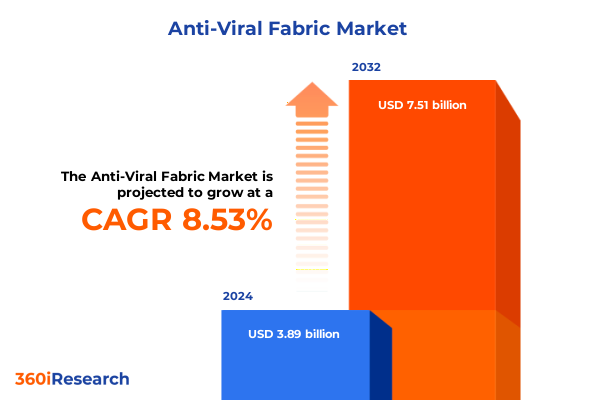

The Anti-Viral Fabric Market size was estimated at USD 4.22 billion in 2025 and expected to reach USD 4.58 billion in 2026, at a CAGR of 8.55% to reach USD 7.51 billion by 2032.

Unmasking the Next Generation of Protective Textiles Revolutionizing Hygiene Protocols to Elevate Safety Standards Across Healthcare Consumer and Industrial Sectors

The global imperative for advanced hygienic solutions has propelled antiviral fabrics into the spotlight as a frontline defense against viral transmission across diverse sectors. What began as an urgent response to the COVID-19 pandemic has now matured into a sustained pursuit of enhanced protective textiles, driven by ongoing public health concerns and heightened consumer expectations for safety. As contagion awareness permeates both public and private domains, decision-makers from hospital administrators to apparel brands seek materials that not only meet stringent efficacy requirements but also maintain comfort and aesthetic appeal in everyday use.

Innovations in the antiviral fabric domain have transcended traditional medical applications, expanding into sportswear, home furnishings, and transportation interiors, where the demand for self-sanitizing properties is becoming a differentiator. Collaborative efforts between material scientists, textile engineers, and regulatory bodies have forged a pathway for next-generation textiles integrating biocidal agents without compromising durability or sustainability. This strategic alignment between health imperatives and product performance underscores a paradigm shift in how industries approach material selection, embedding antiviral capabilities as a core requirement rather than an optional feature.

How Technological Breakthroughs Combined with Market Evolution Are Propelling Antiviral Fabrics to Redefine Material Innovation and Consumer Safety

The antiviral fabric industry is undergoing transformative shifts catalyzed by converging technological advances and evolving consumer behaviors. Rapid improvements in nanotechnology and surface engineering now enable fabrics coated with uniform distributions of metal ions or nanoparticles, enhancing virucidal efficacy within seconds of contact. Techniques integrating liquid metal strategies for copper alloy deposition have demonstrated pathogen eradication rates exceeding 99 percent in under five minutes, marking a significant leap in performance compared to conventional coatings. Concurrently, sustainable manufacturing practices are gaining traction, as eco-conscious stakeholders demand recyclable substrates and low-impact finishing methods. This dual emphasis on high-performance and environmental stewardship signals a maturing market where multifunctionality and responsible sourcing converge.

Parallel to material innovations, consumer and institutional purchasing patterns are shifting toward digital channels and data-driven procurement. Healthcare and hospitality sectors increasingly rely on real-time supply chain visibility to manage antiviral textile inventories, responding swiftly to emerging infection hotspots. This digital pivot not only streamlines distribution but also facilitates traceability and compliance reporting, bolstering stakeholder confidence in product quality. Moreover, strategic partnerships between textile mills and bioscience firms are accelerating the commercialization of embedded antiviral agents, ensuring that therapeutic-grade technologies reach mass-market applications faster than ever before.

Analyzing the Far-Reaching Consequences of the 2025 U.S. Reciprocal Tariff Overhaul on Antiviral Fabric Supply Chains and Cost Structures

In April 2025, the U.S. administration unveiled a sweeping reciprocal tariff framework, initiating a baseline 10 percent levy on nearly all imports and escalating duties on key trade partners to address persistent deficits. These Liberation Day tariffs prompted immediate supply chain recalibrations, as manufacturers faced rising costs for critical raw materials, including specialty fibers and antiviral coatings. To alleviate market disruption, a 90-day moratorium paused country-specific tariffs-excluding China-providing temporary relief to importers while renegotiations took shape. Throughout this period, importers and downstream producers grappled with uncertainty, weighing the benefits of nearshoring against the expense of domestic production scale-up.

The cumulative impact of these tariff measures on antiviral fabric supply chains has been profound. Elevated duties on Chinese imports, which account for a sizable share of nanocoating inputs and synthetic fibers, have driven some manufacturers to explore alternative sourcing in regions with preferential trade terms or lower logistic costs. At the same time, intensified domestic interest in reshoring textile operations has spurred investment in automated finishing lines and expanded capacity for antibacterial and antiviral treatments. However, volatility in tariff policy continues to cast a shadow over long-term planning, underscoring the importance of agile sourcing strategies and diversified supplier portfolios in maintaining cost competitiveness and operational resilience.

Deciphering Diverse Segmentation Lenses to Unearth Strategic Insights Across Product Forms Technologies Substrates and Distribution Pathways

A nuanced appreciation of the antiviral fabric market emerges when examined through multiple segmentation lenses encompassing product form, technology, substrate composition, end-use scenario, industry application, treatment approach, and distribution avenues. Within the product domain, apparel offerings extend from casual wear imbued with self-sanitizing finishes to specialized protective clothing and performance-driven sportswear. Filtration media diverge into air and water filtration substrates, each requiring tailored antiviral chemistries. Home furnishings embrace bedding, curtains, and upholstery engineered to maintain hygienic surfaces in domestic and commercial interiors, while the medical textiles subset spans hospital bedding, surgical gowns, and advanced wound care dressings, each with stringent regulatory benchmarks.

Antiviral technologies themselves bifurcate into surface-applied coatings, embedded agent matrices, and precision nano-finishing techniques. Surface coatings leverage metal or polymer layers for rapid viral inactivation, whereas embedded agents integrate copper or silver ions during fiber extrusion for sustained biocidal activity. Nano-finishing approaches, often incorporating copper or silver nanoparticles, deliver robust antiviral efficacy with minimal impact on fabric hand-feel. Substrate choices range across blended textiles-such as polycotton and poly-wool-natural fibers like cotton and wool celebrated for comfort, and synthetic platforms including nylon and polyester prized for durability.

Application-wise, antiviral fabrics find homes in healthcare settings from clinics to hospitals, domestic environments spanning bedding to upholstery, hospitality sectors including bedding and uniforms, personal protection gear like gloves and masks, and active sportswear. The broader industrial canvas includes adoption by automotive manufacturers for interior surfaces, consumer goods producers embedding protection into everyday items, and hospitality operators seeking elevated guest safety. Treatment methodologies split between inherent modifications during fiber production and surface treatments applied post-manufacture. Finally, distribution channels span direct corporate procurement, partnerships with textile distributors, and burgeoning online platforms, each catering to distinct buyer preferences and logistical models.

This comprehensive research report categorizes the Anti-Viral Fabric market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Antiviral Technology

- Fabric Type

- Treatment Method

- Application

- End Use Industry

- Distribution Channel

Exploring Regional Market Dynamics Catalyzing Demand and Innovation in Antiviral Fabrics Across Americas EMEA and Asia-Pacific

Regional dynamics underscore divergent drivers and adoption curves for antiviral fabrics. In the Americas, robust healthcare infrastructure and proactive public health mandates fuel procurement of advanced protective textiles, while a mature e-commerce ecosystem accelerates direct-to-consumer demand for antiviral garments and home goods. Domestic industry associations have cited temporary tariff relief measures as instrumental in stabilizing supply costs, enabling importers to maintain inventory levels without passing excessive price hikes to end users.

Europe, the Middle East, and Africa (EMEA) present a heterogeneous landscape shaped by regulatory rigor and sustainability mandates. The European Union’s stringent chemical compliance framework and growing emphasis on circular economy principles have encouraged manufacturers to innovate with biodegradable antiviral finishes and biobased agents. Meanwhile, Middle Eastern hospitality titans are integrating antiviral fabrics into luxury properties as a premium hygiene credential, and African healthcare networks are piloting durable antiviral bedding solutions to curb hospital-acquired infections.

Asia-Pacific stands at the vanguard of production-scale innovation, leveraging cost-competitive manufacturing hubs and significant investments in textile nanotechnology. Emerging economies in the region combine rapid industrial growth with tightening health regulations, driving demand for antiviral textiles across streetwear, medical supplies, and mass transit systems. While growth projections have moderated slightly due to global trade tensions, companies in China, India, and Southeast Asia continue expanding capacity for both commodity and specialty antiviral fabrics to meet rising domestic and export-driven orders.

This comprehensive research report examines key regions that drive the evolution of the Anti-Viral Fabric market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling How Strategic Partnerships and Technology Leadership Differentiate Pioneering Companies in the Antiviral Fabric Marketplace

Leading participants in the antiviral fabric arena distinguish themselves through pioneering material science, strategic alliances, and vertical integration. Toray Industries has captured prime positions with its HEPA-grade fibers and nanoparticle-infused textiles, achieving validated viral load reductions exceeding 99 percent within 30 minutes, bolstered by cross-industry partnerships in biotechnology. Teijin Aramid differentiates through mission-critical customization, embedding copper oxide particles into flame-resistant fiber systems tailored for healthcare and defense sectors, while BASF’s polymer-based antimicrobial agents enable seamless integration with existing polyamide and polyester manufacturing processes. Emerging specialists like Sarex are carving niches through bio-based chitosan derivatives, offering performance parity to silver-coated alternatives with reduced manufacturing footprints and lower water usage.

Complementing these textile leaders, chemical and materials corporations have intensified their antiviral portfolios. Avient Corporation’s proprietary polymer additives enhance antiviral performance in diverse applications, from apparel to interior coatings, while HeiQ’s Viroblock treatment has seen broad adoption among mask producers and home textile brands. PPG Industries has also ventured into hospital-grade antiviral wall finishes, extending pathogen control beyond fabrics to built environments. Collectively, these firms illustrate the multifaceted competitive landscape, where synergies between fiber producers, finishers, and additive suppliers drive continuous innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Viral Fabric market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acme Group

- Aditya Birla Fashion and Retail Limited

- Albini Group

- Arvind Ltd.

- Berger Paints

- Boyteks

- Carrington Textiles Ltd.

- Diesel S.p.A.

- Donear Industries Ltd.

- D’Décor Home Fabrics Pvt. Ltd.

- Grado Lab

- HealthGuard Corporation Pty. Ltd.

- HeiQ Materials AG

- iFabric Corp.

- Inner Mettle Inc. Ltd.

- Polygiene Group

- Raymond Ltd.

- Rudolf GmbH

- Shiva Texyarn Limited by Vedanayagam Hospital Private Limited

- Siyaram Silk Mills Ltd.

- SQ Group

- Takisada-Nagoya Co., Ltd.

- Toray Industries, Inc.

- Wearwell (UK) Limited

- Welspun

Strategic Imperatives for Industry Leaders to Harness Innovation Agility and Supply Chain Resilience in the Antiviral Fabric Domain

To thrive in this rapidly evolving sector, industry leaders must prioritize a multifaceted strategic agenda. First, sustained investment in collaborative R&D efforts that bridge textile engineering with virology will accelerate the translation of laboratory breakthroughs into scalable manufacturing processes. Partnerships with academic institutions and certification bodies can streamline regulatory approvals and foster market credibility. Second, agile supply chain configurations are essential; enterprises should diversify sourcing across low-tariff regions and develop contingency protocols to mitigate policy-driven disruptions highlighted by the 2025 U.S. tariff shifts. Integrating advanced analytics for real-time inventory management can further enhance resilience.

Furthermore, organizations should embed sustainability and end-of-life considerations into product roadmaps, exploring biodegradable antiviral treatments and circular design principles to meet tightening environmental regulations. Digital engagement strategies-including virtual product trials using augmented reality and e-commerce integrations-will capture growing consumer demand for transparency and convenience. Finally, differentiation will hinge on demonstrable efficacy and transparency in performance claims; rigorous third-party testing, publicly accessible white papers, and traceable supply chain documentation will build trust among institutional and consumer buyers alike.

Transparent Multi-Stage Research Methodology Integrating Secondary Data Triangulation and Primary Expert Insights for Precise Market Analysis

The research employs a comprehensive multi-stage methodology to ensure robust, actionable insights. Initially, an exhaustive secondary research phase involved the review of academic journals, patent filings, government trade documents, and credible news outlets to map key technological and regulatory developments. This desk research informed the creation of detailed segmentation frameworks covering product types, antiviral technologies, fabric substrates, and end-use applications.

Subsequently, primary research incorporated structured interviews with industry executives, textile engineers, and procurement specialists, validating secondary findings and capturing real-world operational challenges. Quantitative data underwent triangulation, cross-referencing insights from tariffs analysis, regional economic forecasts, and corporate financial disclosures. Finally, a synthesis phase distilled these inputs into strategic narratives, ensuring that conclusions reflect both macroeconomic trends and on-the-ground market dynamics. This layered approach guarantees both depth and precision in understanding the antiviral fabric ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Viral Fabric market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Viral Fabric Market, by Product Type

- Anti-Viral Fabric Market, by Antiviral Technology

- Anti-Viral Fabric Market, by Fabric Type

- Anti-Viral Fabric Market, by Treatment Method

- Anti-Viral Fabric Market, by Application

- Anti-Viral Fabric Market, by End Use Industry

- Anti-Viral Fabric Market, by Distribution Channel

- Anti-Viral Fabric Market, by Region

- Anti-Viral Fabric Market, by Group

- Anti-Viral Fabric Market, by Country

- United States Anti-Viral Fabric Market

- China Anti-Viral Fabric Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3657 ]

Synthesizing Emerging Technological and Geopolitical Dynamics Shaping the Strategic Future Trajectory of Antiviral Fabric Innovations

Antiviral fabrics have evolved from niche medical applications to mainstream solutions reshaping safety protocols across industries. The convergence of nanotechnology, embedded biocidal agents, and sustainable material science has forged fabrics capable of neutralizing pathogens rapidly while maintaining performance and comfort. Concurrently, geopolitical developments such as the 2025 U.S. reciprocal tariffs have underscored the importance of agile supply chains and diversified sourcing, while regional regulatory landscapes continue to influence innovation trajectories.

Ultimately, success in this dynamic market will depend on the ability to integrate advanced research with operational flexibility, ensuring that product developments align with evolving health imperatives and environmental mandates. Organizations that champion collaborative R&D, demonstrate transparent efficacy, and adopt resilient distribution strategies will emerge as leaders in the antiviral textile revolution, setting new benchmarks for protective wear and hygienic environments worldwide.

Secure Competitive Advantage with Expert-Led Antiviral Fabric Market Intelligence and Personalized Access to the Complete Report

To secure unparalleled insights into the evolving antiviral fabric landscape and drive strategic decisions with confidence, engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to obtain the comprehensive market research report that will equip your organization with the foresight needed to navigate emerging opportunities. This indispensable resource distills extensive analysis on technological breakthroughs, tariff impacts, regional dynamics, and competitive strategies into a single, actionable document. Reach out today to access in-depth data, proprietary executive summaries, and personalized consultation aimed at empowering your next strategic move in this dynamic sector. With expert support and customized delivery options, you can accelerate time to decision and ensure that your organization remains at the forefront of antiviral textile innovation.

- How big is the Anti-Viral Fabric Market?

- What is the Anti-Viral Fabric Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?