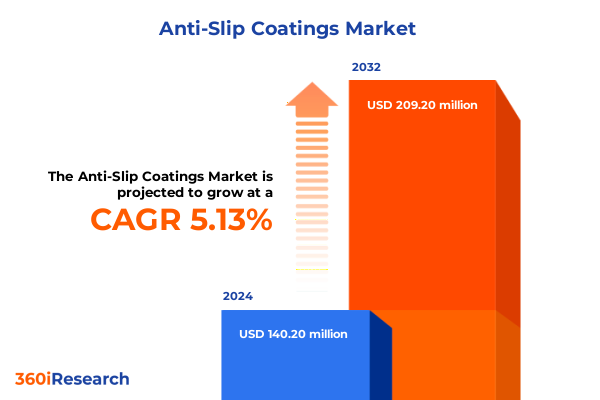

The Anti-Slip Coatings Market size was estimated at USD 147.30 million in 2025 and expected to reach USD 158.09 million in 2026, at a CAGR of 5.13% to reach USD 209.20 million by 2032.

Understanding the Critical Role of Anti-Slip Coatings in Enhancing Safety Across Industrial, Commercial, and Residential Environments

Unintentional falls represent one of the most significant safety hazards for older adults and facility occupants, with CDC data indicating nearly 41,400 fall-related deaths among Americans aged 65 and older in 2023 and a death rate of almost 70 per 100,000 population. This dramatic rise underscores the urgent need for preventive measures that mitigate slip risks in both public and private environments.

Anti-slip coatings have emerged as a frontline defense against slip-and-fall accidents, providing durable, textured surfaces that enhance traction under a range of conditions. Their adoption spans industrial walkways, commercial kitchens, healthcare facilities, and residential bathrooms, where the balance of safety, aesthetics, and maintenance requirements is critical.

Regulatory frameworks further drive the uptake of anti-slip solutions. The Occupational Safety and Health Administration recommends a minimum static coefficient of friction of 0.50 on wetted surfaces to reduce workplace slip hazards, while accessibility guidelines favor even higher thresholds in public buildings to ensure safe access for all individuals. As a result, organizations across sectors are prioritizing the installation of high-performance anti-slip coatings to meet compliance obligations and protect both employees and visitors.

Exploring Breakthrough Innovations and Sustainability Initiatives Revolutionizing Anti-Slip Coatings Technology and Market Dynamics

Sustainability has become a central driver of innovation in the anti-slip coatings industry, as manufacturers reformulate traditional solvent-based systems into waterborne, UV-cured, and high-solids alternatives that align with EPA’s Pollution Prevention strategy. These compliant coatings, defined by low or zero VOC content, exemplify how environmental stewardship and product performance can coexist in modern surface treatments. Simultaneously, the European Union’s REACH regulations have compelled suppliers to limit interior coating VOC emissions to below 300 grams per liter, prompting a global shift towards greener chemistries.

Technological breakthroughs are reshaping the performance profile of anti-slip coatings. Smart anti-slip formulations now react dynamically to weather conditions, adjusting surface texture when moisture or ice is detected to enhance traction by up to 40 percent in field trials. At the same time, self-healing coatings that deploy embedded microcapsules of reactive resin move from laboratory proofs of concept to targeted pilot deployments in heavy-traffic zones, offering significant reductions in maintenance downtime.

Nanotechnology has further extended the lifespan and durability of non-slip surfaces. Graphene-enhanced formulations are demonstrating service lives of up to 15 years in marine environments, compared with three to five years for conventional epoxy systems, thereby reducing recoating frequency and associated environmental footprint.

Meanwhile, raw material and logistics challenges are pressuring supply chains. USGS data shows that aggregate production fell by six percent in the second quarter of 2024, reflecting broader disruptions in sand and gravel mining that are essential to many textured additives. This decline has highlighted the importance of diversified sourcing strategies and inventory buffering to maintain uninterrupted coating application schedules.

Analyzing the Multipronged Impact of 2025 United States Tariff Measures on Resin Supply Chains, Raw Material Costs, and Coatings Industry Transformation

On March 4, 2025, the United States government implemented an additional 20 percent ad valorem tariff on all polyurethane raw materials imported from China, layering onto existing anti-dumping and countervailing duties. This measure has introduced significant cost pressure across multiple downstream sectors, from automotive seating surfaces to industrial flooring manufacturers.

In parallel, the U.S. Department of Commerce finalized anti-dumping determinations on certain epoxy resins from China, Korea, and Taiwan in April 2025, setting the stage for countervailing duties to follow. These actions respond to findings of unfair pricing and subsidization, and they are expected to elevate import costs for Bisphenol A, Novolac, and related resin intermediates absent rapid supplier adjustments.

Trade associations have sounded alarms about the wider implications of these tariffs. The American Coatings Association has warned that new levies on Canada, Mexico, and China threaten to disrupt established supply chains, drive up raw material prices, and challenge manufacturers’ ability to meet delivery timelines, ultimately passing through to end-user industries in the form of higher product costs.

As a result, companies in sectors ranging from construction to oil & gas are recalibrating procurement strategies, exploring domestic production partnerships, and renegotiating supplier contracts to mitigate the cumulative impact of these tariff measures on operating margins and project budgets.

Uncovering Deep Insights into Market Segmentation by Coating Type, End-Use Industry, Resin Composition, Application Method, and Sales Channel Dynamics

Within the anti-slip coatings landscape, product innovation is often rooted in the choice of base chemistry. Acrylic systems, subdivided into butyl acrylate and methyl methacrylate variants, offer rapid cure and aesthetic clarity for residential and light commercial applications. Epoxy formulations-further differentiated into Bisphenol A and Novolac types-provide superior adhesion and chemical resistance that drive their dominance in industrial, marine, and heavy-traffic sectors. Polyurethane options, segmented into aliphatic and aromatic chemistries, deliver enhanced UV stability and abrasion resistance for outdoor decks, ramps, and vehicle platforms.

End-use industries also shape product strategies and distribution channels. Within automotive, coatings tailored for both OEM production lines and aftermarket retrofit solutions address safety requirements for threshold plates and step wells. In construction, differentiated offerings serve commercial, infrastructure, and residential projects with formulations rated for foot traffic, vehicular access, and long-term durability. Marine environments demand specialized non-skid surfaces for both commercial vessels and defense platforms, while oil & gas facilities rely on offshore and onshore coatings that resist aggressive chemicals and extreme weather.

Resin type further influences performance and application. Epoxy resins remain the workhorse for heavy-duty non-slip systems, polyester resins enable flexible primer layers on porous substrates, and vinyl ester resins deliver targeted solvent and acid resistance in harsh chemical environments. Application methods span brush, roll, spray, and trowel techniques, each optimized for substrate geometry, project scale, and speed of deployment.

Sales channels range from direct manufacturer partnerships for large-scale industrial projects to distributor networks that stock standard kits, and online platforms catering to small contractors and residential consumers. This multi-channel approach ensures that specifiers and installers can access the right anti-slip solution in the timeframe and volume they require.

This comprehensive research report categorizes the Anti-Slip Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Coating Type

- Resin Type

- Application Method

- End Use Industry

- Sales Channel

Evaluating Regional Growth Drivers and Emerging Challenges for Anti-Slip Coatings Across the Americas, Europe Middle East & Africa, and Asia-Pacific Regions

In the Americas, robust infrastructure spending and regulatory incentives are driving increased adoption of anti-slip coatings across public transit systems, healthcare facilities, and commercial properties. The U.S. architectural segment has transitioned to water-based formulations for over 90 percent of sales, reflecting environmental priorities and low-VOC mandates in key states. Meanwhile, Canada and Mexico supply chains continue evolving under trade agreements and local content requirements.

Europe, the Middle East, and Africa respond to stringent EU REACH and VOC emission standards by accelerating the phase-out of solvent-borne products and mandating compliant low-emission alternatives. Sustainability certifications such as LEED and BREEAM further bolster demand for eco-friendly non-slip coatings, particularly in commercial real estate developments. Marine safety regulations across the North Sea and Mediterranean also fuel specialized product pipelines for offshore platforms and naval fleets.

The Asia-Pacific region’s rapid urbanization and infrastructure expansion generate high-volume demand for anti-slip solutions in transportation, hospitality, and energy sectors. Local producers leverage cost efficiencies and proximity to raw material sources, though they remain exposed to global tariff dynamics and raw material fluctuations. Digital ordering platforms and regional distribution hubs are increasingly vital to ensure timely delivery across diverse markets from Australia to India and Southeast Asia.

This comprehensive research report examines key regions that drive the evolution of the Anti-Slip Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Coating Manufacturers’ Strategic Moves, Sustainability Focus, and Innovation Pipelines Shaping the Anti-Slip Coatings Competitive Landscape

PPG has advanced its sustainability agenda by expanding its non-bisphenol A HOBA® internal coatings for aluminum bottles and introducing a trio of BPA-NI end-coatings for beverage cans under its INNOVEL® and iSENSE® series, aligning product performance with evolving global food-contact regulations. The company’s ongoing recognition on Barron’s Most Sustainable U.S. Companies list underscores its integrated approach to green product development and operational excellence.

Sherwin-Williams has fortified its market position through targeted innovations in resinous flooring systems. Its American Safety Technologies AS-250 epoxy with Kevlar® delivers unmatched durability in forklift traffic zones, while its Accelera One topcoat for decorative concrete won the 2025 Concrete Contractor Top Products Award for combining fast cure times with high slip resistance and chemical resistance. Additionally, the launch of flooring systems for EV gigafactories demonstrates the company’s agility in addressing specialized facility requirements.

RPM International continues to expand its sustainability footprint across multiple subsidiaries, investing in water efficiency, bio-based building solutions, and energy-efficient powder coatings. Its global brands, including Stonhard and Tremco, lead in high-performance flooring and sealant solutions, serving construction and industrial markets worldwide.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Slip Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd.

- BASF SE

- Hempel A/S

- Henkel AG & Co. KGaA

- Jotun A/S

- Kansai Paint Co., Ltd.

- Mapei S.p.A.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Rust-Oleum Corporation

- Sika AG

- The Sherwin-Williams Company

Actionable Strategies for Industry Leaders to Navigate Regulatory Shifts, Supply Chain Disruptions, and Technological Innovations to Secure Market Leadership

To thrive amid tightening environmental regulations, industry leaders should accelerate the transition to low-VOC and high-solids formulations, leveraging waterborne and UV-curable technologies to meet air quality requirements while maintaining performance. Building strategic partnerships with raw material suppliers and establishing redundant sourcing channels will safeguard against tariff-driven disruptions and aggregate shortages.

Investing in advanced research and development for smart, adaptive coatings and nanotechnology-enhanced surfaces can create performance differentials that justify premium pricing and foster long-term customer loyalty. Engaging proactively with regulatory bodies and participating in standards committees will ensure that emerging technologies shape, rather than respond to, new compliance frameworks.

Finally, expanding digital sales channels and enhancing distributor training programs will strengthen market penetration in underserved segments, while targeted technical support and installation services will reduce project risks and reinforce brand leadership.

Detailing a Rigorous Research Methodology Combining Primary Stakeholder Interviews, Regulatory Analysis, and Comprehensive Multisource Data Triangulation

This report synthesizes insights from a robust primary research program, including in-depth interviews with C-suite executives, technical directors, and installation contractors across key end-use industries. Secondary research sources encompass U.S. Department of Commerce Federal Register notices, EPA environmental guidelines, trade association publications, and company press releases from leading paint and coatings manufacturers.

Quantitative data were validated through cross-referencing of regulatory filings, customs statistics, and proprietary surveys of distribution channel partners. A structured data triangulation process ensured consistency across market segmentation parameters, tariff impact assessments, and regional performance indicators. All findings underwent peer review by an internal panel of industry experts to uphold methodological rigor and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Slip Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Slip Coatings Market, by Coating Type

- Anti-Slip Coatings Market, by Resin Type

- Anti-Slip Coatings Market, by Application Method

- Anti-Slip Coatings Market, by End Use Industry

- Anti-Slip Coatings Market, by Sales Channel

- Anti-Slip Coatings Market, by Region

- Anti-Slip Coatings Market, by Group

- Anti-Slip Coatings Market, by Country

- United States Anti-Slip Coatings Market

- China Anti-Slip Coatings Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Observations on How Safety Imperatives, Sustainability Mandates, and Technological Advancements Will Drive Future Anti-Slip Coatings Innovation

As safety imperatives intersect with environmental mandates and technological progress, anti-slip coatings will continue evolving as a critical component of built environments across the globe. The convergence of low-emission chemistries, adaptive surface technologies, and resilient supply chain models underpins the next phase of market growth.

Companies that proactively integrate sustainability with performance innovation, navigate evolving tariff landscapes, and tailor solutions to regional regulatory frameworks will secure a competitive edge. By aligning product roadmaps with customer safety needs and regulatory trajectories, industry leaders can transform challenges into opportunities for differentiation and value creation.

Contact Ketan Rohom to Secure Your Comprehensive Anti-Slip Coatings Market Intelligence Report and Accelerate Strategic Decision-Making Today

To access the full depth of our analysis on anti-slip coatings, including actionable insights, regulatory updates, and advanced technology trends, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through our comprehensive report’s structure, highlight sections most relevant to your organization’s strategic objectives, and arrange a personalized briefing. Elevate your decision-making with direct access to proprietary data and expert recommendations by contacting Ketan Rohom today.

- How big is the Anti-Slip Coatings Market?

- What is the Anti-Slip Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?