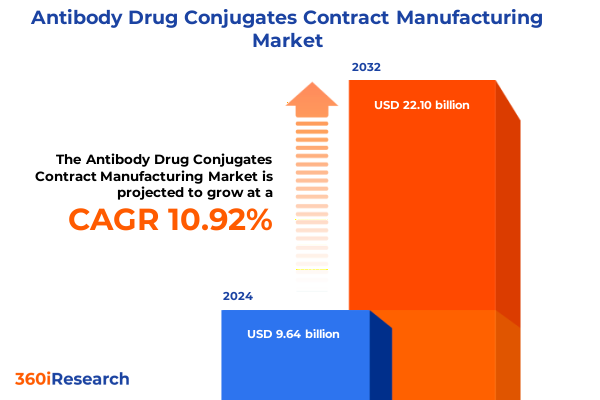

The Antibody Drug Conjugates Contract Manufacturing Market size was estimated at USD 10.65 billion in 2025 and expected to reach USD 11.79 billion in 2026, at a CAGR of 10.98% to reach USD 22.10 billion by 2032.

Navigating the complex convergence of biologics and payload chemistry to align manufacturing strategy with the evolving demands of ADC development and commercialization

Antibody drug conjugates (ADCs) have matured from a niche therapeutic concept into a transformative modality with complex manufacturing demands that span biologics and small-molecule chemistries. The contract manufacturing landscape has evolved to address integrated workflows encompassing monoclonal antibody production, payload synthesis, precise conjugation chemistry, and sterile fill-finish operations. As development timelines tighten and regulatory expectations increase, sponsors and manufacturing partners must reconcile stringent quality systems with highly specialized technical capabilities.

This executive summary synthesizes critical intelligence to help decision-makers navigate capacity planning, partner selection, and technology investments. It interprets operational trends in facility design, workforce skills, analytics, and supply chain resiliency while emphasizing the interplay between clinical stage requirements and commercial-scale readiness. By highlighting strategic inflection points, risk vectors, and capability gaps, the summary provides a grounded view of where contract manufacturers can create durable differentiation for sponsors pursuing ADC programs. The aim is to translate technical complexity into actionable insight for executives, business development leads, and operations planners seeking to secure reliable, compliant, and cost-effective manufacturing routes for advanced ADC pipelines.

Major strategic inflection points are redefining ADC contract manufacturing as integrated biologics and small-molecule capabilities, analytics, and workforce demands accelerate

The ADC ecosystem is experiencing several transformative shifts that are reshaping how contract manufacturing organizations allocate capital and organize capabilities. First, there is heightened integration between biologics and small-molecule operations, requiring CMOs to build cross-disciplinary teams and invest in hybrid cleanroom architectures that accommodate both antibody production and cytotoxic payload handling. Second, analytical rigor has intensified as sponsors demand deeper characterization of linker stability, drug-to-antibody ratio distributions, and impurity profiles; this has accelerated adoption of advanced mass spectrometry, orthogonal release testing, and in-line process analytics.

Concurrently, strategic sourcing models are evolving: sponsors increasingly favor modular engagements that allow them to mix standalone antibody production or payload synthesis with end-to-end manufacturing options as programs transition through clinical phases. Workforce development has moved to the forefront, with talent capable of operating conjugation chemistries and cytotoxic containment in scarce supply. Regulatory agencies are clarifying expectations around comparability and control strategies for ADCs, prompting earlier alignment between development and manufacturing teams. Together, these shifts demand that CMOs adopt flexible platforms, strengthen quality-by-design practices, and pursue targeted partnerships to remain competitive in a market where technical differentiation is as important as capacity.

How United States tariff changes in 2025 are reshaping supply chain decisions, sourcing strategies, and risk-sharing practices across ADC contract manufacturing

The introduction of new tariff measures in the United States in 2025 has introduced a fresh layer of complexity to global ADC contract manufacturing, influencing supply chains, sourcing decisions, and cost structures. Raw materials for both antibody production and payload synthesis, often sourced across multiple geographies, face variable tariff exposure that can alter landed costs and incentivize northern sourcing strategies or nearshoring of critical inputs. In addition, specialized single-use consumables, chromatography resins, and certain laboratory instruments may become more expensive to import, pressuring margins or requiring renegotiation of supplier agreements.

Beyond direct cost impacts, tariffs have catalyzed strategic shifts: manufacturers are reassessing their supplier portfolios to prioritize tariff-insulated vendors, securing multi-year agreements to stabilize pricing, and accelerating qualification of domestic suppliers where regulatory and quality attributes permit. The tariffs have also highlighted the importance of inventory and safety-stock strategies to mitigate short-term price volatility, while prompting consideration of supply chain dual-sourcing and increased vertical integration for critical intermediates. From a regulatory and contractual perspective, sponsors are seeking clearer pass-through terms and risk-sharing mechanisms to manage tariff-related cost uncertainty. In sum, 2025 tariff measures are prompting both tactical reactions to protect margins and longer-term strategic planning to enhance resilience and maintain supply continuity for ADC programs.

Comprehensive segmentation analysis revealing how clinical stage, service modality, payload and linker type, and therapeutic application define ADC manufacturing requirements and investment priorities

A nuanced segmentation framework reveals how demand and capability needs diverge across clinical stage, service modality, payload chemistry, linker design, and therapeutic application. Based on Type, differentiation arises between Clinical-stage programs and Commercial efforts, with the Clinical side subdivided into Phase I, Phase II, Phase III, and Preclinical activities that each impose unique throughput, documentation, and tech-transfer needs. Based on Service Offered, providers are evaluated on their ability to offer End-to-End Manufacturing or Standalone/Modular Services, with the latter encompassing discrete capabilities such as Antibody Production, Bioconjugation, Cytotoxic Payload Manufacturing, Fill-Finish, and Linker Synthesis; sponsors frequently mix these services to align with program risk tolerance and capital constraints.

Based on Payload Type, product strategies vary when utilizing Cytotoxic payloads compared with Non-Cytotoxic approaches, affecting containment, analytical burden, and regulatory scrutiny. Based on Linker Type, the choice between Cleavable and Non-Cleavable linkers has downstream implications for stability, in vivo release profiles, and conjugation processes; Cleavable linkers further branch into Disulfide-based, Enzyme-sensitive, and pH-sensitive mechanisms, each demanding specific analytical and control strategies. Based on Application, priorities shift between Non-Oncology and Oncology uses, where Non-Oncology targets such as Autoimmune Diseases, Infectious Diseases, and Inflammatory Disorders require different safety margins and dosing paradigms than Oncology indications including Breast Cancer, Hematologic Cancers, Lung Cancer, and Ovarian Cancer. Together, these segmentation layers inform capacity planning, regulatory preparedness, and investment choices, enabling manufacturers and sponsors to match capabilities to program-specific technical and commercial trajectories.

This comprehensive research report categorizes the Antibody Drug Conjugates Contract Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Linker Type

- Payload Type

- Development Stage

- Dosage Form

- Application

Regional dynamics and manufacturing footprints shape strategic choices as Americas, EMENA, and Asia-Pacific offer distinct regulatory, cost, and capacity trade-offs

Regional dynamics materially influence where sponsors select manufacturing partners and how providers prioritize investment to serve global pipelines. In the Americas, a strong concentration of sponsors and established biotech hubs has driven demand for scalable capacity, integrated development services, and proximity for tech transfer; regulatory alignment with regional health authorities also encourages localized quality frameworks and expedited engagement for late-stage programs. In Europe, Middle East & Africa, a diverse regulatory landscape and growing biotech activity have created opportunities for specialist CMOs to offer high-touch scientific support, complex chemistry capabilities, and multi-country release strategies, while also navigating heterogeneous regulatory pathways.

In Asia-Pacific, rapid manufacturing capacity expansion, cost-competitive production, and maturing regulatory systems have made the region a focal point for clinical and commercial supply, particularly for antibody production and bulk intermediates. Each region presents distinct trade-offs in terms of cost, lead time, regulatory oversight, and talent availability, and sponsors increasingly adopt hybrid manufacturing footprints that leverage Americas proximity for critical late-stage activities, EMENA expertise for specialized bioconjugation services, and Asia-Pacific scale for cost-efficient bulk manufacturing. Consequently, CMOs must tailor their value propositions to regional nuances in regulatory expectations, talent pipelines, and sponsor preferences to capture cross-border engagements effectively.

This comprehensive research report examines key regions that drive the evolution of the Antibody Drug Conjugates Contract Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How companies differentiate through hybrid capabilities, containment infrastructure, analytical depth, and partnership models to capture complex ADC manufacturing engagements

Competitive dynamics among companies serving ADC programs center on the convergence of technical depth, flexible operating models, and demonstrable compliance track records. Leading contract manufacturers are investing in containment infrastructure for cytotoxic handling, specialized conjugation suites, and expanded analytical laboratories to support complex release testing and stability studies. Partnerships between biologics-focused CDMOs and small-molecule chemistry specialists are becoming more common, enabling end-to-end offerings that reduce tech-transfer friction and shorten timelines between clinical phase transitions.

Business models vary from pure-play modular providers that excel at niche activities such as linker synthesis or payload manufacturing to integrated providers offering full clinical-to-commercial pathways. Companies that prioritize transparent quality systems, robust change-control processes, and early technical collaboration with sponsors tend to secure long-term relationships, particularly for programs with demanding safety and comparability expectations. Strategic differentiation also emerges from investments in digitalization, process intensification, and talent development, with firms that build multidisciplinary teams capable of managing both biologic and cytotoxic chemistries positioned to win complex engagements. Finally, mid-sized and specialized firms often carve out defensible niches by delivering bespoke scientific support and flexible commercial terms that align with sponsor risk profiles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antibody Drug Conjugates Contract Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Abzena Ltd.

- AGC Inc.

- Ajinomoto Bio-Pharma Services

- Almac Group Limited

- AstraZeneca PLC

- Aurigene Pharmaceutical Services Ltd. by Dr. Reddy's Laboratories

- Axplora Group GmbH

- BSP Pharmaceuticals S.p.A.

- CARBOGEN AMCIS AG by Dishman Carbogen Amcis Ltd.

- Catalent, Inc.

- Cerbios-Pharma SA

- Creative Biolabs Inc.

- EirGenix, Inc.

- Fujifilm Holdings Corporation

- Goodwin Biotechnology, Inc.

- Hangzhou DAC Biotech Co., Ltd.

- Jubilant Pharmova Limited Company

- Lonza Group Ltd.

- Lotte Biologics Co., Ltd.

- Merck KGaA

- MicroBiopharm Japan Co., Ltd.

- NJ Bio, Inc.

- Pfizer Inc.

- Piramal Pharma Limited

- Recipharm AB

- Regeneron Pharmaceuticals, Inc.

- Samsung Biologics Co., Ltd.

- Sartorius AG

- Sterling Pharma Solutions Limited

- Syngene International Limited

- WuXi Biologics Inc.

Practical and prioritized recommendations for manufacturers and sponsors to build resilient, analytics-driven, and flexible ADC manufacturing capabilities that support long-term partnerships

Industry leaders should adopt a set of targeted, actionable moves to strengthen competitiveness while mitigating operational and regulatory risks. First, invest deliberately in modular facility designs that permit rapid reconfiguration between antibody production, conjugation activities, and payload synthesis; this reduces downtime and supports mixed-use scheduling. Second, prioritize analytics and quality systems by expanding orthogonal testing, integrating in-process monitoring, and developing clear control strategies for diverse linker chemistries to accelerate regulatory acceptance and simplify comparability exercises.

Third, strengthen supplier ecosystems through qualification of multiple vendors for critical inputs, strategic stockpiling for tariff-sensitive components, and localized sourcing where appropriate to reduce exposure to trade disruptions. Fourth, cultivate multidisciplinary talent by creating rotational programs that blend biologics process engineers with small-molecule chemists and by partnering with academic and vocational institutions to build long-term pipelines. Fifth, pursue selective vertical integration for high-risk intermediates while maintaining flexible outsourcing options for capacity scaling. Finally, enhance commercial engagement models by offering hybrid contracting arrangements that align incentive structures, share technical risk, and provide sponsors with transparent cost and timeline visibility, thereby fostering enduring partnerships and smoother program progression.

Transparent and reproducible research methodology combining expert interviews, regulatory review, process mapping, and scenario analysis to validate ADC manufacturing insights

The research underpinning this executive summary combined primary qualitative engagement with subject-matter experts, systematic review of publicly available regulatory guidance, and targeted technical assessment of manufacturing approaches. Primary inputs included structured interviews with senior manufacturing and quality leaders, technical directors of antibody and payload operations, and heads of process development to capture firsthand perspectives on capacity constraints, technical risk factors, and regulatory interactions. Secondary analysis included review of scientific literature, patent filings, and regulatory approval summaries to validate technology trends, analytic best practices, and linker usage patterns.

Analytical methods incorporated process mapping to identify bottlenecks across the ADC value chain, capability scoring to benchmark provider competencies, and scenario analysis to model the operational effects of tariff shifts and supply interruptions. Data integrity was maintained through triangulation of independent sources, iterative validation with technical experts, and cross-checking of regulatory requirements across jurisdictions. The methodology emphasizes transparency and reproducibility, enabling readers to trace insights back to primary observations and documented technical evidence while acknowledging areas where evolving data will necessitate periodic updates.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antibody Drug Conjugates Contract Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antibody Drug Conjugates Contract Manufacturing Market, by Service Type

- Antibody Drug Conjugates Contract Manufacturing Market, by Linker Type

- Antibody Drug Conjugates Contract Manufacturing Market, by Payload Type

- Antibody Drug Conjugates Contract Manufacturing Market, by Development Stage

- Antibody Drug Conjugates Contract Manufacturing Market, by Dosage Form

- Antibody Drug Conjugates Contract Manufacturing Market, by Application

- Antibody Drug Conjugates Contract Manufacturing Market, by Region

- Antibody Drug Conjugates Contract Manufacturing Market, by Group

- Antibody Drug Conjugates Contract Manufacturing Market, by Country

- United States Antibody Drug Conjugates Contract Manufacturing Market

- China Antibody Drug Conjugates Contract Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Concluding synthesis on how technical integration, analytics, and strategic supply chain choices will determine competitive leadership in ADC manufacturing

In conclusion, antibody drug conjugate contract manufacturing occupies a pivotal position at the intersection of biologics and small-molecule production, requiring providers to master hybrid technical domains, advanced analytics, and resilient supply chains. The industry is undergoing rapid specialization as sponsors seek partners who can deliver both scientific depth and flexible commercial arrangements across clinical and commercial stages. Tariff changes and regional dynamics are accelerating shifts in sourcing strategies and footprint planning, and successful CMOs will be those that can combine modular facilities, strong quality systems, and strategic supplier networks to absorb external shocks while maintaining program continuity.

Looking forward, the most compelling opportunities will favor organizations that invest in cross-functional talent, deepen analytical capabilities, and foster collaborative commercial models that align incentives with sponsors. By embracing these strategic priorities and operational practices, manufacturers and sponsors can reduce development friction, enhance product quality, and accelerate patient access to ADC therapies. The pathway to competitive advantage will hinge on the ability to integrate technical excellence with pragmatic risk management and client-centric service delivery.

Act now to secure the definitive market research report and arrange a personalized briefing with the associate director to accelerate ADC contract manufacturing decisions

To obtain the comprehensive market research report and secure tailored intelligence that supports strategic decision-making, contact Ketan Rohom, Associate Director, Sales & Marketing, who can coordinate access, demonstrate key findings, and arrange customized briefings. The report purchase includes an executive briefing, customizable data extracts, and support for internal presentations to accelerate commercialization strategies and partnership development. Engage with Ketan to schedule a walk-through of the report’s core chapters, explore bespoke research add-ons such as country-level regulatory analysis or manufacturing footprint optimization, and set up a timeline for delivery that aligns with your program milestones.

Prompt engagement will ensure you gain immediate clarity on capabilities mapping, service-provider selection criteria, and risk mitigation frameworks tailored to antibody drug conjugate contract manufacturing. Ketan can also facilitate introductions to technical leads and analysts responsible for the report, enabling direct Q&A on methods, dataset provenance, and scenario planning. Purchasing the report through this channel streamlines procurement, ensures priority access to new analytical updates, and unlocks opportunities for subscription-based tracking of emerging trends, policy shifts, and supplier movements that will shape the ADC CMO landscape over the coming years.

- How big is the Antibody Drug Conjugates Contract Manufacturing Market?

- What is the Antibody Drug Conjugates Contract Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?