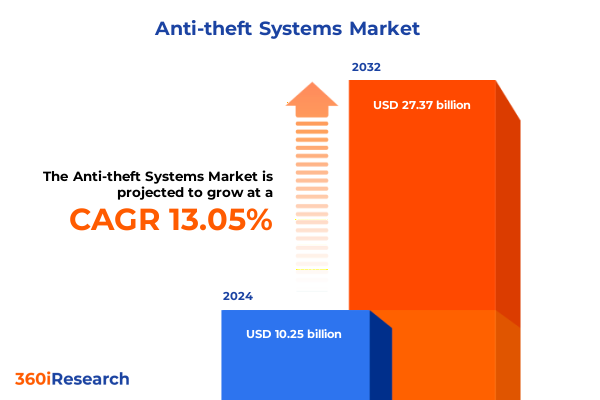

The Anti-theft Systems Market size was estimated at USD 6.74 billion in 2025 and expected to reach USD 7.31 billion in 2026, at a CAGR of 9.15% to reach USD 12.45 billion by 2032.

Setting the Stage for Enhanced Protection Across Vehicles, Commercial Sites, and Homes with Advanced Anti-Theft Solutions

Anti-theft systems have evolved from simple alarm triggers to sophisticated, multilayered solutions that integrate advanced sensors, connectivity, and analytics. In today’s environment of growing security concerns, stakeholders across automotive, commercial, and residential spheres are seeking robust protection strategies to safeguard assets and people. This report opens by contextualizing the convergence of rising theft risks with leaps in technology, illuminating why anti-theft platforms are no longer optional but foundational elements of broader security frameworks.

By examining the interplay of digital transformation, regulatory pressures, and consumer expectations, this introduction lays the groundwork for understanding how anti-theft systems are reshaping risk management. The narrative highlights the urgency for organizations to adopt next-generation protections while balancing cost, scalability, and integration. This foundational overview sets the stage for a deeper dive into the critical shifts, impacts, and insights that define the contemporary anti-theft landscape.

Uncovering the Pivotal Technological and Operational Changes Reshaping the Anti-Theft Ecosystem Ensuring Sustainable Future Resilience

The anti-theft landscape is witnessing a profound transformation driven by the convergence of artificial intelligence, cloud connectivity, and advanced sensor technologies. As organizations migrate from legacy analog frameworks toward intelligent, interconnected ecosystems, real-time analysis and predictive threat detection have become central to modern security postures. This evolution is reshaping how solutions are designed, deployed, and maintained, catalyzing a shift from reactive alarm responses to proactive risk mitigation.

Furthermore, the integration of machine learning algorithms and edge computing capabilities is enabling anti-theft platforms to adapt continuously to emerging threats. Edge-based analytics reduce latency and network dependencies, while cloud orchestration offers scalable data processing and remote management. As a result, stakeholders now benefit from dynamic threat intelligence, automated incident response, and seamless interoperability with broader IoT infrastructures. This section unpacks these pivotal shifts, emphasizing how they converge to create resilient, future-proof anti-theft environments.

Examining How Recent United States Tariffs on Components and Imports in 2025 Have Influenced Anti-Theft Systems Manufacturing Dynamics

In 2025, a series of United States tariffs targeted critical components, including electronic sensors and mechanical assemblies used in anti-theft systems. These measures have led to recalibrated supply chains, as manufacturers contend with elevated import costs and seek alternative sourcing strategies. Consequently, many solution providers are exploring nearshoring and localized production to mitigate exposure to volatile trade policies and to maintain consistent quality standards.

Beyond cost adjustments, the tariffs have stimulated innovation in component design and modular architectures. Vendors are increasingly developing interchangeable hardware modules that can be manufactured domestically or sourced from tariff-exempt regions. Concurrently, rising procurement expenses have underscored the value of software-centric offerings and subscription models, which spread investment over time and reduce upfront capital requirements. Collectively, these adaptations illustrate how external trade policies in 2025 have accelerated strategic realignment and fostered greater agility within the anti-theft ecosystem.

Delving into Comprehensive Application, Component, Installation Type, Technology, End User, and Distribution Channel Layers Shaping the Market

A nuanced examination of market segmentation reveals that application diversity drives tailored solution design. Within the automotive domain, commercial vehicles and passenger cars demand distinct sensor arrays and integration approaches to accommodate varying risk profiles and usage patterns. Meanwhile, commercial infrastructures spanning healthcare facilities and retail environments require customized coverage that balances access control with environmental constraints. In residential contexts, new installations focus on seamless integration with smart home ecosystems, whereas retrofit projects emphasize compatibility and minimal disruption.

Complementing the application perspective, component differentiation underscores the strategic layering of hardware, services, and software elements. Electronic and mechanical components provide the tangible barriers to intrusion, while installation and maintenance services ensure optimal performance over time. Access control and alarm monitoring software modules deliver the core intelligence that drives responsive security actions. Moreover, wired systems utilizing Ethernet or fiber optic backbones coexist with wireless solutions leveraging Bluetooth and RF, each offering trade-offs in installation complexity and network resilience. Finally, the end user’s profile-ranging from large enterprises to individual vehicle owners-alongside distribution channel preferences from traditional retailers to OEM partnerships, shapes the go-to-market execution and post-sale support models.

This comprehensive research report categorizes the Anti-theft Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Installation Type

- Technology

- Application

- End User

- Distribution Channel

Exploring How Regional Dynamics in the Americas, EMEA, and Asia-Pacific Drive Distinct Growth Patterns and Adoption Behaviors Globally

Regional dynamics play a critical role in influencing anti-theft system adoption and evolution. In the Americas, stringent regulatory standards and high consumer awareness have driven widespread integration of advanced alarm monitoring and access control platforms. Stakeholders in North America are particularly focused on interoperability with smart infrastructure initiatives, fostering partnerships between security providers and technology integrators.

Across Europe, the Middle East, and Africa, varied economic landscapes have produced heterogeneous demand profiles. Western European markets emphasize compliance with data protection and safety mandates, while emerging economies in the Middle East are witnessing rapid urbanization that fuels demand for scalable anti-theft deployments. Africa’s growth trajectory hinges on cost-effective wireless solutions that mitigate infrastructure constraints and enable broader security coverage.

In the Asia-Pacific region, soaring vehicle ownership and expanding commercial real estate portfolios are catalyzing uptake of telematics-enabled and biometric anti-theft innovations. Governments and private enterprises alike are investing in smart city initiatives, thereby creating fertile ground for solutions that integrate GPS tracking, RFID tagging, and AI-driven analytics into comprehensive security frameworks.

This comprehensive research report examines key regions that drive the evolution of the Anti-theft Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Partnerships that Are Accelerating Capabilities in the Anti-Theft Systems Industry Landscape

Leading solution providers are charting differentiated paths to capture market attention and cement their influence. Established global organizations are doubling down on research investments to enhance sensor precision, develop machine learning-powered anomaly detection, and streamline user interfaces for centralized oversight. Collaborative alliances between technology vendors and system integrators are also gaining traction, aimed at delivering end-to-end security experiences that encompass hardware, software, and managed services under unified contracts.

Simultaneously, niche innovators are carving out specialized segments by focusing on high-value verticals such as healthcare asset protection and fleet operator monitoring platforms. These agile competitors leverage modular architectures to rapidly introduce feature updates and localized configurations. Partnerships with telecommunications providers are further enabling over-the-air firmware updates and real-time diagnostics, setting a new benchmark for proactive maintenance. Collectively, these company strategies reflect a dual emphasis on continuous innovation and synergistic collaborations to enhance market responsiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-theft Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aptiv Global Operations Limited

- Asahi Denso Co., Ltd.

- Author LLC

- Continental AG

- Franzke Security

- HELLA GmbH & Co. KGaA

- IDISEC

- InVue Security Products Inc.

- Johnson Controls International PLC

- Robert Bosch GmbH

- Schneider Electric SE

- Secureye

- Sensel Telematics Private Limited

- Siffron, Inc.

- Stoneridge, Inc.

- TASS International by Siemens AG

- Thitronik GmbH

- TOKAIRIKA,CO, LTD.

- Tremco Emergency Products

- Unival Group

- Valeo Service SAS

- Zicom Electronic Security Systems Ltd.

Driving Immediate Strategic Actions to Strengthen Security Architectures, Boost Operational Efficiencies, and Ensure Future-Proofing in Anti-Theft Solutions

Industry leaders should prioritize investment in artificial intelligence and edge analytics to deliver predictive threat detection that outpaces emerging tactics. By embedding machine learning models directly into sensor modules, organizations can reduce latency and enhance the accuracy of anomaly identification. Coupled with cloud-based orchestration, this approach ensures that security protocols evolve in lockstep with new forms of intrusion attempts.

In parallel, diversifying supply chains through supplier redundancy and regional manufacturing partnerships will safeguard against future trade disruptions. Embracing modular hardware designs can facilitate seamless component substitution and lower total cost of ownership. Additionally, forging partnerships with cybersecurity firms will strengthen the resilience of anti-theft systems against cyber-physical threats, while continuous training programs for technicians will guarantee consistent installation quality and system upkeep.

Detailing Rigorous Qualitative and Quantitative Research Processes Ensuring Integrity, Relevance, and Depth in Anti-Theft Systems Analysis

The research methodology underpinning this analysis integrated comprehensive secondary investigations and targeted primary engagements. Industry literature, regulatory filings, and technology white papers provided foundational context, while expert interviews with security architects, system integrators, and end-user representatives yielded nuanced perspectives on emerging challenges and priorities.

Data triangulation techniques were applied to reconcile disparate insights, ensuring that qualitative observations aligned with empirical evidence. An iterative validation process involved stakeholder workshops and peer reviews, which refined thematic frameworks and confirmed the applicability of conclusions across diverse market segments. This rigorous approach delivers confidence in the integrity, relevance, and depth of the findings presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-theft Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-theft Systems Market, by Component

- Anti-theft Systems Market, by Installation Type

- Anti-theft Systems Market, by Technology

- Anti-theft Systems Market, by Application

- Anti-theft Systems Market, by End User

- Anti-theft Systems Market, by Distribution Channel

- Anti-theft Systems Market, by Region

- Anti-theft Systems Market, by Group

- Anti-theft Systems Market, by Country

- United States Anti-theft Systems Market

- China Anti-theft Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Synthesizing Core Findings and Insights to Illuminate Critical Imperatives for Stakeholders in the Evolving Anti-Theft Systems Domain

This report synthesizes core findings to highlight strategic focus areas for stakeholders. From the imperative to adopt AI-enhanced sensors and edge computing architectures to the necessity of flexible supply chain configurations, the insights converge on a central theme: adaptability. Organizations that embrace modular, software-driven platforms are best positioned to respond swiftly to evolving threats and regulatory shifts.

Equally, the integration of cybersecurity measures alongside physical security components emerges as a non-negotiable priority. As anti-theft systems become increasingly interconnected, protecting data flows and firmware integrity is essential for sustaining system reliability. By aligning technology investments with both operational demands and future-proofing imperatives, stakeholders can unlock new value streams while reinforcing robust defenses against a dynamic threat landscape.

Partner Directly with Ketan Rohom to Access Comprehensive Analysis and Empower Your Decisions with the Definitive Anti-Theft Systems Research Report

To acquire the strategic intelligence that will inform your next move and secure a competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engage directly to explore how tailored insights can be seamlessly integrated into your planning processes, empowering you with nuanced understanding of the anti-theft systems landscape and the ability to make informed, data-driven decisions.

- How big is the Anti-theft Systems Market?

- What is the Anti-theft Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?