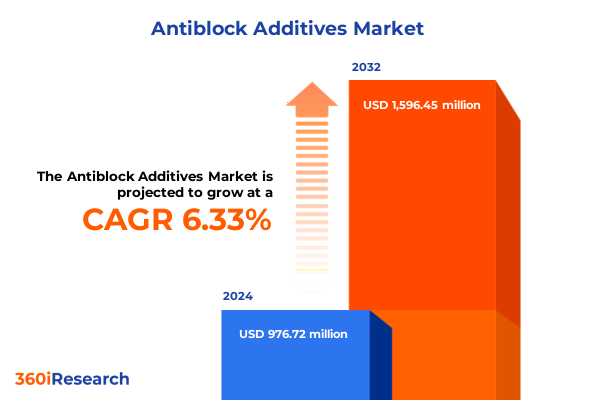

The Antiblock Additives Market size was estimated at USD 1.03 billion in 2025 and expected to reach USD 1.09 billion in 2026, at a CAGR of 6.44% to reach USD 1.59 billion by 2032.

Unveiling the Critical Significance and Evolving Market Dynamics of Antiblock Additives Across Film and Packaging Sectors Worldwide

The demand for antiblock additives has intensified as manufacturers strive to enhance the functionality and clarity of polymer films used across an array of industries, from agriculture to medical packaging. These specialized additives play a pivotal role in reducing surface adhesion between film layers, facilitating smoother processing and preventing defects such as blocking and sticking during handling. As a result, end users benefit from improved productivity, reduced waste, and higher quality finished products.

This executive summary provides a concise yet comprehensive overview of the critical factors shaping the antiblock additive landscape. We begin by examining the fundamental role of these agents in modern polymer processing and then explore the transformative market forces at play. With a focus on evolving regulatory frameworks, shifting supply chain dynamics, and emerging technological innovations, this section lays the groundwork for understanding how stakeholders can optimize their strategies to capitalize on growth opportunities.

Drawing on insights from primary interviews, expert consultations, and corroborative secondary data, this introduction underscores the necessity of a data-driven approach when navigating the complexities of raw material costs, trade policies, and performance requirements. In doing so, it sets the stage for a deeper analysis of tariff impacts, segmentation trends, regional variances, and competitive strategies that collectively define the future trajectory of the antiblock additive market.

Assessing Key Technological Innovations and Regulatory Transformations That Are Redefining Antiblock Additive Applications and Performance Standards

Over the past few years, the antiblock additive sector has witnessed transformative shifts driven by technological breakthroughs and more stringent regulatory environments. One of the most notable developments has been the advent of next-generation organic waxes, which offer superior dispersion in polyolefin matrices and enhanced surface lubricity compared to traditional mineral-based options. These innovations not only improve processing stability but also align with sustainability mandates by reducing carbon footprints and facilitating recyclability.

In parallel, regulatory bodies in key markets have tightened guidelines governing additive purity and migration limits, compelling suppliers to reformulate products to meet elevated performance benchmarks. Consequently, research and development investments have surged as companies race to bring non-toxic, bio-derived antiblock solutions to market. This shift has been further accelerated by collaborations between additive manufacturers and film producers seeking to co-develop systems that balance cost-effectiveness with regulatory compliance.

Moreover, digitalization within manufacturing processes is enabling real-time monitoring of film extrusion and coating operations, enhancing quality control and reducing downtime. Advanced predictive analytics are also being leveraged to forecast additive performance under varying processing conditions, thereby optimizing formulations faster and with greater precision. As these combined forces reshape the competitive landscape, stakeholders must remain agile and embrace cross-sector partnerships to harness the full potential of emerging technologies.

Evaluating the Aggregate Consequences of United States 2025 Tariff Measures on the Antiblock Additive Supply Chain and Competitive Landscape

The enactment of new United States tariff measures in 2025 has introduced material implications for global suppliers and domestic producers of antiblock additives. Increased duties on imported wax and mineral derivatives have elevated the landed cost of critical raw ingredients, prompting many manufacturers to reevaluate their sourcing strategies. This realignment has spurred near-shoring initiatives, with some processors opting to secure domestic contracts to mitigate exposure to volatile import levies and transportation bottlenecks.

Simultaneously, the heightened tariff environment has fostered a wave of strategic partnerships among chemical producers and local distributors to pool resources and share the burden of additional costs. Through collective procurement agreements and joint logistics frameworks, these alliances have been instrumental in preserving margin stability and ensuring consistent supply to downstream film converters.

On the demand side, certain segments have exhibited resilience despite higher additive pricing. In the agricultural films sector, for instance, the drive to maximize crop yields has justified continued investment in quality-enhancing antiblock solutions. Likewise, pharmaceutical and medical packaging applications have absorbed incremental cost increases due to the critical nature of product safety and compliance requirements. As a result, market participants are increasingly focused on value-based selling and highlighting long-term total cost of ownership benefits to offset short-term tariff pressures.

Deriving Strategic Insights from Product, Application, Polymer, End User, Form, and Sales Channel Segmentation Patterns in the Antiblock Additive Market

Understanding the antiblock additive market requires a nuanced view of how distinct segmentation criteria shape both supply and demand dynamics. From a product standpoint, the landscape bifurcates into mineral additives, such as calcium carbonate, silica, and talc, which are prized for their cost efficiency and thermal stability, alongside organic waxes-including carnauba wax, polyethylene wax, and synthetic wax-that deliver enhanced clarity and migration control. Application-driven segmentation further delineates the market across agricultural films, encompassing greenhouse and mulch coverings designed for optimal crop protection; industrial films, which include lamination and shrink applications tailored for heavy-duty packaging and bundling; and packaging films oriented toward food safety, medical containment, and retail presentation.

Polymer preferences play an equally pivotal role, with PET, polyethylene, and polypropylene substrates each exhibiting unique surface characteristics and processing parameters that influence additive selection. Equally important is the end user industry landscape: agriculture demands robust durability under UV exposure, automotive requires precise optical properties for interior and exterior film components, medical emphasizes biocompatibility and cleanroom compatibility, while package producers seek versatile solutions that balance performance with consumer channel requirements.

The physical form in which additives are supplied also impacts handling and dispersion efficiency, whether as aqueous emulsions ideal for coating lines, pre-dispersion masterbatches compatible with extrusion feeds, or dry powders for direct blending. Finally, the choice of sales channel-direct agreements with additive manufacturers, partnerships with regional distributors, or procurement through digital platforms-can influence lead times, technical support, and overall cost structures. Taken together, these segmentation axes provide a strategic framework for stakeholders to tailor product development, marketing, and supply chain decisions in line with targeted end-market demands.

This comprehensive research report categorizes the Antiblock Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Polymer Type

- Form

- Application

- Sales Channel

Comparative Regional Analysis Illuminating Growth Drivers and Challenges for Antiblock Additives Across the Americas, EMEA, and Asia-Pacific Markets

Regionally, the Americas continue to benefit from well-established manufacturing bases and proximity to key raw material sources, allowing domestic antiblock additive producers to capitalize on shorter lead times and reduced logistics costs. Within North America, demand is particularly robust in agricultural films, where growers prioritize biodegradable and high-clarity mulches. In South America, expanding greenhouse infrastructure drives incremental consumption of both mineral and organic antiblock formulations.

In Europe, Middle East & Africa, the regulatory climate exerts a pronounced influence, with the European Union’s REACH regulations steering the shift toward low-migration, bio-based alternatives. Consequently, film converters in this region emphasize collaboration with additive suppliers to co-develop compliant recipes. Meanwhile, in the oil-rich Gulf states, burgeoning medical device manufacturing zones have created new outlets for specialized antiblock additives that meet stringent sterilization and purity standards.

Asia-Pacific remains the fastest growing region, powered by an upsurge in packaging consumption and rapid industrialization. China and India lead volume expansion for polyethylene films, while Southeast Asian countries are increasingly investing in modern agricultural technologies that integrate high-performance greenhouse films. As local producers ramp up capacity, they are forging partnerships with global additive manufacturers to secure technology transfers and scale high-quality outputs, thereby intensifying competition and driving further innovation.

This comprehensive research report examines key regions that drive the evolution of the Antiblock Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players to Reveal Strategic Initiatives, Collaborative Ventures, and Innovation Pipelines Shaping the Antiblock Additive Sector

Leading players in the antiblock additive industry have differentiated themselves through an array of strategic initiatives, ranging from targeted acquisitions and joint ventures to in-house research and formulation advances. Major specialty chemical companies have expanded their wax and mineral portfolios by integrating value-added services such as on-site technical support and customized formulation labs. These enhanced service offerings enable closer collaboration with film producers and end users, thereby accelerating product adoption and driving higher customer retention rates.

In parallel, several manufacturers have engaged in symbiotic partnerships with polymer producers to develop co-engineered additive packages tailored to specific resin grades. Such collaborations optimize compatibility and performance, reducing time-to-market for new film grades. Additionally, investment in application-specific trials and pilot lines has become a hallmark of forward-looking suppliers seeking to demonstrate efficacy under real-world processing conditions.

Furthermore, innovation pipelines are increasingly populated by bio-derived and sustainable materials, reflecting a broader industry trend toward circular economy principles. Some leaders have already introduced plant-based wax analogues that deliver comparable or superior optical and operational benefits while minimizing environmental impact. As competition intensifies, these proactive R&D investments and collaborative frameworks will be essential for maintaining market relevance and securing long-term growth in a dynamic global landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antiblock Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adeka Corporation

- Ampacet Corporation

- Bajaj Plast Pvt. Ltd.

- BASF SE

- Cargill, Incorporated

- Eastman Chemical Company

- Evonik Industries AG

- Malsons Polymers

- Milliken & Company

- PMC Group Limited

- SI Group, Inc.

- Songwon Industrial Co., Ltd.

Strategic Roadmap for Industry Leaders to Capitalize on Innovation, Regulatory Compliance, and Supply Chain Optimization in Antiblock Additives

To thrive in an evolving antiblock additive market, industry leaders should prioritize a strategic roadmap built upon four core pillars. First, investment in advanced R&D capabilities-particularly in bio-derived organic waxes and hybrid mineral-organic formulations-will be essential to meet both performance targets and sustainability criteria. By forging partnerships with academic institutions and leveraging government-funded innovation grants, companies can accelerate the development of next-generation offerings.

Second, proactive regulatory intelligence and compliance frameworks must be integrated into every stage of product development. Organizations that embed toxicity screening and migration analysis within their standard protocols will reduce time-to-market and avoid costly reformulation delays. Close engagement with regulatory bodies and participation in industry consortia will further ensure early alignment on forthcoming policy changes.

Third, supply chain resilience should be enhanced by diversifying raw material sources and implementing digital supply management platforms. Adopting predictive analytics for raw material price forecasting and logistics optimization will help mitigate the impacts of tariffs and transportation disruptions, while near-shoring strategies can shorten lead times and buffer against geopolitical uncertainties.

Finally, companies must embrace customer-centric commercialization models, offering technical training modules, digital application support, and flexible procurement options. Tailored service engagements and performance-based contracting will enable stronger value propositions, driving deeper partnerships with film producers and end users.

Comprehensive Research Methodology Employing Primary and Secondary Data Collection to Ensure Robust Market Intelligence on Antiblock Additives

This study is underpinned by a rigorous research methodology that integrates both primary and secondary data to deliver reliable and actionable insights. Primary research entailed in-depth interviews with over 50 stakeholders, including additive manufacturers, film converters, raw material suppliers, and end users, to capture qualitative perspectives on market trends, challenges, and innovation priorities.

Secondary research encompassed an extensive review of industry publications, regulatory filings, patent databases, and corporate disclosures to corroborate market developments, technology trajectories, and policy shifts. Data triangulation ensured consistency and accuracy, with quantitative metrics validated across multiple independent sources. Advanced analytical frameworks, such as SWOT and Porter’s Five Forces, were applied to evaluate competitive dynamics and identify potential entry barriers.

Segment-level analyses were conducted by mapping product types, applications, polymer substrates, end-user industries, supply chain forms, and sales channels, enabling a granular understanding of market drivers. Regional assessments leveraged macroeconomic indicators, trade data, and regulatory landscapes to highlight geographic variances. Finally, all findings were reviewed by an internal panel of subject-matter experts to affirm methodological soundness and relevancy to current market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antiblock Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antiblock Additives Market, by Product Type

- Antiblock Additives Market, by Polymer Type

- Antiblock Additives Market, by Form

- Antiblock Additives Market, by Application

- Antiblock Additives Market, by Sales Channel

- Antiblock Additives Market, by Region

- Antiblock Additives Market, by Group

- Antiblock Additives Market, by Country

- United States Antiblock Additives Market

- China Antiblock Additives Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Market Imperatives to Provide a Clear Outlook on Future Trajectories Within the Antiblock Additive Industry

In summary, the antiblock additive market is poised for dynamic evolution as technological innovation, regulatory mandates, and regional growth patterns converge to reshape competitive landscapes. Manufacturers that invest strategically in sustainable formulations and co-development partnerships will likely capture emerging opportunities, particularly in high-growth agricultural and medical film segments. Furthermore, resilience against tariff-driven cost pressures will hinge on diversified sourcing strategies and digital supply chain enhancements.

Segmentation analysis underscores the importance of tailoring offerings to distinct application and polymer requirements, while regional insights reveal that success will demand nuanced approaches aligned with local regulatory frameworks and end-market priorities. Leading companies have already begun to translate these imperatives into action through collaborative ventures, strategic acquisitions, and dedicated R&D pipelines focused on bio-based and high-performance mineral solutions.

As the industry moves forward, data-driven decision-making and customer-centric engagement models will be the hallmarks of market leaders. By synthesizing these core findings and market imperatives, this executive summary provides a clear outlook on the future trajectory of antiblock additives, equipping stakeholders with the perspectives needed to inform robust strategic planning.

Engage with Ketan Rohom to Secure In-Depth Antiblock Additive Market Insights and Drive Informed Strategic Decision-Making Today

To explore these comprehensive market insights in depth and equip your organization with actionable intelligence on the evolving dynamics of antiblock additives, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in guiding strategic decisions and facilitating access to our full-market research report will ensure that you are empowered with the data and analysis necessary to stay ahead in a competitive landscape. Engage with Ketan today to secure your copy of the report and leverage tailored insights designed to support your growth objectives and operational excellence in the antiblock additive sector.

- How big is the Antiblock Additives Market?

- What is the Antiblock Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?