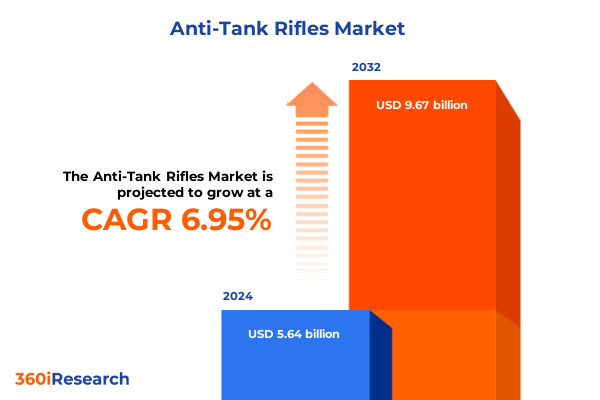

The Anti-Tank Rifles Market size was estimated at USD 5.95 billion in 2025 and expected to reach USD 6.28 billion in 2026, at a CAGR of 7.17% to reach USD 9.67 billion by 2032.

Exploring the Strategic Relevance and Technological Evolution of Anti-Tank Rifles amid Evolving Global Defense Dynamics and Threat Environments

In a landscape defined by rapidly evolving military threats and technological breakthroughs, anti-tank rifles have reemerged as critical enablers of precision engagement and force multiplication. Once overshadowed by heavier missile systems and guided munitions, these portable yet high-velocity platforms are reclaiming strategic prominence at the squad and platoon levels, addressing modern armored threats while preserving maneuverability. By offering a blend of affordability, ease of deployment, and lethal efficacy, anti-tank rifles bridge the capability gap between shoulder-fired rocket launchers and crew-served anti-armor weapons.

Over the past decade, defense planners have recognized that lightweight, high-caliber rifles can deliver decisive effects against lightly armored vehicles, fortifications, and emerging unmanned ground systems. This realization has spurred innovation across materials science, ballistics engineering, and fire control integration, ensuring that anti-tank rifles remain relevant against adaptive adversaries. Consequently, understanding the current market dynamics, technology inflection points, and procurement drivers is essential for manufacturers, policy-makers, and end users seeking to optimize capability portfolios.

This executive summary provides a concise yet comprehensive view of the anti-tank rifle sector, highlighting transformative shifts, the ramifications of trade policy, nuanced segmentation insights, and the competitive landscape. It is designed to equip stakeholders with the actionable intelligence needed to navigate supply chain challenges, align product strategies with end-user requirements, and capitalize on emerging opportunities in a security environment defined by uncertainty and rapid change.

Analyzing How Emerging Warfare Trends and Defense Innovation Are Transforming the Anti-Tank Rifle Landscape and Operational Doctrine

Recent decades have witnessed a paradigm shift in armored warfare, catalyzing profound changes in how anti-tank rifles are designed, deployed, and valued. The resurgence of near-peer competition, with emphasis on high-intensity conflict scenarios, has driven a move away from legacy heavy platforms toward agile, precision long-range systems. This trend is amplified by the proliferation of unmanned combat vehicles and loitering munitions, compelling rifle manufacturers to integrate advanced sighting systems, modular recoil management technologies, and adaptive ammunition solutions.

Moreover, urban and hybrid warfare contexts have reshaped operational priorities, elevating the need for anti-tank rifles that excel in confined spaces and asymmetric environments. Innovations such as variable rifling profiles, retractable bipods, and quick-change barrel assemblies reflect a focus on rapid deployment and minimal logistic footprint. Additionally, material advancements-ranging from high-strength alloys to polymer-backed stocks-enable these rifles to achieve remarkable weight reductions without compromising ballistic performance.

Furthermore, digital transformation is streamlining maintenance and training cycles through remote diagnostics and augmented reality overlays for live-fire drills. As defense budgets experience realignment, cost-effectiveness has become a central tenet, prompting manufacturers to develop scalable production techniques while preserving quality assurance standards. Taken together, these transformative shifts are redefining the competitive landscape and creating fertile ground for next-generation anti-tank rifle systems that respond to the multifaceted demands of contemporary battlefields.

Assessing the Comprehensive Consequences of 2025 United States Tariffs on Anti-Tank Rifle Production, Supply Chain, and Procurement Strategies

In 2025, new United States tariffs on critical raw materials and precision machining imports have introduced significant cost pressures across the anti-tank rifle supply chain. Steel and advanced composite levies, particularly on specialized alloys, have elevated component procurement expenses, prompting manufacturers to recalibrate sourcing strategies and absorb incremental cost burdens. The cumulative effect has manifested in extended lead times for barrel forging, optic assemblies, and recoil management modules.

Procurement agencies are responding by exploring alternative material pathways and deepening partnerships with domestic suppliers to mitigate tariff impact. These efforts include co-development agreements that secure favorable pricing under offset arrangements and incentivize investment in local production capacity. At the same time, end users are adjusting procurement cycles, leveraging multi-year contracting vehicles to stabilize budget forecasts and hedge against further policy shifts.

The tariff regime has also triggered a ripple effect on aftermarket support, where spare part availability and maintenance services are experiencing pricing volatility. To maintain operational readiness, military and law enforcement units are increasingly adopting predictive maintenance platforms, enabling optimized spare inventory management and minimizing downtime. Ultimately, the interplay between trade policy and defense logistics underscores the importance of agile supply chain resilience as a cornerstone of strategic advantage in the anti-tank rifle market.

Uncovering Market Insights through Detailed Action Type, Caliber, End User, and Technology Segmentation Frameworks for Anti-Tank Rifles

A nuanced understanding of the market’s segmentation reveals critical patterns in design priorities, performance thresholds, and end-user adoption. Examining the landscape by action type shows that fully automatic anti-tank rifles, differentiated by gas-operated and recoil-operated mechanisms, are gaining traction among security forces that value sustained emission rates and rapid target acquisition under stress. Bolt-action variants, whether straight-pull or turn-bolt, continue to command respect for their mechanical simplicity and reliability in austere operational conditions. Semi-automatic platforms, leveraging both gas-operated and recoil-operated cycles, bridge the gap by offering controlled follow-up shots without the logistic complexity of full auto systems.

Caliber-based segmentation offers insights into ballistic performance trade-offs. Systems chambered for 12.7 and 14.5 millimeter loads deliver a balance of penetration and recoil management suited for mobile light-armor engagements, whereas 20 millimeter and above rifle platforms-spanning 23, 25, and 30 millimeter calibers-are tailored to defeat heavier armor profiles and fortifications. These distinctions inform ammunition logistics, training regimens, and platform ergonomics.

End-user segmentation highlights divergent procurement drivers. Homeland security agencies focus on rapid deployment rifles with minimal signature and ease of use for border protection and critical infrastructure defense. Law enforcement units prioritize compact designs with enhanced optics for urban standoff scenarios, while military forces demand an amalgam of modularity, range, and lethality that align with doctrinal doctrines for combined arms operations.

Technological segmentation underscores a growing shift toward caseless propulsion architectures-both metal-cased and polymer-cased-aimed at reducing logistical burdens and thermal footprints. Conventional propulsion systems remain prevalent, however, benefiting from mature supply chains and proven reliability. Integrating these segmentation insights equips stakeholders to tailor product roadmaps and marketing strategies consistent with distinct operational requirements.

This comprehensive research report categorizes the Anti-Tank Rifles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Action Type

- Caliber

- Technology

- End User

Charting Regional Dynamics and Demand Patterns for Anti-Tank Rifles across the Americas, Europe, Middle East, Africa, and Asia-Pacific Markets

Across the Americas, procurement cycles are being shaped by a blend of counter-insurgency operations and evolving continental defense partnerships. Nations are modernizing arsenals by investing in medium-caliber rifle systems solvable against light armored vehicles, leveraging both domestic production capabilities and select import strategies. The U.S. market, in particular, is demonstrating robust demand for modular rifle packages that support rapid role changes between anti-material and precision engagement functions.

In Europe, Middle East, and Africa, the security terrain ranges from high-intensity peer competitions to asymmetric stability operations. European defense consortia are emphasizing interoperability and joint procurement frameworks, driving standardization across NATO allies. Concurrently, Middle Eastern nations continue to invest in domestic assembly lines under technology-transfer agreements, while African peacekeeping missions require lightweight, easily maintainable systems that can endure harsh environmental conditions.

Asia-Pacific dynamics reflect a dual focus on territorial defense and maritime security. Regional powers are fielding anti-tank rifles with extended-range pan and tilt capabilities for island defense scenarios, and are integrating these systems into rapid deployment brigades. Collaborative ventures between indigenous manufacturers and international defense firms are enabling technology diffusion, thereby accelerating capability maturation cycles.

This comprehensive research report examines key regions that drive the evolution of the Anti-Tank Rifles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves, Innovation Portfolios, and Competitive Positioning of Leading Anti-Tank Rifle Manufacturers Worldwide

Leading defense suppliers are positioning their anti-tank rifle portfolios through targeted R&D investments, strategic alliances, and niche capability developments. A veteran European manufacturer has advanced gas-operated semi-automatic systems with integrated fire-control units that link to vehicle-borne and dismounted networks, enhancing real-time target tracking. An American specialist has expanded its bolt-action product line by introducing a lightweight straight-pull action optimized for special operations forces requiring rapid follow-up shots under high stress.

Meanwhile, a major defense conglomerate has leveraged polymer-cased caseless ammunition research to reduce overall system mass and thermal signature, collaborating with material science start-ups to accelerate prototyping. Across the industry, a pattern of co-development and licensed production agreements is evident, with manufacturers seeking to localize assembly in key markets to bypass trade barriers and curate aftermarket support ecosystems.

Smaller innovators are carving out niches by focusing on advanced barrel metallurgy, additive manufacturing for precision components, and ruggedized sighting solutions. These specialized firms often serve as upstream suppliers to tier-one OEMs, influencing broader product roadmaps and introducing disruptive technologies into mainstream platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Tank Rifles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accuracy International Ltd.

- Arsenal JSCo

- Barrett Firearms Manufacturing, Inc.

- Bharat Dynamics Limited

- CheyTac LLC

- Denel Land Systems

- Desert Tactical Arms LLC

- Elbit Systems Ltd.

- FN Herstal SA

- General Dynamics Corp.

- Israel Weapon Industries (IWI) Ltd.

- Lockheed Martin Corporation

- McMillan Firearms Manufacturing, Inc.

- Oberland Arms GmbH

- Promtechnologia LLC

- Rafael Advanced Defense Systems Ltd.

- Raytheon Technologies Corporation

- Rheinmetall AG

- Roketsan A.S.

- Saab AB

- Steyr Mannlicher GmbH & Co KG

- United Defense Manufacturing Corporation

- Zastava Arms

Strategic Imperatives and Tactical Recommendations for Industry Leaders to Navigate Market Challenges and Capitalize on Growth Opportunities in Anti-Tank Rifles

To thrive in an environment marked by policy fluctuations and intensifying competition, industry leaders should prioritize diversification of raw material sourcing by expanding supplier bases into allied nations and leveraging trade frameworks to secure tariff exemptions. Simultaneously, investing in flexible manufacturing processes, such as additive manufacturing and modular assembly lines, can reduce lead times and adapt production volume to demand swings without incurring prohibitive overhead.

Strengthening relationships with end users through embedded training programs and mobile maintenance units will foster long-term service contracts and build brand loyalty. Moreover, integrating digital twin models and predictive performance analytics into product support offerings can differentiate service portfolios and drive recurring revenue streams. Collaborating with research institutions to pioneer next-generation caseless and hybrid propulsion ammunition will position firms at the vanguard of weight reduction and thermal management solutions.

Finally, establishing dedicated export control and compliance teams will enable rapid response to evolving geopolitical developments, ensuring that strategic markets remain accessible despite shifting regulatory landscapes. By aligning R&D roadmaps with end-user feedback loops and embracing agile supply chain structures, companies can maintain competitive advantage while delivering mission-critical capabilities.

Detailing a Rigorous Multi-Phase Research Methodology Combining Primary Engagements and Secondary Data Analysis for Anti-Tank Rifle Market Evaluation

This comprehensive report synthesizes data gathered through structured interviews with senior procurement officers, end-user training commanders, and product development engineers across multiple continents. Secondary sources include defense white papers, open-source intelligence databases, and trade policy analyses, all subjected to rigorous cross-validation to ensure accuracy and relevance. Market trends were triangulated by comparing historical procurement volumes and recent contract awards, while tariff impacts were quantified through analysis of publicly disclosed import-export records.

A four-stage framework guided the research, beginning with initial scoping and secondary data collection, followed by primary qualitative engagements and case study development. The third phase involved quantitative data modeling to map segmentation dynamics against regional demand patterns. The final stage encompassed expert validation workshops, where findings were presented to independent defense analysts and subject matter experts to refine conclusions and identify blind spots.

Throughout the process, stringent quality controls were enforced, including source accreditation tracking, consistency checks, and bias mitigation protocols. The result is an evidence-based, transparent methodology that underpins the report’s strategic recommendations and market insights, offering stakeholders a reliable foundation for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Tank Rifles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Tank Rifles Market, by Action Type

- Anti-Tank Rifles Market, by Caliber

- Anti-Tank Rifles Market, by Technology

- Anti-Tank Rifles Market, by End User

- Anti-Tank Rifles Market, by Region

- Anti-Tank Rifles Market, by Group

- Anti-Tank Rifles Market, by Country

- United States Anti-Tank Rifles Market

- China Anti-Tank Rifles Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Strategic Implications to Drive Informed Decision-Making in the Anti-Tank Rifle Market Ecosystem

In synthesizing the evolving contours of the anti-tank rifle market, key themes emerge: the resurgence of high-caliber rifle systems driven by modern threat imperatives; the strategic imperative of supply chain agility in a tariff-constrained environment; and the critical role of segmentation in aligning product offerings with diverse operational requirements. Regional analyses underscore divergent procurement drivers, from interoperability demands in Europe to rapid-deployment needs in Asia-Pacific, each necessitating tailored strategies.

Competitive profiling reveals a dual-track innovation trajectory, with established OEMs advancing digital integration and material science breakthroughs, while specialized entrants accelerate disruption through additive manufacturing and niche optics. The cumulative picture highlights a market in transition-one where adaptability, technological foresight, and customer-centric service models will dictate leadership standings.

Ultimately, stakeholders who harness the detailed segmentation frameworks, heed the tariff-driven supply chain lessons, and embrace collaborative innovation are best positioned to capitalize on emerging opportunities and navigate the complexities of modern defense procurement environments.

Connect with Ketan Rohom to Access Comprehensive Anti-Tank Rifle Market Insights and Secure Your Customized Research Report Today

To secure the definitive insights that industry decision-makers rely on, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise will guide you to the right package that aligns with your strategic objectives and operational needs. Engage with Ketan today to gain immediate access to unparalleled analysis, actionable intelligence, and the comprehensive data required to outpace competitors in the rapidly evolving anti-tank rifle arena. Unlock the full potential of this market research report and position your organization for sustained leadership and innovation.

- How big is the Anti-Tank Rifles Market?

- What is the Anti-Tank Rifles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?