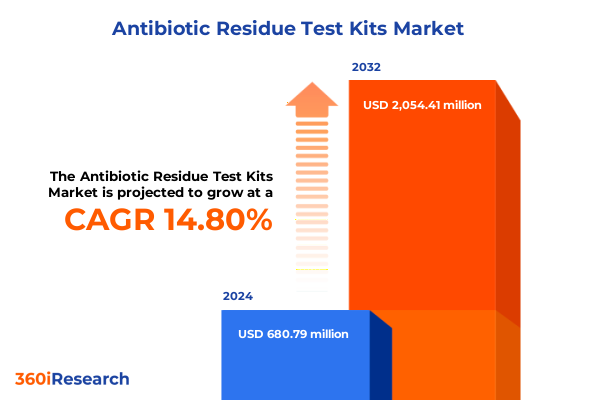

The Antibiotic Residue Test Kits Market size was estimated at USD 779.87 million in 2025 and expected to reach USD 897.34 million in 2026, at a CAGR of 14.84% to reach USD 2,054.41 million by 2032.

Unlocking the Vital Role of Antibiotic Residue Test Kits in Strengthening Food Safety, Public Health Protection, and Regulatory Compliance Worldwide

The presence of antibiotic residues in food products poses a critical threat to public health and consumer confidence, driving the urgent need for precise detection tools. Antibiotic residue test kits have emerged as indispensable instruments across the food value chain, enabling stakeholders to identify even trace levels of antimicrobial compounds in milk, meat, eggs, and aquaculture products. As regulatory bodies worldwide tighten maximum residue limits and enforcement measures, the demand for reliable, rapid, and cost-effective testing solutions continues to rise.

In response, researchers and manufacturers have collaborated to develop a diverse portfolio of test kits that range from high-precision confirmatory platforms to on-site rapid screening assays. This diverse landscape allows end users-including dairy farms, processing plants, and veterinary diagnostic laboratories-to select the methodology best suited to their operational workflows and compliance requirements. Consequently, antibiotic residue testing has evolved from a specialized laboratory procedure into a widely adopted quality assurance practice that safeguards against antibiotic misuse and mitigates the risk of antimicrobial resistance proliferation.

Against this backdrop, market dynamics are being shaped by ongoing innovations, shifting regulatory frameworks, and heightened consumer awareness. This executive summary delves into the transformative trends, tariff impacts, segmentation nuances, regional variations, and competitive forces that define the current antibiotic residue test kit ecosystem. By understanding these factors, decision-makers can align their strategies to leverage emerging opportunities and navigate the complexities of a rapidly changing industry.

Navigating the Technological Revolution Transforming Antibiotic Residue Testing Through Automation, Advanced Biosensors, and AI-Enabled Digital Platforms

Recent years have witnessed a technological renaissance in antibiotic residue testing, characterized by the adoption of advanced automation and digital integration across workflows. Automated platforms now handle high-volume screening with minimal human intervention, reducing variability and enhancing throughput. These systems not only streamline sample preparation and processing but also integrate data capture and reporting modules, offering end users end-to-end traceability and audit readiness. As a result, laboratories are achieving greater operational efficiency and reliability, allowing resources to be reallocated toward complex confirmatory analyses and method development

Parallel to automation, the integration of digital technologies-including cloud-based data management and real-time analytics-is transforming how test results are interpreted and shared. Cloud connectivity enables remote monitoring of assay performance, fosters collaborative troubleshooting, and accelerates regulatory submissions. Additionally, artificial intelligence-driven algorithms are beginning to assist in pattern recognition, threshold optimization, and predictive maintenance of instrument platforms. These advancements not only bolster accuracy but also empower stakeholders to make data-driven decisions with unprecedented speed and confidence

Innovation in biosensor and immunochromatographic technologies has further expanded the range of testing modalities. Lateral flow immunoassays equipped with nanoparticles and disposable reader devices now deliver qualitative results within minutes, making on-site screening accessible to non-technical personnel. Meanwhile, electrochemical and fluorescence-based biosensors provide quantitative sensitivity that rivals laboratory-grade instruments. These portable solutions are particularly valuable in remote environments and small-scale operations, enabling early detection of residues and rapid corrective actions before products reach the consumer

Assessing the Complex Cumulative Effects of 2025 United States Tariff Policies on Supply Chains, Cost Structures, and Market Dynamics for Test Kit Stakeholders

The introduction of a universal baseline tariff on imported goods in April 2025, followed by steep country-specific duties, has substantially altered the cost calculus for antibiotic residue test kit components and consumables. A 10% baseline levy on all non-USMCA imports now applies by default, while China-sourced laboratory reagents and instrument parts face a cumulative tariff burden of up to 145%. Canada and Mexico, though exempt from the universal tariff under USMCA provisions, are subject to separate duties on non-USMCA goods. These measures have introduced pronounced price volatility and supply chain complexity for kit producers and end users alike

In practical terms, manufacturers dependent on overseas suppliers for chromatography columns, antibody reagents, and polymer consumables are experiencing extended lead times and higher landed costs. To mitigate these pressures, some test kit developers have repatriated key manufacturing steps or diversified their vendor base to lower-tariff jurisdictions. Distributors, in turn, are leveraging strategic stock positioning and renegotiated logistics contracts to preserve service levels. Although these adaptations have tempered immediate cost spikes, stakeholder collaboration remains essential to maintaining uninterrupted access to validated testing solutions.

End users-from dairy farms screening milk to veterinary diagnostic laboratories confirming residues in multiple matrices-face the dual challenge of budgetary strain and regulatory compliance. Procurement teams are revisiting contract terms, consolidating orders to achieve volume discounts, and exploring hybrid sourcing models that blend domestic and international suppliers. Regulatory institutes and food processors are also intensifying dialogue with local kit manufacturers to co-develop tariff-safe product lines. These collective efforts underscore a renewed emphasis on supply chain resilience as a strategic imperative in a tariff-constrained market.

Uncovering Deep Insights from Segmentation Analysis Spanning Test Methodologies, Sample Origins, Animal Categories, End Users, and Distribution Channels

A nuanced understanding of the antibiotic residue test kit market emerges when examining its layers of segmentation. Test type segmentation reveals two primary approaches: confirmatory and screening. Confirmatory methods, such as gas chromatography-mass spectrometry and liquid chromatography-mass spectrometry, offer unparalleled specificity and quantitative accuracy, positioning them as the gold standard for regulatory enforcement. Screening tests, typified by enzyme-linked immunosorbent assays and rapid lateral flow devices, prioritize speed and operational simplicity, enabling high-throughput preliminary assessments that flag samples for more detailed follow-up.

Examining the market through the lens of sample types uncovers distinct demand patterns. Aquaculture products, with their unique tissue matrices and diverse antibiotic usage profiles, require specialized protocols. Egg testing presents challenges related to matrix interference and homogenization, whereas meat and milk testing are governed by long-standing regulatory frameworks with well-established maximum residue limits. These differences in sample matrix complexity and industry focus drive tailored kit design and validation strategies.

Animal type segmentation further influences method selection and market penetration. Aquatic animals, cattle, poultry, and swine each exhibit specific pharmacokinetic and tissue distribution characteristics, necessitating customized sensitivity and extraction protocols. End users range from dairy farms instituting on-farm screening programs to food processing plants integrating in-line quality checks. Regulatory institutes oversee compliance across all these domains, while veterinary diagnostic laboratories bridge the gap between field sampling and confirmatory laboratory analysis.

Distribution channels reflect evolving procurement behaviors. Traditional offline channels-comprising direct sales teams and third-party distributors-continue to play a central role, particularly in regions with established supplier relationships. Meanwhile, online channels are gaining traction, with company websites offering direct access to product catalogs and e-commerce platforms enabling rapid replenishment of consumables. The growth of digital procurement portals underscores a broader shift toward streamlined ordering, automated inventory management, and transparent pricing.

This comprehensive research report categorizes the Antibiotic Residue Test Kits market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Sample Type

- Animal Type

- End User

- Distribution Channel

Delivering Critical Regional Perspectives on Drivers and Regulatory Frameworks across the Americas, Europe Middle East & Africa, and Asia-Pacific

Regional landscapes shape both the adoption and evolution of antibiotic residue test kits, with the Americas leading the charge due to robust regulatory enforcement and a highly developed dairy and meat industry infrastructure. In North America, stringent FDA and USDA guidelines have driven widespread implementation of both screening and confirmatory methods, fostering an ecosystem where innovation in rapid testing and confirmatory analytics coexists. Latin American markets, buoyed by export-oriented production, are increasingly adopting validated test kits to meet international residue standards and maintain market access

In Europe, Middle East & Africa, the interplay between European Union maximum residue limit regulations and regional trade agreements has created a heterogeneous regulatory environment. Western European nations lead with advanced laboratory networks and routine surveillance programs, whereas emerging markets in Eastern Europe, the Middle East, and Africa are investing in capacity-building initiatives to modernize testing infrastructure. Collaborative frameworks, such as public-private partnerships and international standard harmonization efforts, are accelerating kit adoption in these regions

Asia-Pacific markets present a dual narrative of rapid industrialization and expanding food safety awareness. Key markets in China, India, and Southeast Asia are scaling production capabilities, both for domestic consumption and export. Governments in the region are strengthening residue monitoring programs and incentivizing domestic kit manufacturing to reduce import dependency. Concurrently, growing consumer demand for transparency and food integrity is underpinning investments in advanced on-site screening solutions and high-throughput confirmatory platforms

This comprehensive research report examines key regions that drive the evolution of the Antibiotic Residue Test Kits market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Leadership and Innovation Strategies Employed by Key Manufacturers Shaping the Antibiotic Residue Test Kit Ecosystem

Prominent manufacturers are defining the competitive landscape of the antibiotic residue test kit market through strategic investments in product development and global expansion. Charm Sciences has distinguished itself by advancing multiplex lateral flow assays that can concurrently detect multiple antibiotic classes, thereby reducing testing time and resource requirements. NEOGEN Corporation continues to expand its portfolio of rapid screening solutions, emphasizing ease-of-use and on-farm applicability to meet the needs of dairy and meat producers. Thermo Fisher Scientific leverages its broad analytical instrumentation capabilities, integrating confirmatory mass spectrometry platforms with consumable reagents to offer turnkey testing workflows. Eurofins Scientific has reinforced its market position through an extensive network of accredited laboratories, complementing in-house kit offerings with contract testing services that cater to regulatory institutes and large-scale processors. DSM, with its focus on sustainable chemistries, is pioneering efforts to develop eco-friendly reagents and biodegradable assay components that align with emerging environmental mandates

Smaller innovators and regional players are also contributing to dynamic market shifts. Companies specializing in niche applications-such as aquaculture-specific test protocols-are carving out dedicated market segments. Collaborative partnerships between technology startups and established life science firms are accelerating the commercialization of next-generation biosensor platforms. Collectively, this competitive interplay is catalyzing a continuous cycle of product enhancements, cost optimization, and market diversification.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antibiotic Residue Test Kits market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies Inc.

- Bioo Scientific Corporation

- Bio‑Rad Laboratories, Inc.

- Boehringer Ingelheim Svanova AB

- Charm Sciences, Inc.

- Creative Diagnostics Ltd.

- DetectaChem Inc.

- DSM Food Specialties B.V.

- Envirologix Inc.

- Eurofins Scientific SE

- Foss A/S

- IDEXX Laboratories, Inc.

- Labtek Services Ltd.

- Megazyme Ltd.

- Neogen Corporation

- PerkinElmer Inc.

- Qingdao SRH Bio‑Engineering Co., Ltd.

- Qisong Technology Co., Ltd.

- Ring Biotechnology Co., Ltd.

- R‑Biopharm AG

- Shenzhen Bioeasy Biotechnology Co., Ltd.

- Thermo Fisher Scientific Inc.

- Unisensor S.A.

- Zhejiang Orient Gene Biotech Co., Ltd.

Proven Strategic Recommendations for Industry Leaders to Enhance Resilience, Drive Innovation, and Secure Sustainable Growth in the Test Kit Sector

Industry leaders should prioritize proactive diversification of their supply chains to mitigate the financial and logistical impacts of evolving tariff frameworks. By establishing multi-jurisdictional sourcing strategies and forging partnerships with low-tariff production hubs, companies can maintain cost stability and ensure uninterrupted access to critical kit components. In parallel, investing in domestic manufacturing capabilities where feasible will provide tariff-safe alternatives and bolster resilience against external trade disruptions

Embracing automation and digital platforms has proven to be a transformative lever for operational efficiency. Organizations should accelerate the integration of automated sample processing, cloud-based data analytics, and AI-driven result interpretation into their testing pipelines. This will not only optimize resource utilization but also enhance data integrity and regulatory traceability. Further, developing strategic alliances with technology providers can simplify deployment and support iterative improvements in analytical throughput.

In an environment of tightening regulations and elevated consumer scrutiny, expanding the scope of multiplex assays and application-specific test kits offers a competitive advantage. Research and development investments should focus on enhancing sensitivity, broadening antibiotic class coverage, and reducing assay times. Simultaneously, committing to sustainable practices-such as biodegradable assay materials and eco-friendly packaging-will meet emerging environmental mandates and resonate with conscientious stakeholders.

Finally, industry leaders must strengthen collaborative engagement with regulatory bodies, academic institutions, and end users. By participating in standardization initiatives, contributing to collaborative validation studies, and maintaining open channels of dialogue, companies can shape forthcoming regulatory changes and align product roadmaps with stakeholder expectations.

Detailing a Robust Research Framework Integrating Primary and Secondary Data Sources with Advanced Analytical Techniques for In-Depth Market Insights

The research underpinning this executive summary was conducted through a comprehensive multi-step methodology. Secondary research involved an extensive review of regulatory publications, scientific literature, industry news, and corporate disclosures to identify emerging trends and tariff developments. Primary research included in-depth interviews with key opinion leaders, supply chain specialists, and laboratory managers to capture firsthand insights into operational challenges and strategic responses.

Data triangulation was employed to reconcile diverse sources and validate qualitative findings against observable market behaviors. Advanced analytical techniques-including SWOT and PESTLE frameworks-were utilized to distill the factors influencing market dynamics. Segmentation analysis was performed based on test type, sample type, animal category, end user, and distribution channel to reveal nuanced demand patterns. Regional evaluation incorporated regulatory landscapes, trade policies, and infrastructure maturity, ensuring that the conclusions drawn reflect both global and local market realities.

This systematic approach ensures that the insights presented are robust, actionable, and tailored to support evidence-based decision-making for stakeholders across the antibiotic residue test kit value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antibiotic Residue Test Kits market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antibiotic Residue Test Kits Market, by Test Type

- Antibiotic Residue Test Kits Market, by Sample Type

- Antibiotic Residue Test Kits Market, by Animal Type

- Antibiotic Residue Test Kits Market, by End User

- Antibiotic Residue Test Kits Market, by Distribution Channel

- Antibiotic Residue Test Kits Market, by Region

- Antibiotic Residue Test Kits Market, by Group

- Antibiotic Residue Test Kits Market, by Country

- United States Antibiotic Residue Test Kits Market

- China Antibiotic Residue Test Kits Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings to Emphasize the Critical Imperative for Adoption, Innovation, and Supply Chain Adaptation in Antibiotic Residue Testing

In synthesizing the core findings, it becomes evident that antibiotic residue test kits are more than diagnostic tools-they are essential instruments for safeguarding public health, ensuring regulatory compliance, and supporting sustainable food production. Technological advancements in automation and biosensors are driving efficiency gains, while digital integration offers enhanced data integrity and traceability.

Navigating the complexities of 2025 tariff policies requires deliberate supply chain strategies, including diversification and localization efforts. Layered segmentation insights highlight the importance of method selection tailored to specific sample matrices, animal categories, and end-user requirements. Regional perspectives underscore the need to adapt product offerings and market approaches in accordance with diverse regulatory frameworks and infrastructure capabilities.

Ultimately, stakeholders who embrace innovation, prioritize resilience, and engage collaboratively with regulators and industry partners will be best positioned to thrive in an evolving landscape that demands precision, agility, and sustainability.

Take Action Today to Engage with Ketan Rohom and Secure Comprehensive Antibiotic Residue Test Kit Market Intelligence Tailored to Your Strategic Objectives

Engaging directly with Ketan Rohom offers a unique opportunity to secure tailored insights that address your specific strategic priorities and operational challenges. Whether your organization is evaluating supply chain diversification, investing in next-generation detection technologies, or exploring new market entry strategies, Ketan can guide you through the report’s findings and help you customize the analysis to your objectives.

By partnering with an experienced associate director of sales and marketing, you gain not only access to comprehensive data but also expert advice on how to translate research into action. Reach out to Ketan Rohom to discuss how the antibiotic residue test kits report can empower your decision-making, strengthen your market position, and drive sustainable growth in an evolving regulatory environment.

- How big is the Antibiotic Residue Test Kits Market?

- What is the Antibiotic Residue Test Kits Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?