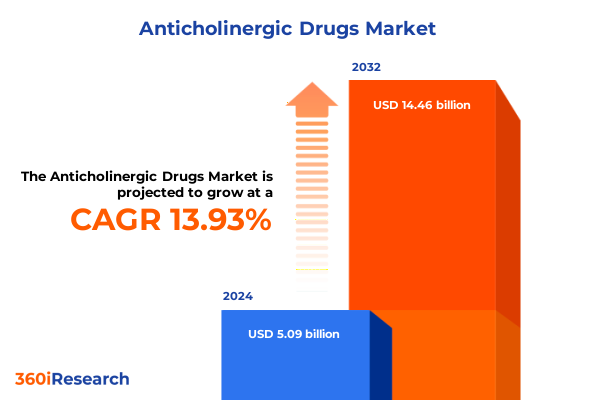

The Anticholinergic Drugs Market size was estimated at USD 5.79 billion in 2025 and expected to reach USD 6.60 billion in 2026, at a CAGR of 13.94% to reach USD 14.46 billion by 2032.

Setting the Stage for Evolving Therapeutic Frontiers in Anticholinergic Pharmacology and Patient Care Across Diverse Clinical Indications

The intersection of demographic shifts, rising chronic disease prevalence, and ongoing innovation in drug delivery has elevated anticholinergic agents into a strategic focal point for healthcare stakeholders. As patient populations age globally and incidence rates for conditions such as chronic obstructive pulmonary disease (COPD), overactive bladder, gastrointestinal spasms, and Parkinson’s disease continue to grow, the therapeutic relevance of anticholinergic compounds has never been more pronounced. Moreover, evolving patient expectations for convenient, targeted, and minimally invasive therapies are driving developers to explore novel formulations and delivery platforms.

Against this backdrop, the anticholinergic market is witnessing an unprecedented convergence of scientific advances, regulatory recalibrations, and commercial imperatives. Pharmaceutical innovators are leveraging molecular engineering to refine receptor selectivity profiles and minimize systemic side effects, while digital health integrations are reshaping adherence paradigms through smart inhalers and connected care ecosystems. Concurrently, payers are intensifying scrutiny on product value propositions amid escalating healthcare budgets, compelling manufacturers to demonstrate both clinical and economic merits through real-world evidence generation.

In light of these dynamics, stakeholders must adopt a 360-degree perspective that bridges R&D pipelines, market access strategies, and patient-centric initiatives. This introduction sets the stage for an in-depth exploration of transformational shifts, tariff implications, segmentation insights, regional nuances, and strategic recommendations that will inform decision-making and drive sustainable growth.

Landmark Technological Clinical and Regulatory Disruptions Redefining the Anticholinergic Therapeutic Arena and Drug Development Pathways

The anticholinergic sector is experiencing transformative shifts fueled by breakthroughs in formulation science, regulatory modernization, and digital health convergence. In inhalation therapeutics, the transition from conventional metered dose inhalers to dry powder inhalers and digitally enabled nebulization platforms is enhancing drug stability, dose consistency, and patient convenience. Concurrently, novel transdermal and topical systems are emerging to address gastrointestinal and urological indications, reducing reliance on systemic administration and improving safety profiles.

Furthermore, regulatory bodies in North America and Europe are streamlining approval pathways for reformulated compounds that demonstrate incremental safety or efficacy gains, incentivizing life cycle management strategies and patent extension efforts. This has led to a surge in modified-release oral and parenteral anticholinergics that differentiate on pharmacokinetic precision and tolerability. In tandem, payers are piloting outcomes-based contracting mechanisms that tie reimbursement to real-world performance metrics, catalyzing deeper partnerships between manufacturers and healthcare providers.

Moreover, advanced analytics and machine learning are reshaping clinical trial design and post-marketing surveillance, enabling rapid signal detection for adverse events and adherence patterns. As a result, organizations are increasingly embedding data science capabilities into cross-functional teams to accelerate decision cycles and de-risk pipeline progression. Taken together, these developments signify a paradigmatic shift toward patient-centric, value-driven drug development and commercialization in the anticholinergic domain.

Assessing the Compound Effects of 2025 US Tariff Reforms on Global Supply Chains Pricing Strategies and Anticholinergic Drug Availability

In 2025, changes to United States tariff structures have reverberated across the pharmaceutical supply chain, particularly affecting APIs and excipients integral to anticholinergic formulations. Heightened duties on certain raw materials sourced from major producers have led to cost escalation pressures for active substance procurement. Consequently, manufacturers are reassessing global manufacturing footprints, with several opting to diversify supplier networks beyond traditional hubs to mitigate future trade uncertainties.

Moreover, elevated import costs have triggered strategic stockpiling of critical intermediates and accelerated initiatives toward backward integration. This shift has induced incremental capital investments in API production capabilities within North America, fostering regional resilience but also reshaping cost structures. In parallel, contract manufacturing organizations are renegotiating long-term agreements to incorporate tariff pass-through clauses, thereby recalibrating pricing frameworks across client portfolios.

Despite these headwinds, the anticholinergic market has demonstrated adaptive agility through collaborative procurement consortia and pooled purchasing agreements among mid-sized players. Furthermore, digital supply chain platforms are enhancing end-to-end visibility, enabling real-time tariff monitoring and dynamic route optimization. As a result, stakeholders are navigating the layered impacts of US tariff reforms by integrating supply chain flexibility, strategic sourcing diversification, and data-driven risk mitigation tactics into their operational playbooks.

Deconstructing Market Dimensions by Therapeutic Use Administration Modalities Distribution Channels and Molecular Origin to Reveal Strategic Opportunities

To navigate the multifaceted anticholinergic ecosystem, it is imperative to understand how therapeutic indications, administration routes, distribution models, and product provenance intersect to shape market trajectories. In terms of indication, agents targeting chronic obstructive pulmonary disease remain foundational, yet emerging gastrointestinal and urological substrates are gaining traction due to unmet needs in motility disorders and detrusor overactivity respectively, with anticholinergic therapies forming critical adjuncts in symptom management. Simultaneously, Parkinson’s disease treatment regimens are integrating anticholinergic adjuncts to address specific motor symptom clusters.

Meanwhile, administration modalities have diversified beyond oral formulations to include inhalation systems such as dry powder inhalers, metered dose inhalers, and nebulization for pulmonary indications, while parenteral, transdermal, and topical approaches are being optimized for systemic and localized delivery. Distribution channels reflect a triadic structure encompassing hospital pharmacies, online pharmacies, and traditional retail outlets, each environment presenting distinct access dynamics and patient engagement opportunities.

Finally, molecular origin remains a strategic differentiator, as natural alkaloids such as atropine and hyoscyamine compete with synthetic quaternary ammonium compounds and tertiary amines that offer tailored receptor specificity and pharmacokinetic versatility. Consequently, portfolio strategies are increasingly predicated on a balanced mix of heritage blenders and next-generation analogues, enabling manufacturers to address broad clinical spectra while capitalizing on differentiated value propositions.

This comprehensive research report categorizes the Anticholinergic Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Indication

- Route Of Administration

- Distribution Channel

Unveiling Regional Divergences and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific in Anticholinergic Therapeutics

Regional dynamics in the anticholinergic sector are underscored by divergent regulatory landscapes, patient demographics, and healthcare infrastructure. In the Americas, market expansion is propelled by robust reimbursement frameworks and high adoption rates for advanced inhalation and transdermal systems, particularly in the United States and Canada. Moreover, Latin American countries are poised for growth as formulary access broadens and local manufacturing partnerships mature.

In contrast, Europe, the Middle East, and Africa exhibit heterogeneity in market maturity and regulatory complexity. Western European markets are characterized by stringent health technology assessments that prioritize cost-effectiveness, driving demand for second-generation anticholinergics with improved safety profiles. Conversely, emerging economies in the Middle East and select African regions are reliant on generic formulations, with market entry strategies emphasizing distribution alliances and patient assistance initiatives.

Asia-Pacific presents a bifurcated landscape where developed markets like Japan and Australia lead in innovative delivery technologies and real-world evidence adoption, while emerging markets in Southeast Asia and South Asia are experiencing rapid uptake of generics driven by evolving healthcare access and local manufacturing incentives. Overall, regional insights underscore the need for adaptive market access strategies calibrated to local payer expectations, regulatory stipulations, and patient behavior patterns.

This comprehensive research report examines key regions that drive the evolution of the Anticholinergic Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Generic Manufacturers Steering Competitive Dynamics and Collaborative Ventures within the Anticholinergic Drug Landscape

A cohort of global pharma leaders and specialized generics manufacturers are actively shaping the competitive contours of the anticholinergic domain. Major innovator companies leverage deep R&D pipelines to introduce differentiated molecules with enhanced receptor selectivity and patient-friendly delivery formats. Concurrently, pure-play generic firms capitalize on patent expirations to provide cost-effective alternatives, driving volume penetration in both mature and emerging markets.

Collaborative alliances between originators and contract development organizations have become commonplace, accelerating time-to-market for novel formulations and enabling scalable launch operations. Additionally, strategic licensing deals are broadening geographic footprints, with rights transfers enabling local players to optimize distribution in regionally nuanced channels. In parallel, several players are investing in digital health platforms linked to inhaler devices, seeking to capture adherence data and enhance patient support offerings.

Furthermore, value chain integration is advancing as select pharmaceutical groups assimilate API production capabilities to ensure supply security and cost control. These multi-dimensional competitive strategies underscore an industry-wide imperative to balance innovation with operational efficiency, ensuring that product portfolios remain resilient against evolving market and regulatory forces.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anticholinergic Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alkermes

- Astellas Pharma Inc.

- Boehringer Ingelheim International GmbH

- Dr.Reddy's Laboratories Limited

- Flagship Biotech International Pvt. Ltd.

- GlaxoSmithKline Plc

- Grevis Pharmaceuticals Pvt. Ltd.

- Hikma Pharmaceuticals PLC

- Manus Aktteva Biopharma LLP

- Merck KGaA

- Novartis AG

- Omicron Pharma

- Pfizer Inc.

- Sanify Healthcare Private Limited

- Sanofi S.A.

- Steris Healthcare Pvt. Ltd.

- Sun Pharmaceutical Industries Limited

- Taj Pharmaceuticals Limited

- Trumac Healthcare

Strategic Imperatives for Pharmaceutical Stakeholders to Capitalize on Emerging Trends and Mitigate Risks in the Anticholinergic Therapeutic Market

To harness emerging opportunities in the anticholinergic market, industry leaders should prioritize a multi-pronged strategic blueprint. First, accelerating investment in novel delivery technologies can unlock new patient segments and adherence improvements, thereby differentiating portfolios beyond conventional oral or inhalation systems. Second, diversifying supply chains through dual-sourcing and regional API production will mitigate external trade risks and enhance cost stability in the face of evolving tariff regimes.

Moreover, forging strategic partnerships with payers and healthcare providers to establish outcomes-based contracting arrangements will solidify reimbursement pathways and align stakeholder incentives toward real-world performance. In addition, embedding advanced analytics into pharmacovigilance and market access functions will enable dynamic signal monitoring, informed pricing decisions, and rapid trial design adaptations. Equally important is the cultivation of patient engagement ecosystems that leverage connected devices and digital therapeutics to deliver holistic care solutions.

Finally, scenario planning and continuous horizon scanning should be institutionalized within corporate strategy teams to anticipate regulatory shifts, competitive moves, and technological breakthroughs. By synthesizing these elements into an agile operating framework, organizations can position themselves to capture value across the evolving anticholinergic landscape while proactively addressing emerging risks.

Comprehensive Research Framework Integrating Primary Expert Engagement Secondary Data Triangulation and Qualitative Quantitative Synthesis

Our research methodology integrates a rigorous blend of primary and secondary approaches to ensure analytical completeness and data validity. The primary component encompasses in-depth interviews with key opinion leaders, including pulmonologists, urologists, gastroenterologists, neurologists, regulatory affairs experts, and supply chain executives. These structured conversations provide qualitative insights into clinical unmet needs, formulary decision drivers, and operational challenges.

Complementing this, secondary research draws upon peer-reviewed journals, regulatory filings, patent databases, trade publications, and corporate disclosures to construct a robust data foundation. An iterative triangulation process cross-verifies quantitative metrics and qualitative findings to resolve inconsistencies and fortify confidence levels. Furthermore, advanced statistical techniques are applied to aggregate and normalize disparate datasets, enabling coherent trend analysis across therapeutic and geographic segments.

To enhance methodological transparency, our team employs a detailed audit trail documenting data sources, assumptions, and validation checkpoints. Periodic expert reviews and internal peer assessments ensure that analytical outputs remain aligned with contemporary industry paradigms and stakeholder expectations. This comprehensive framework underpins the credibility and actionable relevance of our anticholinergic market intelligence deliverables.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anticholinergic Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anticholinergic Drugs Market, by Product Type

- Anticholinergic Drugs Market, by Indication

- Anticholinergic Drugs Market, by Route Of Administration

- Anticholinergic Drugs Market, by Distribution Channel

- Anticholinergic Drugs Market, by Region

- Anticholinergic Drugs Market, by Group

- Anticholinergic Drugs Market, by Country

- United States Anticholinergic Drugs Market

- China Anticholinergic Drugs Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Strategic Narratives and Imperatives to Chart a Forward Looking Roadmap for Anticholinergic Drug Stakeholders

In conclusion, the anticholinergic therapeutic arena is at an inflection point driven by demographic imperatives, technological breakthroughs, and evolving regulatory landscapes. Transformative shifts in drug delivery modalities, coupled with strategic tariff adaptations, are redefining cost structures and patient access paradigms. Segmentation insights underscore the importance of targeted indication-specific strategies and diversified channel approaches, while regional nuances highlight the necessity of localized market access and partnership models.

As competitive dynamics evolve, leading and generic players alike are embracing innovation in formulation science, digital health integration, and supply chain resilience to maintain growth trajectories. To secure sustainable success, stakeholders must implement agile frameworks that integrate scenario planning, outcomes-based contracting, and advanced analytics. By doing so, pharmaceutical organizations can anticipate market disruptions, optimize resource allocation, and deliver differentiated value to patients and payers.

Ultimately, the pathway forward demands a holistic view that harmonizes scientific rigor, operational excellence, and stakeholder alignment. This conclusion synthesizes the strategic narratives presented and sets the stage for decisive actions that drive long-term value creation within the anticholinergic domain.

Connect with Associate Director Ketan Rohom to Access Exclusive Insights and Empower Strategic Decision-Making with the Latest Anticholinergic Market Intelligence

For a comprehensive understanding of the evolving anticholinergic therapeutic landscape, reach out to Associate Director, Sales & Marketing, Ketan Rohom. By engaging directly, you will gain personalized guidance on integrating deep market insights into your strategic priorities. Arrange a consultation to explore tailored licensing, partnership, or expansion pathways that align with your organizational goals. Act now to secure your competitive position and future-proof your pharmacological portfolio with evidence-backed intelligence from our latest anticholinergic market research report.

- How big is the Anticholinergic Drugs Market?

- What is the Anticholinergic Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?