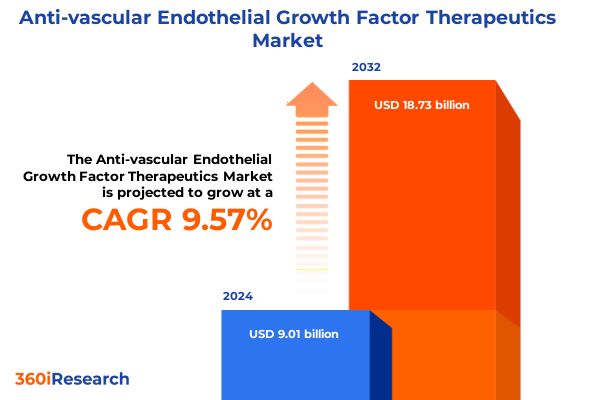

The Anti-vascular Endothelial Growth Factor Therapeutics Market size was estimated at USD 9.87 billion in 2025 and expected to reach USD 10.85 billion in 2026, at a CAGR of 9.58% to reach USD 18.73 billion by 2032.

Positioning Anti-VEGF Therapeutics at the Forefront of Ophthalmic Care Amid Rising Innovation and Complex Healthcare Dynamics

The advancement of anti-vascular endothelial growth factor (Anti-VEGF) therapeutics has redefined the management of sight-threatening ocular conditions, marking a pivotal shift in ophthalmology. These biologic agents, which inhibit the proliferation of abnormal blood vessels in the retina, have transformed therapeutic paradigms for conditions ranging from age-related macular degeneration to diabetic macular edema. As the clinical understanding of neovascular processes deepens, stakeholders across the value chain-from biopharmaceutical developers to healthcare practitioners-are navigating a complex ecosystem driven by scientific innovation, regulatory scrutiny, and evolving patient needs.

In recent years, the introduction of novel molecular formats and delivery systems has heightened competitive intensity. Established agents such as ranibizumab and aflibercept continue to be the cornerstone of intravitreal therapy, while next-generation molecules and biosimilar entrants are extending dosing intervals and expanding accessibility. Simultaneously, payers and providers are seeking cost-containment strategies without compromising clinical outcomes. This dynamic has prompted a reexamination of treatment algorithms and has spurred investment in real-world evidence generation. With these converging forces shaping the therapeutic landscape, a comprehensive understanding of technology trends, regulatory pathways, and clinical adoption patterns is essential for stakeholders aiming to capture future opportunities and address emerging challenges.

Charting the Evolution of Anti-VEGF Treatment Landscapes Through Technological Breakthroughs and Shifting Clinical Paradigms Demand Adaptation

The landscape of Anti-VEGF therapeutics is undergoing a fundamental reinvention driven by cutting-edge drug design and novel delivery modalities. Beyond conventional intravitreal injections, sustained-release implants and ocular drug delivery platforms have emerged, promising to ease treatment burden and improve adherence. When leveraged with concurrent advances in imaging and diagnostic algorithms, these innovations are recalibrating clinical workflows and elevating patient engagement.

Concurrently, the growing integration of real-world evidence and artificial intelligence in clinical decision support is refining treatment personalization. With predictive analytics gaining traction, ophthalmologists can tailor dosing intervals more precisely and identify patients at risk of suboptimal responses. Such data-driven approaches are increasingly valued by payers and providers seeking to optimize resource allocation while maintaining high standards of care.

Furthermore, the pipeline of molecular innovations extends into gene therapies and novel modalities targeting angiogenic pathways beyond VEGF. These prospective treatments, while in early clinical stages, underscore the industry’s ambition to achieve durable disease control with fewer interventions. As the ecosystem adapts to these transformative shifts, collaboration among research institutions, regulatory bodies, and commercialization partners will be instrumental in translating breakthroughs into sustainable patient benefits.

Analyzing the Ramifications of United States Tariff Adjustments in 2025 on Import Channels and Supply Chain Dynamics for Anti-VEGF Biologics

In 2025, adjustments to tariff policies in the United States have introduced new complexities for the importation of Anti-VEGF biologics and ancillary components. These policies, implemented in the first quarter, have increased duties on select active pharmaceutical ingredients and finished formulations sourced from overseas manufacturing hubs. As a result, supply chain stakeholders have encountered elevated landed costs, prompting a reassessment of procurement strategies and distributor agreements.

The ripple effects of these tariff shifts are particularly notable among contract manufacturing organizations and specialty compounding pharmacies that service off-label use of established agents. With raw material expenses rising, manufacturers are expediting onshore production capabilities and diversifying supplier portfolios to mitigate risk. This realignment has generated incremental demand for domestic fill-and-finish operations and has accelerated the adoption of quality by design frameworks aimed at optimizing yield and reducing waste.

Moreover, the impact on downstream distribution channels has been significant. Hospital pharmacies and ambulatory surgical centers have engaged in closer collaboration with suppliers to lock in supply contracts and explore consignment models that shield budgets from near-term cost volatility. At the same time, providers have increased focus on utilization reviews and pathway management to ensure that treatment plans align with evolving reimbursement criteria. As these dynamics continue to unfold, the industry’s ability to adapt to regulatory perturbations will remain a critical factor in securing uninterrupted patient access to Anti-VEGF care.

Uncovering Segmentation Insights on Product Types Therapeutic Areas Administration Routes and Distribution Channels Influencing Market Dynamics

A nuanced understanding of market segmentation offers clarity on how product innovations, disease indications, and delivery mechanisms intersect to shape adoption trends. Within product types, established agents such as aflibercept and ranibizumab maintain strong clinical profiles, while the off-label use of bevacizumab remains a cost-effective alternative in certain settings. Emerging molecules like brolucizumab seek to address unmet needs in durability, competing by extending dosing intervals and refining safety profiles.

When viewed through the lens of therapeutic areas, age-related macular degeneration continues to command significant clinical attention due to its high prevalence among aging populations. Diabetic macular edema follows closely, driven by rising diabetes incidence and the imperative to preserve vision. Less common but clinically significant conditions such as myopic choroidal neovascularization and retinal vein occlusion underscore the importance of tailored treatment approaches, given their unique pathophysiology and patient demographics.

The route of administration further delineates patient experiences and clinical workflows. Intravitreal injections dominate due to direct drug delivery to the retinal tissue, with the choice between prefilled syringes and vials influencing practice efficiencies and safety considerations. Within prefilled syringes, multi-dose and single-dose configurations cater to practices of varying patient volumes, while vials accommodate bulk dispensing requirements. Subconjunctival injections, though less prevalent, offer alternative delivery pathways for investigational agents seeking to broaden the therapeutic toolkit.

Distribution channels-from hospital pharmacies and specialty clinics to online pharmacy platforms-reflect evolving procurement preferences. Retail pharmacies additionally play a role for self-administered formulations under investigation. End-user settings such as ambulatory surgical centers, hospital outpatient departments, ophthalmic clinics, and specialty eye care centers each demonstrate distinct operational imperatives, affecting inventory management, patient education, and billing workflows.

This comprehensive research report categorizes the Anti-vascular Endothelial Growth Factor Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Therapeutic Area

- Route Of Administration

- Distribution Channel

- End User

Highlighting Regional Trends and Emerging Opportunities in the Americas Europe Middle East and Africa and Asia Pacific Driving Therapeutic Reach Expansion

Regional nuances in Anti-VEGF therapeutic engagement reveal divergent regulatory environments and patient access paradigms. In the Americas, the United States leads in adoption of new molecular entities and delivery platforms, underpinned by robust reimbursement frameworks and private-sector innovation incentives. Canada’s provincial formularies, though more conservative, have begun to incorporate biosimilar alternatives to address sustainability pressures.

Across Europe, Middle East and Africa, the harmonization efforts of regulatory bodies are streamlining approval pathways, yet reimbursement decisions remain highly localized. Western European countries have established well-defined health technology assessment processes that influence uptake, while emerging markets in the Middle East and Africa are expanding ophthalmology infrastructure to meet rising demands. Collaboration between public health agencies and non-governmental organizations is pivotal in extending access to rural and underserved communities.

Asia Pacific presents a landscape of rapid growth and variability. Markets in East Asia have demonstrated swift regulatory acceptance of generics and biosimilars, driven by government initiatives to reduce healthcare expenditures. South Asian and Southeast Asian nations are investing in capacity building, with an emphasis on training clinicians and upgrading diagnostic capabilities. In Australia and New Zealand, structured reimbursement listings and integrated patient registries support evidence generation and optimize treatment pathways. Taken together, regional insights underscore the importance of localized strategies to navigate diverse regulatory, economic, and clinical ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Anti-vascular Endothelial Growth Factor Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Their Strategic Alliances Pipeline Initiatives and Collaborative Efforts Advancing Anti-VEGF Therapeutic Innovation

The competitive landscape of Anti-VEGF therapeutics is anchored by multinational biopharmaceutical corporations and agile biotechnology firms. Industry frontrunners have fortified their positions through extensive patent portfolios, robust clinical development programs, and strategic partnership networks. Collaborative ventures with technology providers are enabling the integration of digital health solutions, from remote monitoring tools to adherence tracking platforms.

Parallel to legacy brand innovators, specialized biotech companies are pursuing targeted pathways, including biosimilar development and next-generation molecular constructs. These organizations often engage in licensing agreements or co-development arrangements with established players, leveraging shared expertise and distribution networks to accelerate time to clinic. Additionally, emerging enterprises are exploring orphan indications, seeking to expand the therapeutic footprint beyond common neovascular diseases.

Service providers-ranging from contract research organizations to fill-and-finish specialists-are critical enablers of pipeline advancement and commercial supply continuity. Their investments in biologics manufacturing capabilities and regulatory support services ensure that sponsors can navigate complex approval landscapes while maintaining quality standards. Collectively, this ecosystem of collaborators is driving a multifaceted approach to innovation, underscoring the value of strategic alliances and operational excellence in sustaining competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-vascular Endothelial Growth Factor Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alteogen

- Amgen Inc.

- AstraZeneca Plc.

- Bausch Health Companies Inc.

- Bayer AG

- Biogen Inc.

- Boehringer Ingelheim International GmbH

- Celltrion

- Coherus BioSciences Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- Intas Pharmaceuticals

- Johnson & Johnson Private Limited

- Kyowa Kirin Co. Ltd.

- Merck & Co. Inc.

- Novartis AG

- Ocumension Therapeutics

- Outlook Therapeutics

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Samsung Bioepis Co. Ltd.

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

- Xbrane Biopharma AB

Delivering Actionable Strategic Guidance for Industry Leaders to Capitalize on Anti-VEGF Therapeutic Advancements and Market Complexity With Precision

Industry leaders should prioritize the development of extended-durability formulations that align with evolving patient preferences and clinical protocols. By investing in sustained-release platforms and next-generation molecules, organizations can differentiate their portfolios and reduce treatment burden. Concurrently, forging partnerships with digital health providers will enhance patient engagement and support value-based care models.

Robust supply chain resilience is equally critical. Stakeholders should diversify sourcing strategies and expand domestic manufacturing capabilities to mitigate risks associated with tariff fluctuations and geopolitical uncertainties. Implementing advanced analytics in demand forecasting and inventory management will further strengthen operational agility.

Engagement with regulatory and payer communities remains paramount. Early dialogues and joint evidence generation initiatives can streamline approval processes and inform reimbursement decisions. Moreover, thought leadership efforts-such as investigator-initiated studies and real-world data collaborations-will reinforce the clinical value proposition of Anti-VEGF therapeutics.

Finally, market access teams should tailor launch strategies to reflect regional reimbursement frameworks and health system structures. By aligning clinical development plans with local practice patterns and patient needs, organizations can optimize uptake and foster sustainable growth across diverse healthcare environments.

Outlining Rigorous Multimethod Research Methodology Ensuring Comprehensive Data Integrity Qualitative Enrichment and Quantitative Validation Procedures

This analysis is grounded in a rigorous multimethod research framework designed to triangulate insights from diverse sources. Primary research included in-depth interviews with key opinion leaders, clinicians, industry executives, and payer representatives to capture firsthand perspectives on clinical efficacy, patient pathways, and reimbursement dynamics.

Secondary research incorporated a comprehensive review of peer-reviewed literature, regulatory filings, corporate disclosures, and clinical trial registries. This breadth of data sources ensured that therapeutic profiles, pipeline developments, and approval milestones were validated against authoritative documents.

Quantitative analysis leveraged structured surveys and proprietary databases to assess utilization patterns, distribution dynamics, and end-user preferences. Data integrity was maintained through cross-validation protocols and quality assurance checks, while statistical modeling provided nuanced insights into segmentation and regional variations.

Additionally, a dedicated expert panel provided qualitative enrichment, offering interpretive context around emerging technologies and strategic imperatives. This combination of methodological rigor and multidisciplinary expertise underpins the reliability and relevance of the findings, equipping stakeholders with a robust evidence base for decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-vascular Endothelial Growth Factor Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-vascular Endothelial Growth Factor Therapeutics Market, by Product Type

- Anti-vascular Endothelial Growth Factor Therapeutics Market, by Therapeutic Area

- Anti-vascular Endothelial Growth Factor Therapeutics Market, by Route Of Administration

- Anti-vascular Endothelial Growth Factor Therapeutics Market, by Distribution Channel

- Anti-vascular Endothelial Growth Factor Therapeutics Market, by End User

- Anti-vascular Endothelial Growth Factor Therapeutics Market, by Region

- Anti-vascular Endothelial Growth Factor Therapeutics Market, by Group

- Anti-vascular Endothelial Growth Factor Therapeutics Market, by Country

- United States Anti-vascular Endothelial Growth Factor Therapeutics Market

- China Anti-vascular Endothelial Growth Factor Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings From Clinical Trends Operational Considerations and Market Dynamics Driving the Future Adoption of Anti-VEGF Therapeutics

The convergence of novel delivery mechanisms, advanced molecular entities, and evolving reimbursement landscapes signifies a moment of both opportunity and complexity for Anti-VEGF therapeutics. As innovators push the boundaries of durability and patient-centric administration, providers and payers are recalibrating clinical pathways to balance efficacy, safety, and economic value.

Segmentation insights illustrate that product differentiation, indication focus and delivery modalities will continue to influence adoption trajectories. Meanwhile, regional disparities highlight the importance of customizing strategies to local regulatory, economic and clinical contexts. In the competitive arena, alliances between established companies and emerging biotechs are accelerating pipeline progress, while service providers ensure seamless translation from bench to bedside.

Looking ahead, adaptive frameworks that integrate real-world data, digital health solutions and collaborative reimbursement models will define the next frontier of ophthalmic care. With sustained innovation and strategic foresight, stakeholders can navigate tariff shifts, supply chain complexities and evolving patient needs to secure enduring impact and unlock new avenues for growth.

Engage With Associate Director to Secure Your Comprehensive Anti-VEGF Therapeutics Market Research Analysis and Propel Strategic Decision-Making Forward

To access the full breadth of insights and strategic analysis presented in this report and to equip your organization with the competitive intelligence needed to navigate the evolving Anti-VEGF Therapeutics landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise and guidance will ensure that you obtain a tailored research package aligned with your strategic objectives. Engage today to secure exclusive insights, refine your strategic roadmap, and gain the actionable data necessary to drive informed decisions. Elevate your understanding of innovation trajectories, regulatory changes, and segmentation dynamics by partnering with a dedicated advisor ready to facilitate your purchase and support your journey toward sustained growth.

- How big is the Anti-vascular Endothelial Growth Factor Therapeutics Market?

- What is the Anti-vascular Endothelial Growth Factor Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?