared healthcare objectives and mitigates pricing pressures.

Operational resilience should be reinforced through diversified supplier networks for critical raw materials and agile manufacturing processes that can adapt to regulatory changes or tariff fluctuations. Additionally, cultivating multidisciplinary stakeholder engagement-spanning endocrinologists, primary care physicians, dietitians, and digital health specialists-will expand the total addressable patient population. Finally, investing in patient education and support programs that deliver holistic, culturally sensitive experiences can bolster brand equity and drive sustained market uptake.

Detailing a Robust Mixed-Methods Approach Combining Expert Interviews, Literature Review, and Quantitative Data Triangulation for Holistic Market Insights

This analysis draws on a multi-tiered research methodology combining primary interviews with key opinion leaders, secondary literature review, and quantitative data triangulation. Primary research included in-depth discussions with endocrinologists, clinical pharmacologists, and reimbursement specialists to gain insights into clinical decision-making drivers and real-world utilization patterns. Secondary sources encompassed peer-reviewed journals, regulatory filings, company reports, and health technology assessment publications to validate therapeutic and competitive developments.

Quantitative analysis leveraged prescription data, policy databases, and trade statistics to map distribution trends and tariff impacts. The segmentation framework was applied consistently across all datasets to ensure comparability and rigor. Where possible, longitudinal data was used to identify emerging trajectories, while expert validation workshops were conducted to refine interpretations and reconcile divergent viewpoints. This cohesive approach ensured that the findings are robust, relevant, and reflective of the current anti-obesity therapeutic environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-obesity Prescription Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-obesity Prescription Drugs Market, by Drug Class

- Anti-obesity Prescription Drugs Market, by Administration Route

- Anti-obesity Prescription Drugs Market, by End User

- Anti-obesity Prescription Drugs Market, by Distribution Channel

- Anti-obesity Prescription Drugs Market, by Region

- Anti-obesity Prescription Drugs Market, by Group

- Anti-obesity Prescription Drugs Market, by Country

- United States Anti-obesity Prescription Drugs Market

- China Anti-obesity Prescription Drugs Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Summarizing the Intersection of Scientific Innovation, Policy Evolution, and Strategic Agility That Will Drive Sustainable Success in Obesity Management

The anti-obesity prescription drug market stands at a critical juncture, characterized by unprecedented scientific breakthroughs, evolving stakeholder expectations, and increasing regulatory momentum. As GLP-1 agonists and complementary therapies gain traction, the sector is moving toward a future where pharmacological and digital solutions converge to deliver sustainable patient outcomes. However, supply chain complexities and policy shifts underscore the importance of strategic agility and value-based alignment with payers and providers.

By integrating rigorous evidence generation, patient-centric program design, and resilient operational models, companies can not only address pressing clinical needs but also build enduring competitive moats. The insights presented throughout this executive summary are intended to equip decision-makers with the perspective required to navigate the complex interplay of innovation, regulation, and market forces. Ultimately, the successful commercialization of anti-obesity therapies will depend on collaborative efforts that span R&D, health economics, and stakeholder engagement, ensuring that transformative treatments reach patients in need.

Unlock Exclusive, In-Depth Market Intelligence and Strategic Guidance from Our Associate Director to Propel Your Anti-Obesity Portfolio to New Heights

Investing in comprehensive insights is essential for stakeholders who aim to navigate the complex competitive landscape of anti-obesity therapies and seize emerging opportunities. To access the full detailed analysis, strategic data, and expert forecasts, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who will guide you through the process of securing the definitive market research report tailored to your organization’s goals

- How big is the Anti-obesity Prescription Drugs Market?

- What is the Anti-obesity Prescription Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?